Utah Tax Payment

Utah's tax system plays a vital role in the state's economy, impacting businesses and individuals alike. Understanding the ins and outs of Utah tax payment is essential for anyone navigating the financial landscape of this beautiful state. From income taxes to sales taxes and everything in between, we'll explore the key aspects of Utah's tax structure, offering valuable insights and practical advice.

Unraveling the Utah Tax Landscape

Utah, known for its stunning natural beauty and thriving industries, has a tax system designed to support its economic growth and development. Let's delve into the various taxes levied in the state and how they impact taxpayers.

Income Tax: A Pillar of Utah's Revenue

Utah's income tax system is a significant contributor to the state's revenue. As of [current year], the income tax rate in Utah stands at [rate]%, which is relatively lower compared to many other states. This competitive rate aims to attract businesses and individuals, fostering economic growth.

The state follows a progressive tax structure, meaning the tax rate increases as income rises. For individuals, this means that higher earners pay a higher proportion of their income in taxes. The income tax brackets are adjusted annually to account for inflation, ensuring fairness and stability.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $4,500 | 5.00% |

| $4,501 - $8,000 | 5.25% |

| $8,001 - $10,500 | 5.45% |

| Over $10,500 | 5.95% |

Utah also offers tax credits and deductions to ease the tax burden on its residents. For instance, the state provides a dependent tax credit, benefiting families with children. Additionally, individuals can deduct certain expenses like mortgage interest, charitable contributions, and medical costs, making Utah's tax system more taxpayer-friendly.

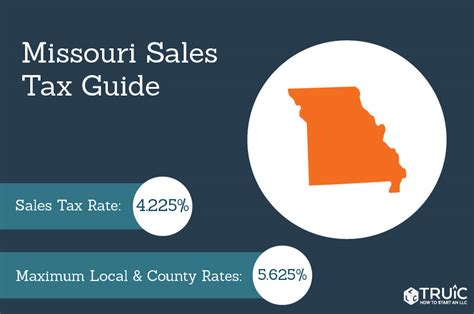

Sales and Use Tax: A Consumer's Perspective

Sales and use tax is another crucial component of Utah's tax landscape. The state levies a sales tax of [rate]% on most goods and services, which is collected by businesses and remitted to the state. This tax is applicable to both online and offline purchases, ensuring a level playing field for local businesses.

Utah has a unique approach to sales tax, known as the Use Tax. Use tax applies to purchases made outside the state but used within Utah. This ensures that even if a purchase is made tax-free in another state, the consumer still pays the appropriate tax to Utah. The use tax rate mirrors the sales tax rate, making it simple for taxpayers to comply.

To facilitate compliance, Utah offers a Voluntary Disclosure Program, encouraging taxpayers to come forward and report their tax obligations. This program provides an opportunity for taxpayers to correct past errors without incurring penalties, fostering a culture of transparency and accountability.

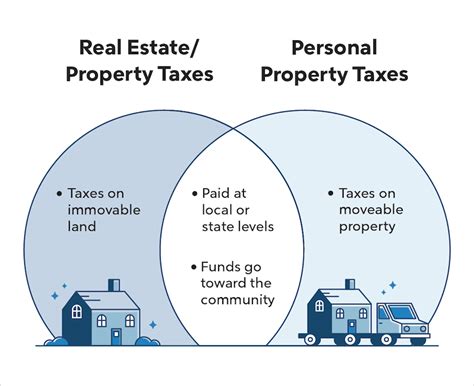

Property Tax: Funding Local Services

Property tax is a critical source of revenue for local governments in Utah. The state's property tax system is designed to fund essential services like schools, fire departments, and infrastructure projects. The tax is levied on both real estate and personal property, with rates varying across counties.

Utah's property tax system is assessed annually, with property values determined by county assessors. The tax rate is set by local governments, ensuring that the revenue generated supports the specific needs of each community. This decentralized approach allows for tailored funding of local services.

To ensure fairness, Utah has implemented property tax exemptions for certain groups, such as veterans and individuals with disabilities. These exemptions reduce the tax burden on those who qualify, promoting social equity and community well-being.

Business Taxes: Supporting Economic Growth

Utah's business-friendly environment is underpinned by a competitive tax structure. The state levies a corporate income tax of [rate]% on business profits, which is among the lowest in the nation. This tax rate, combined with other incentives, makes Utah an attractive destination for businesses looking to expand or relocate.

In addition to the corporate income tax, businesses in Utah are subject to various other taxes, including payroll taxes, franchise taxes, and gross receipts taxes. These taxes contribute to the state's revenue, supporting essential services and infrastructure development.

To encourage business growth, Utah offers a range of tax incentives and credits. For instance, the state provides tax credits for research and development activities, promoting innovation and technological advancement. Additionally, businesses can benefit from tax credits for hiring veterans or individuals with disabilities, fostering a diverse and inclusive workforce.

Tax Payment and Compliance: A Practical Guide

Understanding the tax landscape is just the first step. Ensuring compliance and making timely payments is crucial to avoid penalties and maintain a positive tax standing.

Online Payment Options: Convenience and Accessibility

Utah Tax Commission offers a range of online payment options to make tax payments more convenient and accessible. Taxpayers can pay their taxes online through the UtahTaxes.utah.gov portal, which provides a secure and user-friendly platform. This portal allows individuals and businesses to manage their tax obligations efficiently.

The online payment system accepts various payment methods, including credit cards, debit cards, and electronic checks. This flexibility ensures that taxpayers can choose the method that suits them best, making the payment process seamless.

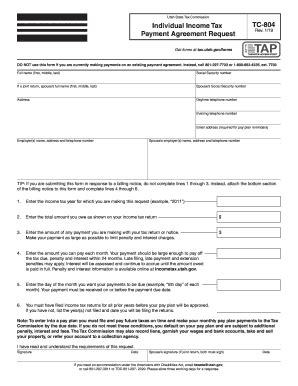

Payment Plans and Installment Agreements

For taxpayers facing financial challenges, Utah Tax Commission offers payment plans and installment agreements to help manage tax liabilities. These options provide taxpayers with the flexibility to pay their taxes over an extended period, making it more manageable to meet their obligations.

To qualify for a payment plan, taxpayers must demonstrate a genuine financial hardship and provide supporting documentation. The Utah Tax Commission works closely with taxpayers to create a plan that suits their unique circumstances, ensuring a fair and reasonable approach.

Filing Requirements and Deadlines

Meeting filing requirements and deadlines is crucial to avoid penalties and interest. Utah Tax Commission provides clear guidelines on filing deadlines for various taxes. For income taxes, the deadline is typically [date], allowing taxpayers ample time to gather the necessary information and file accurately.

For businesses, the filing requirements vary depending on the type of business and the taxes involved. The Utah Tax Commission offers resources and guidance to help businesses understand their filing obligations, ensuring compliance and timely submissions.

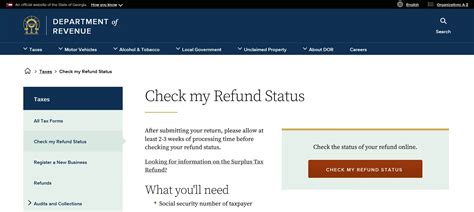

Tax Refunds and Overpayments

In cases where taxpayers have overpaid their taxes or are due a refund, the Utah Tax Commission has streamlined processes to facilitate prompt refunds. Taxpayers can track the status of their refunds online, providing transparency and peace of mind.

If a taxpayer believes they have overpaid their taxes, they can file an amended return to request a refund. The Utah Tax Commission reviews these requests and, if valid, issues refunds promptly. This process ensures that taxpayers receive their rightful refunds in a timely manner.

Navigating Utah's Tax System: Expert Insights

Understanding Utah's tax system can be complex, but with the right guidance, taxpayers can navigate it efficiently and effectively.

Here are some expert insights to help you make the most of your tax obligations:

Frequently Asked Questions

What is the income tax rate in Utah for the current year?

+The current income tax rate in Utah is [rate]% for the [current year].

How can I pay my taxes online in Utah?

+To pay your taxes online in Utah, you can visit the UtahTaxes.utah.gov portal. This secure platform allows you to make payments using credit cards, debit cards, or electronic checks. It's a convenient and accessible way to manage your tax obligations.

What happens if I miss the tax filing deadline in Utah?

+Missing the tax filing deadline in Utah can result in penalties and interest charges. It's important to file your taxes on time to avoid these additional costs. If you're unable to meet the deadline, consider requesting an extension to buy yourself more time.

Are there any tax incentives for businesses in Utah?

+Yes, Utah offers a range of tax incentives for businesses. These include tax credits for research and development, hiring veterans or individuals with disabilities, and more. Exploring these incentives can help reduce your tax burden and support your business growth.

How can I stay updated with tax law changes in Utah?

+To stay updated with tax law changes in Utah, you can subscribe to newsletters or alerts from the Utah Tax Commission. They provide regular updates and announcements on any changes to tax laws, ensuring you remain informed and compliant.

Navigating Utah’s tax system can be a complex journey, but with the right knowledge and resources, taxpayers can ensure compliance and make the most of their tax obligations. Whether you’re an individual or a business, understanding the tax landscape and utilizing the available tools and incentives can lead to a more favorable financial outcome.