Alabama Car Sales Tax

Understanding the intricacies of state-specific taxation is crucial, especially when it comes to significant purchases like vehicles. In Alabama, the sales tax on car purchases is a vital component of the state's revenue stream and has a notable impact on both consumers and the automotive industry.

The Basics of Alabama Car Sales Tax

Alabama imposes a sales tax on the purchase of motor vehicles, which is applicable to both new and used cars. This tax is levied on the purchase price of the vehicle, and it is an essential consideration for anyone looking to buy a car in the state.

The sales tax rate for cars in Alabama is 4%, which is relatively competitive when compared to other states. However, it's important to note that this base rate is not the only tax that might be applicable to your car purchase.

Local Sales Tax

In addition to the state sales tax, Alabama allows local governments to impose their own sales taxes. These local sales taxes can vary significantly, and they are often dependent on the specific county or city where the purchase is made. For instance, while some areas might have a local sales tax of 2%, others could have rates as high as 5%, bringing the total sales tax to 9% in certain regions.

| County | Local Sales Tax Rate |

|---|---|

| Autauga County | 2% |

| Baldwin County | 4% |

| Calhoun County | 3% |

| Montgomery County | 5% |

| Madison County | 4% |

These local sales taxes can significantly impact the overall cost of purchasing a vehicle, and they are a crucial consideration for consumers, especially when comparing prices across different regions.

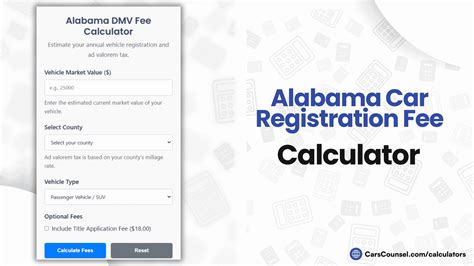

Title and Registration Fees

Beyond the sales tax, Alabama also charges a title fee of 35</strong> for new vehicle registrations and <strong>15 for transfers. Additionally, there is a registration fee of $14 for passenger cars, which is a recurring cost due every year.

These fees, while separate from the sales tax, are an important part of the overall cost of vehicle ownership in Alabama and should be factored into one's budget.

Calculating Your Car Sales Tax

To calculate the total sales tax on your car purchase in Alabama, you need to consider both the state and local sales tax rates. Here’s a simple formula:

- Total Sales Tax = State Sales Tax + Local Sales Tax

- State Sales Tax = 4% of the vehicle's purchase price

- Local Sales Tax = Depends on the county/city; ranges from 0% to 5%

Let's consider an example. If you're purchasing a car in Montgomery County, where the local sales tax is 5%, and the car's purchase price is $25,000, here's how you calculate the total sales tax:

- State Sales Tax: 4% of $25,000 = $1,000

- Local Sales Tax: 5% of $25,000 = $1,250

- Total Sales Tax: $1,000 + $1,250 = $2,250

So, in this scenario, the total sales tax on your car purchase would be $2,250, making the total cost of the vehicle $27,250.

Tax Exemptions and Discounts

While the sales tax on car purchases is a significant expense, Alabama does offer certain tax exemptions and discounts to specific groups.

Military Discounts

Active-duty military personnel, veterans, and their spouses are eligible for a 1% discount on the state sales tax. This means that instead of the standard 4% state sales tax, they would pay 3% on their vehicle purchase. This discount can lead to significant savings, especially on more expensive vehicles.

Disability Exemptions

Individuals with certain disabilities are exempt from paying sales tax on the purchase of vehicles equipped with specific adaptive equipment. This includes items like wheelchair lifts, hand controls, and other modifications that enhance mobility for people with disabilities. This exemption can be a significant financial relief for those who rely on adapted vehicles for their mobility needs.

Trade-In Exemptions

When trading in your old vehicle for a new one, Alabama allows you to deduct the trade-in value from the purchase price of the new car when calculating sales tax. This can lead to a substantial reduction in the amount of sales tax owed. For instance, if your trade-in value is 5,000</strong> and you're purchasing a new car for <strong>25,000, the sales tax is calculated on 20,000</strong> instead of the full <strong>25,000 purchase price.

The Impact on Car Sales and Ownership

The sales tax on car purchases in Alabama has a notable impact on both the automotive industry and consumers. For dealerships and car sellers, the tax can significantly affect their pricing strategies and profit margins. On the consumer side, it’s a substantial expense that must be factored into the overall cost of vehicle ownership.

Consumer Impact

For consumers, the sales tax can be a significant financial consideration when purchasing a car. The tax can add thousands of dollars to the cost of a vehicle, especially for higher-end models. This is why it’s essential for buyers to factor in the sales tax when budgeting for a car purchase.

Moreover, the variability of local sales taxes can lead to strategic purchasing decisions. For instance, a consumer might choose to purchase a car in a county with a lower local sales tax rate to save money. This highlights the importance of understanding the tax landscape when making a car purchase.

Industry Impact

From the industry’s perspective, the sales tax can influence pricing strategies and sales volumes. Dealerships might need to adjust their pricing to remain competitive, especially in regions with higher local sales taxes. They might also need to educate their customers about the tax implications to ensure a smooth purchasing process.

Furthermore, the tax can also impact the aftermarket sales of vehicles. For instance, when selling a used car, the sales tax on the new purchase might influence the price a consumer is willing to pay for the used vehicle, creating a ripple effect throughout the automotive market.

Future Implications and Changes

The landscape of car sales tax in Alabama is subject to change, especially with evolving economic conditions and legislative decisions. While it’s challenging to predict specific changes, understanding the potential future implications can provide valuable insights for both consumers and industry professionals.

Potential Tax Increases

With rising costs and economic pressures, there is a possibility that Alabama might consider increasing the state or local sales tax rates. While this would generate additional revenue for the state, it could also significantly impact the cost of car purchases for consumers. Therefore, keeping an eye on any proposed tax changes is crucial for both buyers and sellers.

Tax Reform and Simplification

There is also a possibility of tax reform in the future, which could simplify the tax structure for car purchases. This might involve standardizing the tax rates across the state or introducing new exemptions or discounts to stimulate the automotive market. Such reforms could make the tax system more equitable and easier to navigate for consumers and businesses alike.

Alternative Taxation Models

Additionally, Alabama might explore alternative taxation models, such as a flat fee for vehicle registration or a tax based on the vehicle’s fuel efficiency or environmental impact. These models, while less common, could offer a more sustainable and equitable approach to vehicle taxation.

Frequently Asked Questions

How does Alabama calculate the sales tax on car purchases?

+Alabama calculates the sales tax on car purchases by applying the state sales tax rate of 4% to the vehicle’s purchase price. Additionally, local governments can impose their own sales taxes, which can vary significantly. The total sales tax is the sum of the state and local sales taxes.

Are there any tax exemptions or discounts available for car purchases in Alabama?

+Yes, Alabama offers several tax exemptions and discounts for car purchases. Active-duty military personnel, veterans, and their spouses are eligible for a 1% discount on the state sales tax. Individuals with certain disabilities are exempt from paying sales tax on vehicles equipped with adaptive equipment. Additionally, when trading in a vehicle, the trade-in value can be deducted from the purchase price for sales tax calculation.

How do local sales taxes impact the overall cost of purchasing a vehicle in Alabama?

+Local sales taxes in Alabama can significantly impact the overall cost of purchasing a vehicle. These taxes, which vary by county or city, can range from 0% to 5%. For example, if you’re buying a car in a county with a 5% local sales tax, it will add an additional 5% to the state sales tax, increasing the total sales tax to 9% of the vehicle’s purchase price.

What other fees are associated with purchasing a car in Alabama, aside from sales tax?

+Aside from sales tax, Alabama charges a title fee of 35</strong> for new vehicle registrations and <strong>15 for transfers. There’s also a registration fee of $14 for passenger cars, which is a recurring cost due annually. These fees are separate from the sales tax and should be factored into the overall cost of vehicle ownership.

How might future changes in car sales tax impact the automotive industry and consumers in Alabama?

+Future changes in car sales tax could significantly impact both the automotive industry and consumers in Alabama. Potential tax increases could make car purchases more expensive, affecting sales volumes and pricing strategies for dealerships. On the other hand, tax reforms or alternative taxation models could offer new opportunities and challenges, requiring adaptability from both buyers and sellers.