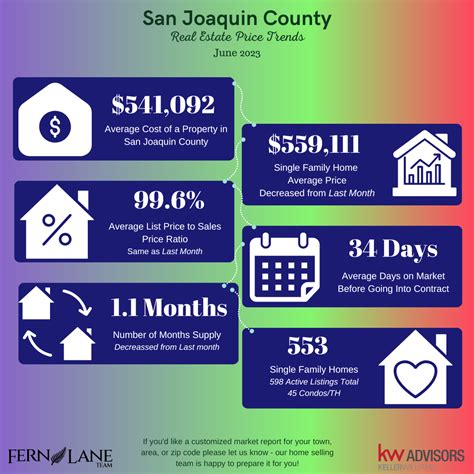

San Joaquin County Property Tax

In San Joaquin County, California, property taxes play a crucial role in funding essential services and maintaining the vibrant community infrastructure. Understanding the nuances of property tax assessments and how they impact homeowners is vital for anyone residing in this region. This comprehensive guide aims to demystify the process, providing an in-depth analysis of San Joaquin County property taxes and their implications.

The Fundamentals of San Joaquin County Property Tax

Property tax assessments in San Joaquin County are governed by a set of regulations and guidelines, ensuring a fair and equitable process for all property owners. The county assessor’s office is responsible for evaluating real estate properties within its jurisdiction, determining their fair market value, and subsequently calculating the property tax due.

The property tax rate in San Joaquin County is expressed as a percentage of the assessed value of the property. This rate is determined annually by the county Board of Supervisors and is used to fund various services, including public safety, education, healthcare, and infrastructure development. The tax rate is typically a combination of general taxes and special district taxes, catering to specific community needs.

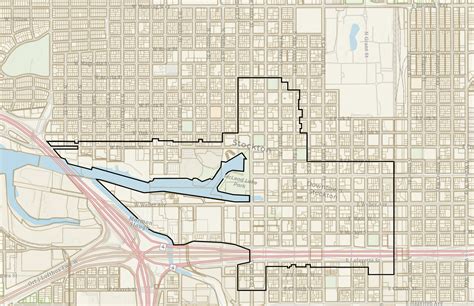

For instance, consider a residential property in Stockton, San Joaquin County's largest city. If the assessed value of this property is $300,000, and the county's property tax rate is 1.25%, the annual property tax liability would amount to $3,750. This calculation demonstrates how the tax rate directly impacts the financial obligations of homeowners.

| Property Type | Assessed Value | Tax Rate | Annual Property Tax |

|---|---|---|---|

| Residential Property (Stockton) | $300,000 | 1.25% | $3,750 |

| Commercial Property (Lodi) | $500,000 | 1.5% | $7,500 |

| Agricultural Land (Ripon) | $250,000 | 0.8% | $2,000 |

This table illustrates the variation in property tax assessments across different property types and locations within San Joaquin County. It showcases how the tax rate and assessed value interplay to determine the final property tax liability for each category.

Property Tax Assessment Process

The property tax assessment process in San Joaquin County involves several key steps. Firstly, the county assessor’s office conducts a comprehensive evaluation of the property, considering factors such as location, size, condition, and recent sales of comparable properties. This ensures that the assessed value is an accurate representation of the property’s market value.

Once the assessment is complete, property owners receive a notice of assessed value, detailing the assessed value and the corresponding property tax liability. This notice provides an opportunity for homeowners to review the assessment and, if necessary, appeal the valuation if they believe it is inaccurate or unfair.

The appeal process in San Joaquin County is designed to ensure transparency and fairness. Property owners can submit written appeals, providing evidence and arguments to support their case. The county's assessment appeals board reviews these appeals and makes a decision based on the available information. This process ensures that property owners have a voice in the assessment process and can challenge valuations if they feel it is warranted.

Factors Influencing Property Tax Assessments

Several factors can influence the assessed value of a property in San Joaquin County. Market conditions play a significant role, with rising property values often leading to higher assessments. Improvements or renovations made to a property can also increase its assessed value, as these enhancements typically add to the property’s overall worth.

Additionally, the location of the property within the county can impact its assessment. Properties in desirable neighborhoods or those with access to excellent amenities and infrastructure may command higher assessments due to their perceived value. Conversely, properties in less desirable areas or those with limited access to services may have lower assessments.

It's important to note that while these factors can influence assessments, the county assessor's office strives to maintain fairness and consistency in its valuation process. Regular reassessments and adjustments ensure that property values remain in line with market trends and that no single property is disproportionately taxed.

Managing Property Tax Obligations

Property tax payments in San Joaquin County are due twice a year, typically in February and August. Homeowners have the option to pay their taxes directly to the county treasurer-tax collector’s office or through their mortgage lender, who may include property taxes in the monthly mortgage payments.

For those facing financial challenges or unexpected circumstances, San Joaquin County offers various programs and resources to assist with property tax payments. These include hardship programs, installment plans, and tax deferment options for eligible individuals. These programs aim to provide relief and ensure that property owners can manage their tax obligations effectively.

Additionally, property owners should be aware of potential tax incentives and exemptions that may reduce their tax liability. For instance, homeowners who qualify for the Homeowners' Property Tax Exemption Program can receive a partial exemption on their property taxes, providing some financial relief. Understanding these incentives and exemptions is crucial for maximizing tax savings.

The Impact of Property Taxes on the Community

Property taxes in San Joaquin County are a vital source of revenue for the local government, funding a wide range of services and initiatives that enhance the quality of life for residents. These funds support public schools, ensuring students have access to quality education and resources. They also contribute to public safety, funding law enforcement agencies and emergency response services, which are essential for community well-being.

Furthermore, property taxes play a crucial role in maintaining and developing community infrastructure. They support road repairs, public transportation, and the construction of new facilities such as parks, libraries, and community centers. These investments not only enhance the aesthetic appeal of the county but also contribute to the overall economic growth and development of the region.

Beyond infrastructure, property taxes also fund social services, ensuring that vulnerable members of the community receive the support they need. This includes programs for seniors, individuals with disabilities, and low-income families. By investing in these services, San Joaquin County strives to create a supportive and inclusive environment for all its residents.

Conclusion: A Comprehensive Approach to Property Taxes

San Joaquin County’s approach to property taxes is comprehensive and transparent, ensuring that the assessment and collection process is fair and beneficial to the community. By understanding the assessment process, homeowners can actively participate in shaping the financial landscape of their neighborhood. The county’s commitment to providing resources and support for property tax management further enhances the overall experience for residents.

In conclusion, San Joaquin County property taxes are an essential component of the local economy and community development. Through a well-regulated assessment process and a range of support programs, the county ensures that property owners have the tools and resources to manage their tax obligations effectively. By fostering a collaborative approach, San Joaquin County strives to create a vibrant and prosperous community for its residents.

How often are property values reassessed in San Joaquin County?

+Property values in San Joaquin County are typically reassessed every three years. However, certain circumstances, such as significant improvements or changes in market conditions, may trigger an earlier reassessment. It’s important for property owners to stay informed about these reassessments and understand how they impact their property tax liability.

What happens if I disagree with my property’s assessed value?

+If you believe that your property’s assessed value is inaccurate or unfair, you have the right to appeal. The county provides a formal assessment appeal process, allowing property owners to submit written appeals and present evidence to support their case. It’s important to gather all relevant information and seek guidance if needed to ensure a successful appeal.

Are there any tax incentives or exemptions available for San Joaquin County homeowners?

+Yes, San Joaquin County offers several tax incentives and exemptions to eligible homeowners. These include the Homeowners’ Property Tax Exemption Program, which provides a partial exemption for primary residences, and various other programs aimed at assisting seniors, veterans, and low-income homeowners. It’s advisable to explore these options to maximize tax savings.