Fl Sales Tax

Welcome to an in-depth exploration of Florida's Sales and Use Tax, a crucial aspect of the state's revenue generation and economic landscape. Understanding this tax is vital for businesses, consumers, and anyone interested in the intricate workings of Florida's economy. In this article, we delve into the specifics of the FL Sales Tax, covering its history, current regulations, and future implications.

Understanding Florida’s Sales and Use Tax: A Comprehensive Guide

Florida’s Sales and Use Tax is a critical component of the state’s fiscal policy, contributing significantly to its overall revenue. This tax, often simply referred to as sales tax, is levied on the sale of goods and certain services within the state. It plays a pivotal role in funding essential public services and infrastructure projects.

The History and Evolution of FL Sales Tax

The journey of Florida’s sales tax dates back to the early 20th century. It was first introduced in 1939 as a temporary measure to provide relief during the Great Depression. However, it proved to be an effective revenue generator, and by 1949, it became a permanent fixture in the state’s tax system.

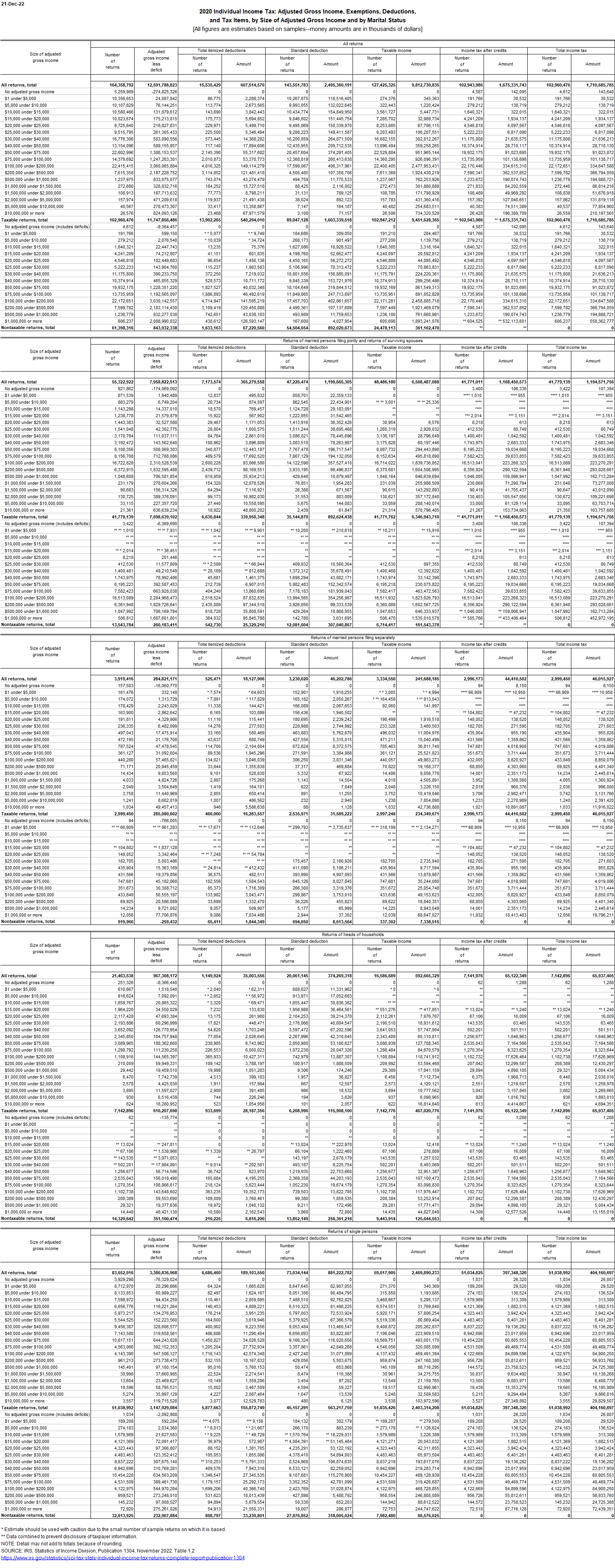

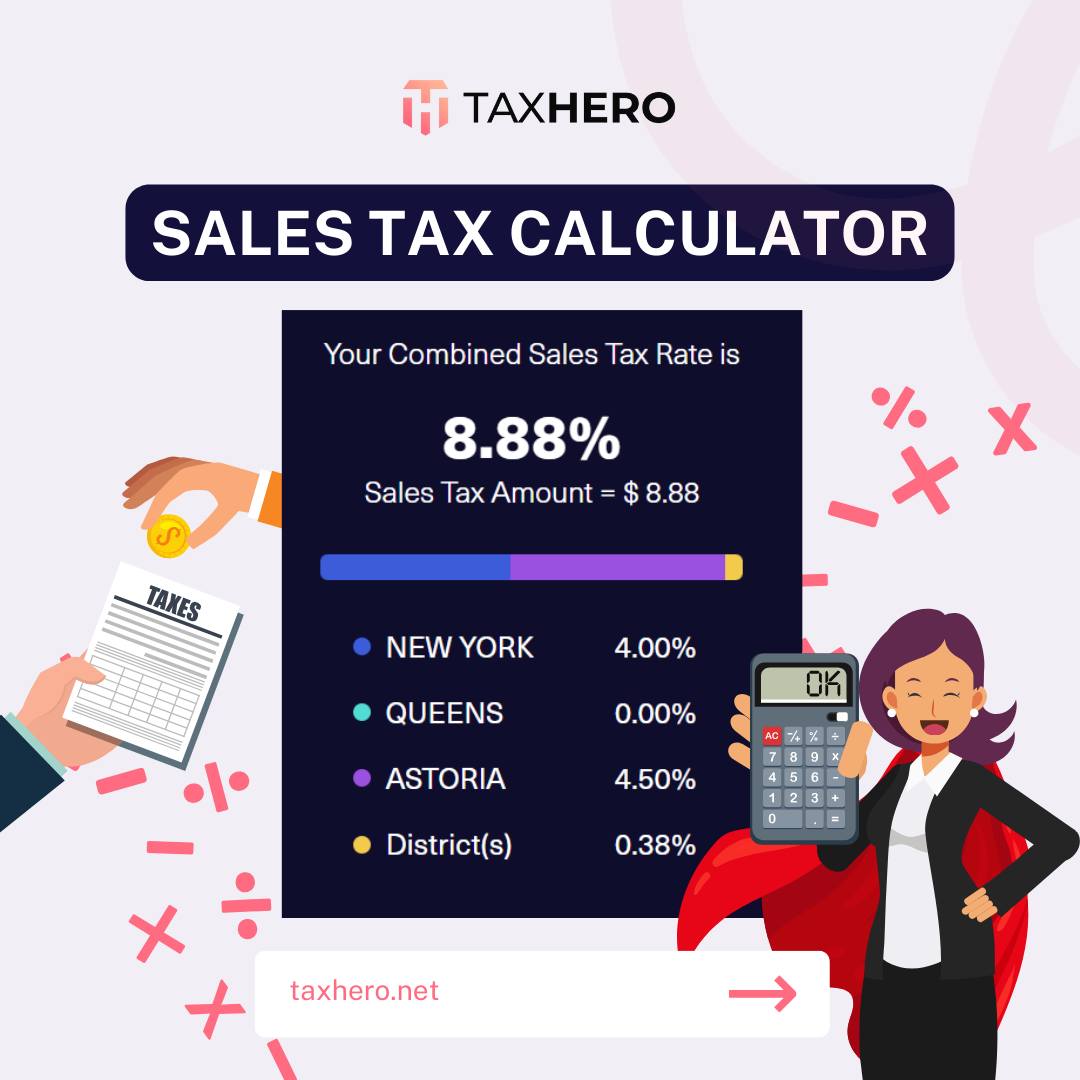

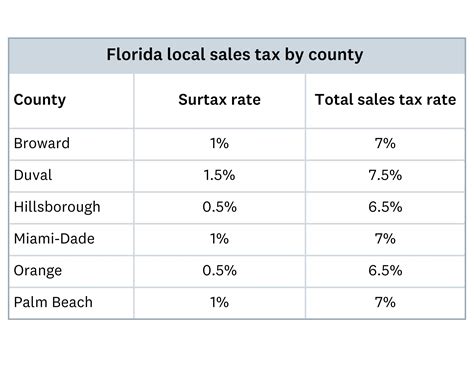

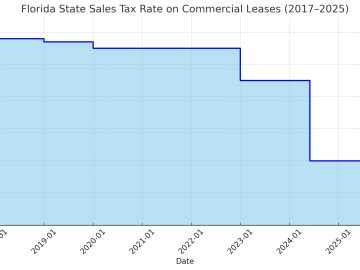

Since its inception, the sales tax rate has undergone several adjustments, with the most recent change occurring in 2019. The state's general sales tax rate currently stands at 6%, with additional local option taxes varying across different counties, resulting in a combined rate that can reach up to 8.5% in some areas.

| County | Local Option Tax Rate |

|---|---|

| Monroe County | 2% |

| Gadsden County | 1% |

| Hillsborough County | 1.5% |

Over the years, the state has also introduced various exemptions and special provisions to the sales tax, catering to specific industries and situations. These exemptions are designed to stimulate economic growth and support specific sectors, such as tourism and agriculture, which are vital to Florida's economy.

Taxable Goods and Services

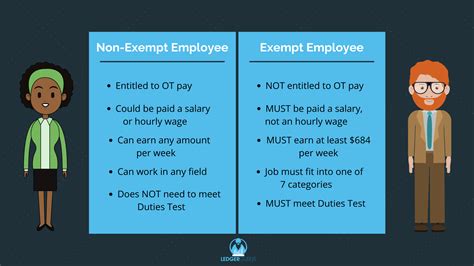

The FL Sales Tax applies to a broad range of goods and services. This includes tangible personal property, such as clothing, electronics, and furniture, as well as certain services like repairs, installations, and professional services. However, there are some notable exceptions, including most groceries, prescription drugs, and residential rent.

- Taxable Goods:

- Clothing and accessories

- Electronics (e.g., smartphones, laptops)

- Vehicles (cars, motorcycles)

- Taxable Services:

- Auto repairs

- Landscaping services

- Haircuts and salon services

It's important to note that the taxability of certain items can be complex and may depend on various factors, including the nature of the transaction and the specific circumstances. Therefore, businesses and consumers alike should stay informed about the latest regulations and seek professional advice when needed.

Compliance and Reporting

Ensuring compliance with Florida’s sales tax regulations is a critical responsibility for businesses operating within the state. This involves accurately collecting, remitting, and reporting sales tax to the Florida Department of Revenue. Non-compliance can lead to significant penalties and legal consequences.

To facilitate compliance, the state provides a range of resources and tools, including online filing and payment systems. Additionally, businesses can leverage sales tax automation software to streamline their tax management processes, ensuring accuracy and timely reporting.

For consumers, understanding their sales tax obligations is equally important. This includes being aware of the tax rate in their specific location and ensuring that the tax is correctly charged and included in the total price of their purchases. Being informed about sales tax regulations can help consumers make more informed financial decisions.

Impact on the Economy and Future Implications

Florida’s sales tax has a significant impact on the state’s economy, shaping consumer behavior, business operations, and revenue generation. The tax provides a stable source of income for the state, funding critical public services and infrastructure projects that drive economic growth.

Looking ahead, the future of Florida's sales tax is closely tied to the state's economic and demographic trends. As the state continues to attract businesses and residents, the sales tax base is expected to expand, potentially leading to further adjustments in tax rates or exemptions to accommodate the changing economic landscape.

Additionally, the ongoing digital transformation of the economy presents both challenges and opportunities for the sales tax system. The rise of e-commerce and remote transactions raises complex issues regarding tax collection and compliance. Florida, like many other states, is actively addressing these challenges to ensure a fair and sustainable tax system in the digital age.

In conclusion, Florida's sales tax is a dynamic and evolving aspect of the state's fiscal policy, playing a pivotal role in shaping its economic future. By staying informed about the latest regulations, businesses and consumers can navigate the complexities of sales tax and contribute to the state's economic prosperity.

What is the current sales tax rate in Florida?

+

The current general sales tax rate in Florida is 6%, with additional local option taxes varying by county, resulting in a combined rate that can reach up to 8.5% in some areas.

Are there any sales tax holidays in Florida?

+

Yes, Florida occasionally offers sales tax holidays, typically for specific items like school supplies or hurricane preparedness items. These holidays provide an opportunity for consumers to save on their purchases.

How often are sales tax rates updated in Florida?

+

Sales tax rates in Florida are typically updated annually, with the most recent change occurring in 2019. However, local option taxes may be adjusted more frequently based on local economic conditions.

What are the penalties for non-compliance with sales tax regulations in Florida?

+

Non-compliance with sales tax regulations in Florida can result in significant penalties, including fines, interest charges, and potential criminal charges in severe cases. It is crucial for businesses to ensure compliance to avoid these consequences.