State Of Virginia Taxes

In the State of Virginia, taxes are an essential component of the financial ecosystem, playing a crucial role in funding public services and infrastructure. From personal income taxes to sales and property taxes, the tax system in Virginia is designed to support the state's economic growth and development. Understanding the intricacies of Virginia's tax landscape is vital for individuals and businesses alike, as it directly impacts their financial obligations and planning.

Understanding Virginia’s Tax System

The Commonwealth of Virginia employs a comprehensive tax system to generate revenue for various state initiatives and programs. This system encompasses a range of taxes, each with its own unique characteristics and implications. Let’s delve into the key components of Virginia’s tax structure.

Personal Income Tax

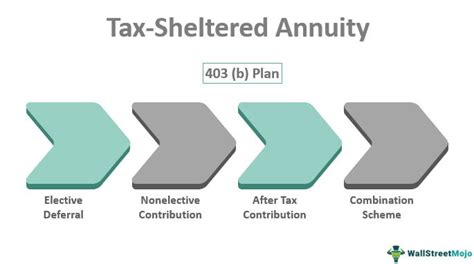

Personal income tax is a significant source of revenue for the state. Virginia follows a progressive tax system, which means that higher income earners pay a higher tax rate. The state offers five income tax brackets, ranging from 2.0% to 5.75%, with the tax rate increasing as taxable income rises. For instance, an individual with a taxable income of $50,000 would fall into the 4.5% tax bracket.

Virginia also provides tax deductions and credits to alleviate the tax burden on its residents. Some common deductions include those for dependents, medical expenses, and retirement contributions. Additionally, the state offers various tax credits, such as the Earned Income Tax Credit (EITC) for low-income families and the Virginia Sales Tax Holiday Credit for qualifying purchases made during designated sales tax holidays.

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 1 | 2.0% | Up to $3,000 |

| 2 | 3.0% | $3,001 - $5,000 |

| 3 | 4.0% | $5,001 - $17,000 |

| 4 | 5.0% | $17,001 - $22,500 |

| 5 | 5.75% | Over $22,500 |

Sales and Use Tax

Sales and use tax is another critical component of Virginia’s tax system. The state levies a 4.3% sales tax rate on most tangible personal property and certain services. This tax is collected by retailers at the point of sale and is then remitted to the state. For example, if you purchase a new television for 500, you would pay a sales tax of 21.50 (4.3% of 500), bringing the total cost to 521.50.

Virginia also offers tax exemptions for specific items and services. These exemptions can vary based on the type of product, the purpose of the purchase, and the consumer's eligibility. For instance, certain food items, prescription drugs, and educational materials are exempt from sales tax. Additionally, there are special tax rates for specific types of businesses, such as grocers and restaurants, which have a reduced sales tax rate of 1.5% on certain items.

| Item | Sales Tax Rate |

|---|---|

| Tangible Personal Property | 4.3% |

| Food | 0% (exempt) |

| Prescription Drugs | 0% (exempt) |

| Groceries | 1.5% (reduced rate) |

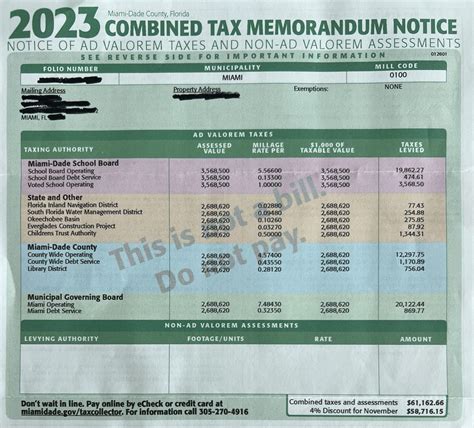

Property Tax

Property tax is a significant revenue stream for local governments in Virginia. The state’s property tax system is administered by individual counties and cities, which have the authority to set their own tax rates. This local control allows for variation in tax rates across the state.

The property tax in Virginia is based on the assessed value of the property. The assessment process involves evaluating the property's fair market value, which is then multiplied by the applicable tax rate to determine the tax liability. For instance, if your property is assessed at a value of $200,000 and the tax rate is 1%, your annual property tax would amount to $2,000.

Virginia offers several tax relief programs for property owners. These programs aim to reduce the tax burden for specific groups, such as seniors, disabled individuals, and veterans. For example, the Land Use Assessment Program provides reduced tax assessments for property owners who maintain their land for agricultural or horticultural purposes.

Tax Compliance and Enforcement

The Virginia Department of Taxation is responsible for administering and enforcing the state’s tax laws. This department ensures that taxpayers comply with their tax obligations and that revenue is collected efficiently and fairly. Non-compliance with tax laws can result in penalties, interest, and, in some cases, criminal charges.

To promote tax compliance, the Department of Taxation offers various resources and support to taxpayers. This includes guidance on tax forms and filings, as well as access to online tools for calculating tax liabilities and making payments. The department also conducts outreach and education initiatives to inform taxpayers about their rights and responsibilities.

In cases of suspected tax evasion or fraud, the Department of Taxation has the authority to investigate and prosecute offenders. These enforcement actions are essential for maintaining the integrity of the tax system and ensuring that all taxpayers contribute their fair share.

Future of Virginia’s Tax Landscape

The tax landscape in Virginia is constantly evolving to adapt to the changing needs of the state and its residents. As the economy grows and demographic trends shift, the state’s tax policies must remain flexible and responsive.

One key area of focus for Virginia's tax system is equity and fairness. The state is exploring ways to ensure that the tax burden is distributed equitably among its residents, taking into account factors such as income, property ownership, and consumption patterns. This includes examining the potential impact of tax reforms on different socioeconomic groups and ensuring that any changes promote economic growth and opportunity for all Virginians.

Additionally, Virginia is committed to simplifying its tax system and reducing administrative burdens for taxpayers. The state is investing in technology and digital solutions to streamline tax filing and payment processes, making it easier for individuals and businesses to meet their tax obligations. This includes the development of user-friendly online platforms and the expansion of electronic filing options.

As Virginia continues to navigate economic challenges and opportunities, its tax system will play a pivotal role in shaping the state's future. By striking a balance between generating sufficient revenue and maintaining a competitive business environment, Virginia can foster economic growth, support public services, and ensure the long-term prosperity of its residents.

What is the current sales tax rate in Virginia?

+The current sales tax rate in Virginia is 4.3%, effective as of January 1, 2024. This rate applies to most tangible personal property and certain services.

Are there any tax breaks or incentives for businesses in Virginia?

+Yes, Virginia offers a range of tax incentives and credits to attract and support businesses. These include tax credits for job creation, research and development, and investment in certain industries. Additionally, there are specific tax breaks for certain types of businesses, such as manufacturers and technology companies.

How often do property tax rates change in Virginia?

+Property tax rates in Virginia can change annually, as they are set by individual counties and cities. Each locality determines its own tax rate based on its budget needs and revenue requirements. Therefore, it’s important for property owners to stay informed about any changes in their specific locality.