Tennessee Sales Tax Rate

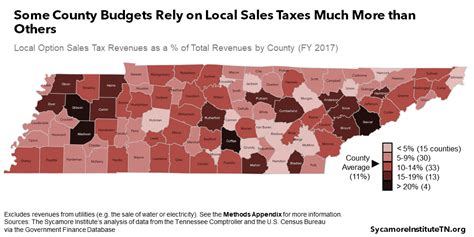

The Tennessee Sales Tax is a consumption tax levied on the sale of goods and some services within the state. It is an important revenue source for the state government and is utilized to fund various public services and infrastructure projects. The sales tax rate in Tennessee varies depending on the type of transaction and the location where it takes place, with local municipalities often adding additional taxes to the state-level rate.

Understanding the Tennessee Sales Tax Rate

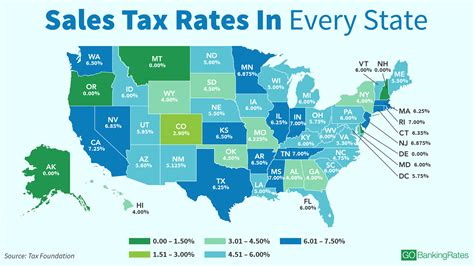

The state of Tennessee imposes a uniform sales and use tax rate of 7% on most tangible personal property and certain digitally provided products and services. This base rate is applied uniformly across the state, making it one of the lower sales tax rates in the United States. However, it is important to note that local governments, counties, and municipalities are authorized to levy additional taxes, which can significantly increase the overall sales tax rate in certain areas.

For instance, the city of Nashville, the state's capital, has a local sales tax rate of 2.25%, resulting in a combined state and local sales tax rate of 9.25% for purchases made within the city limits. Similarly, Memphis, the state's largest city, has a local sales tax rate of 2.75%, bringing the total sales tax rate to 9.75% for transactions occurring in Memphis.

Sales Tax Rates in Different Tennessee Cities

The table below provides a snapshot of the combined state and local sales tax rates for some of Tennessee’s major cities:

| City | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Nashville | 2.25% | 9.25% |

| Memphis | 2.75% | 9.75% |

| Knoxville | 2.25% | 9.25% |

| Chattanooga | 2.75% | 9.75% |

| Clarksville | 2.25% | 9.25% |

These local sales tax rates can vary significantly between different cities and counties within Tennessee, making it essential for businesses and consumers to be aware of the applicable rates in their specific locations.

Exemptions and Special Considerations

While the Tennessee Sales Tax applies to a wide range of goods and services, there are certain categories that are exempt or subject to reduced tax rates. These exemptions can vary based on the type of product, the intended use, or the consumer’s status. For example, certain food items, prescription drugs, and non-prescription medicines are exempt from sales tax, while others may be subject to a lower tax rate.

Additionally, Tennessee offers a Sales and Use Tax Holiday, which is a designated period during which certain items are exempt from sales tax. This holiday typically occurs over a weekend in August and is aimed at providing relief to consumers, especially for back-to-school shopping. The eligible items and the specific dates of the tax holiday vary from year to year, so it is advisable to check the official Tennessee Department of Revenue website for the most up-to-date information.

Impact on Businesses and Consumers

The Tennessee Sales Tax rate has a significant impact on both businesses and consumers within the state. For businesses, particularly those involved in retail sales, the sales tax is a key consideration when setting prices and managing cash flow. They must collect the appropriate sales tax from customers and remit it to the state and local governments, ensuring compliance with tax laws and regulations.

For consumers, the sales tax directly affects the cost of goods and services they purchase. The varying rates across the state can influence buying decisions, with consumers potentially traveling to areas with lower sales tax rates to make significant purchases. Understanding the sales tax rates in their local area is crucial for consumers to budget effectively and make informed purchasing choices.

Compliance and Reporting

Businesses operating in Tennessee must comply with the state’s sales tax laws, which include registering with the Tennessee Department of Revenue, collecting the appropriate sales tax on taxable transactions, and filing regular sales tax returns. The frequency of these returns can vary depending on the business’s sales volume and type, with some businesses required to file monthly, quarterly, or annually.

Failure to comply with Tennessee's sales tax laws can result in penalties, interest, and other enforcement actions by the state. It is crucial for businesses to stay informed about their sales tax obligations and to seek professional advice when necessary to ensure they are meeting their legal responsibilities.

Future Outlook and Potential Changes

The Tennessee Sales Tax rate and structure are subject to change, influenced by various factors such as economic conditions, political decisions, and public opinion. While the state’s current sales tax rate is relatively stable, there have been discussions and proposals in the past to modify the rate or introduce new taxes to address specific budgetary needs or policy objectives.

For instance, there have been debates about the potential introduction of a local option sales tax, which would give individual counties or municipalities more control over their sales tax rates. This could lead to further variations in sales tax rates across the state, impacting both businesses and consumers.

Additionally, the increasing trend of online shopping and the challenge of collecting sales tax on remote sales have led to ongoing discussions about the need for sales tax reform at the federal level. Any changes at the federal level could have significant implications for Tennessee's sales tax structure and the way it is administered and collected.

Are there any items that are exempt from Tennessee Sales Tax?

+Yes, certain items are exempt from Tennessee Sales Tax. These include food items for home consumption, prescription drugs, non-prescription medicines, and some agricultural products. Additionally, there are specific exemptions for certain industries, such as manufacturing and resellers.

How often do businesses need to file Tennessee Sales Tax returns?

+The frequency of filing Tennessee Sales Tax returns depends on the business’s sales volume. Most businesses are required to file monthly or quarterly, but those with higher sales may be required to file more frequently. Annual filing is generally for businesses with very low sales.

What happens if a business fails to collect and remit Tennessee Sales Tax?

+Failure to collect and remit Tennessee Sales Tax can result in penalties, interest, and potential legal action by the state. The severity of the penalties depends on the nature and extent of the violation. It is crucial for businesses to stay compliant with their sales tax obligations to avoid these consequences.

Are there any upcoming changes to Tennessee’s Sales Tax rate or structure?

+As of my last update in January 2023, there were no immediate plans to change Tennessee’s Sales Tax rate. However, sales tax laws are subject to change, and businesses and consumers should stay informed about any potential updates or reforms that may impact them.