Fairfax County Property Tax Records

Welcome to this comprehensive guide on Fairfax County Property Tax Records, a topic of interest for homeowners, real estate enthusiasts, and those curious about the tax landscape in one of the largest counties in Virginia. In this article, we will delve into the intricacies of property taxation in Fairfax County, shedding light on the assessment process, tax rates, payment options, and strategies to navigate this essential aspect of homeownership.

Understanding Property Tax Assessments in Fairfax County

Fairfax County, with its vibrant communities and diverse real estate market, employs a systematic approach to property tax assessments. The Fairfax County Office of Real Estate Assessments is responsible for evaluating properties within the county to determine their fair market value, which forms the basis for property tax calculations. This process ensures that property owners contribute their fair share to the local government’s revenue stream, funding essential services and infrastructure.

Assessment Methodology

The assessment process involves a meticulous examination of various factors, including the property’s location, size, age, condition, and recent sales data of comparable properties. Assessors consider the property’s potential income-generating capacity and any recent improvements or additions. This data-driven approach aims to provide an accurate representation of a property’s value, ensuring fairness and transparency.

| Assessment Factors | Description |

|---|---|

| Location | The neighborhood, school district, and proximity to amenities impact value. |

| Size and Age | Larger, newer properties generally command higher values. |

| Condition and Improvements | Well-maintained properties with modern upgrades are valued higher. |

| Market Trends | Recent sales data of similar properties influence assessments. |

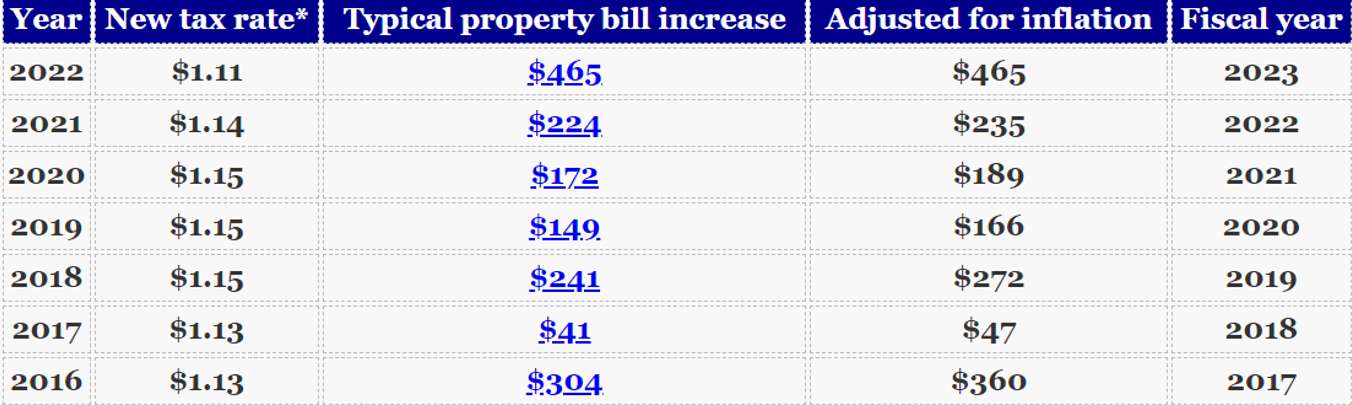

Exploring Property Tax Rates and Calculations

Property tax rates in Fairfax County are determined by the Fairfax County Board of Supervisors, taking into account the county’s budget needs and the desire to maintain a balanced tax structure. These rates are expressed as dollars per hundred dollars of assessed value, ensuring consistency and ease of calculation.

Tax Rate Structure

The tax rate is typically divided into two components: the general tax rate and the real estate tax rate. The general tax rate funds essential services like public safety, education, and county administration, while the real estate tax rate specifically supports public schools and other educational initiatives.

For the fiscal year 2023-2024, the general tax rate is set at $0.998 per $100 of assessed value, while the real estate tax rate stands at $0.972 per $100 of assessed value. This translates to a combined tax rate of $1.97 per $100 of assessed value for residential properties.

Tax Calculation Example

Let’s illustrate the tax calculation process with an example. Suppose a homeowner in Fairfax County has a residential property with an assessed value of 500,000. Using the combined tax rate of 1.97 per $100 of assessed value, we can calculate the annual property tax as follows:

$500,000 (assessed value) x $1.97 (tax rate) / $100 = $9,850

So, in this case, the homeowner would owe $9,850 in property taxes for the year.

Navigating Property Tax Payments

Fairfax County offers several convenient options for property tax payments, ensuring flexibility and accessibility for homeowners. Understanding these payment methods and their timelines is essential for timely remittance and avoiding penalties.

Payment Options

- Online Payments: The Fairfax County website provides a secure online platform for making tax payments. Homeowners can use credit cards, debit cards, or electronic checks for a seamless transaction experience.

- Mail-in Payments: For those preferring traditional methods, payment by mail is an option. Homeowners can send their tax payments along with the provided bill stub to the address specified on the bill.

- In-Person Payments: Fairfax County Taxpayer Services offers in-person payment facilities at designated locations. Homeowners can visit these offices to make payments using cash, check, or money order.

- Automatic Payment Plans: For added convenience, homeowners can enroll in automatic payment plans. This option allows for automatic deductions from a specified bank account, ensuring timely payments without the hassle of manual transactions.

Payment Due Dates

Property taxes in Fairfax County are due semi-annually, with payments typically due in February and July. Late payments incur interest and penalties, so staying informed about due dates is crucial. The county sends out tax bills well in advance, providing homeowners with ample time to make arrangements.

Strategies for Managing Property Taxes

Understanding property tax assessments and rates is just the first step. Homeowners can employ various strategies to manage their property taxes effectively, optimizing their financial situation and ensuring compliance with tax regulations.

Appealing Assessments

If a homeowner believes their property assessment is inaccurate, they have the right to appeal. The Fairfax County Board of Equalization provides a formal process for challenging assessments. Homeowners can present evidence, such as recent sales data or expert appraisals, to support their case. Successful appeals can lead to reduced assessments and, consequently, lower property taxes.

Maximizing Exemptions and Credits

Fairfax County offers several exemptions and tax credits to eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Land Use Assessment, which provides tax relief for agricultural and horticultural lands. Exploring these options and applying for eligible credits can significantly reduce property tax burdens.

Home Improvements and Renovations

Strategic home improvements can impact property assessments and, consequently, tax obligations. Adding energy-efficient upgrades, modernizing outdated features, or enhancing curb appeal can increase a property’s value and potentially lead to higher assessments. However, these improvements should be weighed against the potential tax implications to ensure a positive financial outcome.

Conclusion: Empowering Homeowners with Knowledge

Understanding Fairfax County Property Tax Records is not merely a financial obligation but an opportunity to engage with the local community and contribute to its growth. By exploring the assessment process, tax rates, payment options, and management strategies, homeowners can make informed decisions, optimize their financial situation, and actively participate in the county’s vibrant real estate landscape.

Stay informed, seek professional guidance when needed, and embrace the responsibilities and privileges of homeownership in Fairfax County.

How often are property assessments conducted in Fairfax County?

+

Property assessments in Fairfax County are conducted every year to ensure accurate tax calculations. Assessors review properties and market data to determine fair market values, which form the basis for tax assessments.

Can property owners appeal their assessments if they disagree with the valuation?

+

Absolutely! Property owners have the right to appeal their assessments if they believe the valuation is incorrect. The Fairfax County Board of Equalization provides a formal process for appealing assessments, allowing homeowners to present evidence and arguments to support their case.

What are the payment deadlines for property taxes in Fairfax County?

+

Property taxes in Fairfax County are due semi-annually, typically in February and July. It’s essential to stay informed about these deadlines to avoid late payment penalties. The county sends out tax bills well in advance, providing ample time for homeowners to make arrangements.

Are there any exemptions or tax credits available to reduce property tax burdens in Fairfax County?

+

Yes, Fairfax County offers several exemptions and tax credits to eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Land Use Assessment, which provides tax relief for agricultural and horticultural lands. Exploring these options can significantly reduce property tax obligations.