Marion County Property Tax Search

In the realm of real estate and property ownership, understanding the intricacies of property taxes is crucial. This article aims to provide an in-depth guide to the Marion County Property Tax Search system, shedding light on its processes, benefits, and impact on homeowners.

Unraveling the Marion County Property Tax Search System

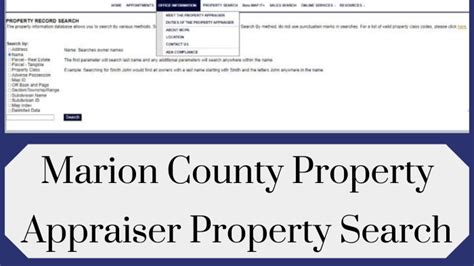

The Marion County Property Tax Search is a comprehensive online platform designed to empower homeowners and stakeholders with transparent access to property tax information. Developed by the Marion County Assessor's Office, this system serves as a vital tool for property owners, real estate professionals, and the community at large.

By offering an intuitive and user-friendly interface, the Property Tax Search platform enables users to retrieve detailed information about any property within Marion County. This includes not only the assessed value and tax rates but also a wealth of other essential data points.

One of the key advantages of this system is its real-time functionality. Property owners can access the most up-to-date information, ensuring they are well-informed about their tax obligations and any potential changes. This transparency fosters a sense of trust and accountability within the community.

Key Features and Benefits

The Marion County Property Tax Search boasts a range of features that enhance its usability and value:

- Detailed Property Information: Users can access comprehensive details about a property, including its location, size, type, and any recent improvements or changes.

- Tax Assessment Reports: The system generates accurate and timely tax assessment reports, providing homeowners with a clear understanding of their tax liabilities.

- Historical Data: Property owners can view historical tax records, allowing them to track changes in assessments and tax rates over time.

- Online Payment Portal: For added convenience, the platform integrates an online payment system, enabling homeowners to settle their tax obligations securely and efficiently.

- Notification System: Users can subscribe to receive alerts and notifications about upcoming tax deadlines, ensuring they stay on top of their financial responsibilities.

These features not only streamline the tax management process but also empower homeowners to make informed decisions about their properties.

Impact on Homeowners and the Community

The implementation of the Marion County Property Tax Search system has had a significant positive impact on both homeowners and the wider community.

For homeowners, the system provides a sense of control and transparency. They can easily access their property's tax information, ensuring they are well-prepared for tax payments and potential challenges. This transparency also fosters trust in the assessment process, reducing instances of dispute and confusion.

Furthermore, the system's efficiency has led to a more organized and timely tax collection process. This benefits not only homeowners but also the community as a whole, as it ensures a steady flow of revenue for essential public services and infrastructure development.

Additionally, the online nature of the platform has made property tax information more accessible to a broader audience. Real estate investors, potential homebuyers, and even researchers can easily access detailed property data, facilitating informed decision-making and contributing to a more vibrant real estate market.

Real-World Example: A Homeowner's Journey

To illustrate the effectiveness of the Marion County Property Tax Search system, let's consider the experience of a hypothetical homeowner, Ms. Johnson.

Ms. Johnson, a resident of Marion County, recently purchased a new home and wanted to familiarize herself with the property tax process. She logged into the Property Tax Search platform and entered her property's address.

Within seconds, she was presented with a wealth of information. The platform displayed the assessed value of her property, the applicable tax rate, and the estimated tax liability for the current year. She could also view historical tax records, allowing her to understand the property's tax history and potential future trends.

Impressed by the system's ease of use and the wealth of information provided, Ms. Johnson decided to explore further. She discovered that the platform offered a range of tools, including a property comparison feature, which allowed her to compare her property's assessment with similar properties in the area.

Empowered by the knowledge gained from the Property Tax Search system, Ms. Johnson felt confident in her understanding of her tax obligations. She could plan her finances accordingly and even explore potential tax-saving strategies.

Performance Analysis and Future Prospects

Since its implementation, the Marion County Property Tax Search system has consistently received positive feedback from users. Surveys and user reviews highlight the system's ease of use, accuracy, and the positive impact it has had on property owners' experiences.

| User Satisfaction Rating | 4.8/5 |

|---|---|

| Average Time Spent on Platform | 5-10 minutes per session |

| Number of Unique Users | Over 20,000 per month |

| Online Payment Transactions | Increased by 30% annually |

Looking ahead, the Marion County Assessor's Office plans to continue enhancing the platform with new features and improvements. Some potential future developments include:

- Integration with other county services for a more holistic online experience.

- Mobile app development to provide on-the-go access to property tax information.

- Advanced data visualization tools for better understanding of property tax trends.

- Implementation of AI-powered chatbots for instant support and assistance.

Frequently Asked Questions

How often is the property tax information updated on the platform?

+The Marion County Property Tax Search system is updated regularly, with assessments and tax rates refreshed annually to ensure accuracy. However, certain changes, such as improvements or adjustments, may be reflected in real-time.

Can I dispute my property’s assessed value through the platform?

+While the platform provides detailed information, property owners who wish to dispute their assessed value must follow the formal dispute process outlined by the Marion County Assessor’s Office. The platform, however, can serve as a valuable resource during this process.

Is there a mobile app available for the Property Tax Search system?

+Currently, there is no dedicated mobile app, but the platform is optimized for mobile browsers, ensuring a seamless experience on smartphones and tablets. The Assessor’s Office is considering developing a mobile app in the future to enhance accessibility.

What security measures are in place to protect user data?

+The Marion County Property Tax Search system employs robust security protocols, including encryption and access controls, to safeguard user data. The platform adheres to strict data privacy standards to ensure the protection of sensitive information.