Texas Payroll Taxes

Texas payroll taxes are an essential component of the state's revenue system, contributing significantly to its economic landscape. These taxes are integral to the functioning of various state programs and services, playing a crucial role in maintaining the state's infrastructure and social safety nets. In this comprehensive guide, we will delve into the intricacies of Texas payroll taxes, covering their calculation, reporting, and compliance requirements, while also exploring the implications they have on businesses and employees within the state.

Understanding Texas Payroll Taxes

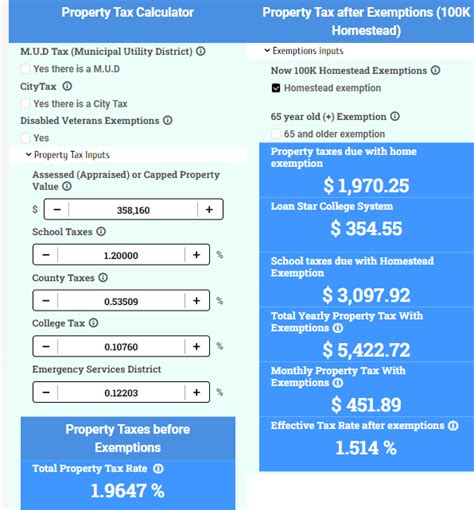

Texas is unique in its approach to taxation, as it does not impose a state income tax on its residents. Instead, the state relies heavily on sales tax and property tax to fund its operations. However, when it comes to payroll taxes, Texas employers and employees navigate a complex system that includes federal, state, and local obligations.

The payroll tax system in Texas is designed to fund specific programs and services, primarily social security, Medicare, unemployment insurance, and worker's compensation. These taxes are mandatory and must be withheld from employee wages and remitted to the appropriate authorities. Let's break down the key components of Texas payroll taxes.

Federal Payroll Taxes

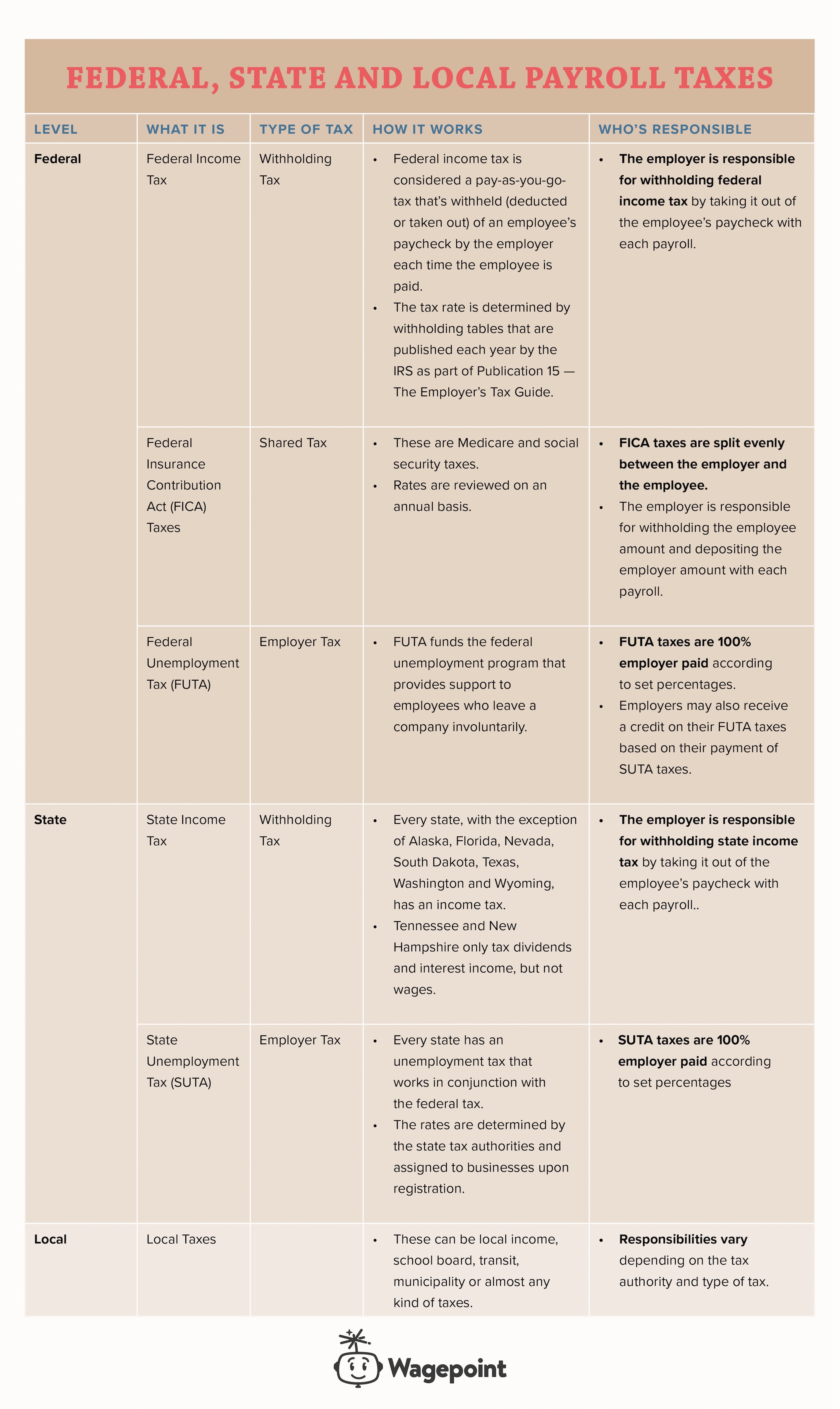

Federal payroll taxes are a universal requirement for all U.S. employers, and Texas is no exception. These taxes include:

- Social Security Tax: Also known as the Federal Insurance Contributions Act (FICA) tax, this tax funds the Social Security system, providing retirement, disability, and survivor benefits. Employers and employees each contribute 6.2% of wages up to the annual wage base limit, currently set at $147,000.

- Medicare Tax: This tax, at a rate of 1.45% of wages, is applied to all earnings without an income limit. Both employers and employees contribute this amount. An additional 0.9% Medicare tax applies to employees earning above a certain threshold, currently $200,000 for single filers.

- Federal Unemployment Tax (FUTA): FUTA is paid solely by employers to fund unemployment benefits. The tax rate is 6% on the first $7,000 of wages paid to each employee annually. However, employers can claim a credit of up to 5.4% if they also pay state unemployment taxes, reducing the effective FUTA rate to 0.6%.

State Payroll Taxes

In Texas, state payroll taxes primarily consist of contributions to the Texas Workforce Commission’s Unemployment Compensation Fund. Employers are responsible for paying a state unemployment tax (SUT) based on their industry and employment history. The SUT rate ranges from 0.25% to 5.4%, with most employers falling within the 2.7% to 3.2% range.

Texas also has a state disability insurance program, but it is not mandatory for private employers. However, certain industries, such as construction and maritime, are required to provide workers' compensation coverage, which includes disability insurance.

Local Payroll Taxes

While most Texas cities and counties do not impose additional payroll taxes, a few municipalities do have local payroll tax requirements. For instance, the City of Dallas has a 0.5% payroll tax, while the City of Austin imposes a 1% tax on employers with annual payrolls exceeding $20,000.

Payroll Tax Calculation and Reporting

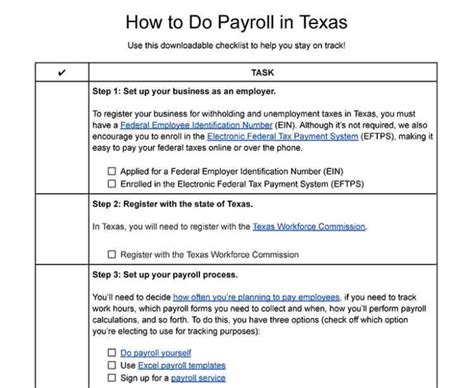

Calculating and reporting payroll taxes in Texas involves a multi-step process that must be completed accurately and timely. Here’s a simplified breakdown of the steps involved:

Step 1: Wage Calculation

The first step is to determine the gross wages for each employee, including base pay, overtime, bonuses, and any other taxable income. It’s crucial to ensure that all forms of compensation are accurately accounted for.

Step 2: Withholding Taxes

Employers must withhold federal income tax, Social Security tax, and Medicare tax from employees’ wages based on the withholding allowances and tax rates. Texas does not have a state income tax, so there is no state withholding requirement.

Step 3: Employer Contributions

In addition to withholding taxes, employers are responsible for matching the Social Security and Medicare taxes. They also need to calculate and pay the state unemployment tax based on their assigned rate.

Step 4: Reporting and Remittance

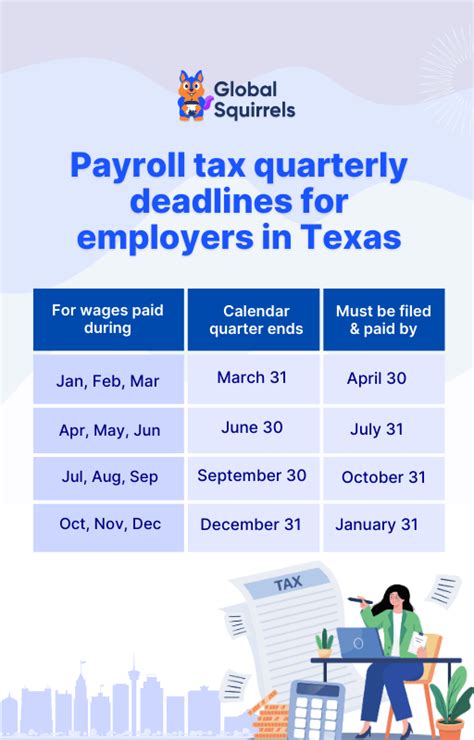

Federal payroll taxes must be reported and remitted to the Internal Revenue Service (IRS) on a periodic basis, typically monthly or semiweekly, depending on the employer’s annual tax liability. State unemployment taxes are reported and paid quarterly to the Texas Workforce Commission.

It's essential to maintain accurate records and ensure timely payment of payroll taxes to avoid penalties and interest charges.

Compliance and Penalties

Compliance with payroll tax regulations is non-negotiable for Texas employers. Failure to comply can result in severe penalties, including fines, interest, and even criminal charges in extreme cases. The IRS and Texas Workforce Commission have stringent enforcement measures in place to ensure compliance.

Some common penalties include:

- Failure to Withhold: Employers who fail to withhold and remit taxes may be held personally liable for the unpaid taxes, even if the business cannot pay.

- Late Payment: Late payment of payroll taxes incurs penalties and interest, which can quickly accumulate.

- Reporting Errors: Incorrect or incomplete tax reporting can lead to penalties and audits.

Implications for Businesses and Employees

Payroll taxes have a significant impact on both businesses and employees in Texas. For businesses, the burden of payroll taxes can be substantial, especially for small and medium-sized enterprises. The cost of payroll taxes must be factored into business operations and financial planning.

Employees, on the other hand, benefit from the social safety nets funded by payroll taxes. These taxes ensure access to unemployment benefits, disability coverage, and retirement security. However, the withholding of taxes from wages can impact employees' take-home pay, so it's essential for employers to communicate tax implications clearly.

Best Practices for Payroll Tax Management

Navigating the complex world of payroll taxes in Texas requires careful planning and adherence to best practices. Here are some key strategies for businesses to consider:

- Accurate Record-Keeping: Maintain detailed and organized records of all payroll transactions, including wages, taxes withheld, and contributions made.

- Timely Payment: Ensure that payroll taxes are remitted on time to avoid costly penalties and interest charges.

- Utilize Payroll Software: Invest in reliable payroll software that can automate tax calculations, withholdings, and reporting to reduce the risk of errors.

- Stay Informed: Stay updated on any changes to tax laws and regulations to ensure compliance. Texas, like other states, may introduce new tax measures or adjust existing rates periodically.

Future Outlook and Considerations

The landscape of payroll taxes in Texas is subject to change, influenced by various factors such as economic conditions, legislative decisions, and societal needs. While it’s challenging to predict specific changes, there are a few key considerations for the future:

- Economic Impact: The state's reliance on sales tax and property tax may shift in response to economic fluctuations. If the state experiences a prolonged economic downturn, there could be pressure to introduce new taxes or adjust existing rates.

- Legislative Initiatives: Texas legislators periodically propose new tax measures or reforms. Employers should stay informed about any pending legislation that could impact payroll taxes.

- Social Safety Nets: The state's commitment to social safety nets, funded by payroll taxes, may evolve to address changing demographics and societal needs. This could lead to adjustments in tax rates or the introduction of new programs.

Conclusion

Texas payroll taxes are a critical component of the state’s revenue system, funding essential programs that benefit both employers and employees. While the absence of a state income tax provides certain advantages, the complexity of payroll tax compliance cannot be understated. Employers must navigate a multi-tiered tax system, ensuring accuracy and timely payments to avoid penalties.

By understanding the intricacies of Texas payroll taxes and implementing best practices, businesses can effectively manage their payroll tax obligations. This comprehensive guide aims to provide a thorough understanding of the subject, empowering employers to make informed decisions and ensure compliance with the state's tax regulations.

What is the difference between FICA and FUTA taxes?

+FICA (Federal Insurance Contributions Act) taxes fund Social Security and Medicare, while FUTA (Federal Unemployment Tax Act) taxes fund unemployment benefits. FICA taxes are paid by both employers and employees, whereas FUTA taxes are solely the responsibility of employers.

How often do employers need to remit payroll taxes in Texas?

+Federal payroll taxes must be remitted on a monthly or semiweekly basis, depending on the employer’s annual tax liability. State unemployment taxes are typically reported and paid quarterly.

Are there any tax credits or incentives for Texas employers?

+Yes, Texas offers various tax credits and incentives for employers, including the Research and Development Tax Credit, the Texas Franchise Tax Margin Credit, and the Texas Enterprise Zone Program. These incentives aim to promote business growth and job creation.