What Is An Ad Valorem Tax

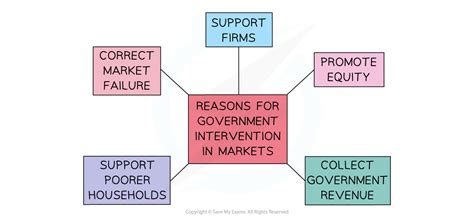

In the realm of taxation, understanding the various types of taxes is crucial, especially for individuals and businesses navigating the complex world of finance and economics. Among these, an ad valorem tax stands out as a unique and widely used mechanism for generating revenue and regulating certain activities. This article delves into the specifics of ad valorem taxes, exploring their definition, historical context, practical applications, and the broader economic implications they carry.

The Essence of Ad Valorem Taxes

At its core, an ad valorem tax is a levy imposed on the value of something, typically a good, service, or property. The term ad valorem, derived from Latin, translates to “according to value,” reflecting the fundamental principle of this tax system. Unlike other forms of taxation, which may be based on quantity, usage, or specific characteristics, ad valorem taxes focus solely on the monetary worth of the item being taxed.

This type of tax is distinct in its application and has been a fundamental tool in economic policy-making for centuries. Its versatility and adaptability make it a key component in various taxation systems worldwide, influencing everything from international trade to local property ownership.

Historical Context and Evolution

The concept of ad valorem taxation can be traced back to ancient civilizations, where it was used to assess the value of goods for trade and taxation purposes. Over time, this practice evolved, especially during the Renaissance and the era of mercantilism, when nations began to use ad valorem taxes as a means to protect domestic industries and control international trade.

In modern times, ad valorem taxes have taken on new forms and applications. They are now a common feature in many countries' tax codes, serving as a primary source of revenue for governments and a mechanism for influencing consumer behavior and market trends.

Practical Applications and Examples

Ad valorem taxes find application in numerous scenarios, each with its own specific implications and benefits.

- Import and Export Duties: Perhaps the most well-known use of ad valorem taxes is in international trade. Countries often impose import duties on goods entering their borders, with the tax amount calculated as a percentage of the item's value. Similarly, export duties can be applied to goods leaving the country.

- Sales and Value-Added Taxes (VAT): Many countries utilize a value-added tax system, where taxes are added at each stage of the production and distribution process, with the final amount based on the product's value. This not only generates revenue but also simplifies tax collection and compliance.

- Property Taxes: Ad valorem taxes are commonly used to assess the value of real estate for the purpose of taxation. Local governments often use property values to determine the tax rate, ensuring a fair and equitable system for property owners.

- Luxury Taxes: Certain goods, such as high-end luxury items, may be subject to additional ad valorem taxes. These taxes are designed to discourage the purchase of non-essential, high-value items, and can also serve as a revenue stream for specific government initiatives.

The versatility of ad valorem taxes allows them to be tailored to specific economic goals, making them a powerful tool in the hands of policymakers.

Economic Implications and Benefits

The implementation of ad valorem taxes has far-reaching effects on economies and markets.

| Economic Impact | Description |

|---|---|

| Revenue Generation | Ad valorem taxes are a reliable source of government revenue, helping to fund public services and infrastructure. |

| Price Control | By influencing the final price of goods and services, ad valorem taxes can help regulate markets and protect consumers. |

| Trade Regulation | Import duties, a form of ad valorem tax, can be used to protect domestic industries and manage trade imbalances. |

| Social Welfare | Specific ad valorem taxes, such as luxury taxes, can be used to redistribute wealth and fund social programs. |

Challenges and Considerations

While ad valorem taxes offer numerous benefits, they also present challenges and considerations that policymakers and economists must navigate.

Valuation and Assessment

Determining the value of goods or property for taxation purposes can be complex and subjective. Different methods of valuation, such as market value, replacement cost, or assessed value, may be used, each with its own advantages and potential for manipulation.

Compliance and Administration

Ad valorem taxes, especially those applied to complex transactions or high-value assets, require robust administrative systems and a high level of compliance from taxpayers. Ensuring accurate reporting and preventing tax evasion is a constant challenge for tax authorities.

Impact on Businesses and Consumers

The imposition of ad valorem taxes can affect the profitability of businesses and the purchasing power of consumers. Higher taxes may discourage investment and consumption, leading to economic slowdowns. Conversely, targeted ad valorem taxes can also incentivize certain behaviors, such as encouraging the use of renewable energy or discouraging the use of harmful substances.

Future Prospects and Innovations

As economies evolve and new technologies emerge, the application and effectiveness of ad valorem taxes may also change. Here are some potential future developments and considerations:

- Digital Economy Taxation: With the rise of the digital economy, ad valorem taxes may need to be adapted to address the unique challenges of taxing digital goods and services, which are often borderless and intangible.

- Environmental Taxes: Ad valorem taxes could play a crucial role in promoting sustainable practices. For instance, taxes based on the carbon footprint of goods could encourage the adoption of greener technologies and reduce environmental impact.

- Artificial Intelligence and Tax Assessment: AI and machine learning could revolutionize the way ad valorem taxes are assessed and administered, making the process more efficient and accurate.

The future of ad valorem taxation is likely to be shaped by a combination of technological advancements, changing economic landscapes, and evolving societal needs.

Conclusion

Ad valorem taxes are a powerful and versatile tool in the realm of taxation, with a rich historical context and a wide range of applications. While they present challenges, their ability to generate revenue, influence economic behavior, and regulate markets makes them an indispensable part of modern economic systems. As we move forward, understanding and adapting ad valorem taxes to new economic realities will be crucial for policymakers and economists alike.

How are ad valorem taxes calculated for import duties?

+Import duties are typically calculated as a percentage of the CIF (Cost, Insurance, and Freight) value of the imported goods. The CIF value represents the total cost of the goods, including their purchase price, insurance, and transportation costs up to the point of import.

What is the difference between ad valorem taxes and specific taxes?

+Ad valorem taxes are based on the value of the item being taxed, whereas specific taxes are levied based on quantity, weight, or other specific characteristics. Ad valorem taxes are more flexible and adaptable, while specific taxes provide a fixed amount per unit.

How do ad valorem taxes affect international trade relations?

+Ad valorem taxes, especially import duties, can significantly impact international trade. They can be used to protect domestic industries by making imported goods more expensive, thereby encouraging the use of local products. However, they can also lead to trade disputes and potential retaliation from trading partners.