California Car Sales Tax

When purchasing a vehicle in California, one important consideration is the sales tax that applies to the transaction. Understanding the car sales tax in California is crucial for both buyers and sellers to ensure compliance with state regulations and to budget effectively. In this comprehensive guide, we will delve into the intricacies of California car sales tax, exploring the tax rates, exemptions, and other essential aspects.

California Car Sales Tax Rates

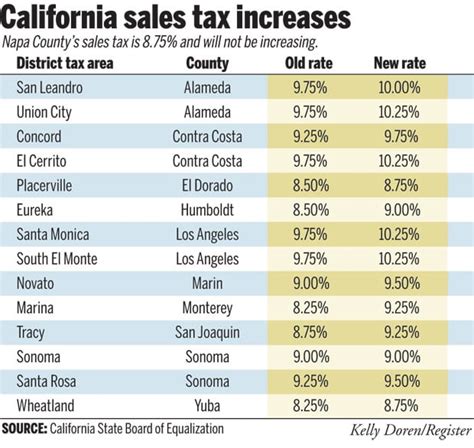

The car sales tax in California is a state-mandated tax levied on the purchase of motor vehicles. The state of California imposes a base sales tax rate of 7.25%, which is applied uniformly across the state. However, it’s important to note that local jurisdictions may add additional taxes, resulting in a higher overall tax rate for vehicle purchases.

Local jurisdictions, including counties and cities, have the authority to impose their own sales taxes. These local taxes can vary significantly, ranging from 0% to 2.25%, depending on the specific location. For instance, in the city of Los Angeles, the total sales tax for vehicle purchases can reach 10.25%, combining the state and local taxes.

| Location | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Los Angeles | 10.25% |

| San Francisco | 9.50% |

| Sacramento | 8.75% |

| San Diego | 8.00% |

The table above provides a glimpse of the varying sales tax rates across different cities in California. It's crucial for buyers to be aware of the specific tax rates in their area to accurately estimate the total cost of purchasing a vehicle.

Calculating Car Sales Tax in California

To calculate the car sales tax in California, you need to consider both the state and local tax rates applicable to your location. Here’s a step-by-step guide to help you compute the sales tax accurately:

- Determine the purchase price of the vehicle. This is the total amount you will be paying for the car, including any additional fees and charges.

- Identify the applicable state sales tax rate, which is 7.25% for California.

- Find out the local sales tax rate for your specific location. You can usually find this information on the website of your local county or city government.

- Add the state and local sales tax rates together to get the total sales tax rate. For example, if the local tax rate is 2%, the total tax rate would be 9.25% (7.25% + 2%).

- Multiply the purchase price of the vehicle by the total sales tax rate to calculate the sales tax amount. For instance, if the purchase price is $30,000, the sales tax would be $2,775 (30,000 x 0.0925).

By following these steps, you can accurately calculate the sales tax for your vehicle purchase in California, ensuring that you have a clear understanding of the financial implications.

Exemptions and Special Cases

While the general sales tax rate applies to most vehicle purchases in California, there are certain exemptions and special cases that buyers should be aware of. These exemptions can help reduce the overall tax burden and are worth exploring to potentially save money.

Vehicle Trade-Ins

When trading in your old vehicle as part of a new purchase, the sales tax calculation can be adjusted to account for the trade-in value. The trade-in value is subtracted from the purchase price of the new vehicle, effectively reducing the taxable amount. This can result in a lower sales tax obligation.

For example, if you are purchasing a new car for $35,000 and trading in your old vehicle for a value of $5,000, the taxable amount would be $30,000 ($35,000 - $5,000). The sales tax would then be calculated based on this reduced amount, potentially saving you money.

Military Personnel

Active-duty military personnel stationed in California are eligible for certain tax exemptions when purchasing vehicles. These exemptions can vary depending on the individual’s circumstances and the length of their deployment. It is recommended that military personnel consult with their legal or financial advisors to understand the specific exemptions available to them.

Vehicle Donations

When donating a vehicle to a qualified charitable organization, the sales tax implications can be different. In some cases, donors may be eligible for a sales tax exemption or a reduced tax rate. It is advisable to consult with the charitable organization or a tax professional to understand the specific rules and regulations surrounding vehicle donations and their tax implications.

Disability Exemptions

Individuals with disabilities may be eligible for sales tax exemptions or reduced rates when purchasing vehicles equipped with specific modifications or adaptive devices. These exemptions are designed to support accessibility and mobility for individuals with disabilities. To claim these exemptions, individuals must provide the necessary documentation and meet the eligibility criteria set by the state.

Vehicle Sales Tax Registration and Reporting

For individuals and businesses involved in selling vehicles in California, it is crucial to understand the sales tax registration and reporting requirements. Here’s an overview of the key aspects:

Sales Tax Registration

Any individual or business selling vehicles in California must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit authorizes the seller to collect and remit sales tax on behalf of the state. The registration process involves completing the appropriate forms and providing necessary information, such as business details and contact information.

Sales Tax Reporting

Sellers are required to report and remit the sales tax collected on vehicle transactions to the CDTFA on a regular basis. The frequency of reporting depends on the seller’s annual sales volume and can range from monthly to quarterly. Sellers must accurately calculate and report the sales tax owed, ensuring timely submission to avoid penalties and interest charges.

Record-Keeping and Documentation

Sellers are responsible for maintaining accurate records and documentation related to vehicle sales transactions. This includes keeping track of purchase prices, sales tax collected, and any applicable exemptions or adjustments. Proper record-keeping is essential for compliance and may be required during audits or tax examinations.

Future Implications and Changes

The landscape of car sales tax in California is subject to potential changes and developments. While it is challenging to predict the exact future direction, certain trends and possibilities can be considered:

Tax Rate Adjustments

Tax rates are often subject to legislative changes and can be adjusted to address budgetary needs or economic conditions. It is possible that the state or local governments may propose adjustments to the sales tax rates, either increasing or decreasing them, to align with changing circumstances.

Vehicle Sales Tax Reform

As the automotive industry continues to evolve, with the rise of electric vehicles and autonomous technology, there may be discussions and proposals for reform in the way vehicle sales taxes are structured and collected. This could involve changes to the tax base, exemptions, or the introduction of new tax mechanisms to adapt to the changing nature of vehicle ownership and usage.

Economic Factors

Economic conditions, such as recessions or periods of economic growth, can influence tax policies. In times of economic hardship, governments may consider tax incentives or temporary reductions to stimulate vehicle sales and support the automotive industry. Conversely, during periods of economic prosperity, tax rates may be adjusted to generate additional revenue.

Environmental Considerations

With growing environmental concerns and the push towards sustainable transportation, there may be discussions around incorporating environmental factors into vehicle sales tax policies. This could involve incentives for purchasing environmentally friendly vehicles or additional taxes on certain types of vehicles to discourage their use.

Digital Sales and E-Commerce

As vehicle sales increasingly move online, there may be a need to address the taxation of digital sales and e-commerce platforms. Governments may explore ways to ensure that sales taxes are accurately collected and remitted for online vehicle transactions, potentially leading to new regulations and compliance requirements.

Conclusion

Understanding the intricacies of California car sales tax is essential for both buyers and sellers to navigate the legal and financial aspects of vehicle purchases. By familiarizing yourself with the tax rates, exemptions, and reporting requirements, you can make informed decisions and ensure compliance with state regulations. Stay informed about potential future changes and developments to stay ahead of any adjustments in the car sales tax landscape.

Are there any ways to reduce the sales tax on vehicle purchases in California?

+Yes, there are a few strategies to potentially reduce the sales tax burden. Exploring trade-ins, understanding military personnel exemptions, and considering vehicle donations can lead to savings. Additionally, individuals with disabilities may be eligible for specific exemptions or reduced rates when purchasing vehicles with adaptive devices.

How often do I need to pay sales tax on my vehicle purchase in California?

+The frequency of paying sales tax depends on the total purchase price of the vehicle. If the purchase price is 5,000 or less, the sales tax is due at the time of purchase. For purchases exceeding 5,000, the sales tax is typically due within 30 days of the purchase date.

Can I negotiate the sales tax rate with the dealership or seller?

+The sales tax rate is a legally mandated tax and is not negotiable. However, you can negotiate the purchase price of the vehicle, which can indirectly impact the sales tax amount. Lowering the purchase price can result in a reduced sales tax obligation.

What happens if I don’t pay the sales tax on my vehicle purchase in California?

+Failing to pay the sales tax on your vehicle purchase can lead to penalties and interest charges. Additionally, it may result in the suspension of your vehicle registration or the inability to renew your registration until the outstanding tax is paid. It is important to fulfill your sales tax obligations to avoid these consequences.

Are there any online resources or tools to help calculate the sales tax for my vehicle purchase in California?

+Yes, there are online sales tax calculators available that can assist in estimating the sales tax for your vehicle purchase. These calculators consider the purchase price, state, and local tax rates to provide an approximate tax amount. However, it is recommended to consult official sources or tax professionals for accurate calculations.