Ohio State Tax Return

For Ohio residents, navigating the state tax return process is an annual task that requires careful consideration and attention to detail. Ohio's tax system, while comprehensive, can present unique challenges and opportunities for taxpayers. This article aims to provide an in-depth guide to understanding and managing your Ohio state tax return, ensuring compliance with the law and optimizing your financial situation.

Understanding Ohio’s Tax Landscape

Ohio operates a progressive tax system, meaning the tax rate increases as your income rises. This approach ensures that higher-income earners contribute a larger proportion of their income to the state’s revenue. The current tax structure consists of five income tax brackets, each with its own tax rate, ranging from 0.479% to 4.799% for tax year 2023.

| Income Bracket (Tax Year 2023) | Tax Rate |

|---|---|

| Up to $10,949 | 0.479% |

| $10,950 - $21,899 | 1.958% |

| $21,900 - $43,799 | 2.937% |

| $43,800 - $87,599 | 3.747% |

| $87,600 and above | 4.799% |

It's important to note that Ohio offers a tax credit for Social Security benefits, which can reduce the taxable income for those receiving these benefits. Additionally, the state provides a Homestead Exemption for eligible homeowners, which can help reduce property taxes. These provisions demonstrate Ohio's commitment to supporting its residents through a fair and equitable tax system.

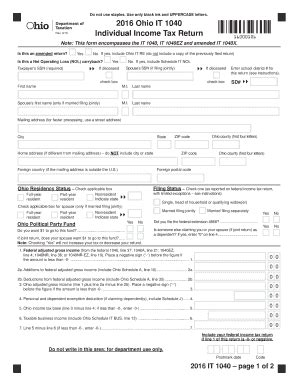

Preparing Your Ohio State Tax Return

When it comes to preparing your Ohio state tax return, accuracy and attention to detail are crucial. Here are some key steps to ensure a smooth process:

Gather Your Documents

- Collect all relevant tax documents, including W-2 forms, 1099 forms, and any other income statements.

- Gather records of deductions and credits you may be eligible for, such as mortgage interest, medical expenses, or charitable contributions.

- Have your previous year’s tax return on hand for reference.

Determine Your Filing Status

Ohio recognizes the same filing statuses as the federal government: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child.

Calculate Your Income

Accurately determine your taxable income by summing up all your sources of income, including wages, salaries, interest, dividends, and any other taxable earnings.

Claim Deductions and Credits

Ohio allows itemized deductions for expenses such as medical and dental costs, state and local taxes, and charitable contributions. You can also claim credits for things like childcare expenses, college tuition, and certain energy-efficient home improvements.

File Your Return

You can file your Ohio state tax return electronically or by mail. The Ohio Department of Taxation provides a user-friendly online filing system, Ohio e-file, which is secure and efficient. If you prefer traditional mail, ensure your return is postmarked by the deadline to avoid penalties.

Common Tax Credits and Deductions in Ohio

Ohio offers a range of tax credits and deductions to help reduce your taxable income and overall tax liability. Here are some of the most common:

Child and Dependent Care Tax Credit

This credit is available for expenses incurred for the care of a qualifying child or dependent, allowing taxpayers to offset some of the costs of childcare or adult care.

Elderly and Disabled Tax Credit

Ohio residents who are elderly or disabled may be eligible for this credit, which provides a reduction in their tax liability based on their income and medical expenses.

Property Tax Deduction

Homeowners in Ohio can deduct a portion of their property taxes from their taxable income, provided they meet certain eligibility criteria.

College Tuition Deduction

Ohio taxpayers can deduct qualified expenses for higher education, including tuition, fees, and certain other related expenses.

Strategies for Maximizing Your Ohio State Tax Return

Maximizing your Ohio state tax return can involve a combination of careful planning, understanding the tax code, and taking advantage of available deductions and credits. Here are some strategies to consider:

Review Your Withholdings

Ensure your tax withholdings from your paycheck align with your expected tax liability. Adjusting your withholdings can help you avoid underpayment penalties and ensure you’re not overpaying throughout the year.

Take Advantage of Tax Credits

Familiarize yourself with the various tax credits offered by Ohio, such as the Earned Income Tax Credit and the Child and Dependent Care Credit. These credits can significantly reduce your tax burden and increase your refund.

Maximize Deductions

Explore all eligible deductions to reduce your taxable income. This includes deducting medical expenses, charitable contributions, and certain business expenses if you’re self-employed.

Consider Tax-Advantaged Retirement Accounts

Contributions to retirement accounts like IRAs and 401(k)s can offer tax benefits, reducing your taxable income and potentially increasing your refund. Consult a financial advisor to understand the best options for your situation.

FAQs

What is the deadline for filing my Ohio state tax return?

+

The deadline for filing your Ohio state tax return is typically April 15th of the year following the tax year. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a state of emergency.

Can I file my Ohio state tax return electronically?

+

Yes, Ohio offers electronic filing through the Ohio e-file system. This method is secure, efficient, and can provide you with a faster refund. It’s recommended to use this method if you’re comfortable with online tax filing.

Are there any tax breaks for homeowners in Ohio?

+

Yes, Ohio provides several tax benefits for homeowners. These include the Homestead Exemption, which can reduce your property taxes, and the Property Tax Deduction, which allows you to deduct a portion of your property taxes from your taxable income.

What happens if I miss the filing deadline for my Ohio state tax return?

+

If you miss the filing deadline, you may be subject to late filing penalties and interest charges. It’s important to file your return as soon as possible to minimize these penalties and maintain compliance with Ohio tax laws.

Can I deduct my student loan interest on my Ohio state tax return?

+

Yes, Ohio allows you to deduct the interest paid on qualified student loans. This deduction can help reduce your taxable income and potentially increase your refund. Keep in mind that there are certain eligibility requirements and income limits to consider.