Phila Real Estate Tax

Welcome to the world of real estate taxes in Philadelphia, a complex yet crucial aspect of property ownership. Understanding the real estate tax landscape is essential for anyone looking to invest in or reside within this vibrant city. This comprehensive guide aims to demystify the process, shedding light on the rates, assessment procedures, payment methods, and potential tax relief options.

Understanding the Philadelphia Real Estate Tax

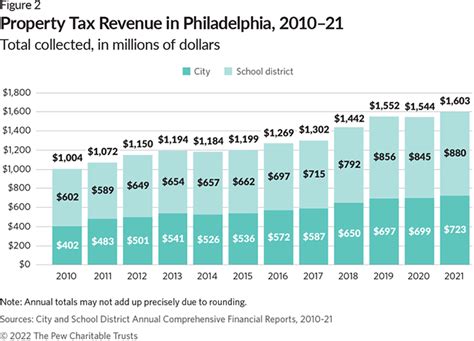

The Philadelphia real estate tax, often referred to as the property tax, is an annual levy imposed on property owners by the city government. It’s a vital source of revenue for the municipality, contributing significantly to the funding of essential services like public education, infrastructure development, and city operations.

The tax is calculated based on the assessed value of the property and is applied uniformly across all types of real estate, including residential, commercial, and industrial properties. This ensures fairness and consistency in tax assessments.

Tax Rates and Assessments

Philadelphia’s real estate tax rate is determined annually by the city’s Office of Property Assessment (OPA). The rate is expressed as a millage rate, where one mill equals 1 for every 1,000 of assessed property value. For the current fiscal year, the millage rate stands at 1.3792 mills, which is a slight increase from the previous year’s rate of 1.3755 mills.

Property assessments are conducted every three years to ensure that tax obligations remain aligned with the current market value of the properties. The OPA employs a team of professionals who analyze various factors such as recent sales, neighborhood trends, and property improvements to determine an accurate assessment.

Here's a breakdown of the tax rates and assessment cycles:

| Assessment Cycle | Tax Rate (Mills) |

|---|---|

| 2024 | 1.3792 |

| 2021 | 1.3755 |

| 2018 | 1.3820 |

It's important to note that property owners can appeal their assessments if they believe the valuation is inaccurate. The OPA provides guidelines and procedures for filing such appeals.

Payment Methods and Due Dates

Philadelphia offers several convenient methods for taxpayers to pay their real estate taxes. The primary method is through the Philadelphia Tax Collector, where payments can be made online, by phone, or in person. The city also accepts payments via mail, but it’s advisable to allow ample time for processing to avoid late fees.

Real estate taxes are typically due in two installments, with the first installment due on March 31 and the second on August 31. Failure to pay by the due date may result in penalties and interest charges, so it's crucial to stay on top of your tax obligations.

Tax Relief Options

Philadelphia understands that real estate taxes can be a significant financial burden, especially for low-income residents and senior citizens. To provide relief, the city offers several tax abatement and reduction programs:

- Homestead Exemption: Property owners who use their home as their primary residence may be eligible for a homestead exemption, which reduces the assessed value of their property by up to $30,000. This exemption can significantly lower their tax burden.

- Senior Citizen Tax Freeze: Senior citizens aged 65 and above who meet certain income criteria can apply for a tax freeze, which locks in their tax liability at the previous year's level. This program ensures that seniors are not disproportionately affected by rising property values.

- Tax Abatement for Renovations: Property owners who undertake substantial improvements or renovations may be eligible for tax abatement, which defers a portion of the increased taxes resulting from the improvements. This encourages investment in the city's real estate market and helps offset the costs of redevelopment.

These programs aim to make Philadelphia a more affordable and accessible place to live, especially for those who have contributed to the city's rich history and culture.

Analysis and Implications

Philadelphia’s real estate tax system is designed to be fair and equitable, with a focus on maintaining essential city services while offering relief to those in need. The annual assessments and millage rates ensure that property owners contribute their fair share based on the current value of their holdings.

The availability of tax relief options demonstrates the city's commitment to social equity and economic development. By providing incentives for homeowners and investors, Philadelphia fosters a stable and thriving real estate market. This, in turn, benefits the entire community by attracting businesses, creating jobs, and enhancing the overall quality of life.

However, it's important for property owners to stay informed about their tax obligations and take advantage of the available resources. Understanding the assessment process, exploring tax relief options, and staying up-to-date with payment due dates are crucial steps in managing one's financial responsibilities as a Philadelphia homeowner.

FAQ

How do I calculate my real estate tax bill in Philadelphia?

+

Your real estate tax bill is calculated by multiplying your property’s assessed value by the current millage rate. For example, if your property is assessed at 200,000 and the millage rate is 1.3792, your tax bill would be 2,758.40 (200,000 x 0.013792 = 2,758.40). This calculation provides a clear understanding of your tax obligation.

What happens if I miss a real estate tax payment deadline in Philadelphia?

+

Missing a real estate tax payment deadline can result in late fees and interest charges. The city of Philadelphia imposes a penalty of 10% of the unpaid taxes for each 30-day period that the taxes remain unpaid, up to a maximum of 60 days. Additionally, interest accrues at a rate of 1.5% per month on the unpaid taxes. It’s important to stay organized and make timely payments to avoid these additional costs.

Are there any tax incentives for homeowners in Philadelphia?

+

Yes, Philadelphia offers several tax incentives for homeowners. The most notable is the Homestead Exemption, which can reduce your property’s assessed value by up to $30,000 if it’s your primary residence. Additionally, senior citizens may be eligible for the Senior Citizen Tax Freeze, which locks in their tax liability at the previous year’s level. These incentives provide much-needed relief for homeowners and promote homeownership in the city.

How can I appeal my property assessment in Philadelphia?

+

If you believe your property assessment is inaccurate, you can appeal it to the Office of Property Assessment (OPA). The OPA provides guidelines and procedures for filing an appeal, which typically involves submitting documentation to support your claim. It’s important to gather evidence and present a strong case to increase your chances of a successful appeal.

What payment methods are accepted for real estate taxes in Philadelphia?

+

Philadelphia offers a variety of payment methods for real estate taxes. You can pay online, by phone, or in person at the Philadelphia Tax Collector office. The city also accepts payments via mail, although it’s advisable to allow sufficient time for processing to ensure your payment is received before the due date. These options provide flexibility and convenience for taxpayers.