Self Employment Tax Percentage

Self-employment is a journey chosen by many entrepreneurs and professionals who wish to pursue their passions and build their own businesses. Along with the freedom and flexibility it offers, self-employment comes with a unique set of responsibilities, one of which is understanding and managing self-employment taxes.

Self-employment tax is a tax levied on the net earnings of self-employed individuals in the United States. It is akin to the payroll taxes that are deducted from the wages of employees. As a self-employed individual, you are responsible for paying both the employee and employer portions of these taxes, which can significantly impact your net income.

Understanding Self-Employment Tax

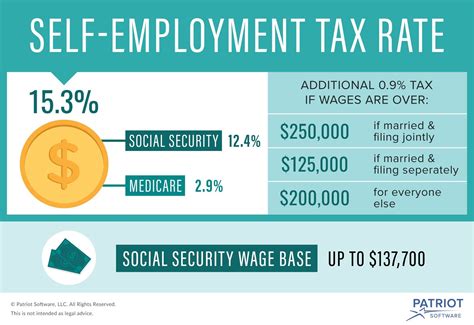

The self-employment tax is a significant consideration for anyone venturing into the world of self-employment. This tax is primarily a combination of two major components: Social Security and Medicare taxes. The rates for these taxes are set annually and can change over time, so it's crucial for self-employed individuals to stay updated with the current rates to effectively manage their tax liabilities.

Social Security tax, often referred to as the Old-Age, Survivors, and Disability Insurance (OASDI) tax, is designed to provide retirement benefits, survivor benefits, and disability benefits. The Medicare tax, on the other hand, funds the Medicare program, which provides health insurance coverage for individuals aged 65 and above, as well as those with certain disabilities.

As of the 2023 tax year, the self-employment tax rate is 15.3%, which is a combination of the 12.4% Social Security tax rate and the 2.9% Medicare tax rate. The Social Security tax is applicable on the first $160,200 of net earnings for the 2023 tax year. Any net earnings above this threshold are not subject to the Social Security tax, although they are still subject to the Medicare tax.

For instance, if a self-employed individual has net earnings of $200,000 in the 2023 tax year, they would pay a Social Security tax of 12.4% on the first $160,200 (which amounts to $19,888.80), and the Medicare tax of 2.9% on the entire $200,000 (which is $5,800). This brings the total self-employment tax liability for this individual to $25,688.80 for the year.

How to Calculate Self-Employment Tax

Calculating self-employment tax accurately is essential to ensure compliance with the Internal Revenue Service (IRS) and to effectively plan your financial strategy. Here's a step-by-step guide to help you calculate your self-employment tax:

Step 1: Determine Your Net Earnings

Net earnings from self-employment are the total income derived from your business activities, minus any allowable business expenses. These earnings can come from various sources, including sales of goods or services, interest, dividends, rents, royalties, and more.

It's important to note that not all income is considered self-employment income. For instance, earnings from certain government payments, such as unemployment compensation or Social Security benefits, are not subject to self-employment tax.

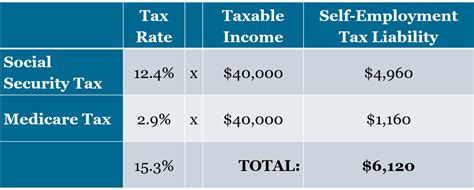

Step 2: Calculate the Social Security Tax

The Social Security tax is levied on the first $160,200 of your net earnings for the 2023 tax year. To calculate the Social Security tax, multiply your net earnings (up to $160,200) by 0.124 (which is 12.4% as a decimal). This will give you the amount of Social Security tax you owe.

For example, if your net earnings are $150,000, your Social Security tax would be $18,600 (calculated as $150,000 x 0.124).

Step 3: Calculate the Medicare Tax

The Medicare tax is applied to all of your net earnings, regardless of the amount. To calculate the Medicare tax, multiply your net earnings by 0.029 (which is 2.9% as a decimal). This will determine the amount of Medicare tax you need to pay.

Using the same example, if your net earnings are $150,000, your Medicare tax would be $4,350 (calculated as $150,000 x 0.029).

Step 4: Combine the Social Security and Medicare Taxes

To find your total self-employment tax, add the Social Security tax from Step 2 and the Medicare tax from Step 3. This sum represents your total self-employment tax liability for the year.

Continuing with the example, your total self-employment tax would be $22,950 (calculated as $18,600 + $4,350)

Reducing Your Self-Employment Tax Burden

While self-employment taxes are a necessary obligation, there are strategies you can employ to potentially reduce your tax burden. Here are some approaches to consider:

1. Maximize Business Deductions

As a self-employed individual, you can deduct ordinary and necessary business expenses from your gross income. This can significantly reduce your taxable income and, consequently, your self-employment tax liability. Business expenses can include items such as office rent, supplies, marketing costs, equipment, travel, and more.

It's important to keep detailed records of all your business expenses and consult with a tax professional to ensure you're maximizing all available deductions.

2. Contribute to a Retirement Plan

Contributing to a retirement plan, such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k), can provide significant tax advantages. These contributions are tax-deductible, which means they reduce your taxable income and, consequently, your self-employment tax liability. Additionally, the funds in these retirement plans grow tax-free until withdrawal.

Consult with a financial advisor to determine the best retirement plan option for your specific situation and to ensure you're taking full advantage of the tax benefits.

3. Claim the Self-Employment Tax Deduction

When you file your federal income tax return, you can deduct half of your self-employment tax from your income. This deduction is designed to offset the fact that self-employed individuals pay both the employer and employee portions of the self-employment tax.

This deduction can provide a significant tax benefit, especially for those with higher self-employment tax liabilities. It's important to note that this deduction is taken on your federal income tax return, separate from your self-employment tax return.

4. Explore Tax Credits and Incentives

There are various tax credits and incentives available to self-employed individuals that can help reduce your tax burden. These may include credits for health insurance, childcare expenses, or even specific industry-related incentives. Stay updated with the latest tax laws and consult with a tax professional to identify any credits or incentives you may be eligible for.

Navigating Self-Employment Tax Complexity

Self-employment taxes can be complex, especially for those new to entrepreneurship. It's essential to understand the nuances of these taxes to ensure compliance and optimize your financial strategy. Here are some additional considerations to keep in mind:

Estimated Tax Payments

As a self-employed individual, you are responsible for making estimated tax payments throughout the year. These payments are due quarterly and help ensure you're meeting your tax obligations. Failure to make these payments on time can result in penalties and interest.

To calculate your estimated tax payments, you can use the estimated tax worksheet provided by the IRS. This worksheet takes into account your prior year's income, expenses, and taxes paid to determine your current year's estimated tax liability.

Filing Your Self-Employment Tax Return

When it's time to file your taxes, you'll need to complete Schedule C (Profit or Loss From Business) to report your business income and expenses. This schedule will determine your net earnings from self-employment, which is then carried over to Schedule SE (Self-Employment Tax) to calculate your self-employment tax liability.

Schedule SE also allows you to claim the self-employment tax deduction, which can further reduce your tax burden. It's important to ensure all your information is accurate and complete when filing these schedules to avoid any potential issues with the IRS.

Seeking Professional Guidance

The world of taxes can be complex, and self-employment taxes are no exception. Consider seeking guidance from a qualified tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), who specializes in small business taxes. They can provide personalized advice and ensure you're taking advantage of all the tax benefits available to you.

Additionally, tax software can be a helpful tool to guide you through the tax preparation process. These programs often provide step-by-step instructions and can help ensure your return is accurate and complete.

Conclusion: Taking Control of Your Tax Strategy

Understanding and managing self-employment taxes is a crucial aspect of running your own business. By staying informed about the current tax rates, calculating your tax liabilities accurately, and employing strategic tax planning, you can effectively manage your tax obligations and optimize your financial outcomes.

Remember, as a self-employed individual, you are both the business owner and the employee, so it's essential to stay on top of your tax responsibilities. With careful planning and the right guidance, you can navigate the complexities of self-employment taxes and focus on growing your business with confidence.

What is the difference between self-employment tax and income tax?

+Self-employment tax and income tax are two different types of taxes. Self-employment tax is levied on the net earnings of self-employed individuals and covers Social Security and Medicare taxes. Income tax, on the other hand, is a tax on your total income, including wages, salaries, and other forms of income. While self-employment tax is specific to self-employed individuals, income tax applies to all individuals and is used to fund various government programs and services.

How often do I need to pay self-employment tax?

+As a self-employed individual, you are required to make estimated tax payments quarterly throughout the year. These payments help ensure you’re meeting your tax obligations and are due on specific dates set by the IRS. Failure to make these payments on time can result in penalties and interest. It’s important to stay organized and plan your payments to avoid any issues with the IRS.

Can I deduct my self-employment tax from my business expenses?

+No, you cannot deduct your self-employment tax from your business expenses. Self-employment tax is a separate tax that you pay on your net earnings from self-employment. However, you can deduct half of your self-employment tax from your income when you file your federal income tax return. This deduction is designed to offset the fact that self-employed individuals pay both the employer and employee portions of the self-employment tax.

What happens if I don’t pay my self-employment tax on time?

+Failure to pay your self-employment tax on time can result in penalties and interest. The IRS may impose penalties for late payment, and interest will accrue on any unpaid tax balance. It’s important to stay on top of your tax obligations and make timely payments to avoid these additional costs. If you’re unable to pay your taxes in full, consider setting up a payment plan with the IRS to avoid further complications.