401K Tax Form

In the complex landscape of personal finance and tax planning, understanding the intricacies of a 401(k) plan and its associated tax forms is essential. This comprehensive guide aims to unravel the mysteries surrounding the 401(k) Tax Form, offering a detailed analysis of its purpose, components, and implications for both employers and employees. By delving into the specifics, we aim to provide a clear roadmap for navigating this crucial aspect of retirement savings.

Understanding the 401(k) Tax Form: A Comprehensive Overview

The 401(k) tax form is an integral component of the 401(k) retirement plan, serving as a vital document for tax reporting and record-keeping. This form, officially known as the “Form 5500 Annual Return/Report of Employee Benefit Plan,” is a critical tool for both employers and employees, ensuring compliance with tax regulations and facilitating the smooth administration of retirement plans.

Employers, particularly those offering 401(k) plans, are responsible for filing this form annually with the Internal Revenue Service (IRS). It provides a detailed snapshot of the plan's operations, including financial information, participant data, and plan investments. For employees, understanding this form is key to grasping the tax implications of their retirement savings and making informed decisions about their financial future.

The Purpose and Importance of the 401(k) Tax Form

The primary purpose of the 401(k) tax form is to maintain transparency and accountability in the management of retirement plans. By requiring employers to disclose specific information about the plan’s operations, the IRS can ensure compliance with tax laws and regulations. This form serves as a critical tool for monitoring the financial health of these plans and protecting the interests of participants.

For employees, the 401(k) tax form provides valuable insights into their retirement savings. It details the contributions made, the investment options chosen, and the overall performance of the plan. This information is crucial for assessing the effectiveness of one's retirement strategy and making adjustments as needed. Moreover, it helps employees understand the tax implications of their contributions and withdrawals, ensuring they can optimize their financial planning accordingly.

Key Components and Information on the 401(k) Tax Form

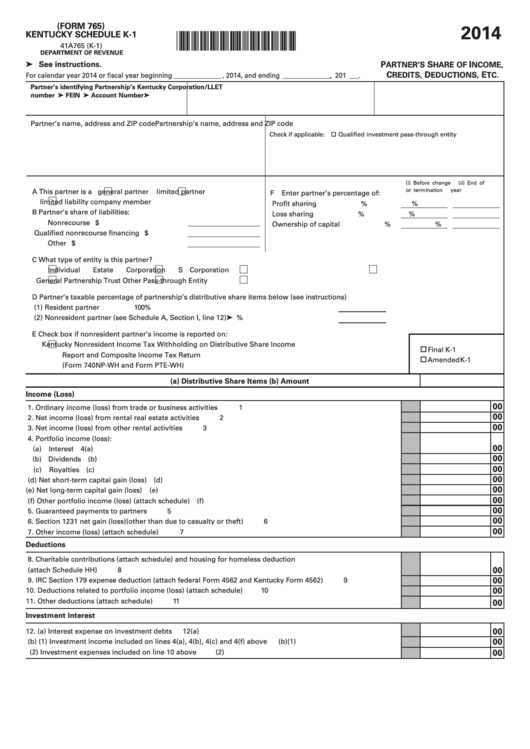

The 401(k) tax form is a comprehensive document, containing a wealth of information about the retirement plan. Some of the key components include:

- Plan Identification: This section provides basic information about the plan, including its name, EIN (Employer Identification Number), and plan number.

- Plan Coverage and Eligibility: Here, employers detail the number of participants in the plan, their eligibility criteria, and any changes made during the year.

- Contributions and Distributions: This section reports on the total contributions made by participants and employers, as well as any distributions or loans taken by participants.

- Plan Investments: A detailed breakdown of the plan's investments, including the types of assets held, their fair market value, and any changes made during the year.

- Fees and Expenses: The form requires disclosure of any fees or expenses incurred by the plan, ensuring transparency in plan administration.

- Audited Financial Statements: For larger plans, an independent audit may be required, with the results included in this section.

| Section | Key Information |

|---|---|

| Plan Coverage | Number of Participants: 250 |

| Contributions | Total Participant Contributions: $2,500,000 Total Employer Contributions: $500,000 |

| Investments | Stock Holdings: $1,200,000 Bond Holdings: $800,000 Mutual Funds: $500,000 |

Note: The above table provides a simplified example of the information presented in the 401(k) tax form.

Tax Implications and Strategies for 401(k) Participants

For employees, understanding the tax implications of their 401(k) contributions and withdrawals is crucial for effective financial planning. The tax treatment of 401(k) plans can vary based on the type of contributions made and the timing of withdrawals.

Types of 401(k) Contributions and Their Tax Treatment

There are primarily two types of 401(k) contributions: pre-tax (traditional) and after-tax (Roth) contributions. The tax treatment of these contributions differs, impacting the tax liability of participants.

- Pre-Tax (Traditional) Contributions: These contributions are made with pre-tax dollars, reducing one's taxable income for the year. While the contributions themselves are not taxed, the earnings and withdrawals are subject to income tax at the time of withdrawal.

- After-Tax (Roth) Contributions: Roth contributions are made with post-tax dollars, meaning the contributions are taxed upfront. However, the earnings and withdrawals from Roth contributions are typically tax-free, making this option attractive for long-term retirement planning.

The choice between pre-tax and Roth contributions depends on individual tax situations and retirement goals. It's essential to consider factors like current tax brackets, expected income in retirement, and the potential for tax law changes when making this decision.

Withdrawal Strategies and Tax Considerations

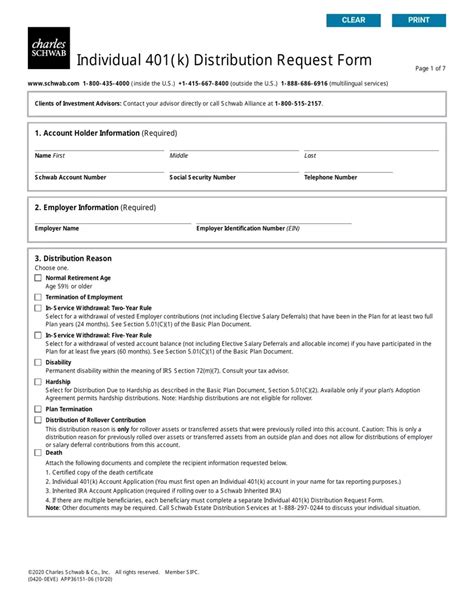

When it comes to withdrawals, 401(k) participants have several options, each with its own tax implications. The primary withdrawal strategies include:

- Regular Withdrawals: Participants can make regular withdrawals from their 401(k) during retirement. These withdrawals are typically subject to income tax and, if taken before age 59½, may incur a 10% early withdrawal penalty.

- Roth Conversions: Converting traditional 401(k) contributions to Roth contributions can be a strategy to reduce future tax liability. This involves paying taxes on the converted amount upfront but enjoying tax-free withdrawals in retirement.

- Rollovers: Participants can roll over their 401(k) funds into an IRA (Individual Retirement Account) when changing jobs. This maintains the tax-deferred status of the funds and can offer more flexibility in investment options.

- Loan Options: Some 401(k) plans allow participants to take out loans against their account balance. These loans are typically subject to repayment with interest, but they can be a viable option for short-term financial needs.

The choice of withdrawal strategy should be made with careful consideration of one's financial goals, tax situation, and the potential risks involved. It's advisable to consult with a financial advisor to navigate these decisions effectively.

The Future of 401(k) Tax Forms and Retirement Planning

As the landscape of retirement planning continues to evolve, so too will the role and structure of the 401(k) tax form. Several trends and potential changes are on the horizon, shaping the future of retirement savings and tax reporting.

Trends and Innovations in 401(k) Plans

The 401(k) landscape is evolving, with employers and plan providers implementing innovative strategies to enhance participant engagement and outcomes. Some key trends include:

- Automated Enrollment and Contributions: Many employers are now automatically enrolling employees into their 401(k) plans, with the option to opt out. This strategy has been shown to increase participation rates and long-term savings.

- Target-Date Funds: These investment options are designed to adjust their asset allocation based on the participant's proximity to retirement. They offer a hands-off approach to investing, making them popular among participants.

- Financial Wellness Programs: Some employers are offering comprehensive financial wellness programs, providing education and support to employees on various financial topics, including retirement planning.

These trends reflect a shift towards more proactive and personalized retirement planning, ensuring that employees are better equipped to make informed decisions about their financial future.

Potential Changes and Updates to the 401(k) Tax Form

The IRS and other regulatory bodies are continuously evaluating the tax forms and reporting requirements for retirement plans. While specific changes are difficult to predict, some potential updates include:

- Simplification of Reporting: To reduce the administrative burden on employers, there may be efforts to simplify the 401(k) tax form, making it more user-friendly and streamlined.

- Enhanced Disclosure of Fees: With a growing focus on transparency, there could be increased scrutiny on plan fees, with potential requirements for more detailed disclosure on the tax form.

- Integration of Digital Tools: As technology advances, there may be opportunities to integrate digital tools and platforms into the tax reporting process, enhancing efficiency and data accuracy.

Staying informed about these potential changes is essential for employers and employees alike, ensuring they can adapt their strategies and stay compliant with evolving regulations.

What are the filing deadlines for the 401(k) tax form?

+The deadline for filing the 401(k) tax form is typically July 31st of the year following the plan year. However, employers can request an extension, which grants an additional 2.5 months to file the form.

How often do employers need to file the 401(k) tax form?

+Employers are required to file the 401(k) tax form annually. This ensures that the IRS can monitor the plan’s operations and compliance with tax regulations on an ongoing basis.

Can employees access the 401(k) tax form?

+Yes, employees have the right to access and review the 401(k) tax form. This transparency allows them to understand the operations and financial health of their retirement plan, ensuring their savings are being managed effectively.