Volusia County Tax Appraiser Florida

The Volusia County Tax Appraiser's Office plays a crucial role in the financial landscape of Florida's Volusia County, assessing the value of properties to determine tax liabilities for homeowners, businesses, and other property owners. This process is integral to the county's fiscal planning and management, influencing the distribution of resources and the development of local communities. The Volusia County Tax Appraiser's Office is responsible for ensuring that property values are assessed fairly and accurately, which can significantly impact the lives and livelihoods of residents.

Property Assessment Process in Volusia County

The Volusia County Tax Appraiser's Office employs a comprehensive and systematic approach to property assessment, utilizing a combination of market analysis, property inspections, and data-driven methodologies. This ensures that property values are not only accurate but also reflective of the dynamic nature of the real estate market.

Property assessments in Volusia County are typically conducted on a cyclical basis, with different areas of the county being appraised in alternating years. This rotational system ensures that all properties are assessed regularly, providing a current and reliable valuation for tax purposes. The appraisal process involves several key steps, including:

- Data Collection: Tax appraisers gather extensive data on each property, including its physical characteristics, such as size, number of rooms, age, and any recent improvements or alterations. They also consider external factors like the neighborhood, zoning regulations, and market trends.

- Market Analysis: The Volusia County Tax Appraiser's Office analyzes recent sales of comparable properties in the area to determine the fair market value of each property. This process involves adjusting for differences in size, location, and other features to ensure a fair and accurate assessment.

- Property Inspections: In some cases, tax appraisers may conduct physical inspections of properties to verify the information on record and ensure that the property is accurately represented. These inspections can reveal additions, improvements, or changes that might impact the property's value.

- Notice of Proposed Property Taxes: Once the assessment process is complete, property owners receive a notice detailing the proposed property taxes for the upcoming year. This notice includes the assessed value of the property and the estimated tax liability based on the local tax rate.

- Appeal Process: Property owners who believe their assessment is inaccurate or unfair have the right to appeal. The Volusia County Tax Appraiser's Office provides a clear and accessible appeal process, allowing for a review of the assessment and, if necessary, a reevaluation of the property's value.

Online Tools and Resources for Property Owners

The Volusia County Tax Appraiser's Office has implemented several online tools to enhance transparency and accessibility for property owners. These resources provide valuable information and assistance, empowering residents to understand and manage their property assessments and tax obligations effectively.

One of the key online resources is the Property Search tool, which allows property owners to look up their property's assessed value, tax information, and recent sales data. This tool provides a transparent view of the appraisal process and enables residents to track changes in their property's value over time. Additionally, the website offers a Tax Estimator, helping homeowners and businesses calculate their estimated tax liability based on the current assessed value and tax rate.

For those interested in learning more about the assessment process or seeking guidance on appeals, the Volusia County Tax Appraiser's Office provides a comprehensive Guide to Property Appraisal and a detailed Appeal Process Guide. These resources offer step-by-step instructions, timelines, and tips to ensure a smooth and successful appeal process.

| Online Resource | Description |

|---|---|

| Property Search | Lookup property assessed value, tax info, and sales data. |

| Tax Estimator | Calculate estimated tax liability based on assessed value and tax rate. |

| Guide to Property Appraisal | Detailed guide to the assessment process and timelines. |

| Appeal Process Guide | Step-by-step instructions and tips for appealing property assessments. |

Impact of Property Assessments on Local Communities

Property assessments are not just a bureaucratic process but have far-reaching implications for the development and well-being of local communities. The values determined by the Volusia County Tax Appraiser's Office influence a range of factors, from the availability of public services to the overall economic health of the region.

Accurate property assessments ensure that the tax burden is distributed fairly among property owners. This fairness is crucial for maintaining a stable tax base, which in turn supports essential public services like education, infrastructure development, and public safety. When assessments are accurate, the county can allocate resources efficiently, benefiting all residents.

Moreover, the assessment process can stimulate economic growth by attracting businesses and investors. A transparent and reliable assessment system provides confidence to potential investors, who can make informed decisions based on accurate property values. This can lead to increased commercial development, job creation, and a thriving local economy.

Volusia County's Approach to Fair Assessment

Volusia County is committed to ensuring that property assessments are fair, accurate, and reflective of the current market. The Volusia County Tax Appraiser's Office implements several strategies to achieve this, including:

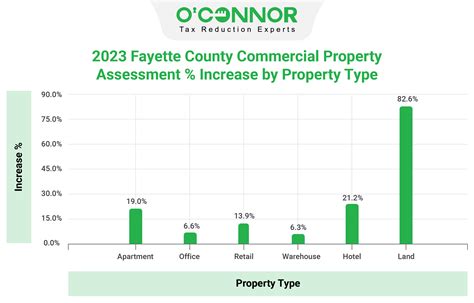

- Regular Market Analysis: The office conducts regular market studies to stay abreast of the latest trends and fluctuations in the real estate market. This ensures that property values are adjusted promptly to reflect changing market conditions.

- Comprehensive Training: Tax appraisers undergo rigorous training to ensure they are equipped with the skills and knowledge necessary to conduct accurate assessments. This includes staying updated on the latest assessment methodologies and technologies.

- Community Engagement: The Volusia County Tax Appraiser's Office actively engages with the community, hosting workshops and information sessions to educate residents about the assessment process. This transparency fosters trust and understanding, making the process more accessible and less intimidating.

- Appeal Process Accessibility: The appeal process is designed to be straightforward and accessible. Property owners are provided with clear guidelines and support to navigate the process, ensuring that any discrepancies or inaccuracies can be addressed promptly.

By implementing these strategies, Volusia County strives to ensure that property assessments are not only accurate but also fair and equitable. This approach benefits the entire community, fostering a sense of trust and transparency in the local government's operations.

Conclusion

The Volusia County Tax Appraiser's Office plays a pivotal role in the county's fiscal health and community development. Through a rigorous and transparent assessment process, the office ensures that property values are accurately determined, influencing the distribution of resources and the overall economic prosperity of the region. The online tools and resources provided by the office empower property owners, fostering a sense of community engagement and ownership in the assessment process.

As Volusia County continues to grow and develop, the role of the Tax Appraiser's Office remains crucial in maintaining a fair and sustainable tax system. By staying committed to accuracy, transparency, and community engagement, the office ensures that the county's financial foundation remains strong, supporting the diverse needs of its residents and businesses.

Frequently Asked Questions

How often are properties assessed in Volusia County?

+

Properties in Volusia County are typically assessed on a cyclical basis, with different areas of the county being appraised in alternating years. This rotational system ensures that all properties are assessed regularly, approximately every two years.

What happens if I disagree with my property’s assessed value?

+

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Volusia County Tax Appraiser’s Office provides a detailed appeal process guide, outlining the steps and requirements for a successful appeal. It’s important to act promptly, as there are specific timelines for submitting an appeal.

How does the Tax Appraiser’s Office determine the value of a property?

+

The Tax Appraiser’s Office uses a combination of methods to determine property values. This includes analyzing recent sales of comparable properties, considering market trends, and conducting physical inspections. The goal is to ensure an accurate and fair assessment of each property’s value.

Are there any online tools to estimate my property’s value and tax liability?

+

Yes, the Volusia County Tax Appraiser’s Office website offers a Property Search tool to look up your property’s assessed value and tax information. Additionally, the Tax Estimator tool allows you to calculate your estimated tax liability based on the current assessed value and tax rate.

What can I expect during a property inspection by the Tax Appraiser’s Office?

+

Property inspections are conducted to verify the information on record and ensure the accuracy of the property’s assessment. Inspectors may take measurements, note any recent improvements or changes, and confirm the property’s physical characteristics. These inspections are typically announced in advance and are an opportunity for property owners to engage with the appraisers.