Fayette County Property Tax

Understanding property taxes and their implications is crucial for homeowners and investors alike. In this comprehensive guide, we will delve into the intricacies of property taxes in Fayette County, specifically focusing on the calculations, assessments, and potential exemptions. By the end of this article, you'll have a thorough understanding of the Fayette County property tax system and the steps you can take to manage your tax obligations effectively.

The Basics of Property Taxes in Fayette County

Property taxes are a significant source of revenue for local governments, including Fayette County. These taxes are levied on real estate properties, such as residential homes, commercial buildings, and land, and they contribute to the funding of essential services and infrastructure in the community.

In Fayette County, the property tax system is governed by a set of regulations and processes aimed at ensuring fairness and accuracy in tax assessments. The tax rate is determined by the county's fiscal needs and is applied uniformly to all taxable properties within the county. This rate is expressed as a millage rate, which represents the amount of tax per dollar of assessed property value.

The millage rate is typically determined annually by the county government and is influenced by factors such as budget requirements, economic conditions, and the need to maintain public services. For instance, in the fiscal year 2023, the millage rate for Fayette County was set at 15.7 mills, which translates to $15.70 for every $1,000 of assessed property value.

It's important to note that property taxes in Fayette County are not solely determined by the millage rate. The assessed value of your property plays a crucial role in calculating your tax liability. The assessed value is an estimate of your property's worth and is typically based on factors such as its location, size, condition, and recent sales data of similar properties in the area.

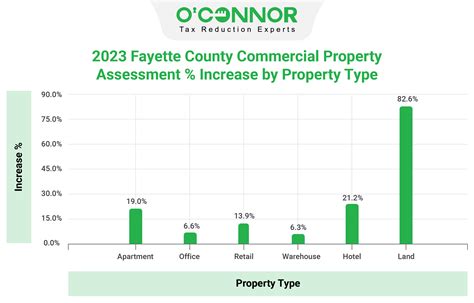

Property Assessment Process

The assessment process in Fayette County is carried out by the Fayette County Tax Assessor’s Office. This office is responsible for determining the fair market value of each taxable property within the county. Assessments are typically conducted every three years, but in some cases, reassessments may be triggered by significant improvements or changes to the property.

During the assessment process, the Tax Assessor's Office may conduct on-site inspections, review recent sales data, and consider other relevant factors to ensure an accurate valuation. Property owners have the right to appeal their assessments if they believe the valuation is incorrect or unfair. The appeals process provides an opportunity for property owners to present evidence and argue their case before an independent review board.

Calculating Your Property Tax Liability

To calculate your property tax liability in Fayette County, you need to multiply your property’s assessed value by the millage rate. Let’s break down the calculation step by step:

- Determine your property's assessed value. This is the value assigned by the Tax Assessor's Office, and it is typically a percentage of your property's fair market value.

- Obtain the current millage rate for Fayette County. As mentioned earlier, this rate is set annually by the county government and is publicly available.

- Multiply your property's assessed value by the millage rate. The result will give you your estimated property tax liability for the year.

For example, if your property has an assessed value of $200,000 and the millage rate is 15.7 mills, your estimated property tax liability would be:

$200,000 x 0.0157 = $3,140

So, in this case, your property tax liability for the year would be $3,140.

Understanding Tax Bills and Payment Options

Property tax bills in Fayette County are typically sent out annually, usually around the beginning of the fiscal year. These bills outline your tax liability, the due date, and payment options available to you. It’s crucial to review your tax bill carefully to ensure accuracy and to plan your finances accordingly.

Fayette County offers various payment options to accommodate different financial situations. You can choose to pay your property taxes in full by the due date, or you may opt for installment payments, which can be made online, by mail, or in person at designated locations. Late payments may incur penalties and interest, so it's important to stay informed about the payment deadlines.

Exemptions and Discounts: Reducing Your Property Tax Burden

Fayette County recognizes that certain individuals and properties may be eligible for exemptions or discounts, which can help reduce the overall tax burden. These exemptions are designed to provide relief to specific groups and promote fairness in the tax system.

Homestead Exemptions

One of the most common exemptions in Fayette County is the homestead exemption. This exemption is available to homeowners who use their property as their primary residence. By applying for the homestead exemption, homeowners can reduce the assessed value of their property for tax purposes, resulting in lower property taxes.

To qualify for the homestead exemption, you must meet specific criteria, such as being a legal resident of Fayette County and occupying the property as your primary residence. The exemption amount can vary, but it typically provides a substantial reduction in the taxable value of your property. It's important to note that the homestead exemption is not automatic; you must apply for it annually.

Senior Citizen and Disability Exemptions

Fayette County also offers exemptions for senior citizens and individuals with disabilities. These exemptions aim to provide financial relief to those who may have limited income or face challenges in meeting their tax obligations.

The senior citizen exemption is available to homeowners who are 65 years of age or older and meet certain income and residency requirements. This exemption can significantly reduce the taxable value of their property, making it more affordable to maintain their homes. Similarly, the disability exemption is designed to assist individuals with disabilities who rely on their property as their primary residence.

Other Exemptions and Discounts

In addition to the aforementioned exemptions, Fayette County provides various other discounts and exemptions, such as:

- Veteran's Exemption: Veterans who meet certain criteria may be eligible for a partial or full exemption on their property taxes.

- Agricultural Use Valuation: Property owners with qualifying agricultural land may benefit from a reduced assessment rate, making farming and ranching more economically viable.

- Historic Property Tax Credits: Owners of historic properties can receive tax credits for maintaining and preserving these cultural landmarks.

It's important to research and understand the specific qualifications and application processes for each exemption to determine your eligibility.

Property Tax Appeals: Challenging Your Assessment

If you believe that your property assessment is incorrect or unfair, you have the right to appeal the decision. The property tax appeal process in Fayette County provides a formal mechanism for property owners to challenge their assessments and seek a reduction in their tax liability.

Reasons for an Appeal

There are several valid reasons why you might consider appealing your property assessment. Some common grounds for an appeal include:

- Overvaluation: If you believe that the assessed value of your property is higher than its actual market value, you can provide evidence to support your claim.

- Unequal Assessment: If you discover that similar properties in your neighborhood have lower assessments, you can argue for an adjustment to align with these comparable properties.

- Change in Property Condition: If your property has undergone significant changes or improvements since the last assessment, you can request a reassessment to reflect the current condition.

The Appeal Process

To initiate an appeal, you must first file a formal request with the Fayette County Board of Tax Assessors. This request should include a detailed explanation of your reasons for the appeal, along with any supporting documentation, such as recent sales data, appraisals, or expert opinions.

Once your appeal is received, the Board of Tax Assessors will review your case and may request additional information. They will then schedule a hearing, where you will have the opportunity to present your case and provide further evidence. It's essential to prepare thoroughly for the hearing and gather all relevant documentation to support your appeal.

Outcomes of an Appeal

After the hearing, the Board of Tax Assessors will make a decision regarding your appeal. There are several possible outcomes:

- Upheld Assessment: If the Board finds that your assessment is accurate and fair, they will uphold the original decision.

- Partial Reduction: In some cases, the Board may agree that your assessment is slightly overvalued and grant a partial reduction, adjusting the assessed value downward.

- Full Reduction: If your appeal is successful, the Board may grant a full reduction, lowering your property's assessed value to match your arguments and evidence.

- No Change: In rare cases, the Board may decide that your assessment is already too low and deny your appeal.

It's important to note that the appeal process can be complex and time-consuming. Engaging the services of a qualified tax professional or attorney may be beneficial to increase your chances of a successful appeal.

Managing Your Property Taxes: Strategies and Tips

Navigating the property tax landscape in Fayette County can be challenging, but with the right strategies and knowledge, you can effectively manage your tax obligations. Here are some tips to help you stay on top of your property taxes:

Stay Informed

Keep yourself updated on the latest property tax regulations, millage rates, and assessment processes in Fayette County. Follow local news and official government channels to stay informed about any changes or updates that may impact your tax liability.

Understand Your Property’s Value

Regularly monitor the market value of your property. Stay informed about recent sales of similar properties in your area to ensure that your assessment accurately reflects the current real estate trends. This knowledge can be valuable when appealing your assessment or negotiating with potential buyers.

Explore Exemptions and Discounts

Research and apply for any exemptions or discounts for which you may be eligible. Take advantage of the homestead exemption, senior citizen exemption, or other relevant programs to reduce your tax burden. Stay informed about new initiatives and changes to existing programs to ensure you don’t miss out on potential savings.

Plan Your Finances

Property taxes are a significant expense, so it’s essential to plan your finances accordingly. Budget for your annual tax payments and consider setting aside funds specifically for this purpose. If you’re facing financial difficulties, explore payment plans or seek assistance from local organizations that provide financial guidance.

Consider Long-Term Strategies

If you’re a long-term homeowner or investor, consider implementing strategies to minimize your tax liability over time. For example, you could explore the possibility of purchasing additional properties that qualify for certain tax benefits or investing in energy-efficient upgrades that may lead to tax credits or deductions.

Conclusion: Empowering Property Owners in Fayette County

Understanding and managing property taxes in Fayette County is an essential aspect of responsible homeownership and investment. By familiarizing yourself with the assessment process, calculation methods, and available exemptions, you can take control of your tax obligations and ensure fair and accurate assessments.

Remember, staying informed, exploring your options, and seeking professional guidance when needed are key to navigating the complex world of property taxes. With the right knowledge and strategies, you can make informed decisions and minimize the impact of property taxes on your financial well-being.

Frequently Asked Questions

What is the current millage rate for Fayette County property taxes?

+

The current millage rate for Fayette County is 15.7 mills. This rate is subject to change annually, so it’s important to stay updated with the latest information from the county government.

How often are property assessments conducted in Fayette County?

+

Property assessments in Fayette County are typically conducted every three years. However, reassessments may occur if there are significant changes or improvements to a property.

Can I appeal my property assessment if I disagree with the valuation?

+

Yes, you have the right to appeal your property assessment if you believe it is incorrect or unfair. The appeal process involves submitting a formal request and attending a hearing to present your case.

Are there any exemptions or discounts available for property owners in Fayette County?

+

Yes, Fayette County offers various exemptions and discounts to eligible property owners. These include homestead exemptions, senior citizen exemptions, disability exemptions, and more. It’s important to research and understand the specific qualifications for each exemption.

How can I stay informed about changes to property tax regulations in Fayette County?

+

To stay informed, follow local news outlets, official government websites, and social media channels. These sources often provide updates on tax regulations, millage rates, and any changes that may impact property owners.