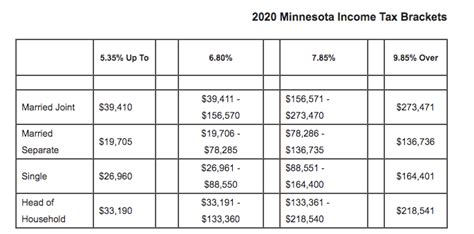

Mn Tax Brackets

Minnesota's tax system, much like that of other states, operates on a progressive tax structure, meaning that the tax rate increases as income levels rise. This system aims to ensure fairness and contribute to a robust revenue stream for the state. Understanding these tax brackets is crucial for individuals and businesses alike, as it influences their financial planning and overall tax strategies.

The Current Tax Landscape in Minnesota

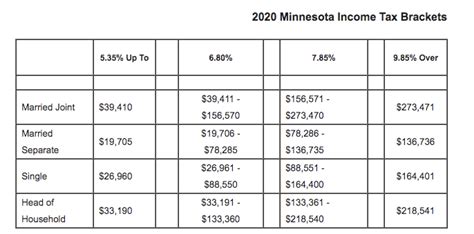

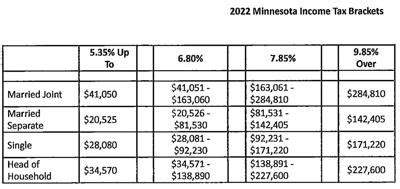

As of my last update in January 2023, Minnesota had six income tax brackets with corresponding tax rates, each designed to apply to different income levels. These rates are subject to periodic adjustments to account for inflation and other economic factors. The brackets and their associated rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $11,440 | 5.35% |

| $11,441 to $36,560 | 7.05% |

| $36,561 to $79,800 | 7.85% |

| $79,801 to $157,920 | 8.725% |

| $157,921 to $303,720 | 9.85% |

| Over $303,720 | 9.85% |

These brackets are applicable for both single and joint filers, with the tax rates increasing as income increases. It's important to note that these rates are for Minnesota state income tax and do not include federal income tax or other potential deductions and credits.

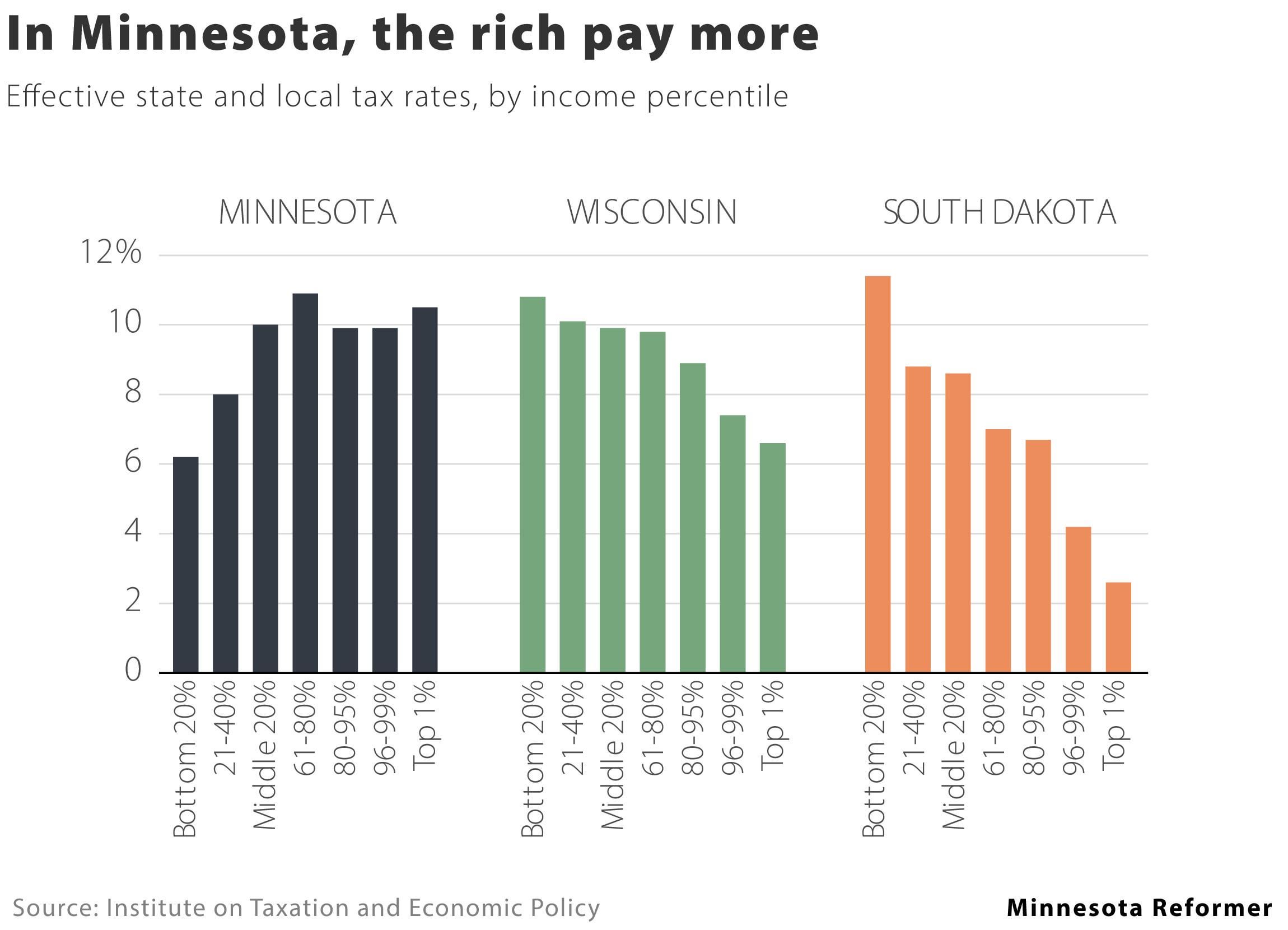

The Impact of Tax Brackets on Minnesotans

The progressive nature of Minnesota’s tax system means that individuals with higher incomes pay a larger percentage of their income in taxes compared to those with lower incomes. This approach is intended to distribute the tax burden more equitably across different income levels. For example, someone earning just above 36,560 would fall into the 7.85% tax bracket, while someone earning 303,720 or more would remain in the highest tax bracket of 9.85%.

How Do These Brackets Affect Tax Planning Strategies?

Understanding these tax brackets is crucial for effective tax planning. For instance, if an individual’s income is approaching the threshold of a higher tax bracket, they might consider strategies to maximize deductions or credits to reduce their taxable income and potentially fall into a lower bracket. On the other hand, businesses might structure their operations or compensation strategies to optimize their tax position within these brackets.

Historical Context and Potential Changes

Minnesota’s tax brackets have evolved over time, with periodic adjustments to rates and the income thresholds at which they apply. These changes are often driven by economic conditions, legislative initiatives, and the state’s budgetary needs. For instance, in recent years, there have been proposals to reform the state’s tax system, including suggestions to introduce more tax brackets or adjust existing ones to promote greater fairness.

The Role of Political and Economic Factors

The political climate and economic landscape significantly influence these changes. Political ideologies, economic growth or recession, and the state’s fiscal health all play a role in determining the structure and rates of these tax brackets. For instance, during economic downturns, there might be a push to reduce tax rates to stimulate the economy, while in times of prosperity, rates might be adjusted upwards to generate more revenue.

The Future of Minnesota’s Tax Brackets

Looking ahead, the future of Minnesota’s tax brackets is uncertain but likely to be influenced by ongoing debates around tax fairness, economic conditions, and the state’s fiscal needs. There are ongoing discussions about potential reforms, including proposals for a flat tax or a more progressive system with additional brackets. These changes could significantly impact taxpayers, altering their tax liabilities and strategies.

Potential Implications of Reform

If Minnesota were to implement a flat tax, for example, it would mean a single tax rate applied to all income levels, which could simplify the tax system but might also lead to a less equitable distribution of the tax burden. On the other hand, adding more brackets could increase the progressivity of the tax system, potentially reducing tax liabilities for lower-income earners while increasing them for those at the top.

How often are Minnesota’s tax brackets adjusted?

+Minnesota’s tax brackets are typically adjusted annually to account for inflation. This adjustment ensures that the brackets keep pace with rising incomes, preventing bracket creep where taxpayers would be pushed into higher tax brackets solely due to inflation.

Are there any special tax rates or brackets for certain types of income in Minnesota?

+Yes, Minnesota has a special tax rate for income derived from capital gains and dividends. This rate is currently set at 9.85%, which is the same as the highest ordinary income tax bracket. However, this rate is subject to change, and there are ongoing discussions about potentially introducing a lower rate for capital gains.

What are the potential benefits of a progressive tax system like Minnesota’s?

+A progressive tax system like Minnesota’s aims to achieve a more equitable distribution of the tax burden. By having higher tax rates for higher incomes, the system ensures that those with greater financial means contribute a larger share of their income to the state’s revenue. This approach can help fund public services and infrastructure projects that benefit all residents.