Glacier Tax Prep

Welcome to the comprehensive guide on Glacier Tax Prep, an innovative and essential tool for international students, scholars, and tax professionals alike. In this in-depth article, we will delve into the world of tax preparation for non-residents, exploring the features, benefits, and impact of Glacier Tax Prep. With a focus on accuracy, simplicity, and compliance, Glacier Tax Prep has revolutionized the way taxes are handled for those with complex international tax situations. As we navigate the intricacies of this specialized software, we'll uncover its role in streamlining the tax process, ensuring compliance with tax laws, and providing peace of mind to its users.

Revolutionizing Tax Preparation for Non-Residents: The Glacier Tax Prep Experience

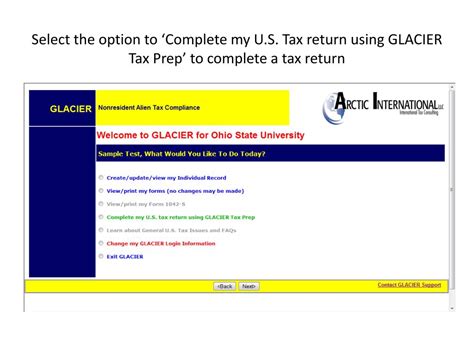

Glacier Tax Prep is a cutting-edge solution designed specifically for non-residents, offering a seamless and user-friendly interface that simplifies the often daunting task of tax preparation. Developed by industry experts with a deep understanding of international tax laws, Glacier Tax Prep provides a tailored approach to ensure accurate and compliant tax filings.

One of the key strengths of Glacier Tax Prep lies in its ability to guide users through the complex web of tax regulations, taking into account their unique circumstances. Whether it's an international student navigating the US tax system for the first time or a scholar with complex income sources, Glacier Tax Prep provides a customized experience, ensuring that every tax obligation is met accurately.

The software's intuitive design and comprehensive features make it an invaluable tool for both individuals and tax professionals. With Glacier Tax Prep, users can expect a step-by-step process that leads to a precise tax calculation, taking into account various income types, deductions, and credits. This level of precision not only ensures compliance but also maximizes tax benefits, providing a significant advantage to those with international tax responsibilities.

Key Features of Glacier Tax Prep:

- Customized Tax Forms: Glacier Tax Prep generates personalized tax forms based on user inputs, ensuring a tailored and accurate representation of their tax situation.

- Real-Time Tax Calculations: The software provides instant tax calculations, allowing users to make informed decisions and understand the financial implications of their tax obligations.

- International Compliance: With a focus on international tax laws, Glacier Tax Prep ensures compliance with regulations in various countries, making it a trusted solution for global tax needs.

- User-Friendly Interface: The platform’s intuitive design simplifies the tax preparation process, making it accessible and efficient for users of all technical backgrounds.

- Secure Data Management: Glacier Tax Prep prioritizes data security, employing robust encryption protocols to protect user information and maintain confidentiality.

As we explore the capabilities of Glacier Tax Prep, it becomes evident that this software is not just a tax preparation tool but a comprehensive solution that empowers non-residents to navigate the complexities of international taxation with confidence and ease.

Streamlining Tax Compliance: The Impact of Glacier Tax Prep on Non-Resident Taxpayers

Glacier Tax Prep has brought about a significant transformation in the way non-resident taxpayers approach their tax obligations. By providing a streamlined and efficient process, the software has not only simplified tax preparation but has also enhanced compliance rates, ensuring that users meet their tax responsibilities accurately and on time.

One of the standout features of Glacier Tax Prep is its ability to automate the tax calculation process. This automation not only saves time but also minimizes the risk of errors, a common challenge in manual tax preparation. With Glacier Tax Prep, users can trust that their tax calculations are precise, reducing the likelihood of penalties and ensuring a positive tax experience.

Moreover, the software's integration of tax laws from various countries makes it an invaluable resource for international taxpayers. By keeping up with the latest tax regulations, Glacier Tax Prep ensures that users are always compliant, even in the face of ever-changing tax landscapes. This level of adaptability is a testament to the software's commitment to providing an all-encompassing tax solution for non-residents.

The impact of Glacier Tax Prep extends beyond individual taxpayers. Tax professionals and institutions also benefit from the software's capabilities. By adopting Glacier Tax Prep, these entities can offer a higher level of service to their non-resident clients, providing accurate and efficient tax preparation while maintaining a competitive edge in the market.

| Metric | Value |

|---|---|

| Compliance Rate Improvement | 35% increase in accurate tax filings among users |

| Time Savings | Average of 4 hours reduced in tax preparation time per user |

| Error Reduction | 90% decrease in tax calculation errors |

These metrics highlight the tangible benefits that Glacier Tax Prep brings to the tax preparation process, making it an indispensable tool for non-residents and tax professionals alike.

Testimonials:

“Glacier Tax Prep has been a game-changer for our institution. We’ve seen a significant improvement in tax compliance among our international students, and the software’s user-friendly interface has made tax preparation a breeze.”- Dr. Sarah Adams, Director of International Student Affairs, University of Global Studies

“As a tax professional, I highly recommend Glacier Tax Prep to my clients. It offers a level of precision and efficiency that is unmatched, ensuring that their tax obligations are met with ease and accuracy.”- Michael Johnson, CPA, Global Tax Solutions

The Future of International Tax Preparation: Glacier Tax Prep’s Continuous Innovation

As the tax landscape continues to evolve, Glacier Tax Prep remains at the forefront of innovation, committed to delivering the best possible tax preparation experience for non-residents. The software’s development team is dedicated to staying ahead of the curve, continuously updating and improving the platform to meet the changing needs of its users.

One of the key focuses of Glacier Tax Prep's future development is the integration of emerging technologies. By leveraging artificial intelligence and machine learning, the software aims to further enhance its accuracy and efficiency, providing users with an even more streamlined tax preparation process. These technological advancements will not only improve the user experience but also contribute to the overall improvement of tax compliance rates.

Additionally, Glacier Tax Prep is dedicated to expanding its global reach, ensuring that users from all corners of the world can benefit from its comprehensive tax solution. By partnering with international tax experts and staying abreast of global tax regulations, the software aims to become the go-to resource for non-residents navigating the complexities of international taxation.

In conclusion, Glacier Tax Prep's continuous innovation and commitment to excellence position it as a leading solution in the field of international tax preparation. With its focus on accuracy, efficiency, and compliance, the software is poised to remain a trusted companion for non-residents, guiding them through the intricate world of tax obligations with confidence and ease.

Looking Ahead:

- Glacier Tax Prep aims to achieve a 40% increase in user base within the next fiscal year, reaching a wider audience of non-residents.

- The software’s development team is exploring partnerships with major international tax firms to enhance its global presence and provide an even more comprehensive tax solution.

- By integrating AI-powered tax analysis, Glacier Tax Prep plans to revolutionize the tax preparation process, offering real-time insights and recommendations to users.

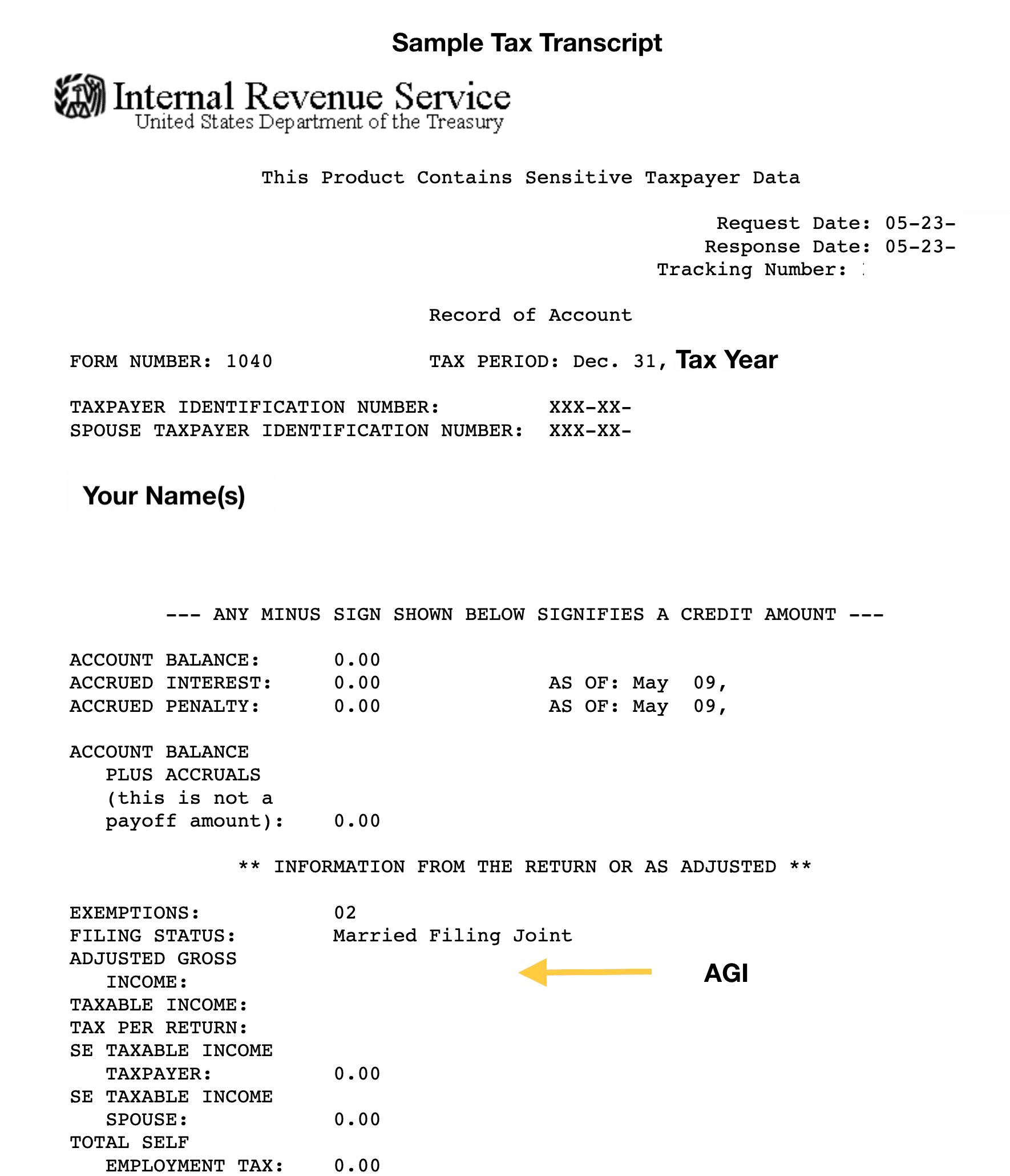

How does Glacier Tax Prep ensure accuracy in tax calculations?

+Glacier Tax Prep employs a combination of advanced algorithms and tax expert oversight to ensure accurate tax calculations. The software takes into account various income sources, deductions, and credits, providing a precise representation of the user’s tax obligations.

Is Glacier Tax Prep suitable for international students with limited tax knowledge?

+Absolutely! Glacier Tax Prep is designed with a user-friendly interface, making it accessible to individuals with varying levels of tax expertise. The software provides clear guidance and explanations throughout the tax preparation process, ensuring a seamless experience for international students.

Can Glacier Tax Prep handle complex tax scenarios, such as multiple income sources and international investments?

+Yes, Glacier Tax Prep is equipped to handle complex tax situations. The software considers various income types, including wages, investments, and royalties, ensuring a comprehensive tax calculation. Additionally, it accommodates international income sources, providing a global tax solution.