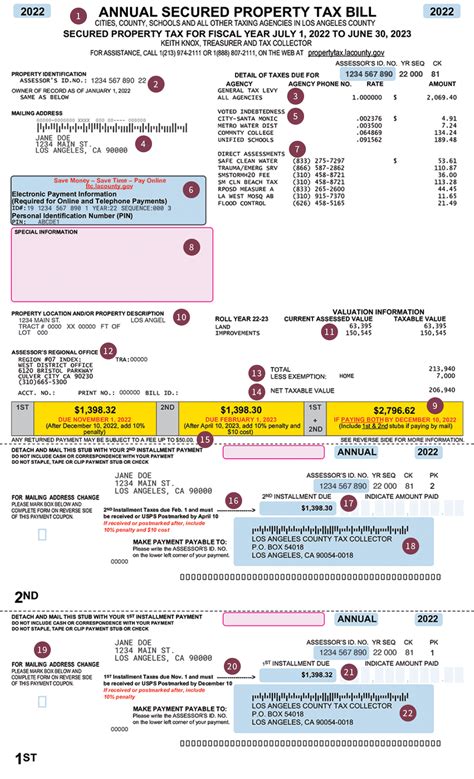

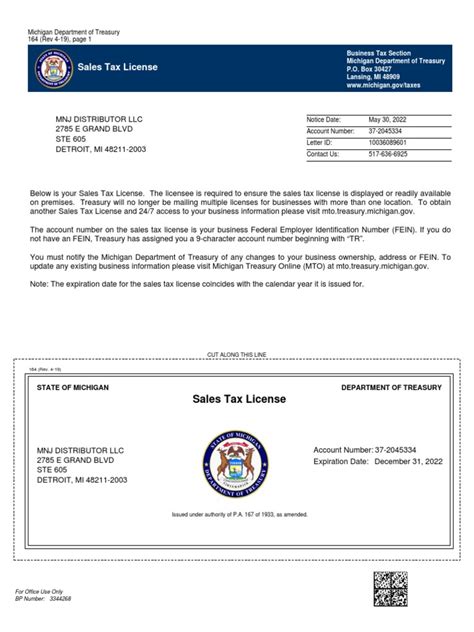

Michigan Sales Tax License

Obtaining a Michigan Sales Tax License, officially known as the Michigan Sales and Use Tax License, is a crucial step for businesses operating within the state of Michigan. This license allows entities to collect and remit sales tax to the Michigan Department of Treasury, ensuring compliance with state tax regulations. In this comprehensive guide, we will delve into the intricacies of the Michigan Sales Tax License, exploring the application process, requirements, benefits, and the role it plays in the state's tax system.

Understanding the Michigan Sales Tax License

The Michigan Sales Tax License is a legal document that authorizes businesses to collect and remit sales tax on behalf of the Michigan government. It is an essential component of the state’s tax structure, as it ensures that revenue generated from sales transactions is accurately accounted for and directed towards funding essential state services and infrastructure.

Sales tax in Michigan is imposed on the retail sale, lease, or rental of tangible personal property, as well as certain services. The tax rate varies depending on the location of the sale, with a state-wide rate of 6% and additional local rates that can increase the total tax rate to as much as 9%. The Michigan Sales Tax License enables businesses to accurately calculate and collect the appropriate tax rate based on the location of their customers.

The license is not only important for compliance purposes but also for establishing a business's legitimacy and credibility. It demonstrates that a business is registered with the state and is authorized to engage in commercial activities, providing assurance to customers, partners, and other stakeholders.

Who Needs a Michigan Sales Tax License

Any entity that sells tangible goods or certain services in Michigan is typically required to obtain a Michigan Sales Tax License. This includes but is not limited to:

- Retail stores

- Online retailers

- Wholesale businesses

- Manufacturers

- Service providers, such as repair shops or salons

- Marketplaces and platforms facilitating sales

It's important to note that even if a business has a physical presence outside of Michigan, if it makes sales within the state, it may still be required to obtain a Michigan Sales Tax License. This includes businesses that sell goods online or over the phone to Michigan residents.

The Application Process

Applying for a Michigan Sales Tax License is a straightforward process that can be completed online through the Michigan Department of Treasury’s website. The application requires businesses to provide specific information about their operations, including:

- Business name, address, and contact details

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Nature of the business and products/services offered

- Estimated annual sales volume

- Expected start date of sales

Additionally, businesses may need to provide documentation supporting their legal status, such as articles of incorporation or a business license. The application process typically takes around 10-14 days, after which the Michigan Department of Treasury will issue the license if the business meets all requirements.

It's worth noting that the application process may vary slightly for businesses that are already registered with other Michigan tax programs, such as the Michigan Income Tax Withholding or Unemployment Insurance Tax. In such cases, businesses may be able to add the Sales and Use Tax License to their existing registration.

Application Fees and Requirements

As of the latest update, there is no application fee for the Michigan Sales Tax License. However, it’s important to stay informed about any potential changes in fees, as these may be subject to alteration by the state government.

In addition to the basic application requirements, certain businesses may need to meet additional criteria. For instance, businesses that sell certain types of goods, such as alcoholic beverages or tobacco products, may require specific permits or licenses from other state agencies before obtaining the Sales and Use Tax License.

| Business Type | Additional Requirements |

|---|---|

| Alcoholic Beverage Sales | Liquor License from the Michigan Liquor Control Commission |

| Tobacco Products | Tobacco Products License from the Michigan Department of Licensing and Regulatory Affairs |

| Gambling or Gaming | Gaming licenses or permits as per Michigan Gaming Control Board regulations |

Benefits and Responsibilities of the License

Obtaining a Michigan Sales Tax License offers several benefits to businesses, including:

- Legitimacy and Compliance: The license ensures that businesses are operating within the bounds of Michigan's tax laws, fostering a culture of compliance and trust.

- Access to Resources: Licensed businesses can access valuable resources and support from the Michigan Department of Treasury, including guidance on tax obligations and potential tax incentives.

- Simplified Tax Reporting: The license streamlines the tax reporting process, making it easier for businesses to calculate and remit sales tax accurately.

However, with these benefits come responsibilities. Licensed businesses must adhere to the following:

- Collect the appropriate sales tax rate based on the location of the sale.

- Remit the collected sales tax to the Michigan Department of Treasury on a regular basis (typically monthly or quarterly, depending on the business's tax liability).

- Keep accurate records of sales transactions, including the tax collected, for a minimum of four years.

- Provide clear and accurate information to customers regarding the sales tax rate and its inclusion in the total purchase price.

Penalties for Non-Compliance

Failing to obtain a Michigan Sales Tax License or neglecting to comply with the associated responsibilities can result in severe penalties. These may include:

- Fines and penalties, which can range from hundreds to thousands of dollars.

- Interest on late payments or underpayments.

- Potential criminal charges for deliberate tax evasion.

- Revocation of the Sales Tax License, preventing the business from engaging in sales activities within the state.

It is essential for businesses to understand their tax obligations and take the necessary steps to ensure compliance. The Michigan Department of Treasury provides resources and guidance to help businesses navigate the tax landscape and avoid non-compliance issues.

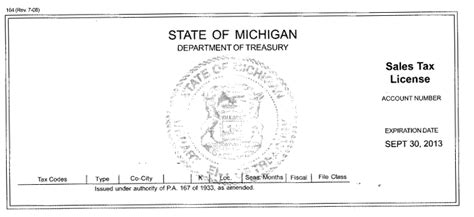

Tax Rates and Calculations

The sales tax rate in Michigan is determined by the location of the sale, with a state-wide rate of 6% and additional local rates that can increase the total tax rate. As of the latest data, here is a breakdown of the sales tax rates in major Michigan cities:

| City | State Tax Rate | Local Tax Rate | Total Tax Rate |

|---|---|---|---|

| Detroit | 6% | 2% | 8% |

| Grand Rapids | 6% | 1.5% | 7.5% |

| Lansing | 6% | 2% | 8% |

| Ann Arbor | 6% | 1% | 7% |

| Flint | 6% | 2% | 8% |

Businesses operating in these cities, or any other location within Michigan, must ensure they are collecting the correct sales tax rate based on the customer's billing or shipping address. This information is crucial for accurate tax calculation and compliance with state regulations.

Special Tax Considerations

In addition to the standard sales tax rates, Michigan has several special tax considerations that businesses should be aware of:

- Food and Drugs: Certain food items and non-prescription drugs are exempt from sales tax.

- Vehicle Sales: The sales tax rate for vehicles, including cars, trucks, and motorcycles, is typically higher than the standard rate and may include additional fees.

- Online Sales: Michigan has specific rules for taxing online sales, including marketplace facilitator laws that require online platforms to collect and remit sales tax on behalf of their sellers.

Businesses should consult the Michigan Department of Treasury's website or seek professional tax advice to fully understand these special tax considerations and ensure compliance.

Future Implications and Trends

The landscape of sales tax in Michigan, like in many other states, is subject to change and evolution. Several trends and potential future developments are worth noting for businesses operating in the state:

Increasing Sales Tax Rates

As state and local governments face budget constraints, there is a growing trend towards increasing sales tax rates to generate additional revenue. While the current rates in Michigan are relatively stable, there have been proposals in the past to raise the state-wide rate. Businesses should stay informed about any potential changes in tax rates to ensure they are prepared for any adjustments.

Expansion of Taxable Services

Historically, sales tax in Michigan has primarily been applied to tangible goods. However, there is a growing trend towards taxing certain services, particularly those that are considered luxury or non-essential. This includes services like streaming media, cloud computing, and online gaming. Businesses offering such services should anticipate potential changes in tax regulations and ensure they are equipped to collect and remit sales tax on these transactions.

Remote Seller Nexus

With the rise of e-commerce, many states, including Michigan, have expanded their definition of nexus, which determines whether a business has a physical presence in the state and is therefore subject to sales tax. The concept of economic nexus has been introduced, which considers factors like the number of transactions or the total sales volume within the state to establish a business’s nexus. As a result, more out-of-state businesses may find themselves required to collect and remit Michigan sales tax, even without a physical presence in the state.

Streamlined Sales Tax Initiative

Michigan is a member of the Streamlined Sales Tax Governing Board, which aims to simplify and modernize sales tax systems across states. This initiative could lead to changes in the way sales tax is administered and collected, potentially making it easier for businesses to comply with multiple state tax regulations. However, it’s important to note that the initiative is still in progress, and its full impact is yet to be realized.

Conclusion

Obtaining a Michigan Sales Tax License is a critical step for businesses operating within the state, ensuring compliance with tax regulations and establishing legitimacy. The application process, while straightforward, requires businesses to provide accurate and detailed information. Once obtained, the license comes with both benefits and responsibilities, including the obligation to collect and remit sales tax accurately and timely.

As Michigan's tax landscape continues to evolve, businesses must stay abreast of any changes in tax rates, taxable services, and the definition of nexus. By doing so, they can ensure they remain compliant and take advantage of any tax incentives or simplifications that may arise. The Michigan Department of Treasury provides valuable resources and guidance to help businesses navigate these complexities and contribute to the state's tax system effectively.

What is the Michigan Sales Tax License, and why is it important for businesses operating in the state?

+

The Michigan Sales Tax License, officially known as the Michigan Sales and Use Tax License, authorizes businesses to collect and remit sales tax on behalf of the state. It is crucial for compliance with Michigan’s tax regulations and for establishing a business’s legitimacy. The license ensures that revenue from sales transactions is accurately accounted for and directed towards funding essential state services.

Who needs to obtain a Michigan Sales Tax License?

+

Any entity that sells tangible goods or certain services in Michigan is typically required to obtain a Michigan Sales Tax License. This includes retail stores, online retailers, wholesale businesses, manufacturers, service providers, and marketplaces. Even businesses with a physical presence outside of Michigan may need a license if they make sales within the state.

How can businesses apply for a Michigan Sales Tax License, and what information is required in the application?

+

Businesses can apply for a Michigan Sales Tax License online through the Michigan Department of Treasury’s website. The application requires details such as the business’s name, address, contact information, FEIN or SSN, nature of the business, estimated annual sales volume, and expected start date of sales. Additional documentation, like articles of incorporation or a business license, may also be needed.

Are there any fees associated with obtaining a Michigan Sales Tax License, and what are the additional requirements for certain business types?

+

As of the latest information, there is no application fee for the Michigan Sales Tax License. However, businesses may need to meet additional requirements based on their specific operations. For example, businesses selling alcoholic beverages, tobacco products, or offering gambling/gaming services may require specific permits or licenses from other state agencies before obtaining the Sales and Use Tax License.

What are the benefits and responsibilities of having a Michigan Sales Tax License?

+

Benefits include legitimacy, compliance with tax laws, access to resources and support from the Michigan Department of Treasury, and simplified tax reporting. Responsibilities include collecting the correct sales tax rate, remitting the collected tax to the state on a regular basis, maintaining accurate sales records, and providing clear information to customers about the tax rate.

What are the potential penalties for non-compliance with Michigan’s sales tax regulations?

+

Penalties for non-compliance can include fines, interest on late payments, potential criminal charges for deliberate tax evasion, and revocation of the Sales Tax License. It is essential for businesses to understand their tax obligations and take steps to ensure compliance.

How are sales tax rates determined in Michigan, and what are the current rates in major cities?

+

The sales tax rate in Michigan is determined by the location of the sale, with a state-wide rate of 6% and additional local rates. As of the latest data, cities like Detroit, Grand Rapids, Lansing, Ann Arbor, and Flint have total tax rates ranging from 7% to 8% due to local surcharges. Businesses must collect the correct rate based on the customer’s billing or shipping address.

Are there any special tax considerations or exemptions in Michigan that businesses should be aware of?

+

Yes, Michigan has several special tax considerations. Certain food items and non-prescription drugs are exempt from sales tax. Vehicle sales often have a higher tax rate and additional fees. Additionally, online sales, including those facilitated by online marketplaces, are subject to specific tax rules and requirements.

<