Disregarded Entity For Tax Purposes

In the complex world of taxation, there exist entities that, for various reasons, are deemed to be disregarded for tax purposes. These entities, despite their legal existence and operational activities, are treated differently by tax authorities, leading to unique implications and considerations. Understanding the concept of disregarded entities is crucial for businesses and individuals alike, as it can have significant impacts on their tax obligations and overall financial strategies.

Unraveling the Concept of Disregarded Entities

A disregarded entity, as defined by tax regulations, is a business structure that is not recognized as a separate entity for tax purposes. This means that the entity’s income, expenses, assets, and liabilities are not treated as belonging to a distinct taxpayer but are instead attributed to its owner or owners. The tax treatment of such entities varies depending on the jurisdiction and the specific entity type.

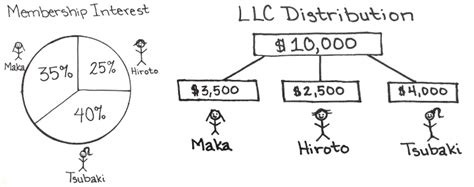

The most common example of a disregarded entity is a single-member limited liability company (LLC). In many countries, including the United States, an LLC with a single owner is typically treated as a disregarded entity by default. This means that the LLC's tax liabilities are passed through to the owner, who reports and pays taxes on the entity's activities as part of their personal tax return.

Key Characteristics of Disregarded Entities

-

Tax Treatment: Disregarded entities are not subject to the same tax obligations as separate entities like corporations. Instead, their tax liabilities are combined with those of their owners.

-

Ownership Structure: These entities often have a single owner or are owned by a larger entity, which leads to the pass-through tax treatment.

-

Legal Entity vs. Tax Entity: Disregarded entities exist as legal entities but are not recognized as distinct taxpayers, highlighting the difference between legal and tax classifications.

Real-World Examples of Disregarded Entities

Let’s explore a few scenarios to better understand how disregarded entities operate in the real world:

-

Single-Member LLC: John, a freelance graphic designer, forms a single-member LLC to provide a legal shield for his business. For tax purposes, John’s LLC is disregarded, and he reports all profits and expenses on his personal tax return.

-

Foreign Entity Operations: An American company establishes a branch office in France. In France, this branch is treated as a disregarded entity, and its profits are taxed as part of the American company’s global income.

-

Qualified Business Units (QBUs): A multinational corporation may have specific business units that are treated as disregarded entities in certain jurisdictions. This allows for simplified tax reporting and compliance.

Implications and Considerations

The status of being a disregarded entity carries several implications that businesses and individuals should be aware of:

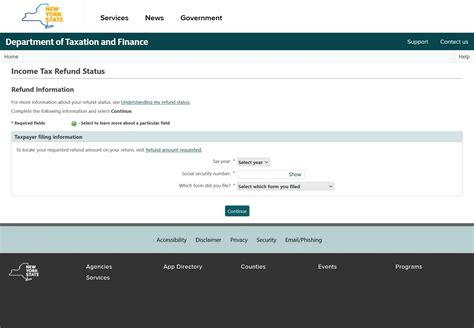

Tax Reporting and Compliance

Owners of disregarded entities must ensure they understand the specific tax reporting requirements. This includes keeping detailed records of the entity’s financial activities and ensuring accurate reporting on personal tax returns.

Pass-Through Taxation

The pass-through nature of disregarded entities means that profits and losses are directly attributed to the owner. This can be advantageous for tax efficiency, as it allows for the use of various tax deductions and credits.

Limited Liability Protection

While disregarded entities provide legal protection for their owners, this protection may be limited in certain jurisdictions. Owners should consult legal and tax advisors to understand the extent of liability protection.

Entity Classification Elections

In some cases, entities can elect to be treated as a corporation for tax purposes, even if they meet the criteria for disregarded status. This election can be beneficial for certain business structures and should be considered based on individual circumstances.

International Tax Considerations

For entities operating across borders, the disregarded entity status can lead to complex international tax implications. It’s crucial to understand the tax treaties and regulations of the involved jurisdictions.

| Jurisdiction | Disregarded Entity Treatment |

|---|---|

| United States | Single-member LLCs are typically disregarded by default. |

| Canada | Certain entities, like sole proprietorships, may be treated as disregarded. |

| United Kingdom | UK law recognizes limited liability partnerships as disregarded entities. |

Navigating the Complexities

Understanding the intricacies of disregarded entities is crucial for anyone involved in business operations or personal financial management. While these entities provide certain advantages, they also come with unique challenges and responsibilities. It is essential to stay informed about the latest tax regulations and consult professionals to ensure compliance and optimize tax strategies.

The world of taxation is ever-evolving, and staying ahead of the curve is key to making the most of these tax classifications. As businesses expand and evolve, so too must their understanding of the tax landscape.

FAQ

Can a disregarded entity have employees?

+

Yes, a disregarded entity can have employees. The tax treatment of these employees would typically follow the same rules as any other business entity.

Are there any tax benefits to being a disregarded entity?

+

Being a disregarded entity can offer tax benefits, such as pass-through taxation and the ability to use personal tax credits and deductions. However, the benefits depend on individual circumstances.

Can a disregarded entity change its tax status?

+

In some cases, yes. Entities can elect to be treated as corporations for tax purposes, which can be advantageous in certain situations.