New York State Taxes Online

In today's digital age, managing your taxes has become more convenient and accessible than ever. The state of New York, known for its bustling cities and diverse population, offers residents and businesses a user-friendly platform for filing taxes online. This comprehensive guide will delve into the process of paying New York state taxes online, exploring the benefits, requirements, and steps involved to ensure a seamless and efficient experience.

The Benefits of Online Tax Filing in New York

The New York State Department of Taxation and Finance has developed an online system that simplifies the tax filing process, making it more efficient and accessible for taxpayers. Here are some key advantages of opting for online tax filing in New York:

- Convenience and Accessibility: Taxpayers can file their returns from the comfort of their homes or offices, eliminating the need for physical visits to tax offices. The online platform is accessible 24/7, allowing individuals to manage their taxes at their convenience.

- Secure and Confidential: The New York State tax website employs advanced security measures to protect taxpayer information. Data encryption and other security protocols ensure that sensitive financial details remain confidential.

- Real-Time Updates and Notifications: Online filing provides taxpayers with instant updates and notifications regarding the status of their returns. This feature keeps individuals informed and reduces the need for frequent manual checks.

- Simplified Payment Options: The online system offers various payment methods, including credit/debit cards, electronic funds transfer, and direct debit. This flexibility accommodates different preferences and financial situations.

- Error Reduction: The automated system minimizes the chances of errors, as it performs real-time calculations and checks for accuracy. This reduces the risk of mistakes that could lead to audits or penalties.

- Faster Processing and Refunds: Electronic filing often results in quicker processing times compared to traditional paper returns. Additionally, eligible taxpayers can receive their refunds more rapidly through direct deposit.

Eligibility and Requirements for Online Tax Filing

Not all taxpayers in New York are required to file their taxes online. However, for those who are eligible, the process is straightforward and offers several benefits. Here are the key requirements and considerations:

Who Should File Online in New York?

The New York State Department of Taxation and Finance encourages taxpayers with straightforward tax situations to utilize the online filing system. This includes individuals who:

- Have a simple tax return with no complex transactions or deductions.

- Are comfortable with basic computer skills and navigating online platforms.

- Prefer the convenience and efficiency of online filing over traditional methods.

Requirements and Documents Needed

To file your New York state taxes online, you’ll need the following information and documents:

- Personal Information: Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), full name, date of birth, and address.

- Income Details: Wage and salary statements (W-2 forms), interest and dividend statements (1099-INT and 1099-DIV), and any other income sources such as rental income or self-employment income.

- Deductions and Credits: Information related to deductions and credits you may be eligible for, such as the Child and Dependent Care Credit (Form CT-240) or the Real Estate Tax Credit (Form IT-214). Check the New York State tax guidelines for a comprehensive list.

- Payment Method: If you have a tax liability, you’ll need to choose a payment method. This could include credit/debit card details, bank account information for electronic funds transfer, or instructions for direct debit.

- Previous Year’s Return: Having a copy of your previous year’s tax return can be helpful for reference and to ensure accuracy.

Step-by-Step Guide to Filing New York State Taxes Online

Now that we’ve covered the benefits and requirements, let’s walk through the process of filing your New York state taxes online. This guide will provide a detailed, step-by-step explanation to ensure a smooth experience.

Step 1: Access the New York State Tax Website

The first step is to visit the official New York State Department of Taxation and Finance website. You can access it by going to https://www.tax.ny.gov. This website serves as your gateway to all the necessary information and resources for filing your taxes.

Step 2: Register and Create an Account

If you are a first-time user, you’ll need to register and create an account. This process involves providing your personal details, such as your name, address, and SSN or ITIN. Once registered, you’ll receive a unique username and password to access your account.

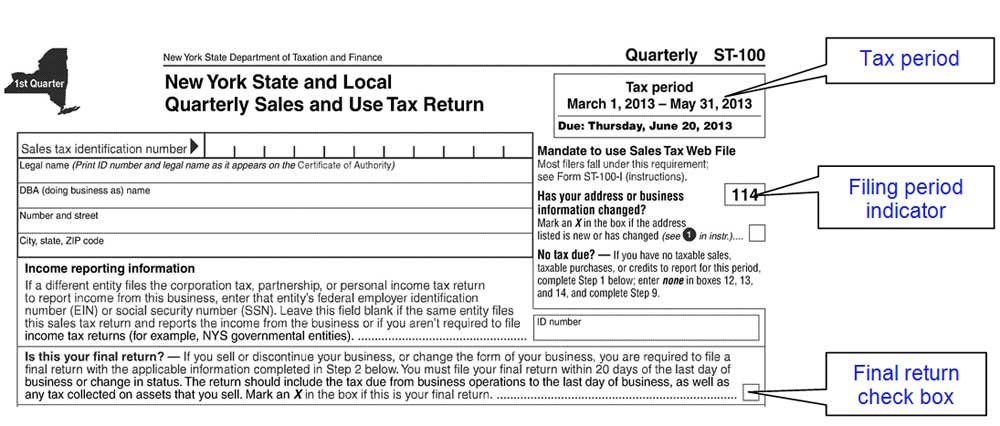

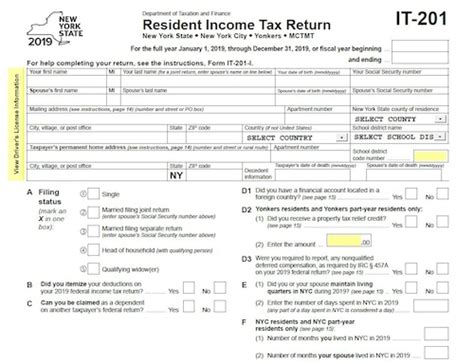

Step 3: Select the Appropriate Tax Form

New York State offers different tax forms depending on your filing status and income sources. The most common form is the Individual Income Tax Return (Form IT-201). However, if you are a business owner or have specific income types, you may need to use different forms. Refer to the tax guidelines on the website for assistance in choosing the correct form.

Step 4: Enter Your Personal and Income Information

Once you’ve selected the appropriate form, you’ll be guided through a series of questions and prompts to enter your personal details and income information. This includes your name, address, SSN or ITIN, and all sources of income. The online system will calculate your taxable income and applicable deductions automatically.

Step 5: Review and Verify Your Information

After entering all your details, carefully review the information for accuracy. Ensure that all your income sources, deductions, and credits are correctly reflected. The online system will provide a summary of your return, allowing you to make any necessary adjustments before finalizing.

Step 6: Choose Your Payment Method

If you have a tax liability, you’ll need to select a payment method. The online system offers various options, including credit/debit card, electronic funds transfer, or direct debit. Choose the method that best suits your preferences and financial situation. Ensure that you have the necessary payment details ready.

Step 7: Submit Your Return

Once you’ve reviewed and verified your information and selected your payment method, you can submit your tax return. The online system will process your return, and you’ll receive a confirmation number. This number serves as a reference for future inquiries or communications with the tax department.

Step 8: Receive Your Refund or Payment Confirmation

If you are due a refund, you’ll receive a notification confirming the amount and the estimated date of payment. The refund will be issued through your preferred method, such as direct deposit or check. If you have a tax liability, you’ll receive a confirmation of payment once the transaction is processed.

Additional Tips and Considerations

To ensure a smooth and successful online tax filing experience in New York, consider the following tips and considerations:

- Stay Informed: Keep yourself updated with the latest tax guidelines, forms, and deadlines. The New York State Department of Taxation and Finance website provides regular updates and resources to assist taxpayers.

- Seek Professional Help: If you have a complex tax situation or are unsure about certain aspects of filing, consider seeking advice from a tax professional. They can provide guidance and ensure your return is accurate and compliant.

- Keep Records: Maintain records of your income, expenses, and any supporting documents. This will help in case of audits or if you need to make adjustments to your return in the future.

- Avoid Common Mistakes: Be cautious of common errors, such as incorrect SSN or ITIN, typos, or miscalculations. Double-check your information before submitting to minimize the risk of penalties or delays.

- Explore Tax Credits and Deductions: Familiarize yourself with the tax credits and deductions you may be eligible for. These can significantly reduce your tax liability and increase your refund. Consult the New York State tax guidelines for a comprehensive list.

Future of Online Tax Filing in New York

The online tax filing system in New York continues to evolve, incorporating new technologies and features to enhance the user experience. The state aims to make the process even more accessible and efficient, reducing the burden on taxpayers. Here are some potential future developments:

- Mobile App Integration: Developing a mobile application could further improve accessibility, allowing taxpayers to file their returns on the go.

- Enhanced Security Measures: With the increasing threat of cyber attacks, the state may implement additional security protocols to protect taxpayer data.

- AI-Assisted Filing: Artificial intelligence could be utilized to provide personalized tax advice and suggestions, making the filing process more intuitive and accurate.

- Integration with Financial Institutions: Exploring partnerships with banks and financial institutions could streamline the payment process, making it even more convenient for taxpayers.

- Real-Time Tax Calculators: Developing real-time tax calculators could provide taxpayers with instant estimates of their tax liability or refund, helping them plan their finances better.

Conclusion

Filing your New York state taxes online offers a convenient, secure, and efficient way to manage your tax obligations. By following the step-by-step guide and considering the tips provided, you can navigate the process with ease. Remember to stay informed, seek professional help when needed, and explore the various tax credits and deductions available to maximize your refund or minimize your liability. With the continuous advancements in technology, the future of online tax filing in New York looks promising, offering an even more seamless experience for taxpayers.

What if I need help filing my New York state taxes online?

+The New York State Department of Taxation and Finance provides extensive resources and support on their website. You can find detailed guides, FAQs, and contact information for assistance. Additionally, you can seek help from tax professionals or use tax preparation software that offers guidance and support.

Are there any deadlines for filing New York state taxes online?

+Yes, there are specific deadlines for filing your New York state taxes online. Generally, the deadline aligns with the federal tax filing deadline, which is typically April 15th. However, it’s important to check the official website for any updates or extensions, as deadlines may vary depending on the year and specific circumstances.

Can I file my New York state taxes online if I’m a non-resident or part-year resident?

+Yes, the online filing system is accessible to non-residents and part-year residents as well. However, the process may differ slightly, and you’ll need to provide additional information regarding your residency status and income sources. Refer to the specific guidelines for non-residents on the New York State tax website.