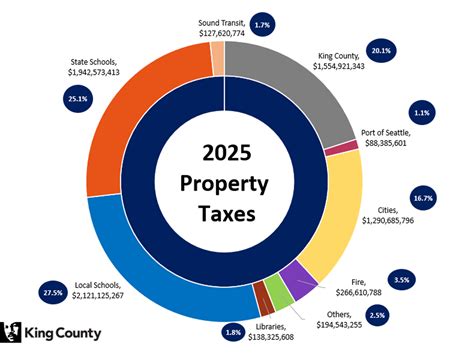

King County Property Tax

Property taxes are a significant aspect of local governance and play a crucial role in funding essential public services and infrastructure. In King County, Washington, property tax assessments and rates are a key topic of interest for homeowners, investors, and those considering a move to the area. This article aims to provide an in-depth exploration of King County's property tax system, shedding light on how it operates, the factors influencing tax rates, and its impact on the local community.

Understanding King County’s Property Tax Landscape

King County, located in the heart of the Pacific Northwest, is renowned for its vibrant cities, picturesque landscapes, and thriving economy. With Seattle as its largest city, the county boasts a diverse range of neighborhoods, from bustling urban centers to serene rural areas. The property tax system in King County is designed to ensure a fair and equitable distribution of the tax burden, supporting the provision of vital services such as education, public safety, transportation, and environmental initiatives.

The property tax in King County is an ad valorem tax, which means it is based on the assessed value of the property. This value is determined by the King County Assessor's Office, which conducts regular assessments to ensure property values are up-to-date and accurately reflect market conditions.

The assessed value of a property is not the same as its market value. Instead, it is a determined valuation set by the assessor's office, taking into account various factors such as location, property type, improvements made, and recent sales data of comparable properties. This assessed value forms the basis for calculating the property tax owed by the owner.

Tax Rate Calculation

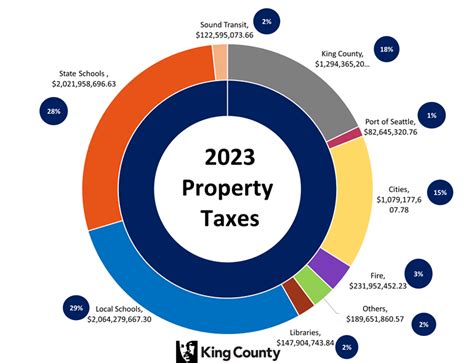

The property tax rate in King County is expressed as a percentage of the assessed value. This rate is determined by the local taxing districts, which include the county government, cities, school districts, and special purpose districts like fire protection and library districts. Each of these districts has the authority to set their own tax rates, which can vary significantly across the county.

The overall tax rate for a property is the sum of these individual district rates. For instance, if a property is located within the boundaries of a city, a school district, and a fire protection district, the property owner will pay taxes to all three entities based on their respective rates. This can result in varying tax rates and amounts for properties situated in different parts of the county.

The tax rate is typically expressed in terms of "mills," where one mill represents $1 of tax for every $1,000 of assessed value. So, if a property has an assessed value of $300,000 and the tax rate is 10 mills, the annual property tax would amount to $3,000 ($1 per $1,000 of assessed value x 10 mills x $300,000 assessed value). These rates can change annually as districts adjust their budgets and tax levies.

Tax Assessment Process

The King County Assessor’s Office conducts property assessments on a regular basis, typically every two years. During these assessments, the assessor’s office examines various factors to determine the fair market value of the property. This includes analyzing recent sales data of similar properties, considering any improvements or additions made to the property, and evaluating the overall real estate market conditions in the area.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process provides an opportunity for property owners to present evidence and arguments to support their case. This can be particularly relevant for properties that have unique features or circumstances that may not be adequately reflected in the standard assessment process.

Once the assessed values are finalized and the tax rates are set by the various taxing districts, property owners receive their tax bills. These bills detail the assessed value of the property, the applicable tax rates, and the total amount due. Property taxes are typically due in two installments, with the first installment due in April and the second in October. Late payments may incur penalties and interest charges.

Factors Influencing Property Tax Rates in King County

The property tax rates in King County can vary significantly, influenced by a multitude of factors. Understanding these factors is crucial for property owners and prospective buyers to make informed decisions about their financial obligations and the services they receive in return.

Local Government Budgets and Priorities

The primary driver of property tax rates is the budget requirements of the local taxing districts. Each district has its own unique set of responsibilities and priorities, which directly impact the tax rate it sets. For instance, school districts often have a significant influence on property tax rates, as they require substantial funding to support education programs, maintain facilities, and meet state standards.

Similarly, city governments may have ambitious infrastructure projects or community development initiatives that require substantial funding. These projects can range from road improvements and public transportation upgrades to the construction of new parks and community centers. The cost of these endeavors is often partially or fully funded through property taxes, which can lead to fluctuations in tax rates over time.

Market Conditions and Property Values

The real estate market plays a critical role in determining property tax assessments and rates. During periods of economic growth and rising property values, the assessed values of properties tend to increase, leading to higher property tax revenues for local governments. Conversely, during economic downturns or periods of stagnant property values, tax assessments may remain relatively stable or even decrease, resulting in lower tax revenues for local services.

Market conditions can also impact the distribution of tax burdens across different areas of the county. For instance, neighborhoods with higher property values may contribute a larger share of tax revenues, while areas with lower property values may have a relatively smaller impact on the overall tax base. This can create disparities in the services and amenities available in different parts of the county.

Special Assessments and Tax Exemptions

In addition to the standard property tax rates, some properties may be subject to special assessments or benefit from tax exemptions. Special assessments are additional charges levied on properties that benefit from specific improvements or services provided by the local government. These could include sewer connection fees, street lighting assessments, or the cost of new infrastructure projects that directly benefit a particular neighborhood.

On the other hand, certain properties may be eligible for tax exemptions, which reduce or eliminate the property tax liability. Common examples include exemptions for senior citizens, veterans, and properties used for charitable or religious purposes. These exemptions are designed to provide financial relief to specific groups or to encourage certain activities that benefit the community as a whole.

The Impact of Property Taxes on King County Communities

Property taxes are a crucial source of revenue for local governments in King County, funding a wide range of essential services and initiatives that directly impact the lives of residents. Understanding the impact of these taxes is essential for fostering a sense of community engagement and ensuring that the tax system remains fair and equitable.

Funding for Education and Schools

One of the most significant impacts of property taxes in King County is the funding they provide for education. School districts rely heavily on property tax revenues to support their operations, including teacher salaries, classroom resources, extracurricular activities, and facility maintenance. This funding ensures that students receive a high-quality education and have access to the tools and resources they need to succeed.

In addition to basic education, property taxes also contribute to specialized programs and initiatives within schools. These could include advanced placement courses, STEM programs, arts education, and support for students with special needs. By investing in education through property taxes, King County aims to foster a skilled and knowledgeable workforce, benefiting the local economy and community as a whole.

Supporting Public Safety and Emergency Services

Property taxes play a vital role in funding public safety services, including police, fire protection, and emergency medical services. These services are essential for maintaining a safe and secure community, and their funding directly impacts the response times, equipment availability, and overall effectiveness of these agencies.

For instance, property tax revenues contribute to the purchase of new fire trucks, ambulances, and police vehicles. They also support the training and retention of highly skilled emergency personnel. By investing in these services, King County aims to create a safer environment for its residents and businesses, fostering a sense of security and well-being.

Infrastructure Development and Maintenance

Property taxes are a key funding source for infrastructure development and maintenance in King County. This includes roads, bridges, public transportation systems, and utilities like water and sewer services. By investing in infrastructure, the county aims to improve mobility, reduce traffic congestion, and enhance the overall quality of life for its residents.

Property tax revenues also support the maintenance and repair of existing infrastructure. This ensures that roads remain safe and passable, bridges are structurally sound, and public transportation systems operate efficiently. Well-maintained infrastructure not only enhances the aesthetic appeal of the county but also attracts businesses and investments, further boosting the local economy.

Community Programs and Initiatives

Beyond the core services, property taxes in King County also support a wide array of community programs and initiatives. These could include recreational facilities like parks and community centers, cultural programs, arts initiatives, and support for local non-profit organizations. By investing in these programs, the county aims to enrich the lives of its residents, foster a sense of community, and promote social well-being.

Property taxes also play a role in funding environmental initiatives and sustainability programs. This could involve supporting renewable energy projects, implementing recycling and waste management programs, and preserving natural habitats and open spaces. By investing in these initiatives, King County aims to create a more sustainable and environmentally conscious community for future generations.

Frequently Asked Questions

How are property tax rates determined in King County?

+Property tax rates in King County are set by the various taxing districts, including the county government, cities, school districts, and special purpose districts. These districts determine their tax rates based on their budget requirements and priorities.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process provides an opportunity to present evidence and arguments to support their case.

What factors influence the assessed value of a property in King County?

+The assessed value of a property is determined by various factors, including location, property type, improvements made, and recent sales data of comparable properties. The King County Assessor’s Office conducts regular assessments to ensure property values are up-to-date.

How often are property assessments conducted in King County?

+Property assessments in King County are typically conducted every two years. During these assessments, the assessor’s office analyzes factors such as market conditions, recent sales data, and property improvements to determine the fair market value.

What happens if I don’t pay my property taxes on time in King County?

+Late payment of property taxes in King County may result in penalties and interest charges. It’s important to stay informed about the payment deadlines and ensure timely payments to avoid additional costs and potential legal consequences.