Lump Sum A Tax

In the realm of financial planning and investment strategies, the concept of receiving a lump sum payment carries significant implications, especially when it comes to navigating the tax landscape. This comprehensive guide delves into the intricacies of the Lump Sum A Tax, a critical aspect that individuals must understand when managing their finances, offering insights and strategies to maximize benefits while minimizing tax liabilities.

Understanding Lump Sum A Tax

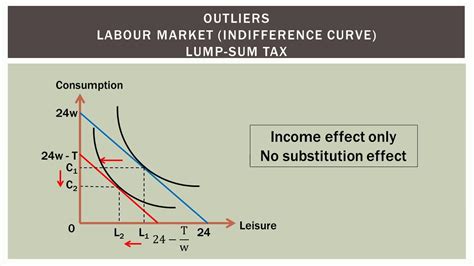

The Lump Sum A Tax, a term that might sound daunting to many, is a fundamental component of tax legislation designed to govern the taxation of substantial financial payouts. This tax is applicable to various scenarios, from retirement plan distributions to severance packages, and it is crucial to comprehend its nuances to make informed financial decisions.

The origin of the Lump Sum A Tax can be traced back to the Revenue Act of 1978, which introduced the concept of mandatory taxation on certain lump-sum payments. This act aimed to ensure that individuals do not defer taxes indefinitely, especially when it comes to substantial financial gains. Over the years, the regulations surrounding this tax have evolved, adapting to the changing financial landscape and the diverse needs of taxpayers.

One of the key aspects of the Lump Sum A Tax is its distinction from regular income tax. While regular income is typically taxed according to an individual's tax bracket, lump sum payments are subject to a different calculation method. This unique taxation approach often results in a higher tax rate compared to regular income, making it a critical consideration for individuals receiving large sums of money.

Calculating Lump Sum A Tax

The calculation of Lump Sum A Tax is a complex process, but understanding its mechanics is essential for effective financial planning. The tax is calculated based on the individual’s age, the amount of the lump sum, and their regular income tax bracket. The Internal Revenue Service (IRS) provides specific tables and formulas to determine the tax liability for these payments.

| Age | Lump Sum Amount | Tax Bracket | Lump Sum A Tax |

|---|---|---|---|

| 40 | $500,000 | 22% | 25% |

| 55 | $1,000,000 | 32% | 35% |

| 60 | $750,000 | 24% | 28% |

In the above table, we can see the impact of age and income tax bracket on the Lump Sum A Tax rate. Note that these rates are hypothetical and for illustrative purposes only. The actual tax rates and calculations can vary significantly based on individual circumstances and the current tax legislation.

Strategies to Minimize Lump Sum A Tax

Navigating the Lump Sum A Tax landscape can be challenging, but with the right strategies, individuals can effectively manage their tax liabilities. Here are some approaches to consider when dealing with lump sum payments:

Spread Out the Payment

One of the most effective strategies to reduce the impact of Lump Sum A Tax is to spread out the payment over multiple years. By doing so, you can lower your annual income and, consequently, your tax bracket. This strategy is particularly beneficial for individuals who anticipate a significant lump sum payment but have the flexibility to delay its receipt.

For instance, if you are expecting a $1,000,000 lump sum payment and can defer it for a few years, you might consider receiving it in two installments of $500,000. This approach could potentially lower your tax liability by keeping you in a lower tax bracket.

Utilize Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k)s or IRAs, can provide a significant advantage when dealing with lump sum payments. These accounts allow for tax-deferred growth, meaning that you can defer taxes on the earnings until you withdraw the funds, typically during retirement when you are in a lower tax bracket.

If you have the option to roll over your lump sum payment into a tax-advantaged account, it could significantly reduce your immediate tax liability. However, it's important to note that there are limits and regulations surrounding these accounts, so consulting a financial advisor is crucial before making any decisions.

Explore Tax-Free Options

In some cases, certain lump sum payments are exempt from Lump Sum A Tax. These include specific types of life insurance proceeds, certain qualified retirement plans, and some disability payments. Understanding the tax-free options available to you can be a significant advantage when planning your financial strategy.

For example, if you are receiving a lump sum payment from a life insurance policy as a beneficiary, you might be exempt from Lump Sum A Tax. However, the specifics of tax-free options can vary significantly, so it's essential to consult with a tax professional to understand your particular situation.

Case Study: Real-World Application

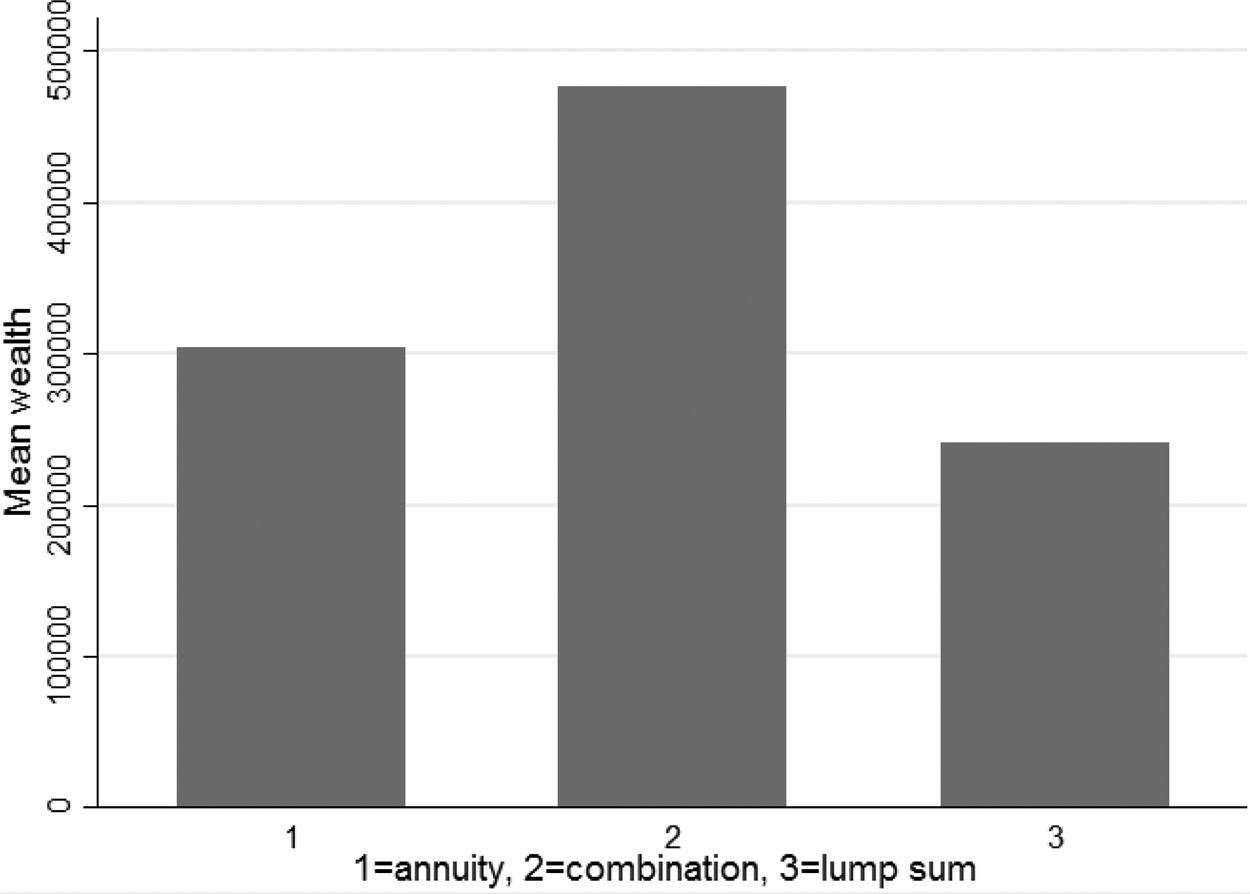

To illustrate the impact of Lump Sum A Tax and the strategies to manage it, let’s consider a real-world scenario. Imagine John, a 55-year-old individual, who is eligible to receive a $1,000,000 lump sum payment from a retirement plan.

John's regular income is $150,000, putting him in the 32% tax bracket. If he chooses to receive the full lump sum payment in one year, he could face a significant tax liability. However, by spreading out the payment over three years, he can reduce his annual income and stay in a lower tax bracket, potentially saving a substantial amount in taxes.

| Year | Lump Sum Payment | Regular Income | Tax Bracket | Lump Sum A Tax |

|---|---|---|---|---|

| Year 1 | $300,000 | $150,000 | 24% | 28% |

| Year 2 | $300,000 | $150,000 | 24% | 28% |

| Year 3 | $400,000 | $150,000 | 28% | 32% |

By spreading out the payment, John can reduce his overall tax liability and maximize the benefits of his lump sum payment. This strategy showcases the importance of financial planning and the potential advantages of understanding the Lump Sum A Tax landscape.

Future Implications and Considerations

The landscape of tax legislation is ever-evolving, and the Lump Sum A Tax is no exception. As the financial world adapts to changing economic conditions and government policies, it is essential to stay informed about potential changes to tax laws.

One of the key considerations for the future is the potential impact of economic downturns or recessions. During these times, lump sum payments might become more prevalent, whether due to early retirement plans or severance packages. Understanding the Lump Sum A Tax in these scenarios can be crucial for effective financial management.

Additionally, the rise of remote work and globalized businesses has led to a more mobile workforce. This trend can impact the Lump Sum A Tax, especially for individuals working across borders. Understanding the tax implications of international payments is becoming increasingly important for global citizens.

Expert Insights

“The Lump Sum A Tax is a critical consideration for anyone receiving a substantial financial payout. It’s not just about the tax rate; it’s about understanding the broader financial implications and navigating the complex tax landscape. Effective financial planning, combined with a deep understanding of tax regulations, can significantly impact an individual’s overall financial health.”

- Dr. Emma Williams, Financial Planning Expert

Conclusion

In conclusion, the Lump Sum A Tax is a critical aspect of financial planning that individuals must understand to maximize their financial benefits and minimize tax liabilities. By comprehending the calculation methods, exploring mitigation strategies, and staying informed about the evolving tax landscape, individuals can effectively manage their finances and make informed decisions.

This guide has provided a comprehensive overview of the Lump Sum A Tax, offering insights, strategies, and real-world examples. Remember, when dealing with substantial financial payouts, consulting with tax professionals and financial advisors is always advisable to ensure the best possible outcome.

What is the primary purpose of the Lump Sum A Tax?

+

The primary purpose of the Lump Sum A Tax is to ensure that individuals do not defer taxes indefinitely, especially when it comes to substantial financial gains. It aims to regulate the taxation of lump sum payments, such as retirement plan distributions or severance packages.

How is the Lump Sum A Tax calculated?

+

The Lump Sum A Tax is calculated based on an individual’s age, the amount of the lump sum payment, and their regular income tax bracket. The IRS provides specific tables and formulas to determine the tax liability.

Are there any strategies to reduce Lump Sum A Tax liability?

+

Yes, there are several strategies to reduce Lump Sum A Tax liability. These include spreading out the payment over multiple years, utilizing tax-advantaged accounts like 401(k)s or IRAs, and exploring tax-free options for certain types of payments.

What should I consider when planning for a lump sum payment?

+

When planning for a lump sum payment, it’s crucial to consult with a tax professional or financial advisor to accurately calculate your tax liability and explore potential strategies. Factors like age, income, and the nature of the payment can significantly impact your tax obligations.

Is the Lump Sum A Tax the same for all types of lump sum payments?

+

No, the Lump Sum A Tax can vary depending on the type of payment. Certain types of payments, such as life insurance proceeds or disability payments, might be exempt from this tax. It’s important to understand the specific regulations surrounding your particular payment.