How To Add A Tax To Price

Implementing a tax system for your business is crucial for compliance and proper financial management. Adding a tax to the price of goods or services can be a straightforward process when you follow the right steps. In this comprehensive guide, we will delve into the intricacies of adding a tax to your pricing structure, providing you with the knowledge and tools to ensure accurate calculations and efficient tax management.

Understanding the Basics of Tax Implementation

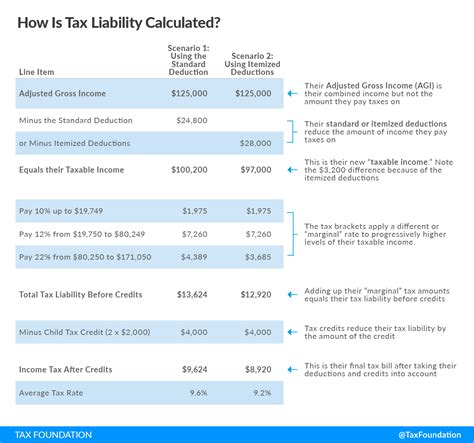

Before diving into the technical aspects, it’s essential to grasp the fundamentals of tax implementation. Tax, often denoted as VAT (Value Added Tax) or GST (Goods and Services Tax), is a percentage-based charge added to the price of goods or services. It is a crucial revenue source for governments and ensures fair contribution from businesses. Here’s a simplified breakdown of the key concepts:

- Tax Rate: This refers to the percentage of tax applied to the price. Different countries and regions have varying tax rates, and it's crucial to stay updated with the latest regulations.

- Taxable Base: The amount on which tax is calculated. It typically includes the price of the product or service, excluding any additional charges like shipping.

- Taxable Amount: The final tax amount to be paid, calculated by multiplying the tax rate by the taxable base.

Step-by-Step Guide to Adding Tax to Your Pricing

Adding tax to your pricing involves a series of well-defined steps. Let’s walk through each step to ensure a seamless integration:

- Determine the Tax Rate: Start by identifying the applicable tax rate for your business. Research and stay informed about the tax regulations in your jurisdiction. Consider factors like the type of goods or services you offer and any special tax considerations.

- Calculate the Taxable Base: Next, calculate the taxable base. This is typically the pre-tax price of your product or service. Ensure that you exclude any non-taxable components, such as discounts or special promotions.

- Apply the Tax Rate: Multiply the taxable base by the tax rate to calculate the taxable amount. For example, if your taxable base is $100 and the tax rate is 10%, the taxable amount would be $10.

- Add the Tax to the Price: Now, add the taxable amount to the pre-tax price to arrive at the final price. In our example, the final price would be $110 ($100 + $10 tax). Ensure that this price is clearly communicated to your customers.

- Rounding Considerations: Depending on your jurisdiction, you may need to consider rounding rules. Some countries require rounding up or down to the nearest whole unit or decimal place. Consult the tax regulations to ensure compliance.

| Example Calculation | Result |

|---|---|

| Pre-Tax Price: $500 | Tax Rate: 15% |

| Taxable Base: $500 | Taxable Amount: $75 |

| Final Price: $575 |

Advanced Considerations for Tax Implementation

While the basic steps are straightforward, there are advanced considerations to ensure accurate and compliant tax implementation. Here are some key points to keep in mind:

- Tax Exemption: Certain goods or services may be exempt from tax. Stay updated with the exemption lists to ensure proper classification and tax treatment.

- Multiple Tax Rates: Some jurisdictions have different tax rates for different types of goods or services. Ensure you apply the correct rate based on the nature of your product or service.

- Rounding Rules: As mentioned earlier, rounding rules can vary. Consult the tax regulations to ensure precise rounding and avoid overcharging or undercharging customers.

- Discounts and Promotions: When offering discounts or promotions, ensure that the tax calculation considers the reduced price. Calculate the tax on the discounted amount to avoid overcharging.

- Tax Registration: Depending on your jurisdiction and sales volume, you may need to register for a tax identification number. This is crucial for compliance and reporting purposes.

Automating Tax Calculations

To streamline your tax implementation process, consider utilizing software or accounting tools that offer automated tax calculation features. These tools can simplify the process, reduce manual errors, and ensure accurate tax management. Look for solutions that integrate with your existing systems and provide real-time tax rate updates.

Staying Compliant and Updating Tax Rates

Tax regulations are subject to change, so it’s crucial to stay updated with the latest tax rates and compliance requirements. Regularly review tax guidelines and consider setting up alerts or notifications to stay informed about any updates. Ensure that your tax implementation processes reflect the current regulations to avoid penalties and maintain a positive relationship with tax authorities.

Example Scenario: Adding Tax to a Restaurant Menu

Let’s illustrate the process with a real-world example. Imagine you own a restaurant and want to add a tax to your menu prices. Here’s how it might look:

- Identify Tax Rate: You determine that the applicable tax rate for your restaurant is 8%.

- Calculate Taxable Base: For a dish priced at $25, the taxable base is $25.

- Apply Tax Rate: Multiplying the taxable base by the tax rate, the taxable amount is $2.

- Add Tax to Price: The final price for the dish, including tax, is $27 ($25 + $2 tax). Ensure this price is clearly displayed on your menu.

Conclusion: Accurate Tax Implementation for a Smooth Business Operation

Implementing tax into your pricing structure is a crucial aspect of running a compliant and successful business. By following the steps outlined above and staying informed about tax regulations, you can ensure accurate tax calculations and provide transparent pricing to your customers. Remember to consider advanced factors like tax exemptions and multiple tax rates, and utilize automation tools to streamline your tax management processes.

Frequently Asked Questions

How often should I update my tax rates?

+Tax rates can change periodically, so it’s important to stay updated. Set up alerts or subscribe to tax regulation updates to ensure you are aware of any changes. Typically, tax rates are reviewed annually, but some jurisdictions may make adjustments more frequently.

Are there any special considerations for online businesses?

+Yes, online businesses often face unique tax challenges, especially when selling across multiple jurisdictions. Research the tax regulations for each region you serve and consider using tax calculation tools specifically designed for e-commerce businesses.

How do I handle tax for international sales?

+International sales require careful consideration of tax regulations in both your home country and the destination country. Research the tax requirements for each country and consult with tax professionals or legal experts to ensure compliance.

Can I offer tax-inclusive pricing instead of adding tax at checkout?

+Yes, some businesses opt for tax-inclusive pricing, where the tax is already included in the displayed price. This can provide a simpler pricing experience for customers. However, ensure that you clearly communicate that the price includes tax to avoid confusion.

What happens if I make a mistake in tax calculations?

+Accurate tax calculations are crucial for compliance. If you discover a mistake, rectify it immediately and inform your customers. In some cases, you may need to issue a refund or credit to correct the error. Staying vigilant and regularly reviewing your tax calculations can help prevent such issues.