Lookup Personal Property Tax Mo

In the state of Missouri, personal property tax is an essential aspect of local government funding, impacting individuals, businesses, and the overall economy. This tax, levied on tangible personal property, plays a significant role in the state's fiscal health and directly influences the provision of public services.

Understanding Personal Property Tax in Missouri

Personal property tax in Missouri encompasses a wide range of assets, including vehicles, boats, airplanes, machinery, equipment, furniture, and inventory. It is a vital revenue source for cities, counties, and school districts, helping to fund vital services such as education, public safety, infrastructure development, and maintenance.

The assessment process for personal property tax involves valuing the property based on its current market value or a percentage thereof, as determined by the Missouri State Tax Commission. This valuation is then used to calculate the tax liability, which varies depending on the property's location and classification.

Personal Property Tax Assessment and Collection

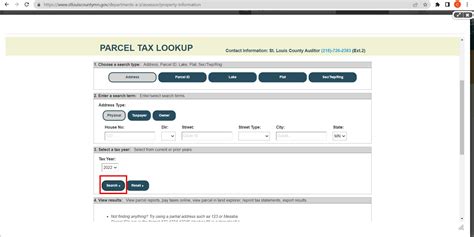

Personal property tax assessment in Missouri follows a systematic process. Property owners are required to declare their personal property annually, typically by March 1st. The declared property is then assessed by local assessors, who determine its value based on specific guidelines and criteria.

The assessed value is then used to calculate the tax liability. Missouri's personal property tax rates are set by local governing bodies, such as city councils or county commissions. These rates are applied to the assessed value of the property to determine the tax amount owed.

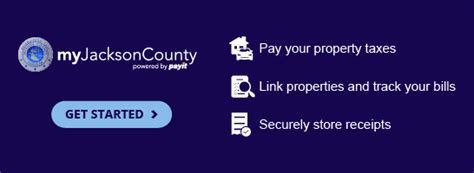

Collection of personal property tax is handled by local taxing authorities. Taxpayers receive a tax bill, usually in the spring, and have until the end of the fiscal year to pay the assessed amount. Failure to pay personal property tax can result in penalties, interest, and potential legal action.

Impact on Individuals and Businesses

Personal property tax in Missouri has a significant impact on both individuals and businesses. For individuals, it can affect the cost of owning vehicles, recreational vehicles, and other personal assets. The tax liability can vary depending on the property’s value and location, influencing an individual’s financial planning and budgeting.

For businesses, personal property tax is a critical consideration in their overall tax strategy. Businesses are responsible for declaring and paying taxes on their equipment, machinery, inventory, and other tangible assets. The tax liability can impact a business's profitability and cash flow, especially for smaller enterprises.

| Personal Property Type | Taxable Value | Average Tax Rate (%) |

|---|---|---|

| Vehicles | $10,000 | 1.75 |

| Boats | $5,000 | 1.5 |

| Machinery & Equipment | $20,000 | 2.25 |

| Inventory | $15,000 | 1.8 |

Exemptions and Abatements

Missouri offers various exemptions and abatements to reduce the tax burden on certain personal property. These provisions are designed to support specific sectors of the economy, promote economic development, and assist individuals and businesses in certain situations.

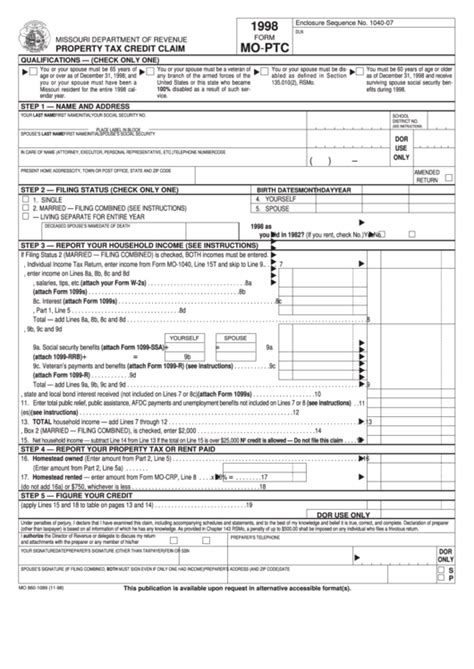

Exemptions for Individuals

Missouri provides exemptions for personal property tax to certain individuals. For instance, individuals who are 65 years of age or older and meet specific income criteria may be eligible for a full or partial exemption on their personal property tax. This exemption helps alleviate the tax burden on seniors, especially those on fixed incomes.

Additionally, individuals with disabilities may qualify for personal property tax exemptions, provided they meet specific criteria outlined by the state. These exemptions aim to provide financial relief to individuals facing unique challenges and ensure they have access to essential personal property without undue tax burden.

Exemptions for Businesses

Businesses in Missouri can also benefit from various personal property tax exemptions. For instance, certain types of agricultural property, such as farming equipment and livestock, are exempt from personal property tax. This exemption supports the state’s agricultural industry and helps farmers manage their financial obligations.

Moreover, Missouri offers incentives for businesses investing in renewable energy. Personal property used for generating renewable energy, such as solar panels and wind turbines, may be eligible for tax exemptions or abatements. These incentives encourage businesses to adopt sustainable practices and contribute to the state's green energy goals.

The Role of Personal Property Tax in Economic Development

Personal property tax plays a crucial role in Missouri’s economic development strategy. The tax revenue generated from personal property assessments funds essential public services, infrastructure development, and initiatives aimed at attracting and retaining businesses. This revenue stream is particularly important for local governments, as it provides a stable source of funding for their operations.

Furthermore, the personal property tax system in Missouri encourages investment and economic growth. By offering exemptions and abatements for certain types of personal property, the state creates an environment that is attractive to businesses, especially those in targeted industries. This strategy not only brings new businesses to the state but also encourages existing businesses to expand their operations, leading to job creation and a thriving economy.

Infrastructure Development and Public Services

Personal property tax revenue is a significant contributor to the funding of infrastructure projects in Missouri. Local governments use this revenue to maintain and improve roads, bridges, and other critical infrastructure. Well-maintained infrastructure not only enhances the quality of life for residents but also attracts businesses by providing efficient transportation and logistics networks.

Additionally, personal property tax revenue is vital for the provision of public services. It supports local schools, public safety departments, and social services. By investing in these areas, Missouri ensures the well-being of its residents and creates an environment conducive to economic growth and development.

Conclusion

Personal property tax in Missouri is a vital component of the state’s fiscal system, providing essential revenue for local governments and impacting individuals and businesses alike. The tax assessment and collection process is a well-established system, ensuring a fair and equitable distribution of the tax burden. With exemptions and abatements in place, the state supports specific sectors and individuals, promoting economic development and social welfare.

Understanding the intricacies of personal property tax in Missouri is crucial for both taxpayers and local government officials. By recognizing the impact of this tax on their financial planning and community development, individuals and businesses can actively participate in shaping a sustainable and prosperous Missouri.

What is the personal property tax rate in Missouri?

+Personal property tax rates in Missouri are set by local governing bodies and can vary depending on the location and type of property. On average, the tax rate for personal property in Missouri ranges from 1.5% to 2.5%.

How often do I need to pay personal property tax in Missouri?

+Personal property tax in Missouri is typically paid annually. Taxpayers receive a tax bill, and the due date is usually before the end of the fiscal year.

Are there any exemptions or abatements for personal property tax in Missouri?

+Yes, Missouri offers various exemptions and abatements for personal property tax. These include exemptions for individuals over 65, individuals with disabilities, agricultural property, and renewable energy equipment. Businesses should consult with local tax authorities to understand the specific exemptions and requirements.

How is personal property tax assessed in Missouri?

+Personal property tax in Missouri is assessed based on the declared value of the property. Property owners are required to declare their personal property annually, and local assessors determine the value based on specific guidelines. The assessed value is then used to calculate the tax liability.

What happens if I don’t pay my personal property tax in Missouri?

+Failure to pay personal property tax in Missouri can result in penalties, interest, and potential legal action. It is important to pay the tax on time to avoid additional fees and potential legal consequences.