West Va Taxes

Welcome to an in-depth exploration of the West Virginia tax landscape, a crucial aspect of understanding the financial health and economic policies of this beautiful state. West Virginia, known for its rich history, stunning natural scenery, and vibrant communities, has a unique tax system that plays a significant role in shaping its economic trajectory. As we delve into the intricacies of West Virginia taxes, we will uncover the key elements, rates, and strategies that impact both individuals and businesses within the state.

The tax system in West Virginia is a complex interplay of federal, state, and local regulations, each with its own set of rules and implications. From income taxes to sales taxes, property taxes, and various other levies, understanding these nuances is essential for residents, businesses, and anyone considering a move to or investment in the Mountain State. This comprehensive guide aims to demystify the tax structure, offering a clear and detailed overview to ensure that you have all the information you need to make informed financial decisions.

Unraveling the West Virginia Tax Structure

The tax structure in West Virginia is a carefully crafted system designed to support the state’s economy and infrastructure. It encompasses a range of taxes, each with its own purpose and impact. Let’s break down the key components to gain a comprehensive understanding.

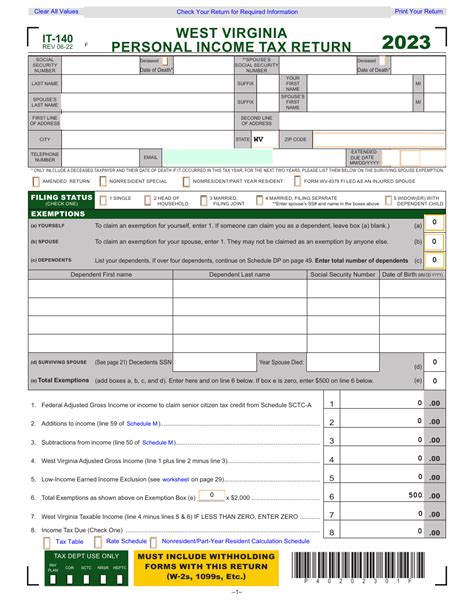

Income Taxes: A Progressive Approach

West Virginia employs a progressive income tax system, meaning that the tax rate increases as your income rises. This approach ensures that those with higher earnings contribute a larger proportion of their income to the state’s revenue. Currently, West Virginia has five income tax brackets, ranging from 3.00% to 6.50%. Here’s a breakdown of the brackets:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.00% |

| $10,001 - $25,000 | 4.00% |

| $25,001 - $40,000 | 4.50% |

| $40,001 - $60,000 | 5.00% |

| Over $60,000 | 6.50% |

These rates are applicable to both individual and joint filers. It's important to note that West Virginia also offers various tax credits and deductions, which can significantly reduce the overall tax liability for eligible residents.

Sales and Use Taxes: A Retail Focus

West Virginia imposes a statewide sales and use tax on retail sales, leases, and rentals of tangible personal property, as well as certain services. The base sales tax rate in the state is 6%, which is applied to most goods and services. However, certain items, such as groceries and prescription drugs, are exempt from this tax.

In addition to the state sales tax, various local taxes are also imposed, creating a patchwork of tax rates across the state. These local taxes, which can range from 0% to 2%, are used to fund local initiatives and infrastructure projects. As a result, the total sales tax rate can vary significantly depending on the location of the purchase.

Property Taxes: A Localized Approach

Property taxes in West Virginia are primarily assessed and collected at the local level, with each county setting its own tax rates. This decentralized approach allows for a more tailored tax system, taking into account the unique needs and financial situations of each community.

The property tax rate in West Virginia is typically expressed as a millage rate, which is the amount of tax per $1,000 of assessed property value. For instance, a millage rate of 100 would mean $100 of tax for every $1,000 of assessed value. These rates can vary significantly from one county to another, with some counties imposing rates as low as 50 mills while others go up to 200 mills or more.

To calculate your property tax liability, you need to multiply the assessed value of your property by the applicable millage rate. It's important to note that West Virginia also offers property tax relief programs for eligible homeowners, such as the Homestead Exemption, which reduces the taxable value of a primary residence.

Impact of West Virginia Taxes on Residents and Businesses

The tax system in West Virginia has a profound impact on both residents and businesses, shaping their financial strategies and decision-making processes. Let’s explore how these taxes affect the daily lives of West Virginians and the operations of businesses within the state.

Personal Finance Considerations

For individuals and families residing in West Virginia, the tax system can have a significant impact on their financial well-being. The progressive income tax structure means that higher-income earners may face a heavier tax burden, which can influence their savings, investment strategies, and overall financial planning.

Additionally, the sales and use tax system can affect daily expenses, particularly for those who frequent retail establishments. While the base rate of 6% may seem modest, the addition of local taxes can increase the overall cost of goods and services. This is especially notable in areas with higher local tax rates.

On the other hand, West Virginia's property tax system, with its localized rates and tax relief programs, offers some flexibility for homeowners. The availability of exemptions and credits can make homeownership more affordable, particularly for those who qualify for these programs.

Business Operations and Investments

The tax environment in West Virginia also plays a crucial role in shaping the business landscape. For companies considering relocation or expansion into the state, the tax structure can be a significant factor in their decision-making process.

West Virginia's income tax rates, while progressive, are generally lower than those in many other states. This can make the state an attractive option for businesses, particularly those with higher-income employees. Additionally, the state offers various tax incentives and business credits to encourage economic development and job creation.

However, the sales and use tax system, with its varying local rates, can create complexities for businesses operating across multiple counties. This can impact pricing strategies, particularly for businesses selling goods and services to consumers.

Moreover, the localized property tax system can also influence business decisions. While property taxes can vary significantly, West Virginia's tax relief programs for businesses, such as the Enterprise Zone Tax Credit, can provide substantial savings for qualifying companies.

Strategies for Navigating West Virginia Taxes

Given the complex nature of West Virginia’s tax system, it’s essential to have a well-informed strategy for managing your tax obligations. Whether you’re an individual looking to minimize your tax burden or a business seeking to optimize your tax position, here are some key strategies to consider.

Maximizing Tax Credits and Deductions

West Virginia offers a range of tax credits and deductions that can significantly reduce your tax liability. For individuals, this may include credits for homeowners, education expenses, or energy-efficient improvements. Businesses, on the other hand, can benefit from credits related to job creation, research and development, and more.

It's crucial to stay updated on the available credits and deductions and ensure you meet the eligibility criteria. Consulting with a tax professional can help you identify and maximize these opportunities, ensuring you receive the full benefit of these programs.

Understanding Local Tax Rates

Given the variability of local tax rates, it’s essential to have a thorough understanding of the tax landscape in the specific areas where you conduct business or reside. This knowledge can help you make more informed financial decisions and plan your expenditures more effectively.

For businesses, this may involve analyzing the tax rates in different counties to determine the most cost-effective locations for operations. For individuals, it can mean comparing the cost of living in different areas to find the most tax-efficient place to call home.

Seeking Professional Guidance

Navigating the intricacies of West Virginia’s tax system can be challenging, especially with the ever-changing tax laws and regulations. Engaging the services of a qualified tax professional, such as a certified public accountant (CPA) or an enrolled agent, can provide invaluable support.

These professionals can help you understand the tax implications of your financial decisions, ensure compliance with state and federal tax laws, and identify opportunities to minimize your tax burden. Their expertise can be particularly beneficial during tax season, but their guidance can also be sought throughout the year to optimize your financial strategies.

Conclusion: A Comprehensive View of West Virginia Taxes

West Virginia’s tax system is a multifaceted structure, designed to support the state’s economic growth and infrastructure development. From progressive income taxes to localized property taxes and varying sales tax rates, understanding these components is essential for both residents and businesses.

By unraveling the complexities of West Virginia taxes, individuals can make more informed decisions about their personal finances, while businesses can strategize their operations and investments more effectively. With a strategic approach and a thorough understanding of the tax landscape, navigating West Virginia's tax system can become a more manageable and rewarding endeavor.

How do West Virginia’s tax rates compare to other states?

+West Virginia’s tax rates are generally lower than many other states, particularly in terms of income taxes. However, the state’s sales and use tax system, with its varying local rates, can make it more expensive than some neighboring states.

Are there any tax incentives for businesses in West Virginia?

+Yes, West Virginia offers a range of tax incentives and credits to encourage economic development and job creation. These incentives can provide significant savings for qualifying businesses.

What is the average property tax rate in West Virginia?

+The average property tax rate in West Virginia varies depending on the county. It can range from around 0.5% to 1.5% of the assessed property value. However, it’s important to note that these rates can vary significantly from one county to another.

Are there any tax relief programs for seniors in West Virginia?

+Yes, West Virginia offers several tax relief programs for seniors, including the Homestead Tax Credit and the Senior Citizens Property Tax Abatement Program. These programs can provide substantial savings on property taxes for eligible seniors.

How can I stay updated on changes to West Virginia’s tax laws?

+To stay informed about changes to West Virginia’s tax laws, you can regularly check the official website of the West Virginia State Tax Department. They often publish updates and provide resources to help taxpayers understand the latest tax regulations.