Car Tax Car

Car tax, a familiar yet often confusing aspect of vehicle ownership, plays a crucial role in the automotive industry and has a significant impact on consumers and the environment. This comprehensive guide aims to demystify car tax, providing an in-depth analysis of its various aspects, including its historical evolution, current regulations, and future implications. By exploring real-world examples and offering expert insights, we aim to equip readers with a comprehensive understanding of car tax and its role in the modern world.

The Evolution of Car Taxation: A Historical Perspective

The concept of car taxation has evolved significantly since its inception. In the early days of automotive history, car taxes were primarily designed to generate revenue for governments, with little regard for environmental or social considerations. For instance, the Highway Code Act of 1888 in the United Kingdom introduced a tax on motor vehicles, which was initially based on the vehicle’s horsepower. This act, though groundbreaking, did not account for the environmental impact of vehicles, which was not yet a significant concern at the time.

As the automotive industry grew, so did the complexity of car taxation. The 1920s saw the introduction of the Vehicle Excise Duty (VED) in the UK, which shifted the focus from horsepower to vehicle weight. This change reflected a growing awareness of the need to regulate the burgeoning automotive industry. Similarly, in the United States, the Federal Gasoline Tax was introduced in 1932, with proceeds going towards road construction and maintenance, highlighting the link between vehicle use and infrastructure development.

Fast forward to the 21st century, and car taxation has become a multifaceted tool. Modern car taxes are designed to balance revenue generation with environmental and social objectives. The introduction of emissions-based taxes, such as the Vehicle Emissions Tax in the UK and the Clean Fuel Standard in the US, reflects a global shift towards sustainable transportation. These taxes aim to incentivize the use of cleaner, more efficient vehicles, while also discouraging the use of high-emitting cars.

Understanding the Current Landscape of Car Taxation

Today, car taxation is a complex system, varying significantly between countries and even within regions. Let’s explore some of the key aspects of modern car taxation.

Vehicle Excise Duty (VED) and Road Tax

In the United Kingdom, Vehicle Excise Duty, commonly known as road tax, is a mandatory annual payment for most vehicles. The amount of VED is determined by a combination of factors, including the vehicle’s carbon dioxide (CO2) emissions, fuel type, and engine size. For instance, a small, electric car with low CO2 emissions will attract a lower VED rate compared to a large, high-emission diesel vehicle.

| Vehicle Type | CO2 Emissions (g/km) | Annual VED Rate |

|---|---|---|

| Electric Vehicle | 0 | £0 |

| Petrol/Diesel | 101-130 | £165 |

| Petrol/Diesel | 131-150 | £215 |

| Petrol/Diesel | 151-250 | £535 |

The UK's VED system encourages the adoption of low-emission vehicles by offering reduced or zero-rate taxes for electric and hybrid cars. This aligns with the government's goal of phasing out the sale of new petrol and diesel cars by 2030.

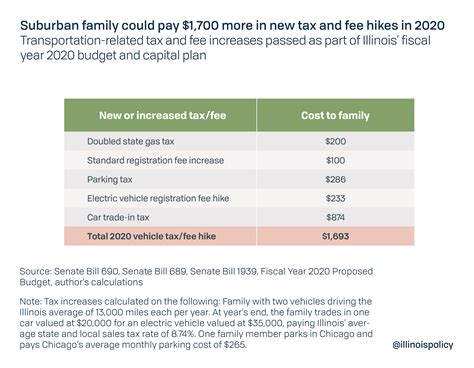

Gasoline and Diesel Taxes

Gasoline and diesel taxes, often referred to as fuel taxes, are another significant component of car taxation. These taxes are typically levied on the purchase or consumption of fuel and are designed to generate revenue for road maintenance and development. For example, the gasoline tax in the United States varies by state, with rates ranging from approximately 0.17 to 0.57 per gallon. These taxes can significantly impact the cost of driving, especially for high-mileage vehicles.

Emissions-Based Taxes and Incentives

Many countries have implemented emissions-based taxes and incentives to promote the use of cleaner vehicles. For instance, the Carbon Tax in France applies a tax on vehicles based on their CO2 emissions during real-world driving conditions. This tax aims to reduce the environmental impact of vehicles and encourage the development of more efficient technologies.

The Impact of Car Taxation on Consumers and the Environment

Car taxation has a profound impact on both consumers and the environment. By understanding these impacts, we can better appreciate the role of car taxes in shaping the automotive industry and society as a whole.

Influencing Consumer Choices

Car taxes play a significant role in influencing consumer behavior. Higher taxes on high-emission vehicles can deter consumers from purchasing such cars, encouraging them to opt for more environmentally friendly options. Conversely, incentives for low-emission vehicles can make these cars more affordable and attractive to buyers. For example, the Plug-in Electric Drive Vehicle Credit in the US offers a tax credit of up to $7,500 for the purchase of electric vehicles, making them a more financially appealing choice for many consumers.

Environmental Benefits

Emissions-based taxes and incentives have a direct impact on the environment. By discouraging the use of high-emission vehicles and promoting cleaner alternatives, these taxes can lead to a reduction in air pollution and greenhouse gas emissions. This is particularly important in urban areas, where vehicle emissions can significantly contribute to poor air quality and health issues.

Revenue Generation and Infrastructure Development

Car taxes are a significant source of revenue for governments, which can be used for a variety of purposes. In many countries, a portion of the revenue generated from car taxes is allocated towards road maintenance, construction, and public transportation. This ensures that the infrastructure can support the growing number of vehicles on the road and provides alternative transportation options for those who may not wish to drive.

Future Implications and Potential Innovations

As the automotive industry continues to evolve, car taxation is likely to play an even more significant role in shaping the future of transportation. Here are some potential future developments and their implications.

The Rise of Electric Vehicles (EVs)

The widespread adoption of electric vehicles is expected to have a profound impact on car taxation. As EVs produce zero tailpipe emissions, they may become exempt from certain taxes, such as the Vehicle Emissions Tax mentioned earlier. This could lead to a significant shift in tax revenue, with governments needing to find alternative sources of funding for infrastructure and road maintenance.

Pay-As-You-Drive (PAYD) Taxation

Some countries are exploring the concept of Pay-As-You-Drive taxation, where drivers pay a tax based on the distance they travel rather than the type of vehicle they own. This system could incentivize more efficient driving practices and encourage the use of public transportation. For example, the Netherlands has implemented a PAYD system, where drivers are charged based on the distance traveled, time of day, and location, with higher rates during peak hours and in urban areas.

Integration of Autonomous Vehicles

The introduction of autonomous vehicles (AVs) could further complicate car taxation. AVs have the potential to significantly reduce traffic congestion and improve road safety, which could lead to a decrease in certain taxes related to vehicle accidents and congestion. However, AVs may also increase the demand for road maintenance and infrastructure upgrades, potentially leading to higher taxes to fund these improvements.

Conclusion

Car taxation is a complex and evolving topic, with a rich history and a promising future. By understanding the various aspects of car taxation, from its historical evolution to its potential future innovations, we can better appreciate its role in shaping the automotive industry and our society. As we continue to embrace sustainable transportation and technological advancements, car taxes will play a crucial role in guiding us towards a greener and more efficient future.

FAQ

How often do I need to pay car tax?

+

The frequency of car tax payments depends on the country and the type of vehicle. In the UK, for instance, most vehicles require an annual VED payment, while some electric vehicles may be exempt for a certain period. In the US, gasoline and diesel taxes are typically paid at the time of fuel purchase.

Are there any tax incentives for buying an electric vehicle?

+

Yes, many countries offer tax incentives for the purchase of electric vehicles (EVs) to encourage their adoption. These incentives can include reduced or zero-rate taxes, tax credits, and rebates. For example, the US offers a tax credit of up to $7,500 for the purchase of a new EV.

How do emissions-based taxes work, and what impact do they have on the environment?

+

Emissions-based taxes, such as the Vehicle Emissions Tax in the UK, apply a tax on vehicles based on their carbon dioxide (CO2) emissions. These taxes aim to discourage the use of high-emission vehicles and encourage the adoption of cleaner alternatives. By incentivizing the use of low-emission vehicles, these taxes can lead to a reduction in air pollution and greenhouse gas emissions, particularly in urban areas.

What is the Pay-As-You-Drive (PAYD) taxation system, and how does it work?

+

The Pay-As-You-Drive (PAYD) taxation system is an alternative approach to traditional car taxation. Instead of taxing vehicles based on their ownership or emissions, PAYD systems charge drivers based on the distance they travel. This system can encourage more efficient driving practices and the use of public transportation. For example, drivers may be charged higher rates during peak hours or in urban areas, incentivizing off-peak travel and the use of alternative modes of transport.