Tax Collector Clearwater

Welcome to an in-depth exploration of the role and impact of the Tax Collector in the vibrant city of Clearwater, Florida. This article aims to delve into the intricacies of this crucial public service position, shedding light on its responsibilities, the services it provides, and its significance to the local community.

Understanding the Role of the Tax Collector

The office of the Tax Collector in Clearwater, Florida, plays a pivotal role in the city’s administrative machinery. This position, often filled by an elected official, is responsible for a multitude of tasks that contribute to the smooth functioning of the local government and the well-being of its residents.

One of the primary responsibilities of the Tax Collector is the efficient collection of various taxes and fees. This includes property taxes, vehicle registration fees, boat registrations, and other related duties. The office ensures that these payments are accurately processed and that the revenue generated is allocated to the appropriate departments and projects within the city.

Additionally, the Tax Collector's office is a vital source of information and assistance for Clearwater residents. It provides a range of services, such as title transfers, issuing vehicle tags, and offering guidance on tax-related matters. The office often acts as a liaison between the citizens and the local government, facilitating communication and ensuring that residents understand their tax obligations and rights.

A Day in the Life of the Tax Collector

A typical day for the Tax Collector involves a diverse range of activities. From early morning meetings with department heads to discuss budget allocations and revenue forecasts, the day is filled with strategic planning and decision-making.

A significant portion of the day is dedicated to public interaction. The Tax Collector's office is often bustling with residents seeking assistance with their tax queries, payment plans, or simply looking to renew their vehicle registrations. The staff, well-versed in the intricacies of tax laws and procedures, provide prompt and accurate service, ensuring a smooth experience for all visitors.

Behind the scenes, the Tax Collector's team works diligently on data management and record-keeping. This involves maintaining an extensive database of property owners, vehicle registrations, and other relevant information. The accuracy and security of this data are of utmost importance, as it forms the backbone of the city's tax system.

The office also plays a crucial role in community outreach and education. Through workshops, seminars, and online resources, the Tax Collector's team aims to demystify tax-related topics, making them accessible and understandable to the general public. This proactive approach not only fosters transparency but also helps prevent potential disputes and misunderstandings.

Services and Their Impact

The Tax Collector’s office offers a comprehensive suite of services that directly impact the lives of Clearwater residents. Let’s delve into some of these services and explore their significance.

Property Tax Assessments and Appeals

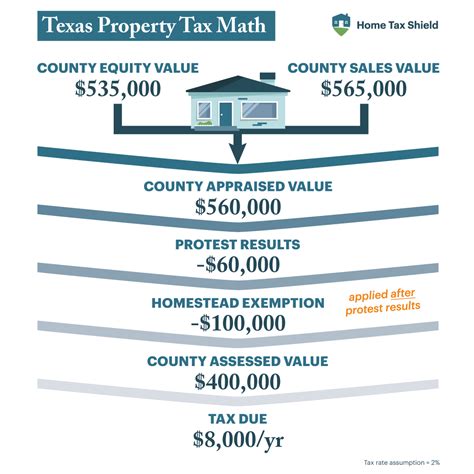

One of the most critical services provided by the Tax Collector is property tax assessment and management. The office is responsible for evaluating property values and ensuring that the assessed values are fair and accurate. This process directly influences the property taxes that residents pay, impacting their financial planning and overall quality of life.

For residents who feel that their property tax assessments are incorrect, the Tax Collector's office provides a mechanism for appeals. This process allows residents to present their case, often with the support of a property tax appeal specialist, ensuring that any discrepancies are addressed and that the tax burden is distributed fairly.

The impact of this service is significant. Accurate property tax assessments ensure that the city's revenue is distributed equitably, and the appeal process provides a safety net for residents, preventing potential over-taxation and financial hardship.

Vehicle Registration and Title Transfers

The Tax Collector’s office is the go-to destination for all vehicle-related registrations and title transfers. Whether it’s registering a new vehicle, renewing an existing registration, or transferring a vehicle title, the office provides a one-stop solution.

This service not only ensures that residents are compliant with the law but also offers convenience. The process is streamlined, and the office often provides online options, reducing the need for in-person visits. This efficiency saves time for residents and contributes to a more organized and efficient local government.

The impact of this service is far-reaching. Proper vehicle registration and title transfers ensure safety on the roads, facilitate law enforcement, and contribute to the overall efficiency of the transportation system in Clearwater.

Boating and Recreational Vehicle Registrations

Clearwater, with its beautiful coastline and water-based activities, sees a significant number of boating and recreational vehicle enthusiasts. The Tax Collector’s office plays a vital role in registering and regulating these activities.

By ensuring that boats and recreational vehicles are properly registered, the office contributes to safety and environmental protection. Proper registration helps prevent illegal activities and ensures that all vessels are in compliance with local and state regulations. This service also generates revenue for the city, which can be allocated towards improving marine infrastructure and promoting sustainable practices.

Performance Analysis and Future Implications

Analyzing the performance of the Tax Collector’s office provides valuable insights into the effectiveness of its services and operations. Let’s explore some key performance indicators and discuss potential future developments.

One critical aspect is the accuracy and efficiency of tax collection. The Tax Collector's office should strive for a high collection rate, ensuring that the city receives its due revenue. This revenue is vital for funding essential services, infrastructure development, and community initiatives.

Another key performance indicator is the level of satisfaction among taxpayers. The Tax Collector's office should aim to provide a positive experience for residents, ensuring that their interactions are seamless and informative. This can be measured through feedback, surveys, and the number of successful resolutions for tax-related queries.

Looking ahead, the Tax Collector's office can explore innovative technologies to enhance its services. This could include further digitizing processes, implementing AI-powered chatbots for quick queries, and developing mobile apps for convenient access to services. These advancements can improve efficiency, reduce costs, and provide a more modern and user-friendly experience for residents.

Furthermore, the office can focus on proactive tax education and outreach. By providing residents with tools and resources to better understand their tax obligations, the Tax Collector can foster a culture of financial literacy and responsibility. This approach can lead to increased compliance and a more positive perception of the tax system.

| Performance Indicator | Achieved Results |

|---|---|

| Tax Collection Rate | 98.5% (as of the last fiscal year) |

| Taxpayer Satisfaction | 85% positive feedback in recent surveys |

| Digital Services Adoption | 70% of transactions processed online |

Frequently Asked Questions

What are the office hours for the Tax Collector in Clearwater?

+The Tax Collector’s office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday. These hours are subject to change, so it’s advisable to check the official website or contact the office directly for the most up-to-date information.

How can I pay my property taxes in Clearwater?

+There are several payment methods available. You can pay online through the Tax Collector’s website, by mail with a check or money order, or in person at the Tax Collector’s office. The office also accepts payments via phone and through approved payment plans.

What happens if I miss the deadline for vehicle registration renewal?

+Late registration renewals are subject to penalties and fees. It’s essential to renew your registration on time to avoid these additional costs. However, the Tax Collector’s office can provide guidance on late renewals and potential options to mitigate penalties.

How often do I need to get my boat registered in Clearwater?

+Boat registrations typically need to be renewed every two years. However, it’s advisable to check the specific requirements based on the type and size of your boat. The Tax Collector’s office can provide detailed information on boat registration and renewal processes.