Texas Property Tax Exemptions

The Lone Star State, Texas, is renowned for its vast landscapes, vibrant cities, and, of course, its unique approach to property taxes. Property taxes in Texas play a significant role in funding local services and infrastructure, making understanding the intricacies of the tax system essential for both residents and prospective homeowners.

In this comprehensive guide, we delve into the world of Texas property tax exemptions, shedding light on the various ways individuals can reduce their property tax liabilities. From state-mandated exemptions to local programs, we explore the strategies and eligibility criteria that can make property ownership more affordable and provide valuable insights into the financial aspects of life in Texas.

Navigating the Texas Property Tax Landscape

Texas property taxes are primarily assessed and collected at the local level, with each of the state’s 254 counties having its own appraisal district. This decentralized system means that property tax rates and assessment practices can vary significantly across the state. However, the Texas Constitution and state laws provide a framework for property tax administration, ensuring fairness and uniformity.

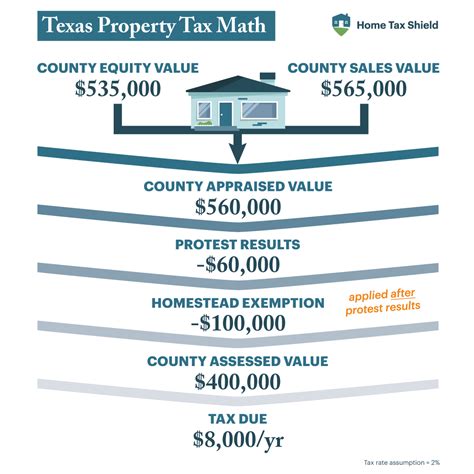

The property tax calculation in Texas involves three main components: the appraised value of the property, the local tax rate, and any applicable exemptions or deductions. The appraised value is determined by the local appraisal district, which considers factors such as the property's market value, improvements, and location. The tax rate, on the other hand, is set by various local taxing entities, including cities, counties, school districts, and special districts, and is expressed as a percentage of the appraised value.

Property owners in Texas have the right to appeal their property's appraised value if they believe it is excessive. This process, known as protest, is a crucial component of the property tax system, allowing homeowners to challenge the appraisal district's assessment and potentially reduce their tax liability.

Understanding Property Tax Exemptions

Property tax exemptions in Texas are legal provisions that reduce the taxable value of a property, effectively lowering the property owner’s tax liability. These exemptions can be based on various factors, including the property’s use, the owner’s occupation, or personal circumstances. Understanding the different types of exemptions and their eligibility criteria is key to maximizing tax savings.

Residential Homestead Exemptions

The Residential Homestead Exemption is one of the most widely utilized property tax exemptions in Texas. It applies to the primary residence of a qualified homeowner and reduces the taxable value of the property by a fixed dollar amount. As of 2023, the standard homestead exemption is set at 25,000, meaning the first 25,000 of a homeowner’s property value is exempt from taxation.

To qualify for the Residential Homestead Exemption, the property must be the owner's principal residence, and they must have owned the property on January 1 of the tax year for which the exemption is sought. Additionally, the owner must file an application with the local appraisal district by April 30 of the tax year. Failure to meet these requirements may result in the exemption being denied.

Some Texas counties offer enhanced homestead exemptions, providing additional tax relief to homeowners. For instance, in Harris County, homeowners can qualify for a School Tax Homestead Exemption, which further reduces the taxable value of their property specifically for school district taxes.

Age-Related Exemptions

Texas offers a range of property tax exemptions tailored to senior citizens and individuals with disabilities. These exemptions aim to provide financial relief to vulnerable populations and encourage longevity in homeownership.

The Over-65 Homestead Exemption is available to homeowners who are 65 years of age or older and meet certain income and residency requirements. This exemption allows eligible homeowners to exclude a significant portion of their property's value from taxation, often resulting in substantial tax savings. In some cases, the exemption can be transferred to a surviving spouse, ensuring continued tax relief even after the death of the original homeowner.

Additionally, the Disability Exemption is available to individuals with disabilities who meet specific criteria. This exemption reduces the taxable value of the property, providing financial assistance to those with physical or mental impairments that limit their ability to work or earn a living.

Veterans and Military Exemptions

Texas takes pride in its support for military veterans and active-duty personnel, offering a range of property tax exemptions to honor their service.

The Disabled Veteran Exemption is a significant benefit for veterans with service-connected disabilities. This exemption completely removes the homestead from taxation, providing substantial savings for eligible veterans and their families. To qualify, veterans must have a disability rating of at least 10% and meet specific residency and ownership requirements.

Furthermore, the 100% Totally Disabled Veteran Exemption goes a step further, exempting the homestead from all property taxes. This exemption is available to veterans with a 100% service-connected disability rating, ensuring they are not burdened by property taxes.

Agricultural and Open-Space Exemptions

Texas’ vast agricultural lands and open spaces are protected through a series of property tax exemptions that encourage land preservation and sustainable land use.

The Agricultural Exemption is designed to support farmers and ranchers by reducing the taxable value of land used for agricultural purposes. To qualify, the land must be actively used for agricultural production, and the owner must demonstrate a certain level of income derived from these activities. This exemption promotes the state's agricultural industry and ensures the continued viability of farming and ranching operations.

The Open-Space Exemption, on the other hand, focuses on preserving natural habitats and open spaces. This exemption is available to landowners who maintain their property in a natural state, promoting environmental conservation and wildlife habitat protection. To qualify, the land must meet specific criteria related to its natural state, size, and management practices.

Maximizing Tax Savings: Strategies and Tips

Navigating the world of Texas property tax exemptions can be complex, but with the right strategies, homeowners can optimize their tax savings. Here are some tips to make the most of these exemptions:

- Stay informed about the exemptions offered in your county and city. Local governments often have specific programs and initiatives that provide additional tax relief.

- Ensure you meet all eligibility criteria for the exemptions you wish to claim. Failure to provide the necessary documentation or meet residency requirements can result in disqualification.

- File your exemption applications promptly. Deadlines vary, but most applications must be submitted by a specific date each year.

- Consider seeking professional advice from tax consultants or financial advisors who specialize in Texas property taxes. They can provide personalized guidance based on your unique circumstances.

- Stay up-to-date with changes in state and local tax laws. Texas regularly updates its tax code, and staying informed can help you take advantage of new exemptions or modifications to existing ones.

Additionally, it's important to note that property tax exemptions are not a one-time benefit. Homeowners must renew their exemptions annually to continue receiving the tax relief. Failure to renew could result in the loss of the exemption and the need to pay additional taxes.

Future Implications and Conclusion

The Texas property tax landscape is continually evolving, with new initiatives and proposals aimed at providing tax relief and improving the overall system. The state’s commitment to fairness and transparency in property tax administration ensures that homeowners have access to a range of exemptions and deductions.

As Texas continues to grow and prosper, the need for efficient and equitable property tax systems becomes increasingly crucial. The state's approach to property tax exemptions not only provides financial relief to homeowners but also encourages homeownership, supports vulnerable populations, and promotes sustainable land use. By understanding and utilizing these exemptions, Texans can navigate the property tax landscape with confidence and make the most of their investment in the Lone Star State.

What is the deadline for applying for property tax exemptions in Texas?

+

The deadline for applying for most property tax exemptions in Texas is typically April 30 of the tax year. However, it’s essential to check with your local appraisal district, as some exemptions may have different deadlines.

Can I transfer my property tax exemptions to a new home if I move within Texas?

+

Yes, in many cases, you can transfer your property tax exemptions to a new home within the state. However, the specific process and requirements may vary depending on the type of exemption and your local appraisal district’s policies. It’s advisable to consult with your local appraisal office for guidance.

Are there any penalties for not applying for property tax exemptions on time?

+

Missing the deadline for applying for property tax exemptions can result in the loss of the exemption for that tax year. This means you may have to pay additional taxes. It’s important to stay informed about the deadlines and file your applications promptly to avoid penalties.

Can I appeal my property’s appraised value if I disagree with the assessment?

+

Yes, Texas property owners have the right to protest their property’s appraised value if they believe it is excessive or inaccurate. The protest process allows homeowners to challenge the appraisal district’s assessment and potentially reduce their taxable value.

Are there any online resources to help me understand and apply for property tax exemptions in Texas?

+

Absolutely! The Texas Comptroller of Public Accounts website offers a wealth of information and resources related to property taxes and exemptions. You can find detailed guides, application forms, and contact information for local appraisal districts. Additionally, many local governments provide online resources specific to their jurisdictions.