Tax Free Florida

Florida, known for its sunny skies, vibrant beaches, and vibrant culture, offers more than just a picturesque vacation destination. It's a state that has attracted residents and businesses alike with its unique advantages, one of which is its status as a tax-friendly haven. In this comprehensive guide, we delve into the intricacies of Tax Free Florida, exploring its benefits, impact on residents, and the factors that contribute to its reputation as a haven for those seeking financial freedom.

The Appeal of Tax-Free Living in Florida

Florida’s tax landscape is notably different from many other states in the US, and this uniqueness has led to a significant draw for both individuals and businesses. Let’s explore the key aspects that make Florida a tax-free paradise.

No Income Tax: A Major Advantage

One of the most significant advantages of residing in Florida is the absence of a state income tax. This means that individuals and businesses operating within the state do not have to pay income tax to the state government. This unique feature sets Florida apart and has a profound impact on the financial well-being of its residents.

Consider the story of John, a software developer who relocated to Florida from a high-tax state. John's decision was largely influenced by the absence of income tax. With a substantial portion of his income no longer going towards state taxes, he was able to invest more in his retirement, save for his children's education, and even explore new business ventures. For John, the move to Florida meant more financial freedom and the opportunity to pursue his dreams without the burden of high taxes.

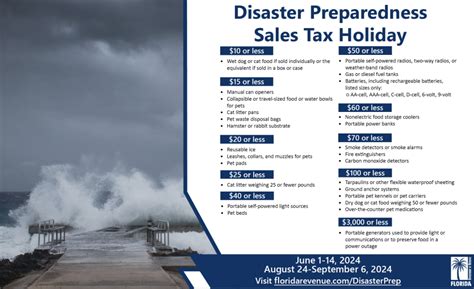

Sales Tax: A Balancing Act

While Florida does not impose an income tax, it does have a statewide sales and use tax that applies to the sale of goods and some services. The standard rate is currently set at 6%, but local governments have the authority to levy additional taxes, resulting in varying rates across the state.

For example, in the vibrant city of Miami, the total sales tax rate is 7.5%, comprising the state's 6% and a local tax of 1.5%. On the other hand, in the tranquil town of Sebring, the total sales tax rate is slightly lower at 6.5%, with a local tax of just 0.5%.

| City/Town | Total Sales Tax Rate | Local Tax |

|---|---|---|

| Miami | 7.5% | 1.5% |

| Sebring | 6.5% | 0.5% |

It's important to note that certain items, such as groceries and non-prepared foods, are exempt from sales tax, providing residents with essential savings on daily necessities. This exemption further enhances Florida's appeal as a tax-friendly state.

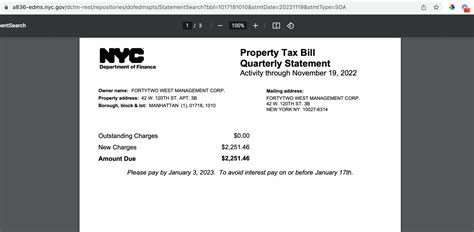

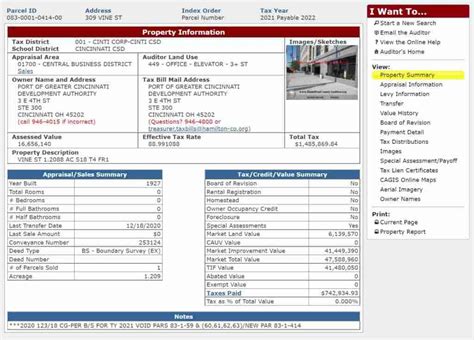

Property Tax: A Local Perspective

Florida’s property tax system is another critical aspect of its tax landscape. The state allows for homestead exemptions, which offer significant savings for homeowners. These exemptions reduce the taxable value of a property, resulting in lower property taxes for eligible homeowners.

For instance, in the charming city of Sarasota, homeowners who qualify for the homestead exemption can save up to $50,000 on their property's assessed value, leading to substantial reductions in their annual property tax bills. This incentive encourages homeownership and contributes to the overall financial well-being of residents.

| City | Homestead Exemption | Potential Savings |

|---|---|---|

| Sarasota | $50,000 | Up to $1,000 annually |

The Impact on Residents and Businesses

Florida’s tax-free status has a profound impact on both residents and businesses. Let’s explore some real-world examples and data to understand these effects.

Financial Benefits for Residents

The absence of income tax in Florida provides residents with a significant financial advantage. Let’s consider a hypothetical scenario: a middle-class family with an annual income of $75,000. In a high-tax state, they might expect to pay a substantial portion of their income in state taxes. However, in Florida, they can keep more of their hard-earned money, allowing them to save for their future, invest in their children’s education, or simply enjoy a higher standard of living.

Furthermore, the sales tax exemptions on essential items like groceries mean that residents can allocate more of their budget towards discretionary spending, boosting the local economy and enhancing their overall quality of life.

Attracting Businesses and Creating Jobs

Florida’s tax-friendly environment is not just a boon for residents; it also plays a pivotal role in attracting businesses and fostering economic growth. Companies, especially those in high-tax states, are drawn to Florida’s absence of income tax, as it significantly reduces their operational costs.

For instance, let's look at the case of a tech startup considering expansion. In a high-tax state, they might have to allocate a substantial portion of their profits to state taxes, hindering their growth and ability to invest in research and development. However, in Florida, they can reinvest those savings, hire more employees, and expand their operations, ultimately contributing to the state's economic prosperity.

A Haven for Retirees and Investors

Florida’s tax-free status has made it a popular destination for retirees and investors seeking financial freedom and growth. The state’s climate, lifestyle, and tax advantages make it an ideal place to spend one’s golden years or grow one’s wealth.

Retirement Benefits

Florida’s tax-friendly environment, combined with its warm climate and diverse recreational opportunities, makes it an attractive destination for retirees. The absence of income tax means that pensioners and those living on fixed incomes can stretch their retirement funds further, allowing them to enjoy a higher quality of life without the burden of high taxes.

Additionally, the state's property tax exemptions and reduced sales tax rates on essential items provide further financial relief, making retirement in Florida an appealing prospect for many.

Investment Opportunities

Florida’s robust economy, coupled with its tax advantages, presents a host of investment opportunities. Real estate, in particular, has been a popular choice for investors, as the state’s property tax system and homestead exemptions make owning property more affordable. This, in turn, drives up property values and creates a positive feedback loop, attracting more investors and fostering economic growth.

Moreover, the absence of income tax makes Florida an attractive jurisdiction for business owners and investors, as it allows them to retain more of their profits, encouraging them to reinvest and grow their ventures.

Florida’s Tax-Free Future

As we look ahead, Florida’s tax-free status is likely to remain a key factor in its economic growth and appeal. The state’s commitment to maintaining a low-tax environment has already paid dividends, attracting residents, businesses, and investors from across the country and beyond.

However, it's essential to note that tax policies are dynamic and can change over time. While Florida's current tax landscape is advantageous, it's crucial for residents and businesses to stay informed about any potential changes that may impact their financial planning.

Additionally, as the state continues to grow and evolve, there may be discussions and proposals to adjust certain tax policies to address emerging needs and challenges. It's a delicate balance between maintaining a competitive tax environment and ensuring the state's long-term fiscal health.

Frequently Asked Questions

What are the main tax advantages of living in Florida?

+

Florida offers several key tax advantages, including no state income tax, a statewide sales and use tax with varying local rates, and property tax exemptions, such as homestead exemptions, which reduce the taxable value of a property.

How does Florida’s absence of income tax benefit residents financially?

+

Without a state income tax, residents can keep more of their income, allowing them to save, invest, or spend more freely. This can lead to improved financial well-being and increased disposable income.

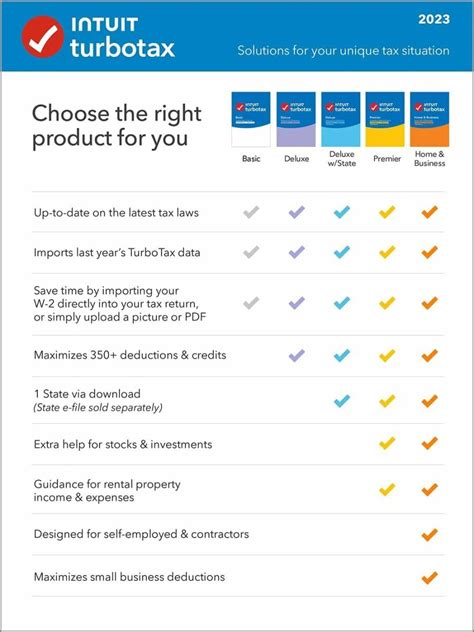

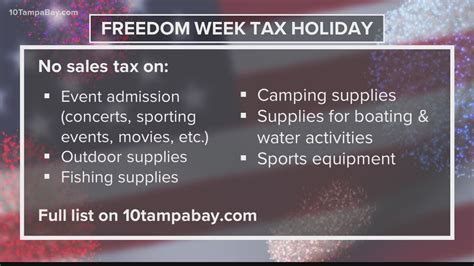

What are some of the sales tax exemptions in Florida?

+

Sales tax exemptions in Florida include groceries, non-prepared foods, and certain essential items, which helps residents save on their daily necessities.

How do Florida’s property tax exemptions work, and what are the potential savings for homeowners?

+

Florida’s property tax system offers homestead exemptions, which reduce the taxable value of a property. Depending on the location and property type, homeowners can save thousands of dollars annually on their property taxes.

In conclusion, Florida’s tax-free status is a significant advantage for both residents and businesses. From the absence of income tax to favorable property tax exemptions and sales tax rates, the state provides a compelling financial landscape. As we’ve explored, this unique tax environment has a profound impact on individuals’ financial well-being, attracts businesses and investors, and contributes to Florida’s overall economic prosperity. However, it’s important to stay informed about potential changes to tax policies and understand the broader context of Florida’s diverse economy and natural advantages.