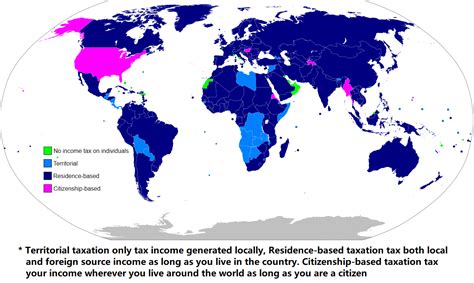

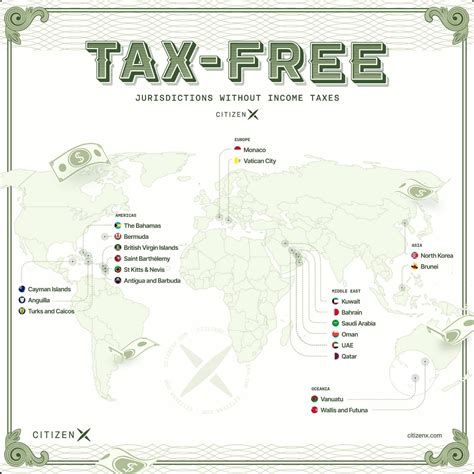

Countries Having No Income Tax

In the realm of international tax systems, the absence of income tax in certain countries presents an intriguing phenomenon. While most nations rely on income tax as a significant revenue source, a handful of jurisdictions have adopted alternative strategies, offering a unique perspective on economic policies. This article delves into the concept of countries with no income tax, exploring their motivations, implications, and the experiences of individuals and businesses within these jurisdictions.

The Unique Tax Systems of Select Countries

A select few countries have taken a bold approach to taxation by completely eliminating income tax. This strategy is often employed as a means to attract foreign investment, talent, and businesses, fostering economic growth and diversification. Let’s explore some of these countries and their innovative tax systems.

The Bahamas: A Haven for Tax-Free Living

The Bahamas, an archipelago in the Atlantic Ocean, boasts a unique tax structure. With no income tax, corporate tax, or capital gains tax, the country has become a popular destination for high-net-worth individuals and businesses seeking tax-efficient operations. The Bahamian government generates revenue primarily through customs duties, stamp duties, and a real property tax, creating a favorable environment for international investors.

For individuals, the absence of income tax translates to a significantly reduced tax burden. However, it's important to note that other taxes, such as sales tax and import duties, still apply. The Bahamas' tax-free status has contributed to its thriving tourism industry and has made it an attractive hub for financial services and international trade.

| Tax Type | Bahamas' Approach |

|---|---|

| Income Tax | Eliminated |

| Corporate Tax | Not applicable |

| Capital Gains Tax | Not levied |

Monako: A European Tax Haven

Monako, officially the Principality of Monaco, is a small city-state nestled on the French Riviera. Known for its glamorous reputation, Monaco has also gained recognition for its tax policies. The country does not impose income tax on individuals or corporations, making it an attractive destination for those seeking tax advantages.

Monaco's economy is primarily driven by tourism, real estate, and financial services. The absence of income tax, combined with a favorable business environment, has attracted numerous high-profile residents and international businesses. However, it's important to note that Monaco does levy other taxes, including a wealth tax and a social security tax for employed residents.

| Tax Category | Monaco's Approach |

|---|---|

| Income Tax | Non-existent for residents |

| Corporate Tax | Varies based on industry and revenue |

| Wealth Tax | Imposed on non-Monegasque residents |

United Arab Emirates: A Tax-Free Economic Hub

The United Arab Emirates (UAE) has emerged as a prominent economic powerhouse in the Middle East. While income tax is not levied on individuals, the UAE has implemented a value-added tax (VAT) system, which applies to most goods and services. This approach has allowed the country to generate significant revenue while maintaining a competitive tax environment.

The UAE's tax-free income policy has been a key factor in its rapid economic growth. The country has become a hub for international businesses and a popular destination for expatriates seeking tax-efficient opportunities. Additionally, the UAE has established free trade zones, offering further tax incentives and simplified regulations for businesses operating within these zones.

| Tax Type | UAE's Approach |

|---|---|

| Income Tax | Not applicable for individuals |

| Corporate Tax | Zero-tax rate in specific free zones |

| Value-Added Tax (VAT) | 5% standard rate |

Other Countries with Limited or No Income Tax

While the aforementioned countries have completely eliminated income tax, several other jurisdictions have adopted more nuanced approaches. For instance, some countries, like Bermuda and the Cayman Islands, impose a limited form of income tax, primarily on local businesses and residents, while offering tax-free benefits to non-residents and international companies.

Other countries, such as Singapore and Hong Kong, have low corporate tax rates and offer various tax incentives to attract businesses. While they do levy income tax on residents, their competitive tax environments have made them attractive destinations for international investment and business operations.

The Impact and Considerations

The decision to eliminate or reduce income tax has both advantages and challenges. For individuals, the absence of income tax can result in significant savings and a higher disposable income. However, it’s important to consider the overall tax burden, as other taxes, such as sales tax or property tax, may still apply.

From a business perspective, tax-free or low-tax jurisdictions can provide substantial cost savings and improved cash flow. This can be particularly beneficial for startups and small businesses looking to establish a foothold in a new market. Additionally, the absence of income tax can simplify tax compliance and reduce administrative burdens.

However, the lack of income tax revenue can pose challenges for governments. Alternative revenue sources, such as customs duties or property taxes, may not be sufficient to fund public services and infrastructure. As a result, some countries with no income tax have implemented other innovative funding mechanisms, such as tourism levies or special development funds.

The Future of Tax-Free Countries

The concept of countries with no income tax is likely to remain an intriguing aspect of international tax policy. As global economies evolve and tax competition intensifies, these jurisdictions will continue to play a pivotal role in shaping investment trends and business strategies.

While the absence of income tax offers clear benefits, it's essential for individuals and businesses to carefully consider the overall tax environment and potential trade-offs. As tax policies continue to evolve, staying informed about the latest developments and seeking professional advice is crucial for making well-informed financial decisions.

What are the potential drawbacks of living in a country with no income tax?

+

While the absence of income tax can provide significant financial benefits, it’s important to consider the overall tax burden. Countries with no income tax may levy other taxes, such as sales tax or property tax, which can still impact individuals and businesses. Additionally, the lack of income tax revenue can limit government funding for public services and infrastructure development.

How do countries with no income tax generate revenue for public services and infrastructure?

+

Countries with no income tax often rely on alternative revenue sources, such as customs duties, stamp duties, property taxes, or even special development funds. Some may also implement unique funding mechanisms, like tourism levies or specific industry-based taxes, to generate revenue for public services and infrastructure projects.

Are there any countries that offer tax-free benefits only to non-residents or international businesses?

+

Yes, several countries, including Bermuda and the Cayman Islands, offer tax-free benefits specifically to non-residents and international businesses. These jurisdictions attract foreign investment and businesses by providing favorable tax environments, while still imposing limited forms of income tax on local residents and businesses.