Avoid These Common Mistakes When Calculating Sales Tax in San Jose

San Jose, California, sits at the forefront of tech innovation and economic vitality, but navigating its complex sales tax landscape can be fraught with pitfalls for businesses, accountants, and entrepreneurs alike. As the city operates within a nuanced framework of state and local tax laws, missteps in calculating sales tax can have significant financial and legal repercussions. Understanding these intricacies, and more importantly, recognizing common mistakes, is vital for compliance and optimal financial management. This article delves into the primary errors made when calculating sales tax in San Jose, presents differing viewpoints on the best practices, and offers a balanced, reasoned perspective to navigate this challenging terrain effectively.

Understanding the Fundamentals of Sales Tax in San Jose

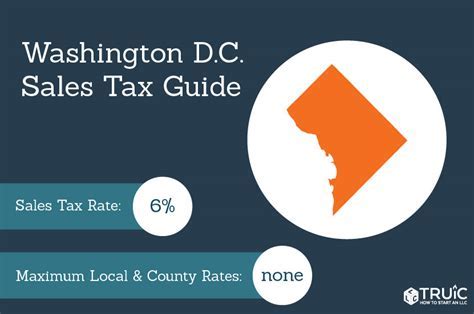

California’s sales tax system is characterized by its layered structure, comprising the statewide base rate, local district taxes, and special district taxes, each contributing to the total rate. San Jose’s location within Santa Clara County means that businesses must account for a combination of these contributions to ensure accurate collection and remittance. As of 2023, the combined sales tax rate in San Jose hovers around 9.25%, but this figure varies slightly with specific district or special tax additions, creating a landmine for miscalculations.

Two key elements shape the sales tax calculation in San Jose:

- Taxability of Products and Services: Not all goods and services are taxable; for instance, many digital products, groceries, and exempt transactions require differentiated treatment.

- Location-based Tax Rates: Given the multiple districts and jurisdictional boundaries, the precise address of the transaction determines the applicable rate.

Any misjudgment or oversight in these fundamental principles can lead to significant errors, potential audits, and penalties. Critics argue that the system's complexity can be a barrier for small business owners, while proponents emphasize the necessity of detailed diligence to ensure compliance.

Key Mistakes When Calculating Sales Tax in San Jose

Key Points

- Failure to Apply Correct Tax Rates Based on Transaction Location—Overlooking district-specific variations can result in undercharging or overcharging customers.

- Incorrect Classification of Taxable and Non-Taxable Items—Misunderstanding exemptions, especially in digital products or services, can distort tax collection.

- Neglecting to Update Tax Rates Regularly—Stagnant rates ignore recent legislative or district tax changes, risking non-compliance.

- Poor Recordkeeping and Documentation—Inadequate records complicate audit responses and financial reconciliation.

- Misinterpretation of Seller’s Use Tax Obligations—When purchasing goods for resale or personal use, failing to account for use tax obligations leads to compliance gaps.

Debate: Is the Complexity of San Jose Sales Tax Calculation Justified?

Proponents for Rigid Compliance and Stringent Calculation Practices

Advocates emphasize that the layered tax structure reflects the city’s commitment to funding local infrastructure, education, and public services. They argue that businesses must adhere strictly to these laws, which necessitates meticulous calculation and regular updates. Experts with accounting backgrounds advocate for robust software solutions that integrate real-time tax rate data, minimizing human error. They point out that, given the high stakes—including substantial penalties for non-compliance—such precision is justified.

For instance, according to the California Department of Tax and Fee Administration (CDTFA), accurate tax collection safeguards not only tax revenue but also maintains fair marketplace competition. Small firms, although often resource-constrained, are advised to seek specialized tax consulting services or leverage advanced POS systems that incorporate geolocation features, ensuring rate accuracy.

Critics Advocating for Simplification and Flexibility

On the other hand, critics argue that the complex mapping of district-specific rates and exemptions imposes unreasonable burdens, especially for small and medium-sized enterprises (SMEs). They cite research indicating that errors stemming from misunderstandings or outdated rate information contribute significantly to non-compliance issues. Moreover, they suggest that the administrative cost of constantly updating systems and retraining staff outweighs the perceived benefits of meticulous calculation.

From a policy perspective, some propose a move toward a streamlined, flat-rate tax system that reduces multidistrict calculations, thus lowering the chance of mistakes and administrative overhead. Implementing such policies would require legislative overhaul and bipartisan consensus, but it could make compliance more straightforward and transparent for all stakeholders.

Synthesis and Personal Perspective

Reconciling these viewpoints, it’s clear that the inherent complexity of San Jose’s sales tax system derives from a desire for equitable revenue collection aligned with local needs. Yet, practicality demands consideration of small business capacities and technological solutions. The optimal approach marries regulatory diligence with technological innovation: comprehensive, regularly updated tax rate databases integrated into point-of-sale systems, combined with targeted education for business owners about specific exemptions and responsibilities.

While a move toward simplification might reduce errors, the current multifaceted framework reflects nuanced policy choices aimed at geographic and economic equity. Therefore, businesses should focus on leveraging technology, seeking expert advice when necessary, and maintaining diligent records. Continuous education and robust compliance protocols will ultimately safeguard against costly mistakes, ensuring sustainability within San Jose’s vibrant economic ecosystem.

Practical Recommendations for Businesses in San Jose

- Implement Automated Tax Calculation Software — Use software that integrates real-time updates for district-specific rates and exemptions.

- Stay Informed about Legislative Changes — Subscribe to official updates from the CDTFA and local government notifications.

- Train Staff Regularly — Ensure your team understands the nuances of tax exclusions, product classifications, and recordkeeping requirements.

- Maintain Detailed Documentation — Store transaction records meticulously to facilitate audit readiness.

- Consult Tax Professionals — Engage with specialists for complex scenarios or when expanding into new product lines or markets.

Frequently Asked Questions

How often do sales tax rates in San Jose change?

+The rates are subject to change at least once a year, often more frequently due to legislative adjustments or district-specific tax measures. Staying updated via official sources such as the CDTFA is crucial for compliance.

What are common exemptions or non-taxable items in San Jose?

+Generally, groceries, prescription medications, and certain digital products are exempt or taxed at a different rate. Businesses must verify the current exemptions list provided by California tax authorities.

Can small businesses handle sales tax calculations manually in San Jose?

+While small businesses technically can, it’s risky and prone to errors. Automated tools or professional consultation are strongly recommended to ensure accuracy and compliance.

What penalties exist for incorrect sales tax collection in San Jose?

+Penalties can include fines, interest on unpaid taxes, and audit costs. The CDTFA enforces strict penalties for significant errors or willful non-compliance, emphasizing the importance of diligent calculation.