Greene County Personal Property Tax

In the realm of local taxation, understanding the specifics of personal property tax can be crucial for residents and business owners alike. Greene County, located in the state of [State Name], has its own set of regulations and procedures when it comes to personal property taxation. This article aims to delve into the intricacies of Greene County's Personal Property Tax, shedding light on its workings, implications, and the steps individuals can take to navigate this essential aspect of financial responsibility.

Unraveling Greene County's Personal Property Tax: A Comprehensive Guide

Greene County's Personal Property Tax is a crucial component of the local tax system, impacting both residents and business entities. This tax is levied on tangible personal property, encompassing a wide range of items, from vehicles and furniture to business equipment and inventory. Understanding the intricacies of this tax is essential for ensuring compliance and managing financial obligations effectively.

The tax rate for personal property in Greene County is currently set at [Tax Rate]%. This rate is applied to the assessed value of the personal property, which is determined by the county's tax assessor. The assessed value is based on factors such as the property's age, condition, and market value, with specific guidelines outlined in the county's assessment procedures.

The Assessment Process: A Step-by-Step Breakdown

The assessment process for personal property tax in Greene County involves several key steps. Firstly, the tax assessor's office conducts a thorough inventory of all personal property within the county. This process typically occurs annually, with assessors visiting businesses and residences to ensure accurate documentation of taxable items.

Once the inventory is complete, the assessor's office proceeds to evaluate each item's value. This evaluation considers factors such as depreciation, obsolescence, and any recent changes in the property's condition or market value. The assessed value is then multiplied by the tax rate to determine the amount owed by the property owner.

Property owners have the right to appeal the assessed value if they believe it to be inaccurate. The appeals process involves submitting documentation and evidence to support the claimed value. The tax assessor's office carefully reviews these appeals, and a decision is made based on the provided information.

Exemptions and Discounts: Navigating Tax Relief

Greene County offers certain exemptions and discounts on personal property tax, providing relief to specific categories of taxpayers. For instance, senior citizens who meet certain income criteria may be eligible for a reduced tax rate or a complete exemption on their personal property tax. Similarly, disabled individuals may also qualify for tax relief based on specific criteria.

Additionally, Greene County offers a homestead exemption, which provides a tax break for primary residences. This exemption is particularly beneficial for homeowners, as it reduces the tax burden on their personal property. The specific requirements and qualifications for this exemption are outlined in the county's tax code.

Business owners may also benefit from tax incentives and discounts, especially those who invest in energy-efficient equipment or make contributions to local community initiatives. These incentives are designed to encourage sustainable practices and support community development.

Online Services and Payment Options: Streamlining the Process

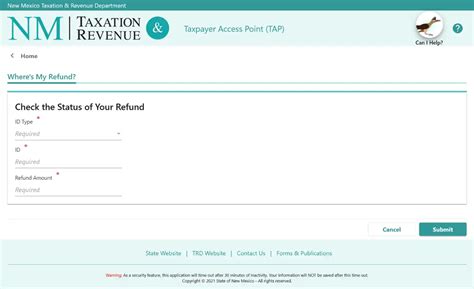

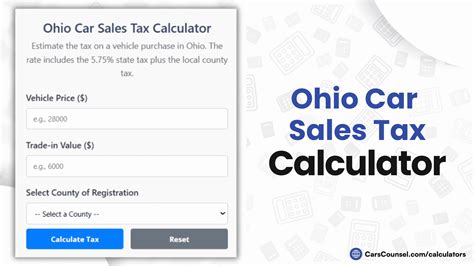

Greene County recognizes the importance of convenience and accessibility in tax administration. As such, the county's tax assessor's office has implemented an online platform for taxpayers to manage their personal property tax obligations. This platform allows residents and businesses to register their personal property, view their assessment details, and make payments securely online.

The online system provides a user-friendly interface, enabling taxpayers to navigate through the various steps of the tax process with ease. It offers real-time updates on tax assessments, payment due dates, and any applicable penalties or discounts. This digital platform streamlines the tax payment process, reducing administrative burdens for both taxpayers and the county's tax department.

In addition to online payments, Greene County accepts various payment methods, including credit cards, debit cards, and electronic checks. This flexibility accommodates the diverse financial needs and preferences of taxpayers, making the payment process more accessible and convenient.

Impact on the Local Economy and Community Development

The revenue generated from personal property tax in Greene County plays a significant role in funding essential public services and infrastructure projects. These funds contribute to the maintenance and improvement of roads, schools, public safety, and other vital community resources.

Moreover, the tax revenue supports local economic development initiatives, such as business grants, job creation programs, and community revitalization projects. By investing in these initiatives, Greene County fosters a thriving business environment, attracting new businesses and creating job opportunities for its residents.

The tax also encourages responsible business practices, as businesses are incentivized to maintain accurate records and comply with tax regulations. This promotes transparency and accountability, fostering a culture of trust and integrity within the local business community.

Staying Informed and Engaged: Resources for Taxpayers

Greene County understands the importance of keeping taxpayers informed and engaged. The county's tax assessor's office provides a wealth of resources and educational materials to help residents and businesses understand their tax obligations and rights.

The office's website offers comprehensive guides, frequently asked questions (FAQs), and contact information for taxpayers seeking assistance. Additionally, the office conducts regular outreach programs, including workshops and seminars, to educate taxpayers on the personal property tax process, exemptions, and appeals procedures.

Taxpayers are encouraged to stay updated on any changes or updates to the tax code, assessment procedures, and payment deadlines. By staying informed, taxpayers can ensure compliance, take advantage of available exemptions, and effectively manage their financial obligations.

Conclusion: Navigating Greene County's Personal Property Tax with Confidence

Understanding and navigating Greene County's Personal Property Tax is a crucial aspect of financial responsibility for residents and businesses alike. By familiarizing themselves with the assessment process, exemptions, and payment options, taxpayers can effectively manage their obligations and contribute to the county's thriving community.

With a commitment to transparency, accessibility, and community development, Greene County ensures that its personal property tax system is fair, efficient, and beneficial to all stakeholders. By staying informed and engaged, taxpayers can navigate this complex process with confidence, ensuring compliance and supporting the growth and prosperity of their local community.

What types of personal property are taxable in Greene County?

+In Greene County, tangible personal property is taxable. This includes items such as vehicles, furniture, business equipment, inventory, and certain types of machinery. Intangible property, such as stocks and bonds, is not subject to personal property tax.

Are there any exemptions or discounts available for personal property tax in Greene County?

+Yes, Greene County offers several exemptions and discounts to eligible taxpayers. These include senior citizen exemptions, disability exemptions, homestead exemptions, and tax incentives for energy-efficient practices and community contributions. It’s important to review the specific criteria and qualifications for each exemption.

How can I register my personal property for tax purposes in Greene County?

+You can register your personal property online through the Greene County tax assessor’s website. The registration process typically involves providing detailed information about your personal property, including descriptions, values, and any applicable exemptions. It’s important to ensure accurate and complete information to avoid penalties or additional assessments.

What payment options are available for personal property tax in Greene County?

+Greene County offers a range of payment options for personal property tax, including online payments, credit/debit card payments, and electronic checks. The online platform provides a secure and convenient way to make payments, with real-time updates on payment status and due dates. You can also pay in person at the tax assessor’s office during business hours.

How can I appeal my personal property tax assessment in Greene County?

+If you believe your personal property tax assessment is inaccurate, you have the right to appeal. The appeals process involves submitting documentation and evidence to support your claim. The tax assessor’s office carefully reviews these appeals, and a decision is made based on the provided information. It’s important to carefully review the appeals process guidelines and gather supporting evidence for a successful appeal.