State Income Tax Rate Michigan

Michigan's state income tax system plays a crucial role in the state's fiscal landscape, influencing both individual taxpayers and businesses. Understanding the nuances of Michigan's income tax rate is essential for residents, investors, and anyone interested in the economic dynamics of the Great Lakes State. This comprehensive guide aims to provide an in-depth analysis of Michigan's income tax rate, its implications, and its role in shaping the state's economy.

Understanding Michigan’s Income Tax Structure

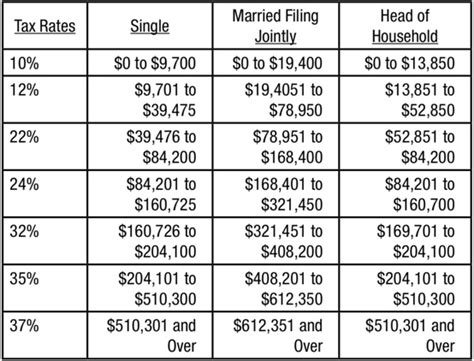

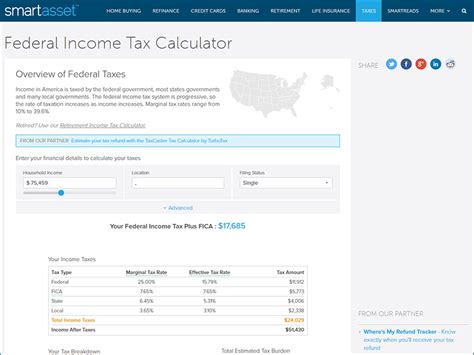

Michigan operates on a flat income tax rate, meaning that all taxpayers, regardless of their income level, are subject to the same tax rate. This approach contrasts with some other states that implement progressive tax systems, where higher income earners are taxed at higher rates. As of my last update in January 2023, Michigan’s state income tax rate stands at 4.25%, a figure that has remained consistent since 2011.

The state income tax is applied to various forms of income, including wages, salaries, commissions, bonuses, and investment income. However, it's important to note that Michigan offers certain exemptions and deductions that can reduce the taxable income for individuals and businesses. These deductions include a standard deduction, personal exemptions, and various tax credits for education, childcare, and other specific expenses.

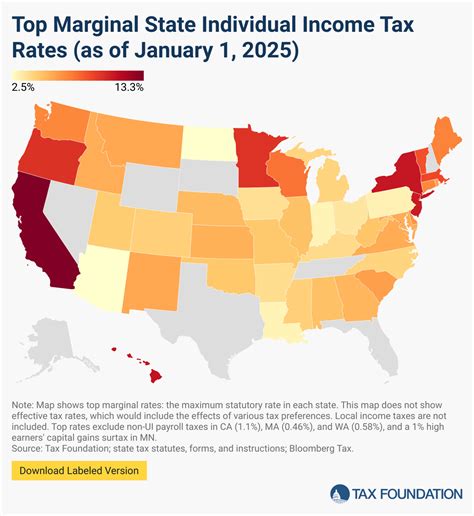

Comparison with Other States

When compared to other states, Michigan’s flat income tax rate of 4.25% places it in the middle range. Some states, like Florida and Texas, have no income tax at all, while others, such as California and New York, have significantly higher tax rates. The flat tax rate in Michigan provides a level of predictability for taxpayers, as they can easily calculate their potential tax liability based on their income.

However, it's worth mentioning that the overall tax burden in Michigan goes beyond just the income tax. Residents also pay property taxes, sales taxes, and various other fees and levies. These additional taxes can significantly impact a person's or business's overall tax liability, making Michigan's tax landscape more complex than a simple income tax analysis.

| State | Income Tax Rate |

|---|---|

| Michigan | 4.25% |

| Florida | 0% |

| Texas | 0% |

| California | 1-13.3% |

| New York | 4-8.82% |

Impact on Individuals and Businesses

The 4.25% income tax rate in Michigan has a direct impact on the disposable income of individuals and the operational costs for businesses. For individuals, a higher tax rate means less money in their pockets, potentially affecting their spending habits and saving patterns. Conversely, a lower tax rate can stimulate economic growth by providing individuals with more disposable income to invest or spend, thus boosting the local economy.

Businesses, on the other hand, factor the state income tax rate into their cost of doing business. A higher tax rate can make Michigan less attractive for businesses, especially when compared to states with no income tax. However, Michigan offers various business incentives and tax credits to offset the income tax burden, making it a competitive choice for many companies.

Case Study: Impact on Small Businesses

Let’s consider a hypothetical scenario involving a small business owner, Sarah, who runs a successful retail store in downtown Detroit. With an annual income of 200,000, Sarah's business is subject to Michigan's <strong>4.25%</strong> income tax rate. This equates to a tax liability of 8,500 for the year. While this amount might seem substantial, it’s important to consider the overall benefits Sarah’s business enjoys in Michigan, including a skilled workforce, access to transportation hubs, and various business incentives.

Furthermore, Sarah can take advantage of several tax deductions and credits, such as the Michigan Business Tax Credit, which can significantly reduce her tax liability. These incentives, combined with the stable tax rate, provide a predictable and potentially beneficial tax environment for her business.

Future Implications and Potential Changes

The income tax rate in Michigan is subject to change, and proposals for tax reform are a regular occurrence in state politics. While a flat tax rate provides simplicity and stability, there are ongoing debates about whether a progressive tax system would be more equitable, especially given the wide range of incomes in the state. Proponents of a progressive tax argue that it would alleviate the tax burden on lower-income earners while generating more revenue from higher-income earners.

Additionally, the state's economic growth and budgetary needs can influence tax policy. If Michigan experiences significant economic growth, there might be less pressure to raise taxes. Conversely, during economic downturns, the state might consider increasing taxes or introducing new revenue streams to balance its budget.

Conclusion: Navigating Michigan’s Tax Landscape

Michigan’s state income tax rate of 4.25% is a key component of the state’s fiscal policy, influencing the economic decisions of both individuals and businesses. While it provides a level of simplicity and predictability, the overall tax burden extends beyond income tax, making Michigan’s tax landscape multifaceted. As taxpayers and businesses navigate this landscape, it’s essential to stay informed about tax policies, deductions, and potential reforms to make informed financial decisions.

By understanding Michigan's income tax structure and its implications, individuals and businesses can better plan their finances, optimize their tax liabilities, and contribute to the economic growth of the state. As Michigan continues to evolve, its tax policies will undoubtedly remain a critical factor in shaping its economic future.

What are the income tax rates for other states in the U.S.?

+

Income tax rates vary widely across the U.S. Some states, like Florida and Texas, have no income tax, while others, like California and New York, have progressive tax systems with rates ranging from 1% to over 13%. It’s important to research each state’s specific tax laws to understand the tax landscape.

Are there any plans to change Michigan’s income tax rate in the near future?

+

As of my last update, there were no immediate plans to change Michigan’s income tax rate. However, tax policy is a dynamic field, and proposals for reform are common. It’s advisable to stay informed about political discussions and legislative changes to anticipate potential tax modifications.

How does Michigan’s flat tax rate compare to other states with progressive tax systems?

+

Michigan’s flat tax rate of 4.25% is generally lower than the top tax rates in states with progressive tax systems. While a flat tax provides simplicity, states with progressive taxes often aim to balance the tax burden across income levels, potentially making them more attractive to lower-income earners.