Illinois Vehicle Tax Calculator

Illinois, like many other states, imposes various taxes and fees on vehicle ownership and usage. These taxes can significantly impact the overall cost of owning a vehicle, and understanding them is crucial for both individual vehicle owners and businesses in the automotive industry. This article aims to provide a comprehensive guide to Illinois' vehicle taxes, offering a detailed breakdown of the different taxes, their calculations, and their implications.

Understanding Illinois Vehicle Taxes

The state of Illinois collects taxes on vehicles through several avenues, each serving a specific purpose and contributing to different aspects of state infrastructure and services. These taxes are typically paid annually or as a one-time fee, depending on the type of tax and the vehicle’s classification.

Vehicle Registration Fee

One of the primary taxes Illinois residents encounter is the Vehicle Registration Fee. This fee varies based on the vehicle’s weight, with lighter vehicles paying less. For instance, a standard passenger car weighing less than 5,000 pounds will incur a registration fee of 101.25, while heavier vehicles, such as trucks or SUVs, will pay a higher fee.</p> <p>The registration fee also includes a <strong>2 environmental fee and a $2 fee for the Illinois State Police Memorial Wall, dedicated to honoring fallen state troopers.

| Vehicle Weight | Registration Fee |

|---|---|

| Up to 5,000 pounds | $101.25 |

| 5,001 - 6,000 pounds | $123.75 |

| 6,001 - 8,000 pounds | $162.50 |

| 8,001 - 10,000 pounds | $185.00 |

| Over 10,000 pounds | Calculated per pound |

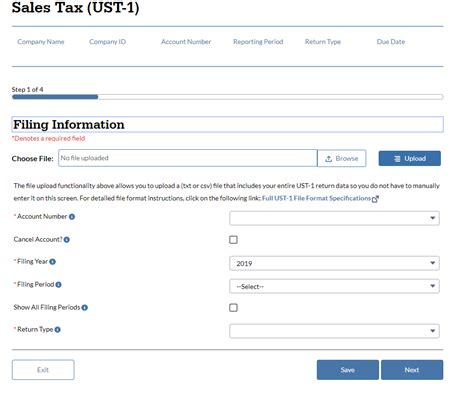

Illinois Use Tax

The Illinois Use Tax is applicable to vehicles purchased outside of Illinois but used within the state. This tax ensures that residents who buy vehicles from other states or online pay their fair share for the use of Illinois’ roads and infrastructure. The calculation for the use tax is based on the vehicle’s purchase price, and it applies to vehicles that cost $1,000 or more.

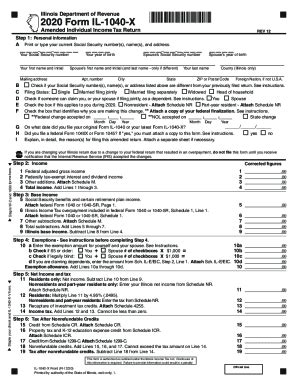

To calculate the Use Tax, follow these steps:

- Determine the Vehicle's Purchase Price (excluding sales tax and trade-in value)

- Multiply the purchase price by the applicable Use Tax Rate (currently 6.25%)

- Add the Vehicle Registration Fee (as mentioned above)

- Include a $2 Environmental Fee and a $2 Illinois State Police Memorial Wall Fee

For example, if you purchased a vehicle for $25,000 out of state, the Use Tax calculation would be as follows:

- $25,000 (purchase price) x 0.0625 (use tax rate) = $1,562.50

- Add $101.25 (registration fee), $2 (environmental fee), and $2 (Illinois State Police Memorial Wall fee)

- Total Use Tax: $1,667.75

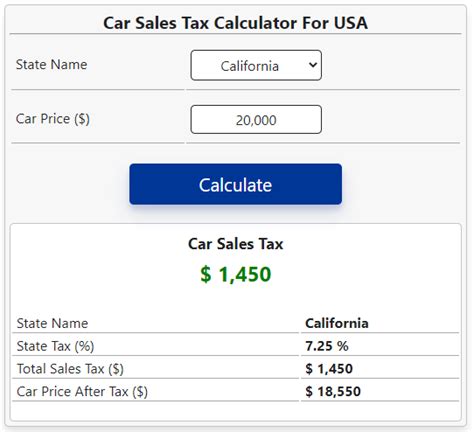

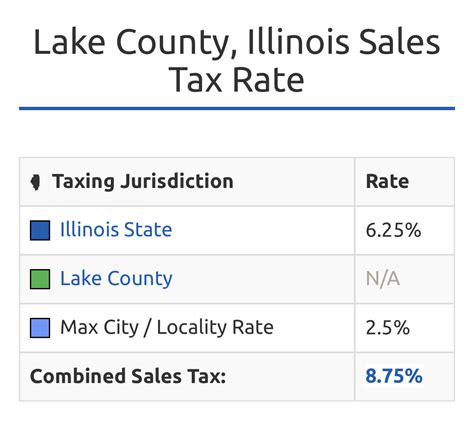

Illinois Sales Tax on Vehicles

Illinois also imposes a Sales Tax on vehicles purchased within the state. This tax is calculated as a percentage of the vehicle's sale price and is typically included in the final purchase cost. The current sales tax rate in Illinois is 6.25%.

When purchasing a vehicle, ensure that the sales tax is clearly outlined in the transaction details. The dealer should provide a breakdown of the tax calculation to ensure transparency.

Special Considerations for Illinois Vehicle Taxes

While the above taxes cover the majority of vehicle ownership scenarios, there are additional considerations for specific vehicle types and situations.

Alternative Fuel Vehicles

Illinois offers incentives for the adoption of alternative fuel vehicles (AFVs), including electric vehicles (EVs) and those running on compressed natural gas (CNG) or liquefied petroleum gas (LPG). These incentives often take the form of tax credits or reduced registration fees. For example, AFV owners may be eligible for a $3,750 tax credit, which can significantly offset the cost of vehicle registration.

Leased Vehicles

For individuals or businesses leasing a vehicle, the tax implications can be slightly different. In Illinois, the lessee is responsible for paying the Use Tax on the vehicle’s value, even if the vehicle is leased from out of state. This tax is calculated based on the lease payment and the duration of the lease agreement.

Vehicle Transfers and Gifts

When a vehicle is transferred or gifted within Illinois, a Transfer Tax is applicable. This tax is calculated as a percentage of the vehicle’s value and is typically paid by the recipient of the vehicle. The current transfer tax rate in Illinois is 0.5% of the vehicle’s value.

Tax Exemptions and Discounts

Illinois offers certain tax exemptions and discounts to specific groups or under particular circumstances. These exemptions can provide significant savings for eligible individuals and businesses.

Senior Citizen Discount

Illinois residents aged 65 and older may be eligible for a 50% discount on their vehicle registration fee. To qualify, individuals must meet certain income criteria and provide proof of age and income to the Illinois Secretary of State’s office.

Disabled Veteran Discount

Veterans with a disability rating of 60% or more from the Department of Veterans Affairs (VA) are eligible for a 50% discount on their vehicle registration fee. This discount applies to one vehicle, and veterans must provide a valid VA rating to the Secretary of State’s office.

Veteran’s Discount

All honorably discharged veterans are eligible for a 25% discount on their vehicle registration fee. To claim this discount, veterans must present a valid DD-214 form to the Secretary of State’s office.

Disabled Person Discount

Individuals with a disability that requires vehicle modifications are eligible for a 50% discount on the registration fee for one vehicle. This discount is available for disabilities that impact mobility or require specialized equipment. A physician’s certification of the disability is required to claim this discount.

The Impact of Illinois Vehicle Taxes

Illinois’ vehicle taxes, while serving important revenue-generation purposes, can significantly affect the overall cost of vehicle ownership. For individuals and businesses, these taxes can represent a substantial annual expense, especially for heavier vehicles or those purchased out of state.

Implications for Businesses

Businesses operating in Illinois, especially those with large vehicle fleets, can face significant tax liabilities. The cumulative effect of vehicle taxes can impact a company’s bottom line and affect its operational costs. For instance, a company with a fleet of 50 vehicles, each weighing over 10,000 pounds, could face substantial registration fees, potentially totaling tens of thousands of dollars annually.

Impact on Individual Owners

For individual vehicle owners, Illinois’ vehicle taxes can represent a significant portion of their annual expenses. The cost of registration, combined with other vehicle-related costs like insurance and maintenance, can be a considerable financial burden. However, the state’s tax exemptions and discounts can provide much-needed relief for certain groups, such as seniors and veterans.

Conclusion

Understanding Illinois’ vehicle taxes is crucial for both individuals and businesses operating within the state. The various taxes, fees, and exemptions can significantly impact the cost of vehicle ownership, and staying informed is essential for effective financial planning. Whether it’s a one-time purchase or an annual registration, Illinois’ vehicle tax landscape is a critical consideration for anyone with a vehicle in the state.

Are there any other fees associated with vehicle ownership in Illinois besides taxes?

+Yes, Illinois also imposes various fees on vehicle ownership, such as a Title Fee (150 for a new title), <strong>License Plate Fees</strong> (ranging from 120 to 240), and <strong>Duplicate Title Fees</strong> (20). These fees are typically paid once and are additional to the vehicle taxes.

Can I apply for tax exemptions if I’m a veteran but not disabled?

+Yes, honorably discharged veterans can apply for a 25% discount on their vehicle registration fee. This discount does not require a disability rating and is available to all veterans who can provide a valid DD-214 form.

How often do I need to pay the Vehicle Registration Fee in Illinois?

+The Vehicle Registration Fee in Illinois is typically paid annually. This fee is due when you renew your vehicle’s registration, and it varies based on the vehicle’s weight, as mentioned earlier.

Are there any environmental considerations in Illinois’ vehicle tax structure?

+Yes, Illinois includes an environmental fee of $2 in its vehicle registration and use tax calculations. This fee is dedicated to environmental initiatives and demonstrates the state’s commitment to sustainability.

What happens if I don’t pay my vehicle taxes in Illinois?

+Failing to pay your vehicle taxes in Illinois can result in penalties and fees. Additionally, your vehicle registration could be suspended until the taxes are paid in full. It’s important to stay compliant to avoid these consequences.