How to Maximize Your Sales Tax Deduction for Tax Savings

Imagine navigating a sprawling warehouse without a clear map—items scattered, pathways unclear, frustration mounting as you search for the valuable goods you need. Similarly, the labyrinth of sales tax deductions can seem daunting without a strategic approach. Yet, for taxpayers and small business owners, understanding how to maximize sales tax deductions offers a rewarding path toward potential savings, much like discovering a shortcut through that warehouse. This article explores in-depth strategies, legal considerations, and practical tips for optimizing sales tax deductions, equipping you with a comprehensive guide that combines fiscal expertise with actionable insights.

The Significance of Sales Tax Deduction in Tax Planning

In the intricate ecosystem of tax deductions, sales tax frequently remains an underutilized yet powerful component, especially for Americans living in states without income tax or those with substantial sales tax expenditures. Analogous to choosing the most efficient route in a maze, knowing how to navigate sales tax deductions properly can significantly reduce your taxable income. Unlike standard deductions that are often capped or fixed, sales taxes paid on durable goods, utilities, or large purchases are often directly deductible, giving taxpayers a flexible and often overlooked avenue for tax savings.

Understanding the Basic Framework of Sales Tax Deductions

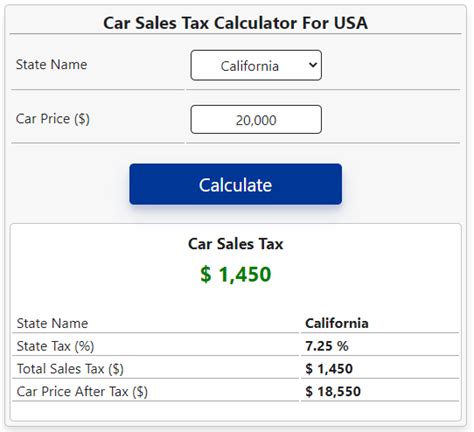

At its core, the sales tax deduction allows taxpayers to deduct the amount they paid in sales taxes throughout the year from their federal taxable income, provided they itemize deductions. This is particularly pertinent in states like Florida, Texas, or Nevada—where income tax is absent, and sales tax plays a more prominent fiscal role. The IRS provides two main ways to calculate this deduction: opting for the general sales tax table based on your income or tracking actual sales tax paid on specific large purchases, whichever yields the higher benefit.

| Relevant Category | Substantive Data |

|---|---|

| IRS Deduction Method | Standard table vs. Actual receipts |

| Maximum Deduction Limit | $10,000 (or $5,000 if married filing separately) as of 2023 |

| Typical Savings | Varies greatly depending on state sales tax rates and individual purchases |

Choosing the Right Method for Deduction: Table Versus Actual Expenses

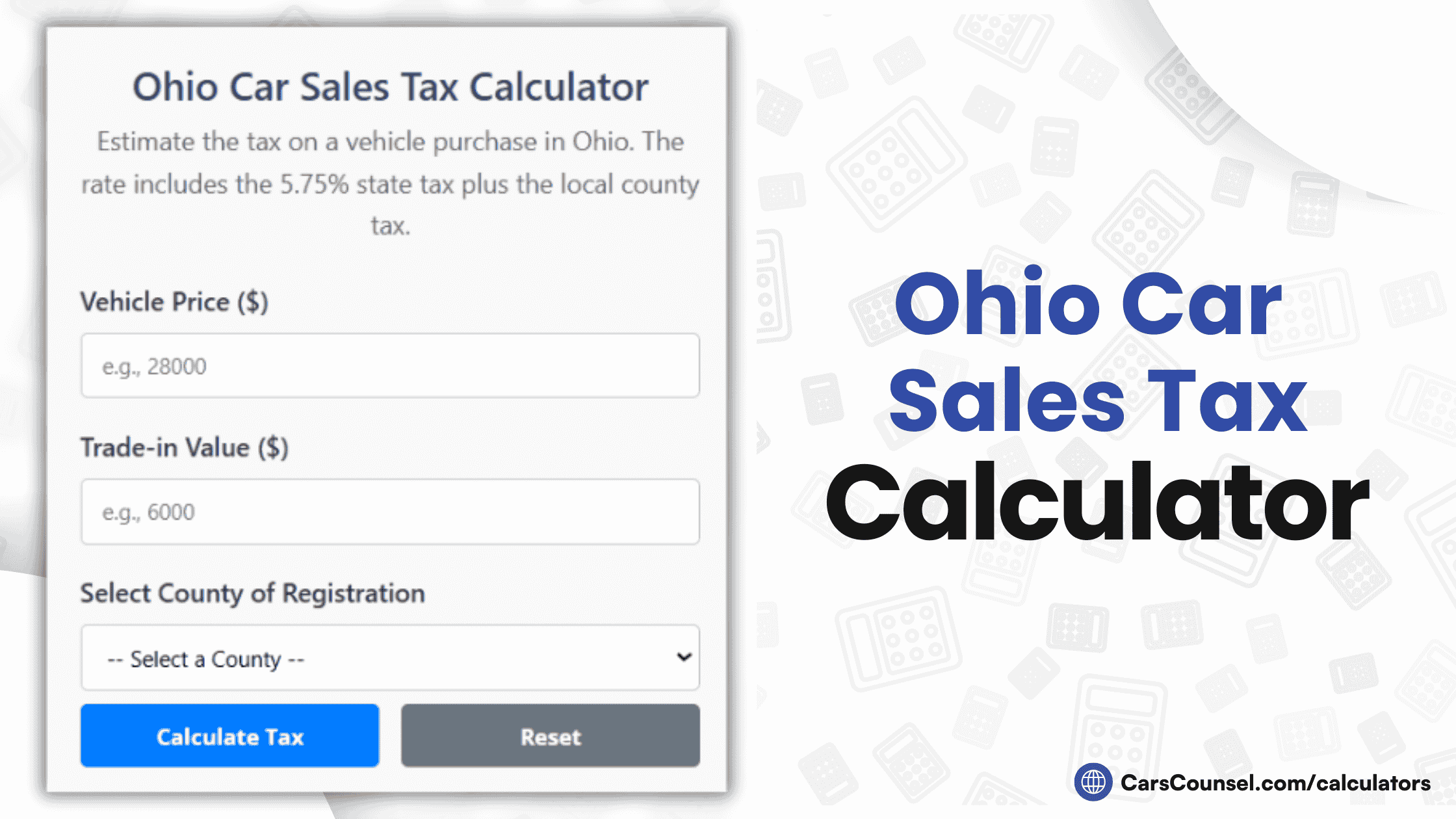

Deciding between the IRS’s standard sales tax deduction table and itemizing actual sales Tax receipts bears resemblance to choosing between taking a fixed route or charting a custom path through a complex maze. The table method simplifies calculations, using average sales tax paid based on income levels and state rates. However, if you’ve made significant large-scale purchases—like a new vehicle, cabinetry, or high-end electronics—tracking the exact amounts paid on those items could result in a larger deduction.

Calculating Sales Tax with the Standard Deduction Table

This approach involves referencing IRS Publication 600, which offers a sales tax deduction table. The table provides estimated sales tax based on your state of residence and income bracket, making it straightforward for most filers. For example, a single filer earning 50,000 in Texas might deduct around 2,400—roughly aligning with actual sales tax paid on typical purchases, but it’s crucial to double-check your specific circumstances each year.

Tracking Actual Sales Tax on Large Purchases

For those who prefer precision, documenting sales taxes on large purchases can surpass the standard deduction. Keep all receipts for items like automobiles, appliances, or significant home improvements. These purchases have higher individual costs, and the taxes paid can be substantial enough to offset the standard deduction amount—particularly in high-tax jurisdictions.

| Relevant Category | Data |

|---|---|

| Records Required | Receipts, credit card statements, dealer documentation |

| Impact of High-Value Purchases | Potential for deductions exceeding standard estimates by 20-50% |

Legal Considerations and Limitations in Deducting Sales Taxes

While the prospect of boosting deductions with meticulous record-keeping is enticing, it bears resemblance to a treasure hunt that requires adherence to specific rules. The IRS enforces limitations—most notably, the cap on the total amount of sales taxes deductible, which as noted, is $10,000 for individuals or married couples filing jointly. Careful compliance with IRS guidelines ensures that your deductions withstand audits and legal scrutiny.

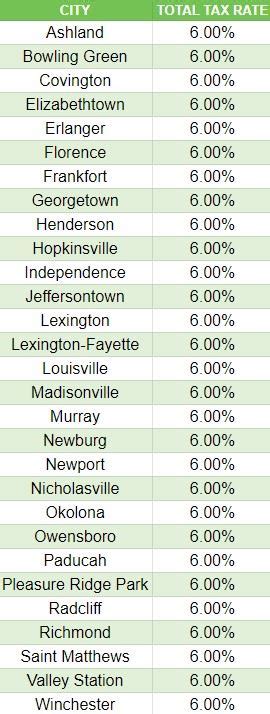

State and Local Tax Rules and Their Impact

State-specific rules can influence your ability to deduct sales taxes. Some jurisdictions impose additional local sales taxes or special district taxes, which are also deductible if you itemize. Understanding the layered tax landscape—especially in municipalities with multiple taxing jurisdictions—is like deciphering an intricate map with various routes; your confidence in navigating it determines the efficiency of your deduction strategy.

Understanding the Alternative Minimum Tax (AMT) and Sales Tax Deductions

For high-income taxpayers, the presence of the AMT can affect the utility of itemized deductions, including sales tax. Since AMT calculations disallow certain deductions, it’s valuable to analyze whether claiming sales taxes provides a net benefit or if the same funds could be better allocated elsewhere in your tax planning.

| Relevant Category | Data |

|---|---|

| Cap on total deductions | $10,000 |

| Effect of AMT | Reduced benefit for high-income earners |

| Recordkeeping compliance | Maintaining accurate receipts is critical |

Practical Strategies to Optimize Sales Tax Deductions

Transforming your approach from casual to strategic is akin to upgrading from a simple map to a GPS-guided navigation system. Each action taken with foresight can substantially increase your deductions while minimizing the risk of audit issues. Here are key tactics for maximizing your sales tax advantage:

Timing Major Purchases for Maximum Benefit

Plan high-value expenditures in years where your income is higher, or when you anticipate a lower standard deduction threshold. For instance, buying a new vehicle or appliance before year-end can lead to significant tax savings, especially if you retain detailed proof of sales tax paid.

Meticulous Record-Keeping and Documentation

Use digital tools or dedicated folders to store receipts, credit card statements, and dealer invoices. High-quality documentation ensures efficient derivation of deductions during tax filing and reduces the risk of audit challenges.

Combine Deduction Methods and Leverage Itemized Deductions

Apply the most advantageous method available to you by cross-referencing the standard table and actual expense totals. When actioned thoughtfully, this dual approach resembles choosing the shortest and least congested route in the maze—saving time and resources.

| Relevant Category | Actionable Item |

|---|---|

| Use of tax software or professional help | Ensure accuracy and compliance with evolving laws |

| Monitor sales tax rate changes | Adjusted annually to optimize deductions |

| Year-end planning | Accelerate or defer purchases based on financial position |

Conclusion: Turning Knowledge Into Savings

Mastering the art of maximizing your sales tax deduction parallels becoming an expert navigator—understanding the terrain, leveraging the right tools, and timing your moves carefully. As you become adept at tracking individual expenses, understanding legal limits, and choosing optimal strategies, you transform a potentially modest deduction into a substantial savings opportunity. When approached with precision and foresight, sales tax deductions turn from a complex challenge into a clear avenue for fiscal benefit, ultimately empowering you in your broader tax planning journey.

How can I ensure I’m accurately tracking my sales tax payments?

+Use digital tools such as expense tracking apps, or maintain organized folders for receipts and credit card statements. Regular updates throughout the year help maintain accuracy and simplify year-end reporting.

Are there restrictions on which types of purchases I can deduct sales tax on?

+Generally, large purchases like vehicles, appliances, and home improvements qualify. Routine retail purchases typically don’t, unless they are part of a significant, defensible expenditure documented properly.

Can I combine sales tax deduction methods for better benefits?

+Absolutely. You may choose the standard deduction table for most expenses and track actual sales tax paid on high-value items for the items that yield higher deductions, optimizing your overall savings.

How does high local sales tax influence my deductions?

+Higher local sales taxes increase your deductible amount if you itemize, often making it more advantageous to track and claim actual sales taxes paid, especially in jurisdictions with multiple overlapping taxes.