Kentucky Sales Tax Rate

In the vibrant state of Kentucky, the sales tax system plays a crucial role in the economic landscape, impacting businesses and consumers alike. This comprehensive guide delves into the intricacies of the Kentucky sales tax rate, exploring its historical context, current regulations, and its implications for various industries and individuals.

Unraveling the Complexity of Kentucky Sales Tax

The sales tax landscape in Kentucky is a multifaceted system, with rates varying across different jurisdictions and types of goods and services. This complexity arises from the state’s approach to taxation, which involves a combination of state, county, and city taxes, each with its own rules and regulations.

Historical Perspective

Kentucky’s sales tax history traces back to the mid-20th century, with the state initially adopting a sales tax system in 1960. This move was a response to the growing need for additional revenue to fund public services and infrastructure development. Over the decades, the sales tax rate has undergone several adjustments, reflecting the state’s economic growth and changing fiscal priorities.

Current Rate Structure

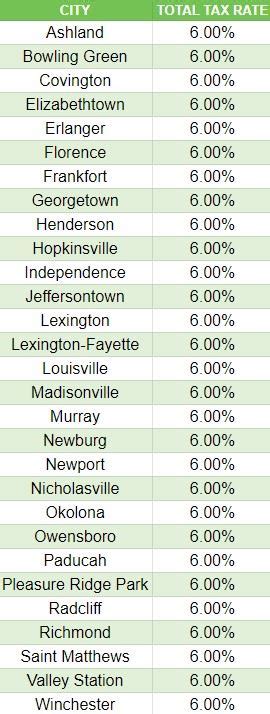

As of the most recent data, Kentucky imposes a 6% state sales tax on most goods and services. However, this is just the starting point; local jurisdictions can, and often do, levy additional taxes, creating a complex tapestry of rates across the state. For instance, in the bustling city of Louisville, the total sales tax rate stands at 6.5%, with an additional 0.5% allocated for specific local projects.

| Jurisdiction | Sales Tax Rate |

|---|---|

| State of Kentucky | 6% |

| Louisville | 6.5% |

| Lexington | 6.5% |

| Jefferson County | 6.5% |

| Other Counties | Varies (6.0% - 6.5%) |

This variation in tax rates can significantly impact businesses operating across multiple jurisdictions, requiring meticulous tax planning and compliance strategies.

Tax Exemptions and Special Considerations

Kentucky’s sales tax regime also includes a range of exemptions and special provisions. For example, certain essential items like groceries, prescription drugs, and residential energy are exempt from sales tax, providing much-needed relief to consumers and ensuring basic necessities remain affordable.

Furthermore, Kentucky offers tax incentives and credits for specific industries, such as the manufacturing sector, to encourage economic development and job creation. These incentives can take the form of reduced tax rates, tax holidays, or rebates, making Kentucky an attractive destination for businesses.

The Impact on Businesses and Consumers

The Kentucky sales tax rate has profound implications for both businesses and consumers. For businesses, especially those with a physical presence in the state, understanding and complying with the sales tax regulations is essential to avoid penalties and maintain a positive relationship with customers.

Compliance and Tax Collection

Businesses must collect and remit sales tax based on the applicable rate at the point of sale. This process involves integrating sales tax calculations into their point-of-sale systems and ensuring accurate record-keeping. Failure to comply with these obligations can lead to fines and legal repercussions.

To facilitate compliance, Kentucky provides resources and guidance for businesses, including online tax registration, tax rate databases, and regular updates on tax law changes. The state also offers assistance programs to help small businesses navigate the complexities of sales tax regulations.

Consumer Behavior and Spending Patterns

From a consumer perspective, the sales tax rate directly influences purchasing decisions and overall spending patterns. Higher sales tax rates can discourage spending, particularly for non-essential items, as consumers may opt to purchase online or in neighboring states with lower tax rates.

Conversely, lower sales tax rates can stimulate consumer spending, leading to increased sales for local businesses and contributing to the state's economic growth. Kentucky's varying sales tax rates across jurisdictions can create a competitive environment, with consumers potentially favoring shopping destinations with more favorable tax rates.

Future Outlook and Potential Changes

As Kentucky’s economy continues to evolve, so too may its sales tax landscape. The state’s policymakers and economic experts are constantly evaluating the effectiveness and fairness of the current sales tax system, considering potential reforms and adjustments.

Potential Reforms and Adjustments

One area of ongoing debate is the potential for a simplified sales tax system. Some stakeholders advocate for a uniform sales tax rate across the state, arguing that it would reduce administrative burdens for businesses and provide a more consistent experience for consumers. However, others emphasize the importance of local control and the revenue generated by local taxes for essential community projects.

Additionally, the rise of e-commerce and online sales has prompted discussions about how to fairly tax these transactions. Kentucky, like many other states, is exploring ways to capture sales tax revenue from online sales, particularly from out-of-state sellers, to ensure a level playing field for local businesses and maintain a stable tax base.

Impact on Economic Development

The sales tax rate is just one factor among many that influence Kentucky’s economic development. However, it plays a significant role in shaping the business environment and attracting investment. A competitive and well-managed sales tax system can enhance Kentucky’s attractiveness as a business destination, encouraging new enterprises and job creation.

Furthermore, the revenue generated from sales taxes is vital for funding public services, infrastructure projects, and social programs. As Kentucky looks to the future, striking the right balance between tax revenue and economic growth will be crucial for sustaining a healthy and vibrant economy.

How often does Kentucky adjust its sales tax rate?

+Kentucky's sales tax rate is relatively stable, with adjustments made infrequently. However, the state may periodically review and update its tax rates to align with economic trends and fiscal needs.

Are there any special sales tax holidays in Kentucky?

+Yes, Kentucky occasionally offers sales tax holidays, typically around major shopping events like back-to-school season. These holidays provide a tax-free period for specific items, encouraging consumer spending.

How can businesses stay updated on sales tax regulations in Kentucky?

+Businesses can subscribe to the Kentucky Department of Revenue's newsletters and updates, which provide regular notifications on tax law changes and compliance requirements.

What happens if a business fails to collect and remit sales tax in Kentucky?

+Businesses that fail to comply with sales tax obligations may face penalties, interest charges, and even legal action. It is crucial for businesses to understand and adhere to the state's sales tax regulations.

In conclusion, Kentucky’s sales tax rate is a dynamic and influential component of the state’s economic fabric. Understanding its complexities, exemptions, and potential future reforms is essential for businesses and consumers alike. As Kentucky continues to evolve, the sales tax system will remain a key focus for policymakers and stakeholders, shaping the state’s economic trajectory.