Where Is Agi On Tax Return

When it comes to filing your taxes, understanding where to enter your AGI (Adjusted Gross Income) is crucial. AGI is a key metric used by tax authorities to determine your tax liability and eligibility for certain deductions and credits. This article will guide you through the process of finding the right place to report your AGI on your tax return, ensuring you complete your tax obligations accurately and efficiently.

Understanding AGI

Adjusted Gross Income (AGI) is a vital calculation in the tax filing process. It represents your total income adjusted by certain deductions and expenses. Your AGI is an important number as it impacts the taxes you owe and the deductions and credits you can claim. The Internal Revenue Service (IRS) uses AGI as a baseline to calculate your taxable income and determine your tax bracket.

Here's a simplified breakdown of how AGI is calculated:

- Start with your total income, including wages, salaries, interest, dividends, and other sources of income.

- Subtract certain deductions, such as student loan interest, IRA contributions, and certain business expenses.

- The resulting number is your Adjusted Gross Income.

AGI plays a significant role in tax planning, as it determines your eligibility for various tax benefits and deductions. It's essential to calculate your AGI accurately to ensure you're maximizing your tax savings.

Locating AGI on Tax Forms

The specific location of AGI on tax forms can vary depending on the type of tax return you’re filing. Here’s a guide to help you find the right spot for your AGI based on common tax forms:

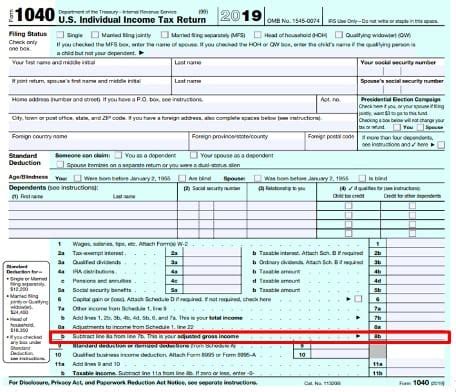

Form 1040 (Individual Income Tax Return)

For most individual taxpayers, Form 1040 is the primary tax form used. Here’s where you’ll find AGI on this form:

- Line 11: This is the designated spot for entering your AGI. It's located near the top of the form, making it one of the first pieces of information you'll input.

- Line 7: Before reaching Line 11, you'll calculate your total income on Line 7. This total income is then adjusted on Line 8 to account for certain deductions, leading to your AGI on Line 11.

Form 1040 is a comprehensive form, and Line 11 serves as a crucial junction point for various tax calculations. Ensure you have your AGI ready when filling out this form to simplify the process.

Form 1040-NR (U.S. Nonresident Alien Income Tax Return)

If you’re a nonresident alien filing taxes, you’ll use Form 1040-NR. Here’s where you’ll find AGI on this form:

- Line 37: AGI is reported on Line 37 of Form 1040-NR. This line is specifically dedicated to nonresident aliens and follows a similar calculation process as the regular Form 1040.

Nonresident aliens have unique tax considerations, and understanding where to place AGI on Form 1040-NR is essential for accurate tax reporting.

Form 1040-SS (U.S. Self-Employment Tax Return)

Self-employed individuals use Form 1040-SS to report their income and taxes. Here’s where AGI comes into play on this form:

- Line 22: AGI is entered on Line 22 of Form 1040-SS. This line is specifically designated for self-employed individuals to report their adjusted gross income.

Self-employment comes with its own set of tax complexities, and having your AGI ready simplifies the process of completing Form 1040-SS.

Form 1040-PR (U.S. Individual Income Tax Return for Puerto Rico)

For individuals residing in Puerto Rico, Form 1040-PR is the relevant tax form. Here’s where you’ll find AGI on this form:

- Line 11: AGI is reported on Line 11 of Form 1040-PR, mirroring the placement on the standard Form 1040. This line serves as a critical junction for tax calculations specific to Puerto Rico residents.

Understanding the unique tax landscape of Puerto Rico is essential, and knowing where to place AGI on Form 1040-PR is a key component of accurate tax reporting.

Form 1040-ES (Estimated Tax for Individuals)

If you’re required to make estimated tax payments throughout the year, you’ll use Form 1040-ES. Here’s where AGI comes into play on this form:

- Line 3: AGI is reported on Line 3 of Form 1040-ES. This line is specifically dedicated to individuals making estimated tax payments and serves as a crucial reference point for calculating estimated tax payments.

Estimated tax payments are an important obligation for certain taxpayers, and having your AGI ready ensures accurate calculations on Form 1040-ES.

AGI’s Impact on Tax Planning

AGI is more than just a number on your tax return. It has a significant impact on your overall tax strategy and can influence your financial decisions throughout the year. Here’s how AGI affects your tax planning:

Deductions and Credits

AGI plays a crucial role in determining your eligibility for various tax deductions and credits. Some deductions and credits have income limits tied to AGI. For example, the Child Tax Credit has an income threshold based on AGI, and certain medical expense deductions also consider AGI.

Understanding your AGI can help you make informed decisions about claiming deductions and credits. It's important to stay updated on the latest tax laws and guidelines to maximize your tax savings.

Tax Brackets and Rates

Your AGI also determines your tax bracket and the corresponding tax rates you’ll pay. The IRS uses AGI to place you in a specific tax bracket, which then determines the percentage of your income subject to taxation.

By understanding your AGI and its impact on tax brackets, you can make strategic financial decisions to potentially reduce your tax liability. This might involve exploring tax-efficient investment options or contributing to tax-advantaged retirement accounts.

Tax Strategies

AGI can be a powerful tool in your tax planning arsenal. By manipulating your AGI strategically, you can potentially lower your tax burden. Here are some strategies to consider:

- Maximizing Deductions: AGI-adjusting deductions, such as contributions to a traditional IRA or 401(k), can lower your taxable income and reduce your AGI. This strategy is particularly effective if you're close to income thresholds for certain deductions or credits.

- Strategic Timing of Income: If you have control over the timing of income, you can consider spreading it across tax years to potentially lower your AGI and tax liability. This strategy is often used by business owners and investors.

- Charitable Contributions: Donating to qualified charities can reduce your AGI and provide a tax benefit. This strategy is especially effective if you're in a higher tax bracket and can deduct a larger portion of your charitable contributions.

It's important to consult with a tax professional or financial advisor to understand the specific strategies that align with your financial goals and tax situation.

AGI’s Role in Tax Audits

AGI is a critical piece of information in the event of a tax audit. Tax authorities, such as the IRS, use AGI as a starting point to verify the accuracy of your tax return. Here’s how AGI factors into tax audits:

Audit Selection

AGI can influence your likelihood of being selected for an audit. The IRS uses various factors, including AGI, to identify tax returns for further scrutiny. Higher AGI individuals may be more likely to be audited, especially if there are discrepancies or potential red flags in their tax returns.

Audit Process

During an audit, the IRS will thoroughly review your tax return, including your AGI calculation. They will verify the accuracy of your income, deductions, and credits to ensure they align with your reported AGI. Any discrepancies or errors in your AGI calculation could lead to further scrutiny and potential penalties.

It's crucial to maintain accurate records and documentation to support your AGI and other tax return information. This helps ensure a smooth audit process and reduces the risk of penalties or additional taxes.

Tips for Accurate AGI Reporting

To ensure you’re reporting your AGI accurately on your tax return, consider the following tips:

- Gather Income Records: Collect all relevant income statements, such as W-2s, 1099s, and interest statements. This ensures you capture all sources of income in your AGI calculation.

- Review Deductions: Carefully review the deductions you're claiming. Make sure they're eligible and properly documented. This helps ensure your AGI calculation is accurate and supported by valid deductions.

- Use Tax Software: Tax software can simplify the AGI calculation process by automatically populating relevant forms and guiding you through the necessary deductions. This reduces the risk of errors and ensures a more accurate AGI.

- Seek Professional Help: If you have complex tax situations or are unsure about your AGI calculation, consider consulting a tax professional. They can provide expert guidance and ensure your AGI is reported accurately.

Future of AGI Reporting

As technology continues to advance, the future of AGI reporting is likely to become even more streamlined and efficient. Here’s a glimpse into the potential future of AGI reporting:

Digital Tax Returns

With the increasing popularity of digital tax software and online filing, the process of reporting AGI is expected to become even more user-friendly. Taxpayers will likely have access to intuitive interfaces that guide them through the AGI calculation process, reducing the risk of errors.

Real-Time Data Integration

In the future, tax authorities may have access to real-time data from various sources, such as banks and employers. This could lead to a more automated AGI calculation process, where tax returns are pre-populated with accurate income and deduction information.

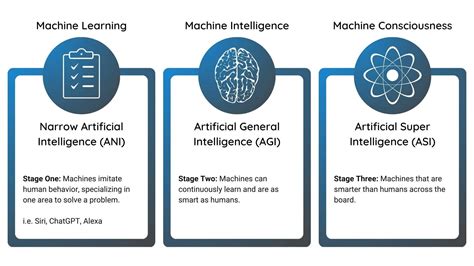

Artificial Intelligence (AI) Assistance

AI-powered tax assistants could become more prevalent, offering personalized guidance and suggestions for AGI reporting. These AI tools could analyze your financial data and provide insights to help you optimize your AGI and tax strategy.

While the future of AGI reporting looks promising, it's important to stay informed about the latest tax laws and regulations. The tax landscape is constantly evolving, and staying up-to-date ensures you can make the most of the available tax benefits and strategies.

Conclusion

Understanding where to report your AGI on your tax return is a fundamental aspect of tax compliance. By knowing the specific location on your tax forms and the impact of AGI on your tax planning, you can ensure an accurate and strategic approach to your taxes. Whether you’re an individual taxpayer or a business owner, AGI is a critical metric to master for a successful tax filing journey.

What happens if I report my AGI incorrectly on my tax return?

+Reporting your AGI incorrectly can have serious consequences. It may lead to an audit, additional taxes, and penalties. It’s crucial to review your AGI calculation carefully and consult a tax professional if needed to ensure accuracy.

Can I adjust my AGI to lower my taxes?

+Yes, there are legal strategies to adjust your AGI and potentially lower your taxes. However, it’s important to consult a tax professional to ensure you’re taking advantage of legitimate deductions and credits. Manipulating your AGI illegally can lead to severe penalties.

How often should I update my AGI calculation?

+You should update your AGI calculation annually when filing your tax return. However, if your financial situation changes significantly during the year, it’s advisable to consult a tax professional to determine if any adjustments are necessary.