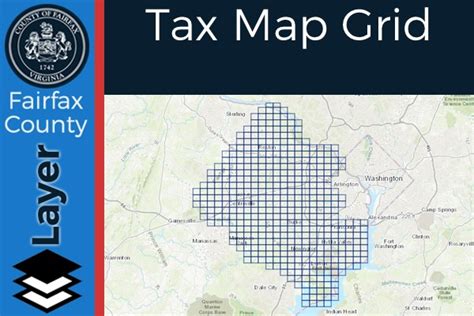

Fairfax County Tax

Welcome to our comprehensive guide on Fairfax County Tax, a topic of interest for residents and property owners in this vibrant county. As one of the largest counties in Virginia, Fairfax County boasts a diverse economy, a rich history, and a vibrant community. However, with great prosperity comes the responsibility of understanding and managing local taxes. This article aims to shed light on the intricacies of Fairfax County's tax system, offering a deep dive into its various components, benefits, and potential challenges.

Understanding Fairfax County’s Tax Structure

Fairfax County operates on a robust tax system, designed to fund essential public services and maintain the county’s infrastructure. The tax structure is primarily composed of real estate taxes, personal property taxes, and a range of business and professional taxes. These taxes are levied based on the value of property, assets, and income generated within the county.

The county's tax system is renowned for its efficiency and transparency. The Fairfax County Board of Supervisors, elected representatives of the county's various districts, oversee the tax assessment and collection processes. They work in conjunction with the Fairfax County Tax Office, which is responsible for assessing property values, collecting taxes, and providing assistance to taxpayers.

Real Estate Taxes: A Closer Look

Real estate taxes form the backbone of Fairfax County’s tax revenue. These taxes are assessed on both residential and commercial properties, with the tax rate varying based on the property’s assessed value and its classification (residential, commercial, or agricultural). The tax rate is determined annually by the Board of Supervisors, and it is subject to change based on the county’s budgetary needs and economic conditions.

The assessment process for real estate taxes involves a detailed evaluation of each property by the Fairfax County Office of Real Estate Assessments. This office considers various factors, including the property's location, size, condition, and recent sales data of similar properties in the area. The assessed value is then used to calculate the tax liability for each property owner.

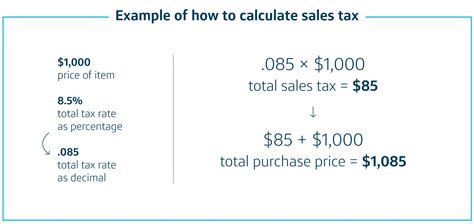

To illustrate, let's consider a hypothetical scenario. Assume a residential property in Fairfax County has an assessed value of $500,000, and the current tax rate is 0.99% for residential properties. The annual real estate tax liability for this property would be calculated as follows:

| Assessed Value | Tax Rate | Annual Tax Liability |

|---|---|---|

| $500,000 | 0.99% | $4,950 |

It's important to note that Fairfax County offers various tax relief programs to eligible homeowners, such as the Homestead Exemption, which reduces the taxable value of a primary residence, and the Land Use Assessment Program, which provides tax benefits for landowners who preserve their property for agricultural or conservation purposes.

Personal Property Taxes: Beyond Real Estate

While real estate taxes take center stage, Fairfax County also levies taxes on personal property, including vehicles, boats, and aircraft. These taxes are assessed annually and are based on the property’s value and the type of property. The tax rates for personal property are typically lower than those for real estate, but they can still vary depending on the property’s age, condition, and other factors.

For instance, the tax rate for passenger vehicles in Fairfax County is calculated based on the vehicle's wholesale value, with older vehicles typically having lower tax rates. The county uses a Base Tax Table to determine the tax rate for each vehicle, considering its make, model, and age. This table is updated annually to reflect changes in vehicle values.

Let's look at an example. Suppose you own a 2018 sedan with a wholesale value of $20,000. According to the Base Tax Table, the tax rate for this vehicle would be 0.65%. Your annual personal property tax liability for this vehicle would be calculated as follows:

| Vehicle Value | Tax Rate | Annual Tax Liability |

|---|---|---|

| $20,000 | 0.65% | $130 |

Fairfax County offers tax exemptions for certain personal property, such as vehicles used for business purposes or those owned by disabled veterans. These exemptions can significantly reduce the tax liability for eligible taxpayers.

Business and Professional Taxes: Powering the Economy

Fairfax County’s thriving economy is fueled by a robust business community, and the county’s tax system plays a crucial role in supporting this economic engine. Businesses operating within the county are subject to various taxes, including business license taxes, machinery and tools taxes, and business, professional, and occupational license taxes (BPOL taxes). These taxes contribute to the county’s revenue and help fund essential services and infrastructure projects.

The Fairfax County Business Tax Office is responsible for administering and collecting these business taxes. They provide resources and guidance to help businesses understand their tax obligations and ensure compliance. The tax rates for these business taxes can vary depending on the type of business, its location within the county, and its revenue or payroll.

For instance, the BPOL tax rate for a professional service firm with annual gross receipts of $500,000 could be as low as 0.125%, while a retail business with the same gross receipts might be subject to a higher rate of 0.25%. These rates are determined by the Board of Supervisors and can change based on the county's budgetary requirements.

Fairfax County Tax Benefits and Challenges

Fairfax County’s tax system offers several benefits to taxpayers, including the aforementioned tax relief programs and exemptions. Additionally, the county’s strong fiscal management has resulted in a stable and reliable tax system, providing consistent funding for public services and infrastructure development.

However, the county's tax system is not without its challenges. One of the primary concerns for taxpayers is the potential for property value reassessments, which can lead to increased tax liabilities. While these reassessments are necessary to ensure the tax system remains fair and equitable, they can be a source of anxiety for property owners.

Another challenge is the complexity of the tax system, especially for businesses. With multiple types of business taxes and varying tax rates, businesses need to stay informed and compliant to avoid penalties. The Fairfax County Business Tax Office provides valuable resources and guidance to help businesses navigate this complexity.

Fairfax County Tax Relief Programs: A Lifeline for Taxpayers

Recognizing the financial burden that taxes can impose on certain segments of the population, Fairfax County has implemented several tax relief programs to provide assistance to eligible taxpayers. These programs aim to make the tax system more equitable and to support residents facing economic hardships.

One of the most significant tax relief programs is the Homestead Exemption. This program allows eligible homeowners to reduce the taxable value of their primary residence, effectively lowering their real estate tax liability. To qualify, homeowners must meet certain income and residency requirements, and the exemption amount can vary based on factors like age, disability, and military service.

For instance, a homeowner who is over 65 years old, has an annual income below a certain threshold, and has lived in Fairfax County for at least five years might be eligible for a Homestead Exemption of up to $500,000. This exemption would significantly reduce their real estate tax liability, providing much-needed financial relief.

Another notable tax relief program is the Land Use Assessment Program. This program offers tax benefits to landowners who agree to preserve their property for agricultural or conservation purposes. By keeping land in agricultural use or preserving it for natural habitat, landowners can receive a reduced assessment rate, lowering their real estate tax liability.

Additionally, Fairfax County provides tax relief for veterans, offering exemptions and reduced tax rates for certain types of personal property owned by disabled veterans. These programs aim to honor the service and sacrifice of veterans while providing them with much-needed financial support.

Navigating the Complexity: Fairfax County’s Tax Resources

Given the complexity of Fairfax County’s tax system, the county provides an array of resources to assist taxpayers in understanding their obligations and rights. These resources are designed to empower taxpayers, ensuring they can navigate the tax system confidently and efficiently.

The Fairfax County Tax Office offers a comprehensive website with detailed information on all aspects of the county's tax system. This website provides resources for both residential and business taxpayers, including tax rates, assessment information, and details on tax relief programs. Taxpayers can access forms, make payments, and track the status of their tax accounts online, making the tax process more convenient and transparent.

In addition to the online resources, the Fairfax County Tax Office operates a dedicated taxpayer assistance center. This center provides personalized assistance to taxpayers, answering questions, providing guidance, and resolving issues related to tax assessments, payments, and relief programs. Taxpayers can visit the center in person or contact them via phone or email.

Furthermore, Fairfax County hosts taxpayer workshops and seminars throughout the year. These events offer valuable insights into the tax system, providing taxpayers with an opportunity to learn about new tax laws, understand complex tax topics, and connect with other taxpayers and tax professionals. These workshops are often free or low-cost, making them accessible to all county residents.

Fairfax County Tax: A Look to the Future

As Fairfax County continues to thrive and grow, its tax system will play a pivotal role in shaping the county’s future. The county’s strong fiscal management and commitment to transparency have established a solid foundation for the tax system, ensuring its stability and effectiveness.

Looking ahead, the county's tax system is expected to continue evolving to meet the changing needs of its residents and businesses. This evolution may involve the introduction of new tax relief programs, the refinement of existing programs, and the adoption of innovative tax collection methods to enhance efficiency and convenience.

Furthermore, Fairfax County is committed to promoting economic development and supporting its business community. The county is likely to explore ways to streamline business taxes, reduce compliance burdens, and provide incentives to attract and retain businesses. These efforts will not only benefit businesses but will also contribute to the overall economic growth and prosperity of the county.

In conclusion, Fairfax County's tax system is a vital component of the county's success, funding essential services and infrastructure while supporting its thriving economy. While the tax system may present challenges, the county's commitment to transparency, fairness, and taxpayer assistance ensures that taxpayers can navigate the system with confidence. As Fairfax County looks to the future, its tax system will continue to adapt and evolve, ensuring the county's continued prosperity and the well-being of its residents and businesses.

How often are real estate taxes assessed in Fairfax County?

+Real estate taxes are assessed annually in Fairfax County. The assessment process involves evaluating the property’s value based on factors like location, size, condition, and recent sales data. This ensures that the tax liability is fair and accurate.

Are there any tax exemptions for senior citizens in Fairfax County?

+Yes, Fairfax County offers the Homestead Exemption program, which provides tax relief to eligible senior citizens. To qualify, homeowners must meet certain age, income, and residency requirements. The exemption reduces the taxable value of their primary residence, lowering their real estate tax liability.

How can I stay informed about changes in tax rates and laws in Fairfax County?

+Fairfax County provides a wealth of resources to keep taxpayers informed. The Fairfax County Tax Office website is a valuable source of information, providing updates on tax rates, laws, and relief programs. Additionally, the county hosts taxpayer workshops and seminars, offering opportunities to learn about tax changes and connect with tax professionals.