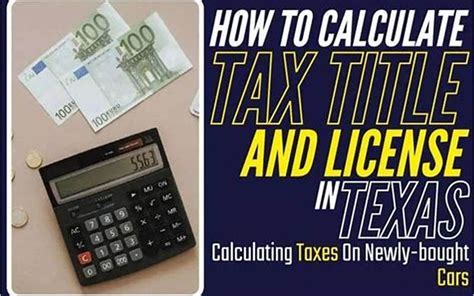

Tax Title License Calculator

In the complex world of vehicle ownership, understanding the financial obligations that come with purchasing a car can be a daunting task. The Tax, Title, and License (TTL) fees are an essential part of the overall cost of owning a vehicle, and they vary significantly depending on numerous factors. This article aims to provide an in-depth analysis of TTL fees, offering a comprehensive guide to help prospective vehicle owners navigate these costs with clarity and confidence.

Unraveling the Complexity of Tax, Title, and License Fees

The Tax, Title, and License fees, often referred to as TTL fees, are a trio of expenses that are integral to the process of registering a vehicle in the United States. These fees are mandatory and must be paid to the state or local government before a vehicle can be legally operated on public roads.

Taxes: A Crucial Component of TTL

The tax component of TTL is typically calculated as a percentage of the vehicle’s purchase price. This percentage varies from state to state, with some states imposing a flat rate while others calculate it based on the vehicle’s make, model, and year. For instance, in Texas, the sales tax on vehicles is 6.25%, while in Washington, it can range from 2.9% to 10.4% depending on the county.

| State | Sales Tax Rate |

|---|---|

| Texas | 6.25% |

| Washington | 2.9% - 10.4% |

| California | 7.25% (State) + Local Taxes |

It's important to note that sales tax is often just one part of the tax equation. Additional taxes, such as use tax, luxury tax, or excise tax, may also apply, depending on the state and the type of vehicle being purchased.

Title Fees: Official Ownership Documentation

Title fees are charged by the state to register and record the ownership of a vehicle. This fee is usually a flat rate and is used to cover the administrative costs of processing and maintaining vehicle titles. The title fee ensures that the vehicle’s ownership is legally recognized and documented, providing a crucial record for future transactions.

| State | Title Fee |

|---|---|

| California | $15.00 |

| Texas | $33.00 |

| Florida | $75.25 |

The title fee is a critical component of the registration process, ensuring that the vehicle's ownership is properly recorded and that the new owner has the necessary documentation to prove their legal right to operate the vehicle.

License Fees: Permitting Operation on Public Roads

License fees, often referred to as registration fees, are charged by the state to permit the operation of a vehicle on public roads. These fees typically vary based on the type of vehicle, its weight, and its intended use. For example, a standard passenger vehicle will have different license fees than a commercial truck or a motorcycle.

| Vehicle Type | Registration Fee |

|---|---|

| Passenger Vehicle | $36.00 - $72.00 (Annual) |

| Motorcycle | $20.00 - $30.00 (Annual) |

| Commercial Truck | Varies by Gross Vehicle Weight Rating (GVWR) |

License fees are essential for maintaining public safety and ensuring that vehicles meet certain standards and regulations before being allowed on the road. These fees cover administrative costs and contribute to road maintenance and safety initiatives.

Understanding the Total Cost of Ownership

When calculating the total TTL fees, it’s crucial to consider not just the tax, title, and license fees, but also any additional costs that may be associated with registering a vehicle. These can include emissions testing fees, title transfer fees, or even special taxes for certain types of vehicles, such as electric or hybrid cars.

For instance, in California, there is an additional Clean Air Vehicle Decal Fee for certain low-emission vehicles, which can add up to $150 to the total TTL cost. Additionally, some states charge a separate fee for title transfers, which can range from $10 to $50.

Calculating TTL Fees: A Step-by-Step Guide

Calculating TTL fees can be complex, given the variety of factors that influence these costs. However, with the right information and tools, it’s possible to estimate these fees accurately. Here’s a step-by-step guide to help you calculate your TTL expenses:

- Determine the Purchase Price of the Vehicle: Start by identifying the purchase price of the vehicle. This is typically the final negotiated price, including any applicable discounts or rebates.

- Calculate the Sales Tax: Multiply the purchase price by the applicable sales tax rate for your state. This will give you the estimated sales tax amount.

- Research and Note the Title Fee: Look up the title fee for your state. This is often a flat rate and can be found on the Department of Motor Vehicles (DMV) website for your state.

- Identify the Registration Fee: Determine the registration fee for your vehicle type. This can vary based on the vehicle's weight and use, so be sure to select the correct category.

- Consider Additional Fees: Check for any additional fees that may apply in your state, such as emissions testing fees or special taxes for certain vehicle types.

- Calculate the Total TTL Fees: Add up all the fees, including the sales tax, title fee, registration fee, and any additional charges. This will give you the estimated total TTL cost.

It's important to note that while this guide provides a comprehensive framework for calculating TTL fees, the specific costs can vary significantly based on your state, local government, and the type of vehicle you're purchasing. It's always advisable to consult official government resources or seek professional advice for the most accurate and up-to-date information.

State-Specific TTL Fees: A Comparative Analysis

The variability of TTL fees across different states is significant, with some states imposing much higher costs than others. This section provides a comparative analysis of TTL fees in several states, offering a snapshot of the diverse landscape of vehicle registration costs across the United States.

Texas: A State with Affordable TTL Fees

Texas is known for having relatively affordable TTL fees. The sales tax rate in the state is 6.25%, which is applied to the vehicle’s purchase price. The title fee is 33.00, which is a flat rate. Registration fees vary based on the vehicle type, but for a standard passenger vehicle, the annual registration fee is typically around 50.00.

Thus, for a $20,000 vehicle in Texas, the estimated TTL fees would be:

- Sales Tax: $20,000 * 0.0625 = $1,250

- Title Fee: $33.00

- Registration Fee: $50.00

- Total TTL Fees: $1,333.00

California: High TTL Fees but Varied Taxes

California is known for having high TTL fees, especially when it comes to sales tax. The state sales tax rate is 7.25%, but this can vary by county, with some counties imposing additional local taxes. The title fee in California is 15.00, and registration fees can range from 36.00 to $72.00 annually for a standard passenger vehicle.

However, California also has a unique set of additional taxes and fees. For instance, the Clean Air Vehicle Decal Fee can add up to $150 for certain low-emission vehicles. Additionally, there are fees for title transfers and emissions testing.

Florida: Competitive TTL Fees with Some Surprises

Florida has competitive TTL fees, with a sales tax rate of 6% and a title fee of 75.25. Registration fees for a standard passenger vehicle are around 224.25 annually. However, Florida also has a unique set of fees, such as a 2.00 "Disaster Preparedness Fee" and a 1.00 “Wildlife Conservation Fee.”

Thus, for a $20,000 vehicle in Florida, the estimated TTL fees would be:

- Sales Tax: $20,000 * 0.06 = $1,200

- Title Fee: $75.25

- Registration Fee: $224.25

- Additional Fees: $3.00 (Disaster Preparedness and Wildlife Conservation Fees)

- Total TTL Fees: $1,499.25

Washington: A State with Varied TTL Fees

Washington has a unique sales tax structure, with rates varying from 2.9% to 10.4% depending on the county. The state also has a 30.00 title fee and registration fees that can range from 45.00 to $140.00 annually for a standard passenger vehicle.

Thus, for a $20,000 vehicle in Washington (assuming a 6% sales tax rate), the estimated TTL fees would be:

- Sales Tax: $20,000 * 0.06 = $1,200

- Title Fee: $30.00

- Registration Fee: $45.00 - $140.00 (depending on the county)

- Total TTL Fees: $1,275.00 - $1,375.00

The Future of TTL Fees: Trends and Implications

The landscape of TTL fees is constantly evolving, influenced by various factors such as economic conditions, environmental concerns, and changes in state policies. Understanding these trends is crucial for vehicle owners and prospective buyers alike, as it can significantly impact the overall cost of vehicle ownership.

The Rise of Electric and Hybrid Vehicles

With the increasing popularity of electric and hybrid vehicles, many states are considering or have already implemented special taxes and fees for these types of vehicles. The rationale behind these fees is twofold: to generate revenue for infrastructure upgrades and to compensate for lost fuel tax revenue, as these vehicles typically use less or no gasoline.

For instance, California has a Clean Air Vehicle Decal Fee that ranges from $25 to $150, depending on the vehicle's emission standards. Similarly, Washington has a Low Emission Vehicle Annual Fee that ranges from $75 to $120.

The Impact of Economic Conditions

Economic conditions can also play a significant role in the evolution of TTL fees. During times of economic downturn, states may increase sales tax rates or introduce new fees to generate additional revenue. Conversely, during periods of economic prosperity, states may reduce or eliminate certain fees to stimulate vehicle sales.

For example, during the COVID-19 pandemic, several states, including New York and New Jersey, temporarily waived certain vehicle registration fees to provide financial relief to residents.

The Role of Environmental Policies

Environmental policies are another significant factor influencing TTL fees. As states strive to meet emission reduction targets, they may introduce incentives or penalties to encourage the adoption of electric and hybrid vehicles. This can take the form of reduced registration fees or special tax credits for these types of vehicles.

Additionally, states may impose higher registration fees on vehicles with higher emissions, effectively penalizing owners of gas-guzzling vehicles. This strategy aims to encourage the use of more environmentally friendly vehicles and reduce carbon emissions.

The Influence of Technological Advancements

Technological advancements in the automotive industry can also impact TTL fees. For instance, the introduction of autonomous vehicles may lead to new types of fees or taxes. As these vehicles become more prevalent, states may need to invest in infrastructure upgrades, such as dedicated lanes or charging stations, which could be funded through additional fees or taxes.

Furthermore, the increasing use of telematics and vehicle connectivity may lead to new types of fees based on vehicle usage or mileage. This could incentivize more efficient driving habits and reduce traffic congestion.

Conclusion: Navigating the Complex World of TTL Fees

Understanding and calculating Tax, Title, and License fees is a critical aspect of vehicle ownership. With the diverse range of fees and the ever-changing landscape of state policies, it’s essential to stay informed and up-to-date with the latest regulations and trends. By doing so, vehicle owners can make more informed decisions and effectively manage the financial obligations associated with owning a vehicle.

Stay Informed, Stay Prepared

TTL fees can vary significantly depending on a multitude of factors, including the state you reside in, the type of vehicle you purchase, and even the economic and environmental policies in place at the time of purchase. By staying informed about these factors, you can better prepare for the financial obligations that come with vehicle ownership.

Seek Professional Advice

While this guide provides a comprehensive framework for calculating TTL fees, it’s always advisable to seek professional advice from a qualified tax advisor or vehicle registration expert. They can provide personalized guidance based on your specific circumstances and ensure that you’re fully compliant with all relevant regulations.

Consider the Total Cost of Ownership

When evaluating the financial implications of vehicle ownership, it’s crucial to consider not just the upfront TTL fees, but also the ongoing costs associated with maintaining and operating the vehicle. These costs can include fuel, insurance, maintenance, and repairs, which can significantly impact your overall budget.

Embrace Technological Tools

In today’s digital age, there are numerous online tools and resources available to help you calculate and manage TTL fees. These tools can provide accurate estimates, track your vehicle’s registration status, and even remind you when your registration is due for renewal. By leveraging these technologies, you can streamline the process of managing your vehicle’s TTL obligations.

FAQ

What are Tax, Title, and License (TTL) fees, and why are they important for vehicle owners?

+

TTL fees are a combination of taxes, title fees, and license (or registration) fees that must be paid to legally operate a vehicle on public roads. These fees vary by state and vehicle type, and they are crucial for ensuring proper registration, documentation of ownership, and compliance with state regulations.

How do I calculate the TTL fees for my vehicle purchase?

+

Calculating TTL fees involves determining the purchase price of your vehicle, the applicable sales tax rate, the title fee, and the registration fee. Additional costs, such as emissions testing fees or special taxes, may also apply. It’s best to consult official government resources or seek professional advice for the most accurate information.

Are there any ways to reduce or avoid TTL fees?

+

TTL fees are mandatory and set by state regulations, so there are no legal ways to avoid them entirely. However, you may be able to reduce certain fees by purchasing a vehicle that qualifies for tax credits or incentives, such as electric or hybrid vehicles in some states. Additionally, staying informed about state policies and economic conditions can help you plan your vehicle purchase strategically.