Arkansas Auto Sales Tax

When it comes to purchasing a vehicle, understanding the various taxes and fees involved is crucial. Arkansas, like many other states, imposes an auto sales tax, which can significantly impact the overall cost of buying a car. In this comprehensive guide, we will delve into the intricacies of the Arkansas auto sales tax, exploring its structure, rates, exemptions, and the impact it has on both residents and out-of-state buyers. By the end of this article, you'll have a thorough understanding of this tax and be equipped with valuable insights to make informed decisions when purchasing a vehicle in the Natural State.

Understanding the Arkansas Auto Sales Tax

The Arkansas auto sales tax is a state-imposed tax levied on the purchase of vehicles, including cars, trucks, SUVs, and motorcycles. This tax contributes to the state’s revenue and is used to fund various public services and infrastructure projects. It is important for buyers to be aware of this tax and its implications to budget effectively and plan their vehicle purchases accordingly.

The auto sales tax in Arkansas is calculated as a percentage of the purchase price of the vehicle. The rate, however, can vary depending on several factors, including the type of vehicle, its age, and the location of the sale. Understanding these variables is essential to estimate the tax accurately and avoid any surprises during the purchase process.

Tax Rate Structure

Arkansas has a progressive tax rate structure for auto sales, which means the tax rate increases as the value of the vehicle rises. This approach ensures that buyers of more expensive vehicles contribute a higher proportion of the tax. The current tax rate schedule is as follows:

| Vehicle Value | Tax Rate |

|---|---|

| Up to $4,000 | 3% |

| $4,001 - $10,000 | 4% |

| $10,001 - $20,000 | 6% |

| $20,001 and above | 7% |

It's important to note that these rates are subject to change, so it is advisable to check the official Arkansas Department of Finance and Administration website for the most up-to-date information.

Exemptions and Special Cases

While the auto sales tax applies to most vehicle purchases, there are certain exemptions and special cases that buyers should be aware of. These exemptions can help reduce the overall tax burden and are worth exploring for potential savings.

- Trade-Ins and Rebates: If you trade in your old vehicle as part of the purchase, the value of the trade-in can be deducted from the purchase price, potentially lowering the tax amount. Additionally, any manufacturer or dealer rebates can also reduce the taxable value of the vehicle.

- Military Personnel: Active-duty military personnel stationed in Arkansas may be eligible for a reduced tax rate. This exemption is in recognition of their service and can provide significant savings on vehicle purchases.

- Disabled Individuals: Arkansas offers tax exemptions for certain vehicles purchased by individuals with disabilities. These exemptions apply to vehicles specifically adapted for the disabled person's use, such as wheelchair-accessible vans.

- Out-of-State Purchases: If you purchase a vehicle from a dealer in another state and register it in Arkansas, you may be required to pay a use tax. This tax is calculated similarly to the sales tax and ensures that out-of-state purchases contribute to Arkansas' revenue.

Impact on In-State and Out-of-State Buyers

The Arkansas auto sales tax has different implications for in-state and out-of-state buyers. Understanding these distinctions is crucial for both groups to make informed decisions and plan their vehicle purchases effectively.

In-State Buyers

For Arkansas residents, the auto sales tax is a standard cost associated with purchasing a vehicle. When buying from a local dealer, the tax is typically included in the final price, making it convenient and straightforward. However, it is essential to be aware of the tax rate and any applicable exemptions to ensure you are not overcharged.

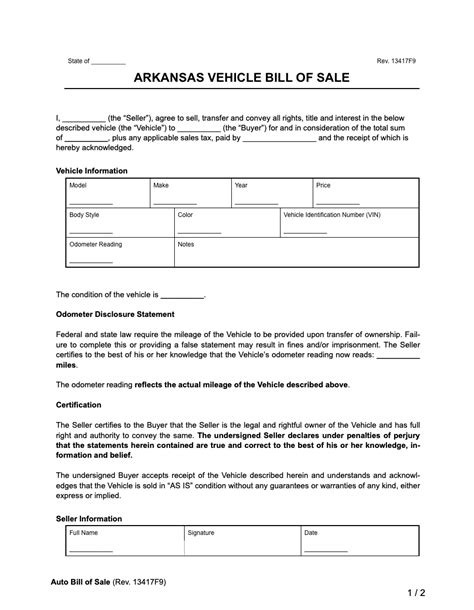

When purchasing a used vehicle from a private seller, the buyer is responsible for calculating and paying the auto sales tax. This process involves providing the necessary documentation to the Department of Finance and Administration to register the vehicle and obtain a title.

Out-of-State Buyers

Out-of-state buyers face a different scenario when it comes to the Arkansas auto sales tax. If you purchase a vehicle from an Arkansas dealer and plan to register it in your home state, you may be subject to the use tax mentioned earlier. This tax ensures that vehicles purchased in Arkansas contribute to the state’s revenue, regardless of where they are registered.

It is crucial for out-of-state buyers to understand the tax laws in both Arkansas and their home state. Some states may have reciprocity agreements with Arkansas, allowing for a reduced or waived tax burden. On the other hand, certain states may impose their own taxes on vehicles purchased out of state. Researching these laws and consulting with tax professionals can help out-of-state buyers navigate this complex landscape.

Calculating the Auto Sales Tax

Calculating the auto sales tax accurately is essential to budget effectively and avoid any unexpected expenses. Here’s a step-by-step guide to help you determine the tax amount for your vehicle purchase:

- Determine the Purchase Price: Start by identifying the total purchase price of the vehicle, including any additional fees or options. This price will be the basis for calculating the tax.

- Identify the Tax Rate: Refer to the tax rate schedule provided earlier in this article or check the official Arkansas tax website for the most current rates. Determine the applicable tax rate based on the vehicle's value.

- Calculate the Tax: Multiply the purchase price by the tax rate to find the tax amount. For example, if the vehicle costs $25,000 and the tax rate is 7%, the tax amount would be $1,750.

- Consider Exemptions: If you are eligible for any exemptions, such as trade-in deductions or military discounts, subtract these amounts from the purchase price before calculating the tax. This step can significantly reduce the tax burden.

It is important to note that the calculation process may vary slightly depending on the specific circumstances of your purchase. For instance, if you are buying a used vehicle from a private seller, you may need to provide additional documentation to the Arkansas Department of Finance and Administration to determine the correct tax amount.

Comparing Arkansas Auto Sales Tax with Other States

To gain a broader perspective, let’s compare the auto sales tax in Arkansas with that of a few neighboring states. This analysis will provide valuable insights into how Arkansas fares in terms of tax rates and overall cost to vehicle buyers.

| State | Tax Rate | Additional Fees |

|---|---|---|

| Arkansas | Progressive (3%-7%) | Title and registration fees |

| Texas | 6.25% | Title transfer fee, registration fee |

| Oklahoma | 4.5% | Title and registration fees |

| Missouri | 4% | Title and registration fees, excise tax |

As the table illustrates, Arkansas's progressive tax rate structure sets it apart from its neighboring states. While Texas has a higher flat rate, Oklahoma and Missouri have lower tax rates. However, it is important to consider the additional fees and potential exemptions when comparing the overall cost of vehicle ownership.

Future Implications and Potential Changes

The Arkansas auto sales tax, like any tax policy, is subject to change and evolution. As economic conditions and political landscapes shift, the tax rates and exemptions may be adjusted to align with the state’s financial needs and priorities.

Currently, there are ongoing discussions and proposals to modify the auto sales tax structure in Arkansas. Some suggestions include simplifying the rate schedule, introducing additional exemptions for certain vehicle types, or even implementing a flat tax rate. These changes, if enacted, could have a significant impact on the cost of purchasing vehicles in the state.

Staying informed about any proposed changes and their potential effects is crucial for both residents and businesses in Arkansas. By being aware of these potential shifts, individuals can make more informed decisions when planning vehicle purchases, and businesses can adjust their pricing strategies accordingly.

Conclusion

Understanding the Arkansas auto sales tax is essential for anyone considering a vehicle purchase in the state. With its progressive rate structure, exemptions, and impact on both in-state and out-of-state buyers, this tax plays a significant role in the overall cost of vehicle ownership. By delving into the intricacies of the tax, calculating it accurately, and staying informed about potential changes, buyers can make well-informed decisions and plan their purchases effectively.

As you navigate the vehicle-buying process in Arkansas, remember to research, ask questions, and seek professional advice when needed. With the right knowledge and preparation, you can ensure a smooth and cost-effective vehicle purchase experience.

Are there any ways to reduce the auto sales tax burden in Arkansas?

+Yes, there are a few strategies to consider. Trading in your old vehicle and applying for applicable exemptions, such as those for military personnel or disabled individuals, can help reduce the tax burden. Additionally, carefully researching and comparing dealers’ offers can sometimes lead to negotiated deals that include tax savings.

How often are the auto sales tax rates updated in Arkansas?

+The tax rates are typically reviewed and updated annually by the Arkansas Department of Finance and Administration. However, in certain circumstances, such as economic shifts or legislative changes, the rates may be adjusted more frequently. It’s always a good practice to check the official sources for the most up-to-date information.

What happens if I fail to pay the auto sales tax when purchasing a vehicle in Arkansas?

+Failing to pay the auto sales tax can result in significant penalties and legal consequences. It’s important to ensure that the tax is paid promptly to avoid any issues with vehicle registration and potential legal action. Consult with a tax professional or the Arkansas Department of Finance and Administration for guidance if you have any concerns.

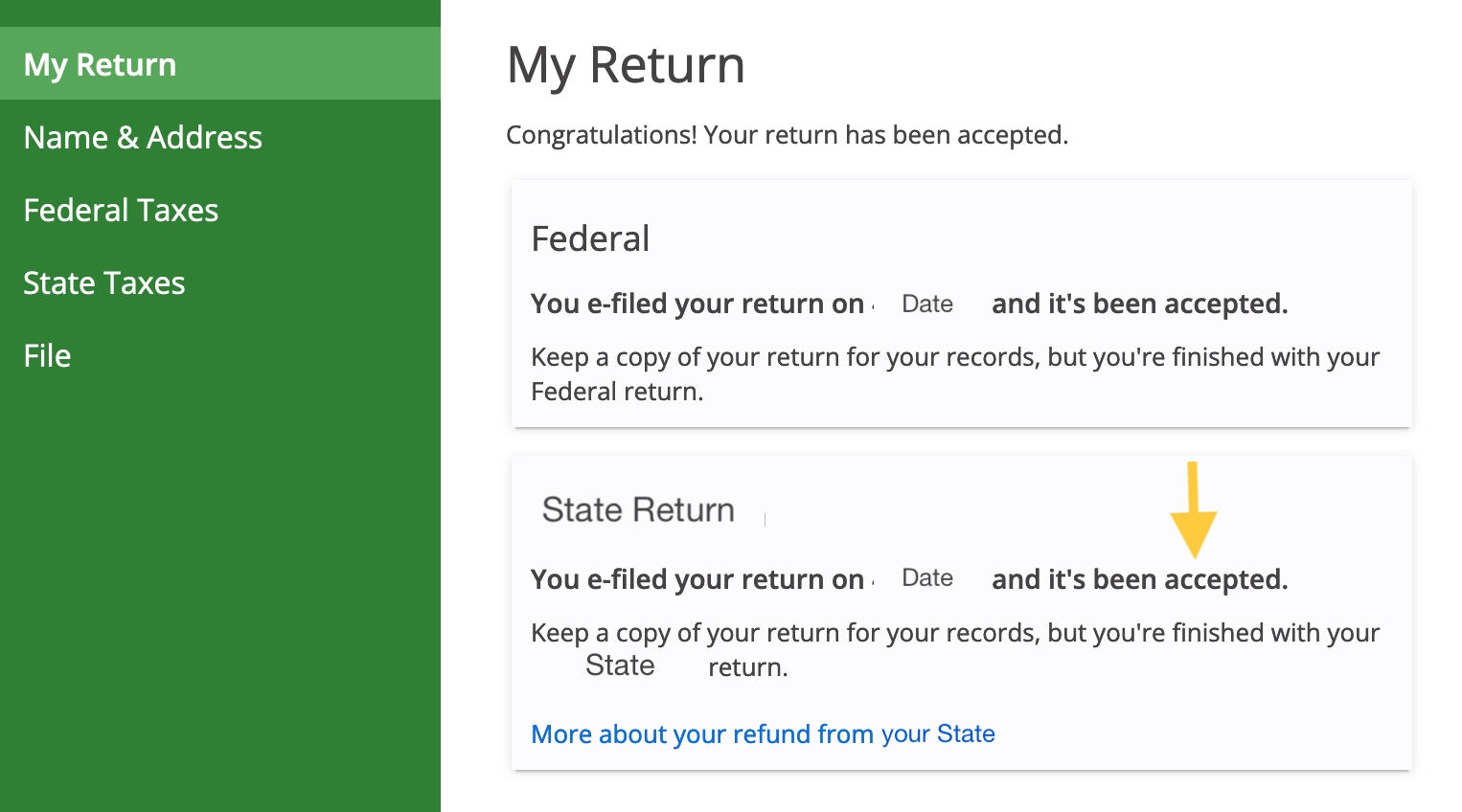

Are there any online resources or calculators available to estimate the auto sales tax in Arkansas?

+Yes, there are several online tools and calculators available that can provide estimates of the auto sales tax based on the vehicle’s value and the applicable tax rate. These resources can be valuable for budgeting and planning your vehicle purchase. However, always refer to official sources for the most accurate and up-to-date information.