Pay Oregon Taxes Online

In today's digital age, managing financial obligations like paying taxes has become more convenient and accessible than ever. The Oregon Department of Revenue (ODOR) offers an online platform that allows residents and businesses to pay their taxes efficiently and securely. This article will guide you through the process of paying Oregon taxes online, covering everything from the benefits of online payment to the step-by-step procedure and potential challenges you might encounter.

The Benefits of Paying Oregon Taxes Online

The ODOR’s online tax payment system provides numerous advantages, making it a preferred method for many taxpayers. Here are some key benefits:

- Convenience and Accessibility: Online tax payment allows you to settle your tax liabilities from the comfort of your home or office, eliminating the need for physical visits to tax offices.

- Time Efficiency: With online payment, you can complete the process quickly, saving valuable time compared to traditional manual methods.

- Secure Transactions: The ODOR employs advanced security measures to protect your financial information, ensuring that your payments are safe and confidential.

- Real-Time Updates: The online system provides real-time updates on your tax payments, helping you keep track of your financial obligations easily.

- Flexibility in Payment Options: The ODOR offers various payment methods, including credit cards, debit cards, and electronic checks, catering to different preferences and needs.

Step-by-Step Guide to Paying Oregon Taxes Online

Now that we’ve established the advantages, let’s delve into the process of paying Oregon taxes online. Follow these steps to ensure a smooth and successful transaction:

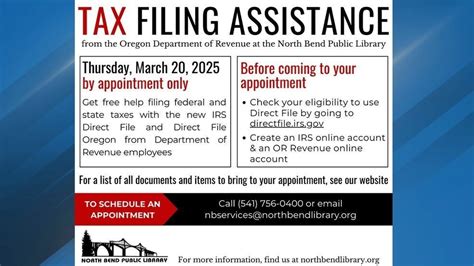

- Access the ODOR Website: Begin by visiting the official Oregon Department of Revenue website at https://www.oregon.gov/dor. This is the secure and official platform for tax-related transactions.

- Register or Log In: If you are a new user, you’ll need to register an account. Provide the necessary details, such as your name, contact information, and tax identification number. If you already have an account, simply log in using your credentials.

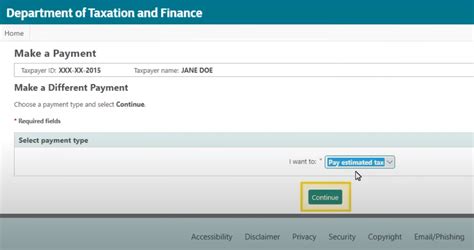

- Select the Tax Type: The ODOR website caters to various tax types, including income tax, corporate tax, sales tax, and more. Choose the specific tax for which you wish to make a payment.

- Enter Tax Information: You will be prompted to enter relevant tax details, such as the tax year, the amount due, and any applicable penalties or interest. Ensure the information is accurate to avoid any discrepancies.

- Choose Your Payment Method: The ODOR offers multiple payment options, including credit cards (Visa, MasterCard, and Discover), debit cards, and electronic checks. Select the method that suits your preference and financial situation.

- Provide Payment Details: Depending on your chosen payment method, you will need to enter the required information. For credit or debit cards, this includes the card number, expiration date, and CVV. For electronic checks, you’ll provide your bank account and routing numbers.

- Review and Confirm: Before finalizing the payment, carefully review all the details, including the tax amount, payment method, and any associated fees. Ensure everything is accurate and complete. If you need to make changes, go back and edit the necessary fields.

- Submit Payment: Once you’ve verified all the information, click the “Submit Payment” or “Pay Now” button. This action will initiate the transaction, and you will receive a confirmation message or email.

- Receive Payment Confirmation: The ODOR’s system will generate a payment confirmation, which you should receive via email or download from the website. This confirmation serves as a record of your tax payment and can be used for future reference or audit purposes.

Potential Challenges and Solutions

While the online tax payment process is designed to be user-friendly, you might encounter some common challenges. Here’s how to navigate through them:

- Technical Issues: If you experience technical difficulties, such as website errors or payment gateway problems, try refreshing the page or clearing your browser’s cache and cookies. If the issue persists, contact the ODOR’s technical support team for assistance.

- Payment Method Limitations: Some tax types or situations might have specific payment method restrictions. For instance, certain taxes might only allow payment via electronic check. Ensure you understand the accepted payment methods for your specific tax obligation before proceeding.

- Late Payments and Penalties: If you are making a late payment or have incurred penalties, ensure you include these amounts in your online transaction. The ODOR’s system should automatically calculate and include these additional charges.

- Account Verification: In some cases, the ODOR might require additional verification to ensure the security of your account. This could involve providing further identification documents or answering security questions. Cooperate with the verification process to maintain the integrity of your tax records.

Conclusion

Paying Oregon taxes online offers a convenient, secure, and efficient way to fulfill your tax obligations. By following the step-by-step guide provided in this article, you can navigate the ODOR’s online payment system with ease. Remember to keep your tax information organized and up-to-date to ensure a smooth payment process. Should you encounter any challenges, the ODOR’s support team is available to assist you in resolving technical or procedural issues.

What are the accepted payment methods for online tax payment in Oregon?

+The ODOR accepts various payment methods, including credit cards (Visa, MasterCard, and Discover), debit cards, and electronic checks. These options provide flexibility and cater to different financial preferences.

Are there any fees associated with online tax payment in Oregon?

+Yes, there might be fees associated with online tax payments. These fees vary depending on the payment method chosen. Credit card payments often incur a convenience fee, while electronic checks and debit cards might have lower or no fees. Check the ODOR’s website for the latest fee information.

Can I pay my taxes online if I owe multiple tax types to the ODOR?

+Absolutely! The ODOR’s online payment system allows you to manage and pay multiple tax types. You can select the specific tax you wish to pay and repeat the process for each type of tax obligation you have.

How long does it take for my online tax payment to be processed and reflected in my tax account?

+Online tax payments are generally processed immediately. However, it may take some time for the payment to be reflected in your tax account, typically within 24 to 48 hours. This processing time can vary depending on the payment method and the volume of transactions.