King County Taxes Property Taxes

Welcome to our comprehensive guide on understanding and managing King County property taxes. This article will delve into the intricacies of property tax assessment, payment, and potential challenges, offering valuable insights for homeowners and property owners in the region.

Understanding King County Property Taxes

King County, located in the vibrant state of Washington, is renowned for its diverse landscapes, bustling cities, and thriving communities. As with many regions, property taxes are a significant aspect of local governance and revenue generation. These taxes contribute to essential services, infrastructure development, and the overall functioning of the county.

Property taxes in King County are determined based on the assessed value of a property, which is established through a rigorous assessment process conducted by the King County Assessor's Office. This value is then multiplied by the applicable tax rate to determine the annual tax liability for each property owner.

Assessment Process

The assessment process involves a thorough evaluation of a property’s characteristics, including its location, size, age, and condition. The Assessor’s Office utilizes various methods, such as market analysis, sales comparison, and cost approaches, to estimate the fair market value of each property. This value is then adjusted to reflect any exemptions or special assessments that may apply.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process provides an opportunity to present evidence and arguments to support a re-evaluation of the property's value.

| Assessment Timeline | Key Dates |

|---|---|

| Notice of Value | Sent by April 30th |

| Appeal Deadline | 30 days after Notice of Value |

| Decision Notification | Within 30 days of appeal |

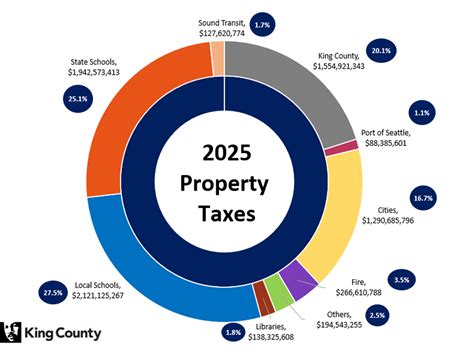

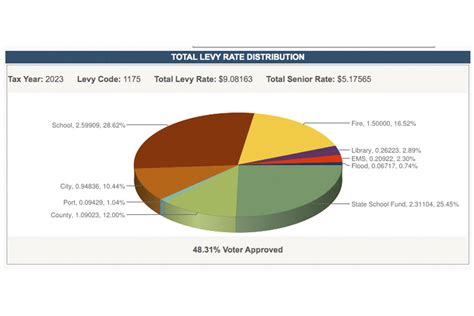

Tax Rates and Calculations

The tax rate applied to the assessed value of a property is determined by the local taxing authorities, including the county, cities, and special purpose districts. These rates can vary based on the type of property, its location, and the specific services it receives. The total tax rate is the sum of all applicable rates, which can include rates for general fund, schools, roads, and other specific purposes.

For example, in 2023, the general fund tax rate for residential properties in King County was $10.35 per $1,000 of assessed value. This rate can change annually based on budgetary needs and voter-approved initiatives.

| Taxing Authority | 2023 Tax Rate ($/ $1,000) |

|---|---|

| General Fund | $10.35 |

| School District | $3.47 |

| Road Fund | $2.42 |

| Fire District | $2.12 |

| Total Tax Rate | $18.36 |

Exemptions and Special Assessments

King County offers various exemptions and special assessments that can reduce the taxable value of a property. These include senior and disability exemptions, veterans’ exemptions, and special assessments for agricultural lands or historic properties. Understanding these exemptions and ensuring eligibility can result in significant tax savings.

For instance, the Senior Exemption reduces the assessed value of a property by $60,000 for homeowners aged 61 or older. This exemption can lead to a substantial reduction in property taxes, providing financial relief for eligible seniors.

Property Tax Payment Options

Property tax payments in King County are due twice a year, typically in February and August. Property owners have several payment options to choose from, ensuring flexibility and convenience.

Online Payment

The most convenient method is to pay property taxes online through the King County Treasurer’s Office website. This option allows for secure payments using a credit or debit card, eCheck, or electronic funds transfer. Online payments can be scheduled in advance, providing peace of mind and ensuring timely payments.

In-Person Payment

Property owners can also make payments in person at the King County Treasurer’s Office during regular business hours. This method offers the opportunity to receive immediate assistance and resolve any payment-related queries.

Mail-In Payment

For those who prefer traditional methods, property taxes can be paid by mailing a check or money order to the Treasurer’s Office. It’s important to ensure that the payment is received by the due date to avoid late fees and penalties.

Payment Plans

King County understands that unexpected financial circumstances can arise. To assist property owners, the county offers payment plans for those who may struggle to pay their taxes in full by the due date. These plans allow for timely payment of taxes while providing flexibility in managing financial obligations.

| Payment Plan Options | Details |

|---|---|

| Installment Plan | Divide your taxes into equal monthly installments over a specified period. |

| Deferred Payment | Defer your taxes until a later date, with interest accrued during the deferral period. |

| Hardship Exemption | For those facing financial hardship, this exemption may provide temporary relief from property taxes. |

Challenges and Strategies

While property taxes are an essential aspect of local governance, they can pose challenges for property owners. Understanding these challenges and implementing effective strategies can help manage tax obligations more efficiently.

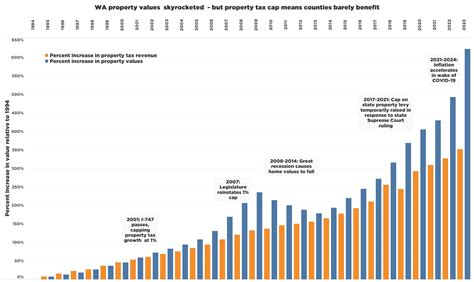

Rising Property Values

As property values increase, so does the assessed value, leading to higher tax liabilities. This can be particularly challenging for homeowners on fixed incomes or those facing financial difficulties. Strategies such as appealing assessed values, exploring exemptions, or considering payment plans can help alleviate the burden of rising property taxes.

Late Payment Penalties

Late payment of property taxes can result in significant penalties and interest charges. To avoid these penalties, it’s crucial to stay informed about payment due dates and explore options like online payments or payment plans to ensure timely remittance.

Communication and Awareness

Staying informed about changes in tax rates, assessment processes, and available exemptions is vital. The King County Assessor’s Office and Treasurer’s Office provide valuable resources and updates. Subscribing to their newsletters or following their social media accounts can ensure that property owners are well-informed and can take advantage of any benefits or changes.

Conclusion

Property taxes are an integral part of community development and infrastructure maintenance in King County. By understanding the assessment process, tax calculations, and available exemptions, property owners can actively manage their tax obligations. With a range of payment options and strategies, King County offers flexibility and support to ensure a smooth tax payment process.

We hope this guide has provided valuable insights into the world of King County property taxes. Remember, staying informed, seeking assistance when needed, and actively engaging with local authorities can lead to a more positive tax experience.

How can I determine the assessed value of my property?

+You can access your property’s assessed value through the King County Assessor’s Office website. Simply search for your property by address or parcel number to view the current assessed value and any changes made in recent years.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in late fees and interest charges. It’s important to stay informed about payment due dates and explore payment plan options to avoid penalties.

Are there any tax breaks or exemptions for senior citizens?

+Yes, King County offers the Senior Exemption, which reduces the assessed value of a property by $60,000 for homeowners aged 61 or older. This exemption can significantly reduce property taxes for eligible seniors.

Can I appeal my property’s assessed value?

+Absolutely! If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal. The appeal process allows you to present evidence and arguments to support a re-evaluation of your property’s value.

How can I stay updated on changes in tax rates and assessment processes?

+The King County Assessor’s Office and Treasurer’s Office provide regular updates and resources. Subscribing to their newsletters or following their social media accounts ensures you receive timely information about any changes or developments.