Westmoreland County Tax Map

Westmoreland County, nestled in the heart of Pennsylvania, is a vibrant community with a rich history and a diverse landscape. One of the essential aspects of living in this county is understanding its tax system, which is intricately linked to the Westmoreland County Tax Map. This comprehensive guide will delve into the intricacies of the Westmoreland County Tax Map, shedding light on its significance, functionality, and impact on the community.

Unveiling the Westmoreland County Tax Map

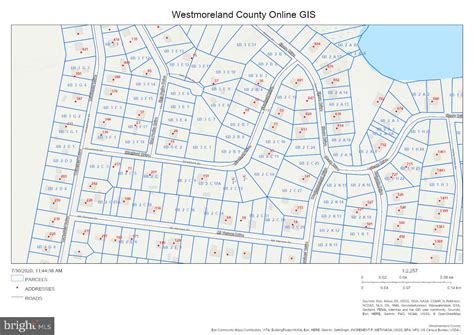

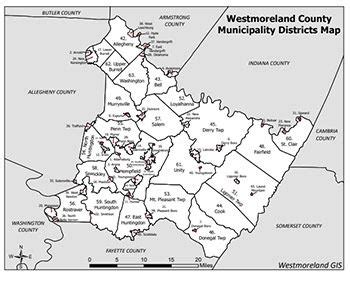

The Westmoreland County Tax Map serves as a crucial tool for both residents and the local government, providing a detailed visual representation of the county’s tax parcels. This map is an indispensable resource, offering a clear and organized view of the county’s land divisions and their corresponding tax information. Let’s explore the key features and implications of this essential tool.

Tax Parcel Identification

At the core of the Westmoreland County Tax Map is the unique identification of each tax parcel. These parcels are assigned specific numbers, often referred to as tax map numbers, which serve as a primary reference for tax assessment and billing. The map provides a visual layout, allowing users to easily locate and identify these parcels, which are essential for various administrative and planning purposes.

| Parcel Type | Tax Map Designation |

|---|---|

| Residential Properties | R-1, R-2, R-3 |

| Commercial Zones | C-1, C-2, C-3 |

| Agricultural Land | A-1, A-2 |

Tax Assessment and Valuation

The Westmoreland County Tax Map plays a pivotal role in the process of tax assessment. Assessors use the map to accurately determine the boundaries of each parcel, ensuring fair and consistent valuation. This visual representation aids in assessing the property’s value, taking into account factors like size, location, and improvements.

For instance, a property located in a prime commercial zone (C-2) may have a higher assessed value compared to a residential property (R-1) in a less developed area. The tax map provides a clear framework for assessors to make these distinctions, contributing to a fair and equitable tax system.

Property Ownership and Records

Beyond tax assessment, the Westmoreland County Tax Map serves as a vital resource for property ownership records. Each parcel is linked to specific ownership details, making it easier for residents, real estate professionals, and government officials to access and verify property information.

Imagine a scenario where a homeowner is researching the history of their property. The tax map, along with other records, can provide valuable insights into previous owners, property transfers, and any changes in zoning or land use over time. This transparency fosters a sense of community trust and ensures a well-informed citizenry.

Planning and Development

The Westmoreland County Tax Map is not just a tool for tax assessment; it’s a cornerstone for urban and regional planning. Planners and developers rely on the map’s detailed layout to make informed decisions about future developments. The visual representation of the county’s land divisions helps identify suitable areas for residential, commercial, or industrial growth, taking into account factors like infrastructure, environmental impact, and community needs.

For instance, a developer looking to construct a new housing community can use the tax map to identify available parcels with the necessary zoning and infrastructure. This ensures a more efficient and strategic approach to development, benefiting both the developer and the community.

Navigating the Westmoreland County Tax Map

Understanding how to navigate and interpret the Westmoreland County Tax Map is essential for anyone seeking to utilize its information. Here’s a step-by-step guide to help you get started:

- Access the Map: The Westmoreland County Tax Map is typically accessible online through the county's official website or a dedicated tax assessment portal. You can also visit the county offices to view physical copies of the map.

- Locate Your Parcel: Use your property's address or tax map number to find your specific parcel on the map. Each parcel is clearly labeled with its unique identifier, making it easy to locate.

- Explore Parcel Details: Once you've found your parcel, you can access detailed information about it. This may include ownership records, tax assessment data, zoning information, and more. The level of detail provided depends on the specific tax assessment platform used by the county.

- Compare and Analyze: If you're researching multiple properties or comparing different parcels, the tax map allows you to do so side by side. This can be particularly useful for real estate professionals, developers, and even residents looking to understand the market value and potential of different areas.

- Stay Informed: The Westmoreland County Tax Map is regularly updated to reflect changes in ownership, zoning, and tax assessments. It's essential to check for the most recent version to ensure you have accurate and up-to-date information.

The Future of Tax Mapping in Westmoreland County

As technology advances, the Westmoreland County Tax Map is poised for further development and innovation. Here’s a glimpse into the future of tax mapping in this vibrant community:

Digital Integration and Accessibility

With the increasing demand for digital services, Westmoreland County is likely to enhance its online tax map platform. This could include features like interactive maps, advanced search functionalities, and integration with other county databases, making it easier for residents to access and understand their tax information.

Real-Time Updates and Notifications

In the future, the tax map may incorporate real-time updates, providing users with instant notifications about changes in their tax status, zoning regulations, or property assessments. This level of transparency and immediacy can greatly benefit both residents and businesses, allowing them to stay informed and proactive.

Enhanced Data Analysis

Advancements in data analytics and machine learning could lead to more sophisticated tax mapping systems. These systems could provide predictive insights, identify trends, and assist in making more informed decisions regarding tax assessments, property valuations, and community development planning.

Community Engagement and Transparency

Westmoreland County could leverage the tax map as a tool for community engagement. By providing transparent and accessible tax information, the county can foster a sense of trust and involvement among residents. This could lead to more informed discussions about tax policies, community development projects, and citizen-led initiatives.

Conclusion

The Westmoreland County Tax Map is more than just a static representation of land divisions; it’s a dynamic tool that reflects the community’s growth, development, and progress. By understanding and utilizing this resource, residents, businesses, and government officials can make informed decisions that shape the future of Westmoreland County.

As technology continues to evolve, the tax map will adapt, ensuring that Westmoreland County remains at the forefront of efficient tax assessment, transparent governance, and sustainable community development.

How often is the Westmoreland County Tax Map updated?

+The Westmoreland County Tax Map is typically updated annually to reflect changes in property ownership, assessments, and zoning. However, certain significant changes, such as new developments or major infrastructure projects, may warrant additional updates throughout the year.

Can I access the Tax Map online?

+Yes, the Westmoreland County Tax Map is accessible online through the county’s official website. You can search for your property using its address or tax map number to view detailed information.

What information can I find on the Tax Map about my property?

+The Tax Map provides a wealth of information, including your property’s boundaries, tax assessment value, zoning details, and ownership records. It’s a comprehensive resource for understanding your property’s tax status and potential.