Tax Return Accepted

The moment you receive confirmation that your tax return has been accepted is a significant milestone in the tax filing process. It signifies that your tax submission is complete and has met the necessary requirements, ensuring peace of mind and paving the way for the next steps in your financial journey. In this article, we will delve into the intricacies of what "Tax Return Accepted" means, exploring the process, the potential challenges, and the steps you can take to ensure a smooth and successful outcome.

Understanding the Tax Return Acceptance Process

The acceptance of a tax return is a crucial step in the annual tax filing journey. It is the point at which the tax authority, such as the Internal Revenue Service (IRS) in the United States, acknowledges that your tax return has been successfully submitted and meets the basic criteria for processing.

When you file your tax return, it undergoes an initial screening process. The tax authority checks for basic errors, such as missing information, incorrect calculations, or incomplete forms. If your return passes this initial scrutiny, it is deemed accepted, and you receive a confirmation notification.

This confirmation can come in various forms, depending on the filing method you choose. For instance, if you file your taxes electronically, you may receive an immediate acceptance message or email. On the other hand, traditional paper filing might require a bit more patience, as the processing time can vary.

What Does “Tax Return Accepted” Mean for You?

Receiving the notification that your tax return has been accepted is a cause for celebration, as it indicates that you’ve successfully navigated the initial hurdles of the tax filing process. Here’s what this acceptance means for your financial standing and future tax obligations:

- Compliance with Tax Laws: Your tax return has met the basic requirements set by the tax authority, ensuring that you are in compliance with the law. This is a critical aspect, as non-compliance can lead to penalties and legal issues.

- Peace of Mind: With your return accepted, you can breathe a sigh of relief, knowing that you've fulfilled your tax obligations for the year. This frees you from potential worries about overdue filings or penalties.

- Next Steps: Acceptance of your tax return is just the beginning. The next step is for the tax authority to review your return in detail, which may involve further scrutiny and potential audits. However, this initial acceptance is a positive sign, indicating that your return is off to a good start.

Challenges and Potential Issues

While receiving the “Tax Return Accepted” confirmation is a positive step, it’s important to be aware of potential challenges and issues that might arise during the process. Here are some common concerns to keep in mind:

Errors and Omissions

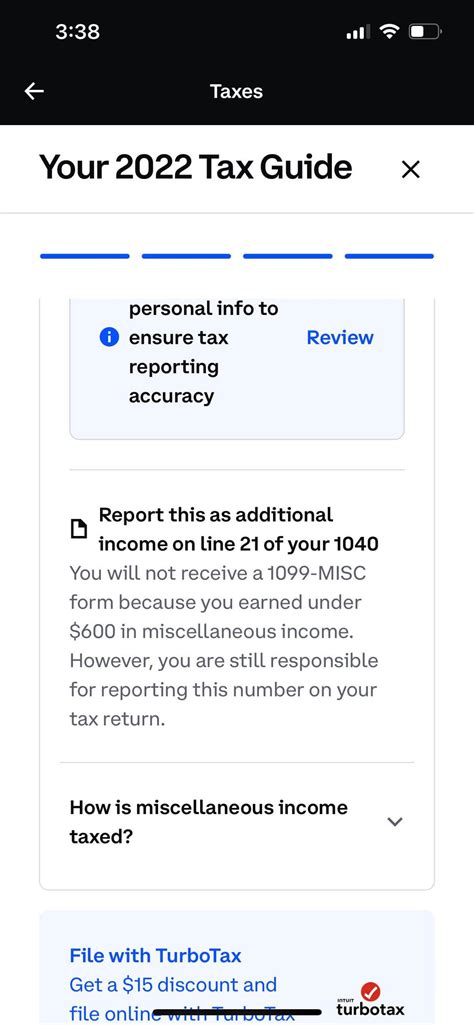

Despite the initial screening process, errors and omissions can still slip through. These might include incorrect calculations, missing attachments, or mistakes in reporting income or deductions. Such errors can lead to further scrutiny and potential adjustments to your tax liability.

Complex Tax Situations

For taxpayers with complex financial situations, such as multiple sources of income, business ownership, or significant investments, the tax return acceptance process can be more intricate. These cases often require additional documentation and a more detailed review, which may take longer to process.

Audit Risk

While not all accepted tax returns are audited, the risk of an audit is always present. Tax authorities may select returns for audit based on various factors, including random selection, high-risk criteria, or discrepancies identified during the initial screening.

Maximizing the Benefits of Tax Return Acceptance

To make the most of your tax return acceptance and ensure a smooth process moving forward, consider the following tips and strategies:

Accurate Filing

Accuracy is paramount when filing your tax return. Double-check all calculations, ensure all necessary forms are included, and provide complete and honest information. This reduces the likelihood of errors and potential audits.

Seek Professional Help

For complex tax situations or if you’re unsure about any aspect of your return, seeking the guidance of a tax professional can be invaluable. Tax experts can help ensure your return is complete and accurate, reducing the risk of errors and potential audits.

Stay Informed

Keep yourself updated on tax laws and regulations. Tax authorities often provide resources and guidelines to help taxpayers understand their obligations. Staying informed can help you navigate the process more effectively and avoid common pitfalls.

Keep Records

Maintain thorough records of your financial activities, especially those related to your tax return. This includes receipts, invoices, bank statements, and any other documents that support the information on your return. These records can be crucial if your return is selected for audit.

Future Implications and Planning

The acceptance of your tax return is not the end of your financial journey; it’s a step towards future financial planning and stability. Here’s how this acceptance can impact your future financial strategies:

Tax Planning

The acceptance of your tax return provides an opportunity to reflect on your financial strategies and make informed decisions for the upcoming tax year. Review your return, identify areas for improvement, and consider ways to optimize your tax situation, such as maximizing deductions or exploring tax-advantaged investments.

Financial Planning

Taxes are an integral part of your overall financial picture. With your tax return accepted, you can better understand your financial obligations and plan accordingly. This might involve adjusting your savings strategies, investment plans, or budgeting to ensure you’re on track to meet your financial goals.

Long-Term Financial Goals

A smooth tax return acceptance process can provide a foundation for achieving your long-term financial goals. Whether it’s saving for retirement, funding education, or planning for major purchases, understanding your tax obligations and managing them effectively is crucial to achieving these goals.

Conclusion

The acceptance of your tax return is a significant milestone, marking the successful completion of a complex process. It is a time to celebrate your financial responsibility and look forward to the opportunities that lie ahead. By understanding the process, being aware of potential challenges, and taking proactive steps, you can ensure a smooth journey through the tax filing process and maximize the benefits of your tax return acceptance.

What happens after my tax return is accepted?

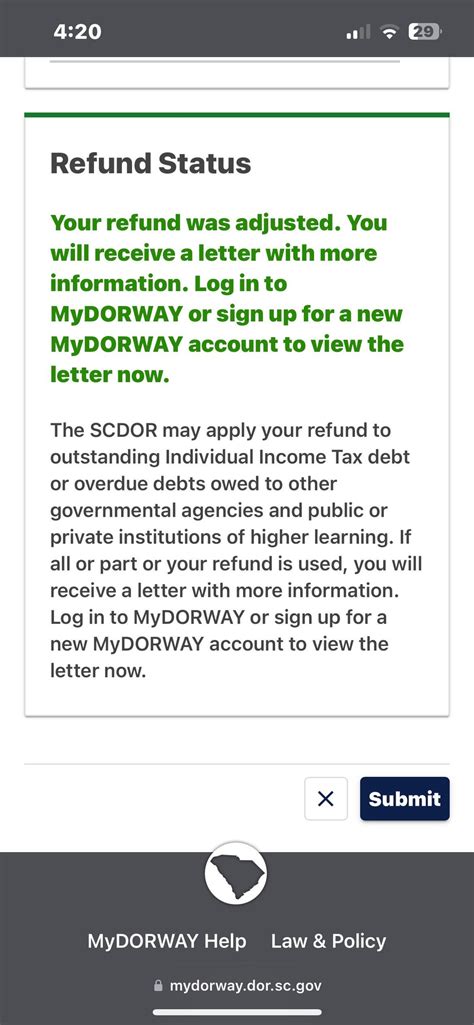

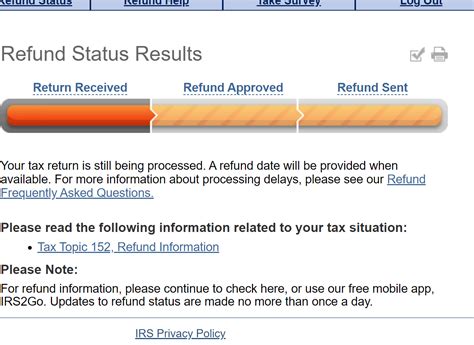

+After your tax return is accepted, it undergoes further review. The tax authority will analyze your return in detail, potentially requesting additional information or making adjustments. If everything checks out, you’ll receive your tax refund or notice of any balance due.

How long does it take for a tax return to be accepted?

+The time it takes for a tax return to be accepted varies. Electronic filing typically provides immediate acceptance, while paper filing can take several weeks. Factors like the complexity of your return and the tax authority’s workload can also influence processing times.

What if my tax return is rejected or has errors?

+If your tax return is rejected, you’ll receive a notification with details about the errors or omissions. Address these issues and resubmit your return. It’s important to correct any errors promptly to avoid potential penalties.

Can I check the status of my tax return acceptance online?

+Yes, most tax authorities provide online tools to check the status of your tax return. You can typically access these tools on the official tax authority website using your filing credentials.