Washington State Estate Tax

In the vast landscape of financial planning and estate management, understanding the intricacies of state-specific taxes is crucial. Washington State, with its unique tax structure, presents a nuanced approach to estate taxation. This article aims to delve deep into the world of Washington State Estate Tax, offering a comprehensive guide for individuals and professionals seeking clarity on this complex topic.

Navigating Washington State Estate Tax: A Comprehensive Guide

Estate planning is an essential aspect of financial management, and it becomes even more intricate when dealing with state-specific regulations. Washington State, often regarded as a tax-friendly jurisdiction, introduces a unique set of rules when it comes to estate taxation. This guide aims to unravel the complexities, providing a comprehensive understanding of the Washington State Estate Tax system.

Understanding the Basics of Estate Tax

Estate tax, also known as inheritance tax or death tax, is a levy imposed on the transfer of assets from a deceased individual’s estate to their beneficiaries. It is a state-level tax, meaning the rules and regulations can vary significantly across different jurisdictions. In Washington State, the estate tax system is designed to ensure a fair and equitable distribution of assets while contributing to the state’s revenue stream.

One of the key aspects to note about Washington State's estate tax is its exemption level. The state currently exempts estates with a value below $2.193 million from the estate tax. This means that for estates valued at or below this threshold, no estate tax is payable. However, for estates exceeding this amount, the tax rate starts to apply.

Estate Tax Calculation: A Step-by-Step Guide

Calculating the estate tax can be a complex process, but breaking it down into steps can simplify the understanding. Here’s a simplified breakdown of how the estate tax is calculated in Washington State:

- Determine the Gross Estate Value: This includes all assets owned by the decedent, such as real estate, personal property, investments, and more. The gross estate value is the starting point for tax calculations.

- Apply Deductible Expenses: Certain expenses are deductible from the gross estate value. These include funeral expenses, administrative costs, and any outstanding debts or liabilities. These deductions reduce the taxable estate value.

- Calculate the Taxable Estate: Subtract the deductible expenses from the gross estate value to determine the taxable estate. This is the amount upon which the estate tax is calculated.

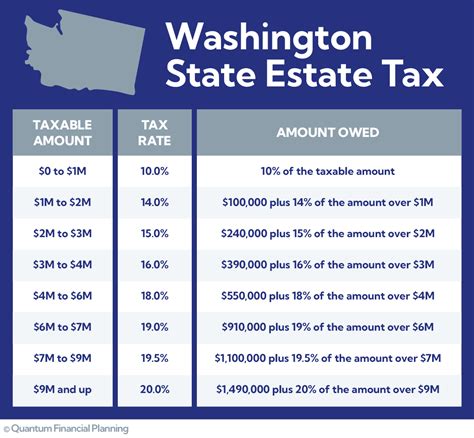

- Apply the Tax Rate: Washington State uses a progressive tax rate structure for estates exceeding the exemption level. The tax rate ranges from 10% to 20%, with the rate increasing as the estate value increases. The tax is calculated based on the taxable estate value.

- Add Tax Credits and Deductions: Washington State offers certain tax credits and deductions that can reduce the overall estate tax liability. These include charitable contributions, certain types of insurance proceeds, and more. These credits and deductions are applied to the calculated tax amount.

- Final Tax Liability: After applying all tax credits and deductions, the remaining amount is the final estate tax liability. This is the amount payable to the Washington State Department of Revenue.

Strategies for Minimizing Estate Tax

Given the complexity and potential financial impact of estate tax, it’s essential to explore strategies to minimize the tax liability. Here are some effective approaches:

- Gift Giving: Making gifts during one's lifetime can reduce the size of the estate and potentially lower the estate tax liability. Gifts can be made to individuals, charities, or other eligible entities.

- Use of Trusts: Establishing certain types of trusts can help reduce estate tax. For example, a bypass trust can help shelter a portion of the estate from tax, allowing for a more efficient transfer of assets.

- Life Insurance Planning: Life insurance proceeds are often exempt from estate tax if structured properly. Utilizing life insurance can provide a significant tax advantage and ensure financial security for beneficiaries.

- Charitable Contributions: Donating to qualified charitable organizations can provide a double benefit: reducing the taxable estate value and potentially receiving a tax deduction. This strategy can be particularly effective when combined with other tax-efficient planning.

| Estate Value | Tax Rate |

|---|---|

| $2.193 million and below | 0% |

| $2.193 million - $5.341 million | 10% |

| $5.341 million - $10.681 million | 12% |

| $10.681 million - $15.021 million | 14% |

| Above $15.021 million | 20% |

Estate Tax Planning for High-Net-Worth Individuals

For high-net-worth individuals, estate tax planning becomes even more critical. With larger estates, the potential tax liability can be significant. Here are some advanced strategies tailored for this demographic:

- Gifting Strategies: Making substantial gifts to family members or charitable organizations can help reduce the size of the estate and minimize tax liability. However, it's important to consider gift tax implications and plan accordingly.

- Irrevocable Trusts: Establishing irrevocable trusts can provide greater asset protection and tax efficiency. These trusts can be used to transfer assets out of the estate, potentially reducing the taxable estate value.

- Business Succession Planning: For business owners, planning for the transfer of ownership can be complex. Utilizing business valuation strategies and implementing succession plans can help minimize estate tax liabilities while ensuring a smooth transition.

- Charitable Lead Trusts: This type of trust can be an effective tool for high-net-worth individuals. It allows for a stream of income to be paid to a charity for a specified period, with the remaining assets transferred to beneficiaries. This strategy can reduce the taxable estate value and provide a charitable legacy.

The Future of Washington State Estate Tax

As with any tax system, the future of Washington State Estate Tax is subject to potential changes and reforms. While the current exemption level and tax rates are set, there is always the possibility of legislative adjustments. It’s essential to stay informed about any proposed changes or updates to the estate tax laws.

Additionally, the impact of federal tax laws on state estate tax systems cannot be overlooked. Changes at the federal level can have a ripple effect on state tax policies. Staying abreast of these developments is crucial for effective estate planning.

Frequently Asked Questions (FAQ)

What is the current exemption level for Washington State Estate Tax?

+

The current exemption level for Washington State Estate Tax is $2.193 million. This means that estates valued at or below this threshold are exempt from the estate tax.

Are there any deductions or credits available to reduce estate tax liability?

+

Yes, Washington State offers certain tax credits and deductions that can reduce the overall estate tax liability. These include charitable contributions, certain types of insurance proceeds, and more. It’s important to consult with a tax professional to understand the specific deductions and credits available.

Can I gift assets to reduce my estate tax liability?

+

Yes, making gifts during one’s lifetime can be an effective strategy to reduce estate tax liability. However, it’s crucial to consider gift tax implications and ensure compliance with gift tax regulations. Working with a tax professional can help navigate these complexities.

Are there any tax implications for establishing a trust?

+

The tax implications of establishing a trust depend on various factors, including the type of trust, its purpose, and the assets involved. Some trusts, such as irrevocable trusts, can provide tax advantages, while others may have different tax considerations. Consulting with a tax expert is recommended to understand the specific tax implications of trust establishment.

Washington State Estate Tax is a complex yet crucial aspect of financial planning. By understanding the basics, exploring strategies for minimization, and staying informed about potential changes, individuals and professionals can navigate this landscape effectively. Remember, seeking expert advice is essential to ensure compliance and maximize the benefits of estate tax planning.