San Diego Property Tax Records

San Diego County, nestled along the scenic coastline of Southern California, is renowned for its vibrant culture, diverse landscapes, and a thriving real estate market. As an essential component of the local economy, property taxes in this region play a significant role, impacting both residents and investors alike. This comprehensive guide aims to unravel the intricacies of San Diego property tax records, offering a detailed analysis of the assessment process, payment options, and the key factors that influence these taxes.

Unveiling the San Diego Property Tax Landscape

The San Diego County Assessor’s Office is the primary authority responsible for assessing properties and determining their tax values. This crucial process ensures that property owners contribute their fair share to the county’s revenue, which is then allocated for vital public services and infrastructure development.

The assessment process involves evaluating each property's value based on various factors, including its location, size, condition, and any recent improvements or renovations. The assessor's office employs a combination of methods, such as physical inspections, market analysis, and the application of state-mandated formulas, to arrive at an accurate and fair assessment.

One of the unique features of San Diego's property tax system is the Proposition 13, a constitutional amendment that limits the annual increase in the assessed value of real property to no more than 2% unless there's a change in ownership or new construction. This provision, enacted in 1978, provides stability and predictability for property owners, ensuring that their tax burden does not skyrocket year after year.

However, it's important to note that Proposition 13 also means that the assessed value of a property may not always reflect its current market value, especially in a rapidly appreciating real estate market like San Diego's. In such cases, a property's taxable value may lag behind its actual worth, potentially leading to a lower tax bill than what one might expect based on recent sales prices.

Understanding Assessment Notices

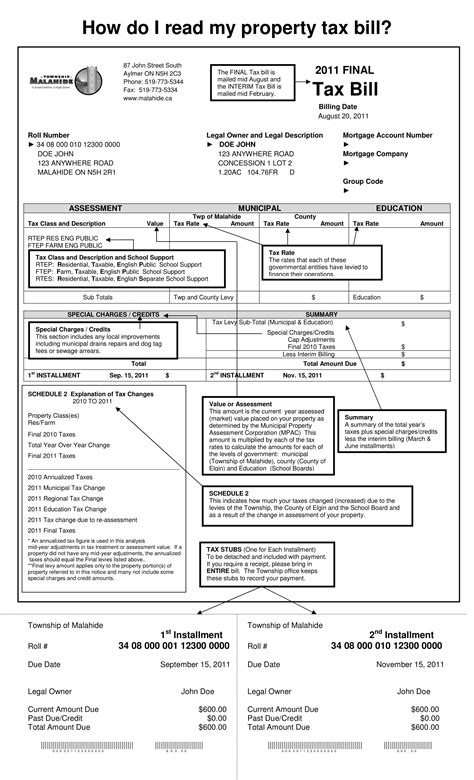

Each year, the Assessor’s Office sends out assessment notices to property owners, detailing the assessed value of their property and the corresponding tax amount. These notices are typically mailed in the spring and provide a comprehensive breakdown of the assessment, including any changes from the previous year.

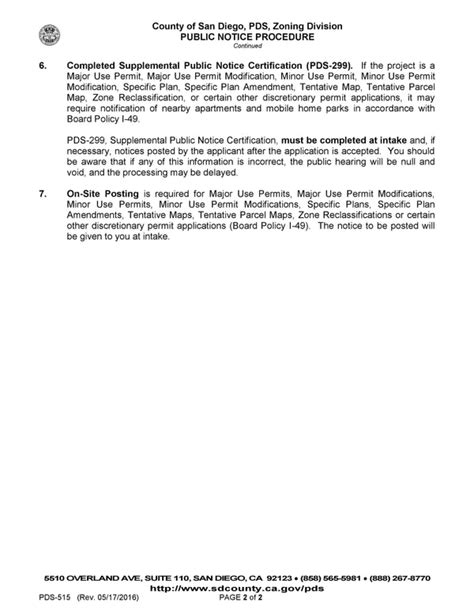

If a property owner disagrees with the assessed value, they have the right to appeal the assessment through a formal process. The Assessor's Office provides detailed instructions and guidelines for filing an appeal, which involves submitting evidence and arguments to support the requested change in value.

| Key Dates for Property Tax Cycle in San Diego County | |

|---|---|

| Assessment notices mailed | March - April |

| Deadline for filing appeals | May - June |

| First installment tax bill due | November |

| Second installment tax bill due | February |

Appeals can be based on various grounds, including errors in the assessment, changes in the property's condition or usage, or discrepancies with recent sales data. The appeal process is overseen by the Assessment Appeals Board, an independent body that reviews and makes decisions on appeals.

Navigating Property Tax Payments

Property taxes in San Diego County are typically due in two installments, with the first installment payable by December 10th and the second by April 10th of the following year. However, to provide flexibility and convenience to taxpayers, the county offers several payment options.

Online Payment Options

San Diego County’s website provides a secure online portal where property owners can access their tax information and make payments. This platform allows for quick and easy payments using a credit or debit card, with a small convenience fee applicable for this service.

Additionally, the county has partnered with third-party payment processors to offer alternative online payment methods, such as e-checks and direct bank transfers. These options often come with reduced or waived convenience fees, making them an attractive choice for taxpayers.

Payment by Mail or In-Person

Traditional methods of payment are also available for those who prefer a more conventional approach. Property owners can mail their tax payments to the designated address, ensuring they reach the county treasurer’s office before the due date.

For those who wish to make payments in person, the county provides multiple locations where taxpayers can visit and pay their taxes. These locations are typically well-staffed and equipped to handle a range of payment methods, including cash, checks, and money orders.

Payment Plans and Hardship Options

Recognizing that financial circumstances can vary, San Diego County offers payment plans and hardship options for property owners facing difficulties in meeting their tax obligations.

The Deferred Payment Program allows eligible senior citizens, disabled persons, and veterans to defer their property tax payments until their property is sold, transferred, or until they no longer occupy the property as their primary residence. This program provides much-needed relief for those on fixed incomes or facing financial hardships.

For taxpayers who are temporarily unable to make full payments due to unforeseen circumstances, the county offers short-term payment plans to help them stay current with their tax obligations. These plans typically involve a reduced penalty and interest rate, making it more manageable to catch up on missed payments.

Factors Influencing Property Taxes in San Diego

The amount of property tax owed by a San Diego property owner is influenced by several key factors, each playing a unique role in the assessment and tax calculation process.

Property Value

The most significant factor in determining property taxes is the assessed value of the property. As mentioned earlier, this value is established by the Assessor’s Office and is subject to the limitations set by Proposition 13.

The assessed value is a crucial component in calculating the property tax rate, which is expressed as a percentage of the assessed value. A higher assessed value generally results in a higher tax bill, all other factors being equal.

Tax Rate Areas

San Diego County is divided into various tax rate areas, each with its own unique tax rate. These rates are established by local taxing agencies, such as cities, school districts, and special districts, and are used to calculate the property tax owed to each agency.

The tax rate for a specific property is determined by the tax rate areas in which the property is located. Properties that are situated in multiple tax rate areas may have a combined tax rate, which is the sum of the individual rates for each area.

Special Assessments

In addition to the standard property tax, San Diego property owners may also be subject to special assessments, which are additional charges levied by local governments or special districts to fund specific improvements or services that benefit the property.

Special assessments can cover a wide range of projects, including street lighting, sewer improvements, road maintenance, or even the construction of public facilities like parks or libraries. These assessments are typically included in the property tax bill and are payable along with the standard property tax.

Conclusion: A Comprehensive Guide to San Diego Property Tax Records

Understanding the intricacies of San Diego property tax records is essential for both residents and investors in the region. From the assessment process, which determines the taxable value of a property, to the various payment options and factors influencing tax amounts, this guide has provided a detailed overview of the key aspects of San Diego’s property tax landscape.

By staying informed about their property taxes and the assessment process, San Diego property owners can ensure they are contributing their fair share to the community while also protecting their financial interests. Whether it's appealing an assessment, navigating payment options, or understanding the impact of special assessments, knowledge is power when it comes to managing property taxes effectively.

What is the average property tax rate in San Diego County?

+The average property tax rate in San Diego County is approximately 1.25%, which includes both the countywide rate and the rates set by local taxing agencies.

How often are property taxes assessed in San Diego?

+Property taxes in San Diego are assessed annually. The Assessor’s Office sends out assessment notices each year, typically in the spring, detailing the assessed value and tax amount for the upcoming fiscal year.

Can I pay my property taxes online in San Diego County?

+Yes, San Diego County offers an online payment portal where property owners can make secure payments using a credit or debit card. Alternatively, they can also use third-party payment processors for e-checks or direct bank transfers.

What happens if I miss a property tax payment deadline in San Diego?

+If a property tax payment is missed, penalties and interest will accrue. San Diego County offers short-term payment plans to help taxpayers catch up on missed payments and avoid further penalties.

Are there any programs to assist low-income property owners with their tax payments in San Diego?

+Yes, San Diego County has programs like the Deferred Payment Program, which allows eligible senior citizens, disabled persons, and veterans to defer their property tax payments until a future date, providing much-needed financial relief.