Harris County Tax Office Near Me

Welcome to this in-depth exploration of the Harris County Tax Office, a crucial administrative entity that plays a pivotal role in the financial landscape of the region. This article aims to provide a comprehensive understanding of the Harris County Tax Office, its functions, services, and how it impacts the local community. By delving into its operations, we can uncover the intricacies of property tax assessments, payment processes, and the overall importance of this office in the day-to-day lives of residents and businesses.

The Harris County Tax Office: A Vital Administrative Hub

Nestled in the heart of Harris County, Texas, the Harris County Tax Office stands as a beacon of efficiency and public service. Established with the mandate to manage and oversee the collection of property taxes, this office is a vital cog in the county’s financial machinery. Its role extends beyond mere tax collection; it serves as a key interface between the local government and its constituents, offering a range of essential services that shape the economic fabric of the community.

Property Tax Assessment: A Comprehensive Process

The process of property tax assessment is a cornerstone of the Harris County Tax Office’s operations. It involves a meticulous evaluation of each property within the county to determine its fair market value. This value forms the basis for calculating property taxes, ensuring that residents and businesses contribute fairly to the county’s revenue stream.

The assessment process is handled by a dedicated team of professionals who utilize a combination of market data, property characteristics, and specialized software. They strive for accuracy and fairness, taking into account factors such as location, size, improvements, and any applicable exemptions.

Here's a simplified breakdown of the key steps involved in the property tax assessment process:

- Data Collection: Tax assessors gather information on each property, including physical attributes, ownership details, and any recent transactions.

- Market Analysis: Assessors study the local real estate market to understand current property values and trends.

- Valuation: Using advanced valuation techniques, they assign a fair market value to each property, taking into account its unique features and location.

- Review and Appeal: Property owners have the right to review and appeal their assessed value if they believe it is inaccurate or unfair.

- Tax Calculation: Once the assessed value is finalized, the tax office applies the appropriate tax rate to determine the property tax due.

This meticulous process ensures that property taxes are calculated fairly and accurately, contributing to the financial stability and development of Harris County.

Navigating Property Tax Payments: A Guide

Understanding the process of paying property taxes is essential for residents and business owners in Harris County. The Harris County Tax Office offers a range of convenient payment options to cater to different preferences and needs.

For those who prefer traditional methods, the tax office accepts payments by check or money order, either by mail or in person. Additionally, they provide the option to pay in cash at select locations, ensuring accessibility for all.

However, in today's digital age, the tax office has also embraced online payment systems. Property owners can now pay their taxes securely and conveniently through the official Harris County Tax Office website. This online platform offers real-time updates on tax balances, due dates, and payment histories, providing transparency and ease of access.

To further enhance accessibility, the tax office also accepts credit and debit card payments, both online and over the phone. This option is particularly beneficial for those who value flexibility and prefer the convenience of electronic transactions.

| Payment Method | Details |

|---|---|

| Check/Money Order | By mail or in person |

| Cash | At select locations |

| Online Payment | Secure platform on the official website |

| Credit/Debit Card | Online or over the phone |

By offering a diverse range of payment options, the Harris County Tax Office ensures that property tax payments are accessible and convenient for all residents and businesses.

Harris County Tax Office: Impact on the Community

The Harris County Tax Office’s influence extends far beyond its core function of tax collection. It plays a pivotal role in shaping the economic landscape of the county, impacting the lives of residents and the overall development of the community.

Economic Development and Infrastructure

Property taxes collected by the Harris County Tax Office are a significant source of revenue for the county. This revenue is allocated to various essential services and infrastructure projects that directly benefit the community. From funding public schools and hospitals to maintaining roads and public transportation, the tax office’s contributions are vital for the county’s overall development and prosperity.

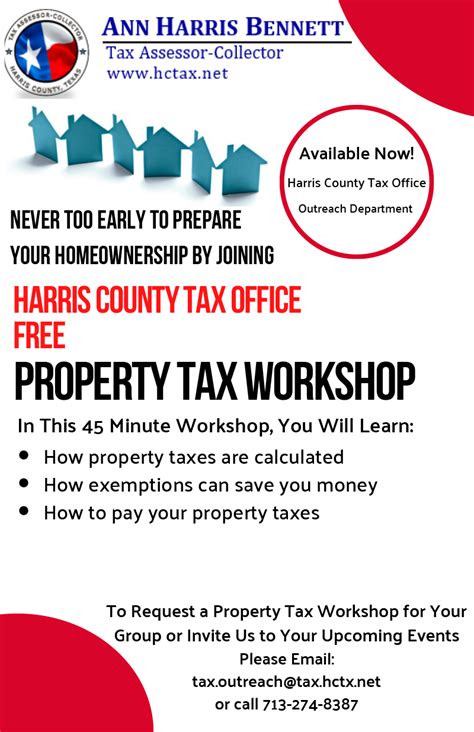

Community Engagement and Support

The Harris County Tax Office actively engages with the community, offering support and resources to residents and businesses. They provide educational workshops and seminars on tax-related topics, helping individuals and businesses navigate the complex world of property taxes. Additionally, the tax office offers assistance with tax exemption applications, ensuring that eligible individuals and organizations can benefit from reduced tax burdens.

Transparency and Accountability

The Harris County Tax Office operates with a strong commitment to transparency and accountability. They maintain an open-door policy, welcoming inquiries and feedback from the public. Their website serves as a valuable resource, providing detailed information on tax rates, assessment processes, and payment options. This transparency builds trust and ensures that residents and businesses have the information they need to understand and participate in the tax system effectively.

Future Outlook and Innovations

As technology continues to advance, the Harris County Tax Office is poised to embrace new innovations and streamline its processes. Here’s a glimpse into the future of this vital administrative entity:

Digital Transformation

The tax office is exploring ways to enhance its digital presence and services. This includes developing a more robust online platform that offers an even wider range of services, such as online tax appeals, virtual assistance, and interactive tax calculators. By embracing digital transformation, the tax office aims to improve efficiency, reduce processing times, and enhance the overall user experience.

Data Analytics and AI Integration

Leveraging advanced data analytics and artificial intelligence (AI) technologies, the Harris County Tax Office can further optimize its assessment processes. AI-powered systems can analyze vast amounts of data quickly and accurately, aiding in the identification of trends, anomalies, and potential tax evasion cases. This integration of AI will not only enhance the accuracy of assessments but also strengthen the tax office’s ability to combat fraud and ensure fair taxation.

Community Outreach and Education

The tax office recognizes the importance of community engagement and plans to expand its outreach initiatives. By conducting regular town hall meetings, hosting online webinars, and partnering with local organizations, the tax office aims to foster a deeper understanding of its role and services. This enhanced community outreach will empower residents and businesses to actively participate in the tax system and contribute to the overall well-being of Harris County.

Conclusion: A Vital Administrative Entity

The Harris County Tax Office is more than just a tax collection agency; it is a vital administrative entity that drives the economic engine of the county. From its meticulous property tax assessment processes to its commitment to community engagement and innovation, the tax office plays a pivotal role in the daily lives of residents and businesses. As it continues to adapt and evolve, the Harris County Tax Office remains a cornerstone of the county’s financial stability and development.

What is the role of the Harris County Tax Office in property tax assessments?

+The Harris County Tax Office is responsible for conducting comprehensive property tax assessments. This involves evaluating each property’s fair market value, taking into account various factors such as location, size, and improvements. The assessed value is then used to calculate property taxes, ensuring fair and accurate contributions to the county’s revenue.

How can I pay my property taxes in Harris County?

+Harris County offers a variety of payment options for property taxes. You can pay by check or money order by mail or in person. Cash payments are accepted at select locations. Additionally, you can pay online through the official Harris County Tax Office website, offering a secure and convenient method. Credit and debit card payments are also accepted, both online and over the phone.

What happens if I miss the property tax payment deadline in Harris County?

+Missing the property tax payment deadline can result in late fees and penalties. It’s important to stay updated on your tax obligations to avoid additional costs. The Harris County Tax Office provides resources and notifications to help residents stay informed about due dates and payment options.

How does the Harris County Tax Office support community development and infrastructure?

+The Harris County Tax Office plays a crucial role in funding community development and infrastructure projects. The revenue generated from property taxes is allocated to various essential services, including public schools, hospitals, roads, and public transportation. By contributing to these services, the tax office supports the overall growth and well-being of the community.

What resources does the Harris County Tax Office provide for community engagement and education?

+The Harris County Tax Office offers a range of resources to engage and educate the community. This includes workshops and seminars on tax-related topics, helping residents and businesses understand their tax obligations. They also provide assistance with tax exemption applications, ensuring eligible individuals and organizations can benefit from reduced tax burdens.