Collin County Tax Appraisal

Welcome to an in-depth exploration of the Collin County Tax Appraisal process, a critical aspect of property ownership and management in this vibrant Texas county. In this comprehensive guide, we will delve into the intricacies of property valuation, tax assessment, and the various factors that influence the overall tax landscape in Collin County. From the appraisal methods employed by the county to the impact of market trends and homeowner rights, this article aims to provide a clear and insightful understanding of the tax appraisal journey in this dynamic region.

Understanding the Collin County Tax Appraisal Process

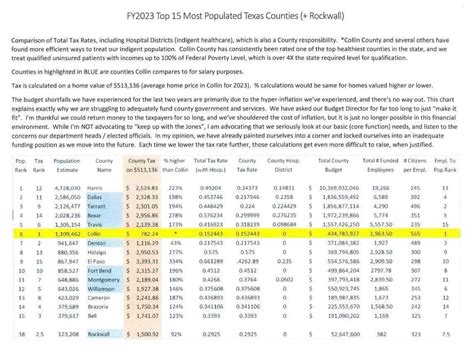

Collin County, known for its thriving communities and economic prosperity, maintains a robust system for assessing property taxes. The Collin County Tax Appraisal District (CCAD) plays a pivotal role in ensuring fair and accurate taxation, impacting homeowners, businesses, and the overall economic health of the county.

Appraisal Methods and Market Value Determination

The CCAD employs a systematic approach to property valuation, utilizing various appraisal methods to determine the market value of real estate within the county. These methods include:

- Sales Comparison Approach: This method involves analyzing recent sales of similar properties to determine the value of a subject property. CCAD appraisers consider factors such as location, size, age, and condition to make accurate comparisons.

- Cost Approach: The cost approach estimates the value of a property by calculating the cost to replace the structure, minus depreciation, and adding the land value. This method is particularly useful for unique or specialized properties.

- Income Approach: For income-producing properties like commercial buildings or rental units, the income approach is employed. It considers the potential net income of the property and applies capitalization rates to determine its value.

By combining these methods, the CCAD aims to provide a comprehensive and fair valuation, ensuring that property owners are taxed equitably based on the true market value of their assets.

| Appraisal Method | Description |

|---|---|

| Sales Comparison | Analyzes recent sales of similar properties. |

| Cost Approach | Estimates value based on replacement cost and land value. |

| Income Approach | Considers potential net income for income-producing properties. |

Factors Influencing Property Values in Collin County

The determination of property values in Collin County is influenced by a myriad of factors, including:

- Location: The desirability of a property's location within the county, proximity to amenities, and neighborhood characteristics play a significant role in its value.

- Market Trends: Overall real estate market trends, such as supply and demand dynamics, can impact property values county-wide.

- Property Improvements: Upgrades, renovations, or additions made to a property can increase its value, especially if they enhance its functionality or aesthetic appeal.

- Economic Factors: The local and regional economic climate, including employment rates, business growth, and population trends, can affect property values over time.

The Role of the Tax Appraisal District

The Collin County Tax Appraisal District serves as the backbone of the county’s tax system, ensuring a transparent and fair process for all property owners. The CCAD is responsible for a range of critical functions, including:

- Property Appraisal: Conducting annual appraisals to determine the market value of all taxable properties within the county.

- Tax Roll Maintenance: Maintaining accurate tax rolls, which contain essential information about each property, its value, and the corresponding tax liabilities.

- Equalization Process: Implementing measures to ensure that property values are assessed uniformly and fairly across the county, promoting equity among taxpayers.

- Taxpayer Assistance: Providing resources and support to property owners, including answering questions, resolving disputes, and offering exemptions or special valuation programs where applicable.

Taxpayer Rights and Appeals Process

Property owners in Collin County have certain rights and avenues to challenge their property values if they believe the assessment is inaccurate or unfair. The appeals process is a crucial component of the tax appraisal system, ensuring that taxpayers can voice their concerns and seek resolution.

Steps to Appeal a Property Value

- Obtain the Notice of Appraised Value: Property owners typically receive a notice from the CCAD detailing the appraised value of their property. This notice serves as the basis for any appeal.

- Review the Appraisal: Carefully examine the appraisal details, including the property characteristics, comparable sales data, and any adjustments made by the appraiser. Identify any discrepancies or errors.

- Gather Evidence: Collect supporting documentation, such as recent sales data, appraisals from private sources, or expert opinions, to strengthen your case for a value adjustment.

- File an Appeal: Submit a formal protest with the Appraisal Review Board (ARB) within the specified deadline. The ARB is an independent body that hears and decides on taxpayer appeals.

- Attend the ARB Hearing: Present your case to the ARB, providing evidence and arguments to support your claim for a lower property value. This is an opportunity to voice your concerns and have your say.

- ARB Decision: The ARB will issue a written decision, either upholding or changing the appraised value. If the decision is unfavorable, property owners have the right to further appeal to district court.

Taxpayer Protections and Rights

Collin County property owners are entitled to certain protections and rights, including:

- Right to Notice: Taxpayers have the right to receive timely notice of their appraised property value and any changes made by the CCAD.

- Right to Appeal: The right to challenge the appraised value through the formal appeals process, as outlined above.

- Equal and Uniform Taxation: The guarantee that all properties within the county are appraised and taxed equitably, based on their market value.

- Exemptions and Special Valuations: Eligibility for certain exemptions or special valuation programs, such as the homestead exemption or agricultural valuation, which can reduce tax liabilities.

Future Outlook and Market Trends

The property market in Collin County is influenced by a combination of local and national factors, shaping the tax landscape for years to come. Understanding these trends is essential for property owners and investors alike.

Market Projections and Forecasts

Recent market analyses and expert forecasts indicate a continued growth trajectory for Collin County’s real estate market. Key factors driving this growth include:

- Economic Prosperity: The county's strong economy, driven by diverse industries and a skilled workforce, continues to attract businesses and residents, increasing demand for residential and commercial properties.

- Population Growth: Collin County's population is expected to rise steadily, with a particular influx of young professionals and families seeking high-quality living environments.

- Infrastructure Development: Ongoing infrastructure projects, such as road expansions and improvements to public transportation, enhance the county's connectivity and overall appeal.

Impact on Property Values and Taxation

The positive market outlook is likely to have a significant impact on property values in Collin County. As demand rises and supply remains relatively stable, property values are expected to increase steadily. This, in turn, will influence the tax appraisal process, potentially leading to higher tax assessments for property owners.

However, it's important to note that the CCAD's commitment to fair and equitable taxation means that property values will be appraised based on market trends, ensuring that taxpayers are not disproportionately burdened.

Conclusion: Navigating the Collin County Tax Appraisal Landscape

The Collin County Tax Appraisal process is a complex yet essential aspect of property ownership. By understanding the methods, factors, and rights associated with property valuation and taxation, property owners can navigate this landscape with confidence. Whether it’s ensuring accurate appraisals, exercising their right to appeal, or staying informed about market trends, a proactive approach can help Collin County property owners manage their tax liabilities effectively.

How often does the CCAD conduct property appraisals?

+The CCAD conducts annual appraisals to determine the market value of taxable properties. This ensures that property values are up-to-date and reflect the current market conditions.

What happens if I disagree with my property’s appraised value?

+If you disagree with your property’s appraised value, you have the right to appeal. The formal appeals process involves submitting a protest to the Appraisal Review Board (ARB), presenting your case, and receiving a decision from the ARB. If you’re still dissatisfied, you can further appeal to the district court.

Are there any tax exemptions or special valuation programs in Collin County?

+Yes, Collin County offers various exemptions and special valuation programs. These include the homestead exemption, which reduces the taxable value of a homeowner’s primary residence, and agricultural valuation for qualified agricultural land. It’s important to research and understand these programs to maximize your tax benefits.